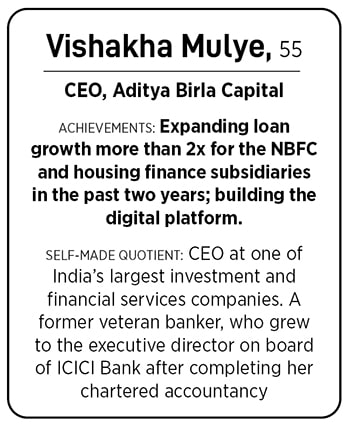

On Betting big on NBFC, housing finance and SME biz: Vishakha Mulye

Former veteran banker Mulye finds a place in the coveted Forbes India W-Power list for being a CEO at one of India's largest investment and financial services companies

By 2022, Aditya Birla Housing Finance (ABHFL)—betting big on affordable housing—was facing the headwinds of rising costs, increasing competition and poor supply in the ecosystem. It reflected in sluggish growth where ABHFL’s lending book for Q3FY22 shrunk to Rs11,606 crore from Rs12,190 crore in Q3FY20. The challenging situation called for a tough decision.

ICICI Bank veteran Vishakha Mulye, who had taken charge of Aditya Birla Capital Ltd (ABCL) in June 2022, was clear on getting growth back for the housing finance company, which is a subsidiary of the holding company ABCL.

Mulye brought in trusted ICICI Bank colleague Pankaj Gadgil to lead the housing finance (HFC) and digital businesses at ABCL. Today the net interest income of the HFC business stands at Rs290 crore for Q3FY25 from Rs148 crore in Q1FY23 and the HFC loan book has grown by 2.2 times to Rs26,714 crore from Rs12,049 crore in the same period.

Mulye brought in trusted ICICI Bank colleague Pankaj Gadgil to lead the housing finance (HFC) and digital businesses at ABCL. Today the net interest income of the HFC business stands at Rs290 crore for Q3FY25 from Rs148 crore in Q1FY23 and the HFC loan book has grown by 2.2 times to Rs26,714 crore from Rs12,049 crore in the same period.

Mulye is one of the few self-made professionals in the corporate world, joining ICICI Bank after completing her chartered accountancy. She rose to become the executive director on board of ICICI Bank and has been involved hands-on in leadership and strategic decisions at both ICICI Bank and ABCL.

The last few years have been a period of transformation and consolidation for ABCL. “We redefined our strategic roadmap, strengthened our capabilities in data, digital and technology," she tells Forbes India.

Today ABCL, with aggregate assets under management (AUM) of over Rs5 lakh crore with a consolidated lending book of over Rs1.46 lakh crore through its subsidiaries, competes with rivals such as Bajaj Finserv, L&T Finance, Cholamandalam Finance and JM Financial—besides several banks—to sell mutual funds, health and life insurance and housing, personal and business loans.

In recent years, ABFL has lowered its exposure to unsecured lending due to the risks of rising bad loans in the ecosystem. Unsecured lending was approximately 44 percent of the disbursements in Q3FY23 for the NBFC, which has reduced to under 30 percent in Q3FY25, with around 74 percent of the loan book being secured, as of December 2024.

While digital took time to gain momentum, ABCL, under Mulye’s leadership, is growing. Its loan book grew to Rs1.46 lakh crore in December 2024 from Rs67,887 crore in June 2022 while the NBFC loan book grew similarly to Rs1.19 lakh crore in December 2024 from Rs57,839 crore in the similar period. Total mutual fund and insurance AUM grew by 1.4 times to more than Rs5 lakh crore in December 2024 from Rs3.6 lakh crore in June 2022.

“With all the building blocks in place and significant market opportunities ahead, we are now focussed on leveraging our strengths to drive ABCL’s next phase of growth," says Mulye, which will be calibrated in approach.

Macquarie’s research analysts Suresh Ganapathy and Punit Bahlani, in a March 20 Aditya Birla Capital note to clients, say: “We believe unsecured personal-loan growth should pick up and margins should also improve due to a falling rate cycle, aiding recovery in Return on Assets."

After raising more than Rs4,500 crore of capital over the last two years through different routes, Mulye believes ABCL is well capitalised, with a capital adequacy (CRAR) at 16.77 percent and Tier 1 ratio of 14.43 percent.

Mulye, like most bankers of the past, is firmly of the rationale of preservation of capital. “Gaining market share and achieving profitability are equally important. While scale matters, it should not come at the cost of profitability," she says, explaining the principle of return-of-capital being as important as return-on-capital.

“Preservation of capital may delay profits, but ultimately it strengthens long-term growth prospects," Mulye says.

The mistake that people make in evaluating financial sector entities is that they focus too much on the asset side franchise. “The cost of liability probably is more important because it reflects the quality of your asset," she says. Lower costs enable lending to better-rated customers. For any finance company, liabilities are assets, as they serve a direct reflection of an institution’s financial strength and credibility. This will remain one of the cornerstones to ABCL’s growth path.

Mulye is recognised as a peoples person, who has a broader understanding of business dynamics. “She is revenue and bottomline focussed but is flexible enough to tweak business models, as and when it is required," says A Balasubramanian, managing director and CEO of Aditya Birla Sun Life AMC. “She is not afraid of factors such as increasing costs as long as they can create future value," he tells Forbes India.

Mulye is confident that economic growth will pick up in India, led by government spending. “Greenfield expansion is yet to take place but investments towards brownfield projects have taken place, with promoters balancing and enhancing manufacturing facilities," she says.

Mulye believes working hard is a given for every professional. Acquiring the right skill set is more important. “Individuals must define their personal and professional priorities based on merit. Every minute you make that trade-off, but you must be ready to face the consequences of your decisions," she says.

The dearth of women leading corporates in India is evident. But Mulye argues a “lot of things" need to fall into place. “Women need a role model in their life. The answer to the critical question of whether all this is worth is, of course, it is. But they do need to try to be a supermom all the time. Create a support system around yourself," she says.

First Published: Apr 28, 2025, 13:04

Subscribe Now