Buyers slow to pay back retail loans

It's still early days as retail loans in some categories record higher delinquencies

Image: Shutterstock[br]A decade-long boom in consumer lending has seen Indians shift preferences in how they borrow. Instead of borrowing to buy cars, homes and against properties owned by them they are choosing to increase spends on their credit cards and through personal loans.

A recent report by Motilal Oswal, a brokerage has laid out this changed lending landscape. While all categories of loans are still growing there is a clear shift away from secured borrowing to unsecured loans. There are also initial signs of delinquencies increasing in some categories. It also points to a slowing rate of growth in some categories.

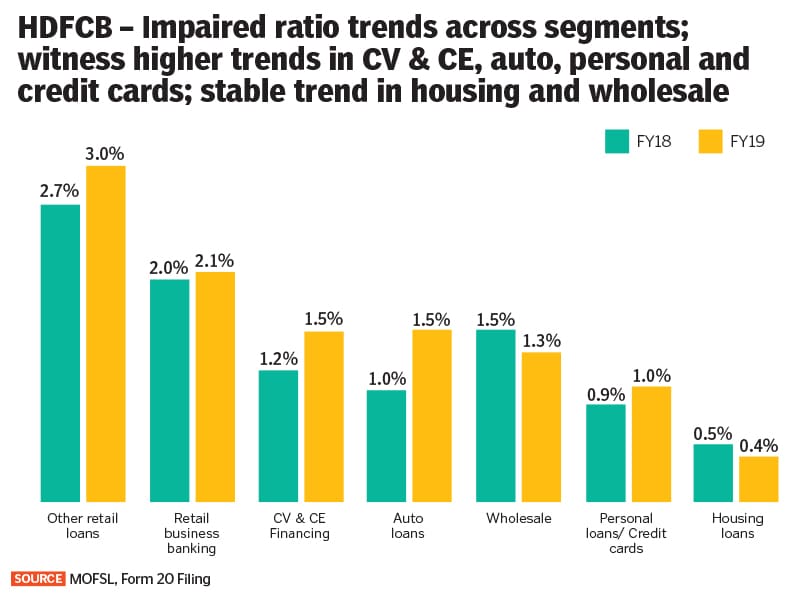

The average outstanding on a credit card has increased 9 percent to Rs24,000 in the last year and the number of accounts with delinquencies for over 90 days is 1.95 percent up 6 basis points. Total personal loans rose 28 percent to Rs42,920 crores in the second quarter of this fiscal. Total retail loans now account for 28 percent of all credit with all the gains made on account of lesser credit to industry. Importantly retail credit now accounts for 12 percent of GDP, the highest in the last decade.While there are no signs of large scale delinquencies a slowing economy is bound to impact the payment ability of borrowers. HDFC Bank points this out in a Form 20F filing with the Securities and Exchange Commission (see graphic) Retail, auto and personal loans have shown a higher rate of delinquency. At ICICI Bank retail loan impairments have risen from 1.3 percent in FY16 to 1.5 percent in FY19.

First Published: Jan 21, 2020, 16:47

Subscribe Now