Will credit growth pick up as NPA decline?

Although NPAs will improve, lenders will focus on improving their own financial health rather than aggressively extend credit

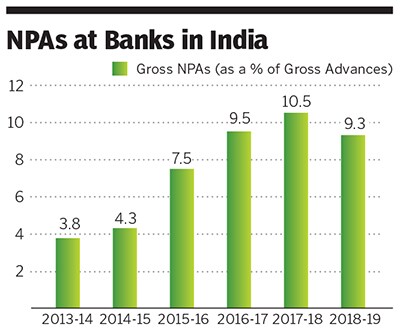

Image: Francis Mascarenhas/ Reuters[br]The problem of non performing assets (NPAs) that has affected banks from lending for over five years appears to be getting resolved. The Financial Stability Report of the RBI in June 2019 noted: “...the gross NPA ratio for commercial banks may decline to 9 percent in March 2020 from 9.3 percent in March 2019.”

Image: Francis Mascarenhas/ Reuters[br]The problem of non performing assets (NPAs) that has affected banks from lending for over five years appears to be getting resolved. The Financial Stability Report of the RBI in June 2019 noted: “...the gross NPA ratio for commercial banks may decline to 9 percent in March 2020 from 9.3 percent in March 2019.” This might encourage banks to start lending more. But India is in the middle of a consumption slowdown, where not only is the demand for goods and services, but also income levels and the capacity to spend are weak. Corporates are reluctant to invest in capex. Almost every large bank we have spoken to indicates that the economy is still far from credit growth. Even though some of the private lenders might be in an improved situation to lend, a lot of the others aren’t. Gross bank credit grew by 8.07 percent in November data by the RBI, while growth was in double digits in mid-2018 and mid-2019.

This might encourage banks to start lending more. But India is in the middle of a consumption slowdown, where not only is the demand for goods and services, but also income levels and the capacity to spend are weak. Corporates are reluctant to invest in capex. Almost every large bank we have spoken to indicates that the economy is still far from credit growth. Even though some of the private lenders might be in an improved situation to lend, a lot of the others aren’t. Gross bank credit grew by 8.07 percent in November data by the RBI, while growth was in double digits in mid-2018 and mid-2019.

The collapse of IL&FS has created a crisis of confidence, while at least 10 public sector banks are in the midst of mergers, preventing them from taking calls on risky lending. So even while NPAs will decline in 2020, banks and NBFCs are likely to continue to focus on improving their financial health instead of extending credit.

First Published: Jan 01, 2020, 10:17

Subscribe Now