What to expect from the Direct Tax Code

A report, which aims to overhaul the Income Tax Act, has not been released to the public, but its recommendations are expected to cover four primary areas

Image: Reuters[br] The surprise increase in income tax surcharge, as announced in Budget 2019, could soon be a thing of the past. On August 19, the Direct Tax Code (DTC) took a firm step in its 11- year journey with a draft report submitted to Finance Minister Nirmala Sitharaman.

Image: Reuters[br] The surprise increase in income tax surcharge, as announced in Budget 2019, could soon be a thing of the past. On August 19, the Direct Tax Code (DTC) took a firm step in its 11- year journey with a draft report submitted to Finance Minister Nirmala Sitharaman.

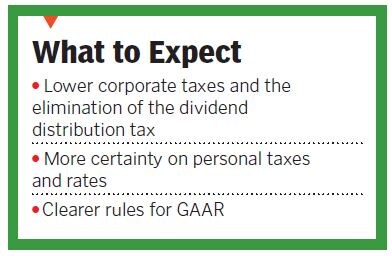

Also, on personal taxes, it would provide certainty on tax rates and do away with imposing surcharges and cesses. One can expect rates to shoot up if they are removed. So far, there has been no talk of reimposing wealth tax or introducing inheritance tax.

The General Anti-Avoidance Rule or GAAR introduced in April 2017 has been a source of frustration for corporates. Mergers, acquisitions and amalgamations are often questioned when tax authorities don’t agree with valuations. The DTC is likely to have a detailed set of rules that lay down the grounds on which assessments can be opened. Lastly, expect authorities to go slow on disputes relating to angel tax.

First Published: Aug 29, 2019, 15:47

Subscribe Now