Flexi-caps show greater resilience than large-cap funds

Last Updated: Apr 09, 2016, 06:05 IST1 min

Image: Getty Images

Image: Getty Images

30.3% was the fall in the Nifty PSU Bank index in the last year. In comparison, the Nifty Bank index fell just 13.7 percent in the same period

The massive pile of NPAs in the books of state-run banks has weighed heavily on their stocks. The BSE Finance index, that comprises banking and NBFC stocks, fell 28 percent in the last one year.

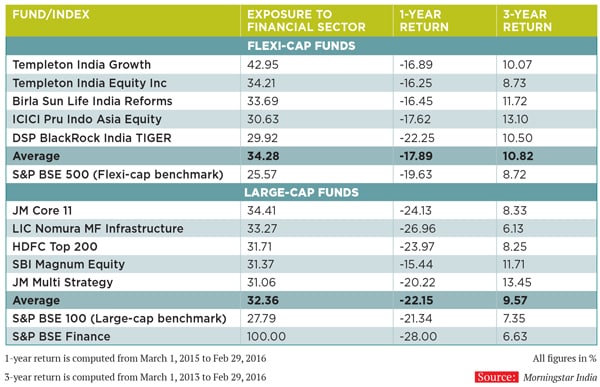

Interestingly, flexi-cap funds—that invest in small-, mid- and large-cap companies—managed to outperform large-cap funds, despite a higher average exposure to the financial sector. The table compares the funds with the highest exposure to finance stocks and their returns.

First Published: Apr 09, 2016, 06:05

Subscribe Now