Protect your assets with comprehensive general insurance solutions

Often, people underestimate the value of a suitable insurance cover until it is too late

Life is full of surprises some pleasant, some otherwise. Unforeseen events such as theft, accident or natural disasters like fire, earthquake, flood and storm, etc. can cause serious loss and/or damage. Health could be another cause of concern – sudden illness and medical exigencies can not only be traumatic but also make a huge dent in your savings.

Life is full of surprises some pleasant, some otherwise. Unforeseen events such as theft, accident or natural disasters like fire, earthquake, flood and storm, etc. can cause serious loss and/or damage. Health could be another cause of concern – sudden illness and medical exigencies can not only be traumatic but also make a huge dent in your savings. Even while travelling, you are exposed to various hazards including health issues, mishaps, baggage/documents loss and other financial problems. While these risks cannot be completely eliminated, it makes sense to safeguard yourself and all that you value against life’s uncertainties to ensure peace of mind.

Even while travelling, you are exposed to various hazards including health issues, mishaps, baggage/documents loss and other financial problems. While these risks cannot be completely eliminated, it makes sense to safeguard yourself and all that you value against life’s uncertainties to ensure peace of mind.

It may seem quite unlikely but any such event can impede your financial wellbeing and have devastating effect on your finances, lifestyle and future. Your financial soundness, therefore, hinges on the security and safety of your assets. With proper planning, you can provide protection to yourself, your loved ones as well as the things you cherish. Whether it is your business, your house, car, jewellery and other valuables, general insurance products can help you mitigate risks and safeguard your assets. For medical exigencies, you can opt for health insurance, which offers protection for emergency expenses in case of sudden illness or injury.

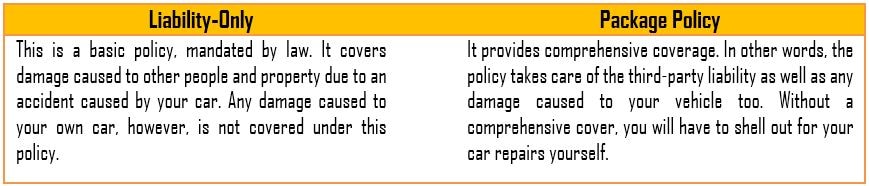

It is, however, important to note that merely having insurance is not enough. Your insurance cover should be comprehensive and also accessible whenever required. A comprehensive cover provides extensive coverage. For instance, a comprehensive car insurance policy provides complete coverage from loss or damage caused to you as well as to others due to theft or accident.

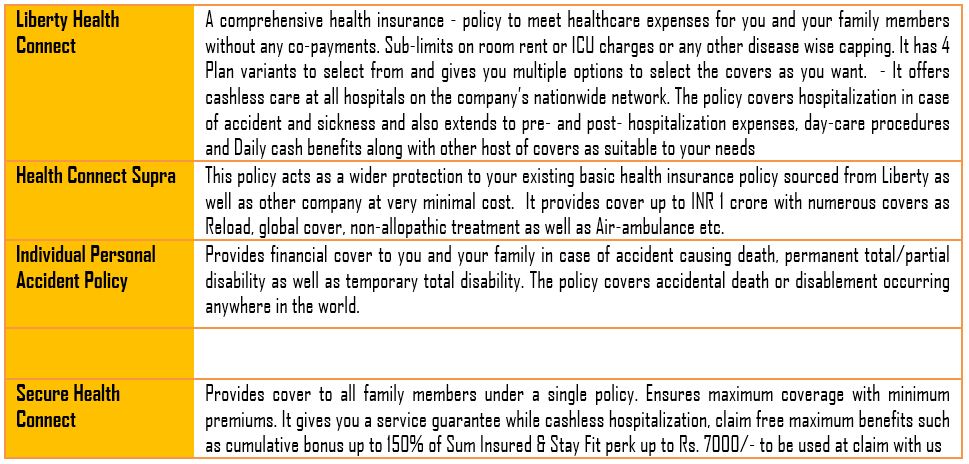

Liberty General Insurance’s (LGI) health, car and two-wheeler insurance products come with a variety of features and options.

Based on your choice, LGI’s car insurance offers additional benefits such as depreciation, consumables, gap value, road-side assistance, passenger assistance, key loss and engine safe covers.

LGI has a network of over 4,300 garages to provide hassle-free and cashless claim services to its clients. Moreover, the insurance company operates in a claim-settlement period of just 7 working days. The insurance company has a simple claims process procedure, with support and assistance available on phone as well as online.

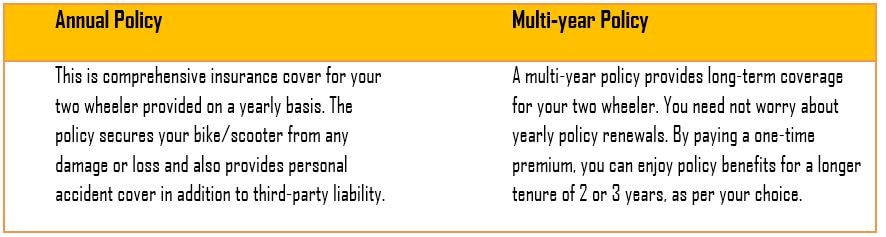

You can purchase the two wheeler policies online through a simple, paper-less process and avail of its benefits almost instantly. LGI provides two wheeler cashless claim service across over 2,500 network garages in India. The insurance company also offers discounts on renewal of your existing policy.

LGI also provides attractive renewal benefits such as free health checkup after 2 years of continuous policy renewal and other loyalty perks.

Since life is a journey full of twists and turns, you might as well make the ride as comfortable as possible —investing in adequate and comprehensive general insurance will ensure that you are well-prepared for any emergencies you may meet along the way.

Disclaimer: The pages slugged ‘Brand Connect’ are equivalent to advertisements and are not written and produced by Forbes India journalists.

First Published: Oct 04, 2019, 17:37

Subscribe Now

LGI’s two wheeler insurance comes with additional benefits (optional) including depreciation, consumables, gap value, road-side assistance and engine safe covers.

LGI’s two wheeler insurance comes with additional benefits (optional) including depreciation, consumables, gap value, road-side assistance and engine safe covers.