Air India: Flying high with FDI

Just how attractive is Air India for foreign investors?

Regis Duvignau / Reuters

Regis Duvignau / Reuters

A decade after an ill-fated merger threw national carrier Air India into a tailspin, the Narendra Modi government has given it a new lease of life. On January 10, the government decided to allow foreign direct investment (FDI) of 49 percent in the airline. That means a foreign player could end up owning a notch less than half of the flag carrier, by tying up with an Indian company.

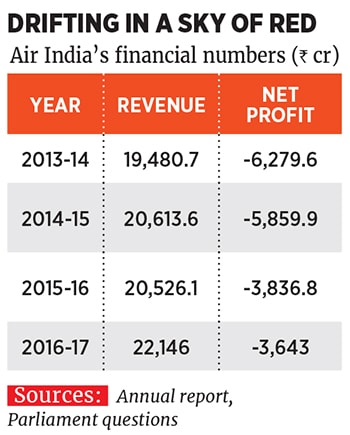

Already, the Tata Group and InterGlobe Aviation, which owns IndiGo, have expressed interest in buying the beleaguered airline. Air India has a debt of over `50,000 crore, which it picked up after a merger with domestic carrier Indian Airlines to create the National Aviation Company of India Limited (NACIL) in 2007. At the time, Air India only flew international routes.

“There are many reasons for an investor to buy Air India,” Mahantesh Sabarad, head of retail research at Mumbai-based SBICap Securities says. “Apart from the large fleet that it has [119 aircraft, excluding its subsidiaries], the airline also has a number of bilateral rights and slots at some of the biggest airports in the world. But, debt is a big overhang and unattractive. Therefore, the government needs a mechanism to sweeten the debt for the buyer.”The airline has a 13.6 percent share in India’s domestic aviation market. Last year, rating agency ICRA said that Air India also had the largest share in ferrying international passengers.

“India is one of the fastest growing aviation markets in the world and there will be many companies willing to buy Air India,” says Mark Martin, founder of Dubai-based Martin Consulting. “Any buyer will be able to start operations from day one as there is no startup cost or upkeep cost. The airline is a [potential] money-spinner and the buyer will have access to a large number of countries [around 40].”

Domestic air travel in India is expected to grow 9.5 percent annually between 2011 and 2031, according to Airbus.

It is not just India’s aviation market that the buyer will have access to. The airline owns some of the most expensive real estate in India and abroad, and also operates ancillary services. For instance, Air India Air Transport Services (AIATSL), its ground handling arm, enjoys a near monopoly. The airline is also a member of the lucrative airline network Star Alliance.

“The sale will attract cash-rich companies such as Etihad and Qatar Airways,” says Martin. “[But] you need to invest nearly $20 billion over the next few years in the company and it would take over 50 years to recover. So, it is a prized asset, but not many investors have the appetite to spend so much cash in one go.”

First Published: Jan 19, 2018, 08:23

Subscribe Now