Welspun India: Out of the woods

Less than a year ago, Welspun India faced its biggest business crisis. But the company met the challenge head-on by focusing on customer retention, upgrading processes and innovation

Welspun Group chairman Balkrishan Goenka is confident that he can win Target back as a customer Image: Mexy Xavier

Welspun Group chairman Balkrishan Goenka is confident that he can win Target back as a customer Image: Mexy Xavier

Balkrishan (BK) Goenka is unlikely to forget August 2016 in a hurry. The chairman of the $2.3 billion Welspun Group brought in his 50th birthday with family and friends at a lavish party in a luxury hotel in Mumbai. The celebrations came on the back of an impressive entrepreneurial run and him being ranked 83 on the 2015 Forbes India Rich List with an estimated personal wealth of $1.37 billion.

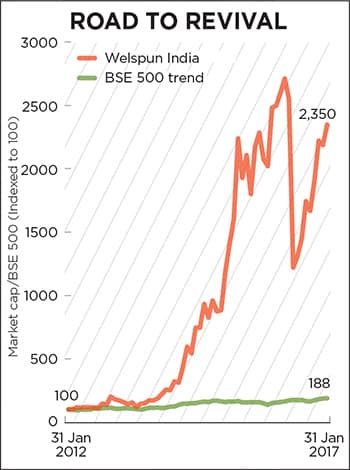

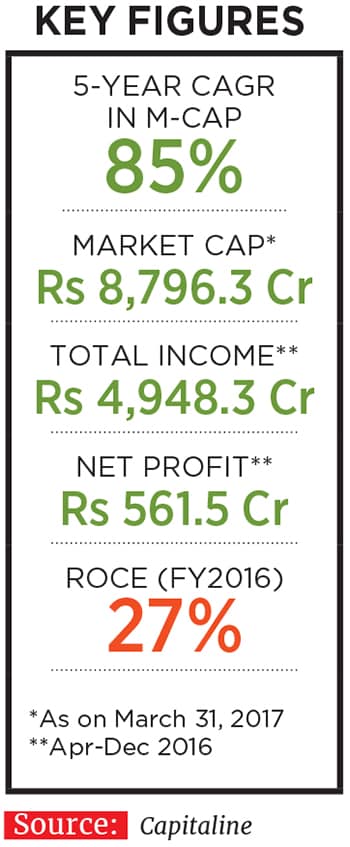

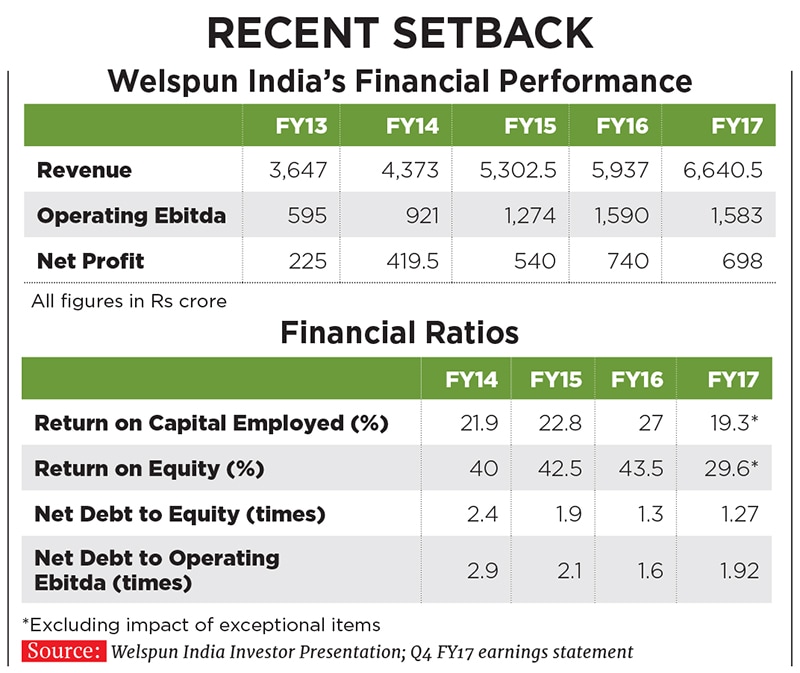

Welspun India Ltd (WIL) too had witnessed remarkable growth across all financial parameters over the last five years till the end of FY16 (See chart on page 76). Its chief financial officer Altaf Jiwani, 50, therefore, was optimistic while wooing international investors in London on August 19. Things would change dramatically soon. Hours later, the world came crashing down on Goenka and Jiwani as an allegation threatened the very existence of the company.

Target Corp, the second-largest value retailer in the US after Walmart, shot off a letter to its millions of customers telling them that the bed sheets it had sold, which were supplied by WIL and supposedly made of Egyptian-origin cotton, may not have been made with that premium variety of the natural staple fibre. It ordered a recall, offered refund to buyers and snapped all business ties—worth $90 million (around 10 percent of WIL’s overall business)—with its Indian vendor.

WIL had captured market share in the US like none other because of its focus on partnering its customers with solutions, and not just commodity textile products. It had reached out to end-buyers of its bed and bath linen in the US to understand their preferences and tailored products accordingly. Through its analytics wing, it had also kept an eye on inventory levels and provided timely inputs to customers. The ramifications of the development were therefore grave.

It didn’t take long for naysayers to write off the three-decade-old company which makes every fifth towel sold in the US in addition to bed linen and rugs. The markets reflected their sentiments. By August 30, close to 55 percent of WIL’s market value had been wiped off amid speculation that other American retailers may follow Target.

Goenka, who founded his business empire comprising steel pipes, textiles and infrastructure in 1985 with $100,000 borrowed from his father, admits that the crisis came like a bolt from the blue. “We were zapped and didn’t know what had hit us,” he says. “It wasn’t like there was any issue with the quality of the bed sheets they always enjoyed the highest user ratings.”

The challenge ahead was daunting, but Goenka, who’s no stranger to dealing with business upheavals—he says he has faced a crisis every seven years since 1992—believed he could salvage the reputation of his textiles behemoth. He led the turnaround aided by his pragmatism and never-say-die attitude. And his determination was bolstered by the gumption showed by wife Dipali, 47, who was designated WIL’s CEO and joint managing director last year, Jiwani and a 25,000-strong global workforce.

Acknowledging the issue

As a first step towards course correction, WIL decided to admit its mistake with timely communication to all its stakeholders. As early as August 22, the company decided to hold a conference call with analysts. “The idea was to acknowledge the issue, explain to everyone what we had understood till then and explain the future steps we would take to ensure that such an incident does not repeat,” Jiwani tells Forbes India.

The strategy seems to have worked as the company is slowly getting back on track. As on April 24, 2017, it had regained 85 percent of the market value it had lost, indicating that many investors saw the turmoil as a buying opportunity to enter the stock.

Their faith had been bolstered by the fact that other than Target, the company had managed to retain all its other marquee clients, including JC Penney, Walmart, Macy’s and Bed Bath & Beyond. This validation was crucial because over the years, WIL has emerged as a vendor of choice for the who’s who in global retail, especially in the US.

The internal efforts did not go unnoticed with the business community either. “They stood up, faced the music, evolved their systems and processes and came out of the crisis in 6-8 months,” says Arun Kejriwal, director of Kejriwal Research and Investment Services. “I doubt if any other company could have managed this. It is an affirmation of the fact that they didn’t deliberately shortchange their customers.”

Welspun has always accorded priority to its customers and it became even more imperative to protect their interests after the Target fiasco. WIL offered them the option of recalling the products and offering a full refund, or re-labelling and selling the bed sheets at a marked-down price with full disclosure. It even tied up with Cotton Egypt Association, which is exclusively authorised to give a gold seal certification to Egyptian cotton products, to further ensure the authenticity of the natural fibre it sources from that country. “This proactive approach was appreciated by our clients who decided to stick with us,” says Dipali, who was ranked 16 on Forbes Asia’s 50 Power Businesswomen List last year. Dipali Goenka reassured WIL’s big clients after the Target fiascoAs the company’s revival began taking shape, it infused greater enthusiasm among its employees. Jiwani says the promoters’ commitment to deal with the crisis inspired confidence in him. And though Goenka saw his personal wealth decline in tandem with the loss in market value of the company, he was willing to cut a cheque for “whatever it took” to salvage the situation.

Dipali Goenka reassured WIL’s big clients after the Target fiascoAs the company’s revival began taking shape, it infused greater enthusiasm among its employees. Jiwani says the promoters’ commitment to deal with the crisis inspired confidence in him. And though Goenka saw his personal wealth decline in tandem with the loss in market value of the company, he was willing to cut a cheque for “whatever it took” to salvage the situation.

“Immediately, a contingency fund of $75 million was created and this gave our clients the confidence that we are committed to solving the issue,” Jiwani tells Forbes India. WIL eventually took a hit of Rs 500 crore owing to the cost of recall and refunds given to buyers.

Such measured steps stemmed the potential loss of further business (it lost around 13 percent of revenue, including business from Target and the Egyptian cotton portfolio across retailers). However, the job was only half done. The challenge was to ensure that such a scenario does not arise again.Goenka says the textile industry procures raw material, including cotton, yarn and fabric, from multiple vendors globally. A lot of them are unorganised. As a result, cotton from different sources (but with the same physical characteristics) tends to get mixed with each other. The challenge is exacerbated by the fact that production of actual Egyptian cotton has declined over the years (from 1.4 million bales in FY05 to 0.18 million in FY17, according to a Credit Suisse report), and a lot of non-Egyptian cotton tends to land up in the African country to get re-exported. “What happened with us could have happened to anyone. It is an issue that is systemic to the textile industry,” explains Goenka. “But there was no point in giving excuses. We needed to figure out a solution.”

Eye on innovation

Welspun got audit and consulting firm Ernst & Young (EY) to conduct a thorough audit and ascertain how processes could be beefed up. A technology-enabled system called Wel-Trak has been put in place at WIL, which uses an RFID (radio frequency identification) and colour-coding to ensure end-to-end accountability of where a batch of cotton has come from, in which product it has been used, and to which retailer it has been shipped. End-buyers of these home textiles can even scan the QR code on these products to know the origin of the cotton used.

As many as 10 consultants, including EY, KPMG, PricewaterhouseCoopers, Accenture, IBM and SAP, have been mandated by WIL to use technology to improve various processes ranging from HR automation to reducing manual intervention in manufacturing. “We have become the consultants’ delight,” Jiwani says jokingly. At a group level, Welspun has allocated Rs 150 crore for this technological upgrade, and a “lion’s share” of that is dedicated for the textile company, he adds.

For all premium products where it is essential to ensure traceability, the company has decided to only procure cotton externally and carry out the spinning and weaving work internally to exercise strict quality control. An executive has been stationed in Egypt to ensure that the Egyptian cotton procured by the company originates there. WIL is also trying to create an ecosystem of ancillary partners, along the lines of what is common in the automobile industry, and get spinners, weavers and packers of the end-product to co-locate along with WIL’s factories in Gujarat.

Dipali believes there is an opportunity in crisis. “I feel we had become too big. There is always a threshold in time when you need to relook at existing systems and upgrade them,” she says.

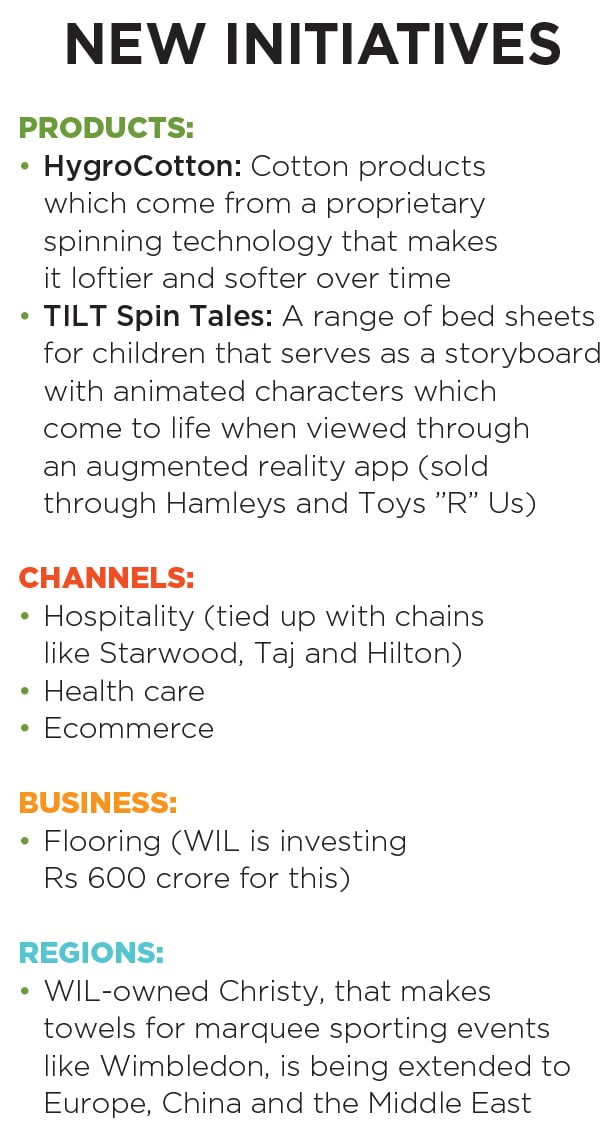

The wheels may have been set in motion, but there’s still a lot left to be done. As a result, WIL’s management has indicated to the Street that topline growth is likely to be muted in 2017-18, but should return to close to normal in the next fiscal. A Credit Suisse report dated April 10, which initiated coverage on WIL with an outperform rating, says: “While revenue growth may drop to 5-8 percent in FY18 due to this [issues with Egyptian cotton], we expect a recovery in FY19 with 15 percent revenue growth.”As of now, WIL is sticking to its earlier target of achieving a turnover of $2 billion by 2020 riding on innovation. Innovative products that leverage technology account for around 36 percent of the company’s revenue at present and the target is to ramp up this share to half of WIL’s turnover in the next three years. (See box: New Initiatives). WIL has filed for 27 patents pertaining to such products of which nine have been granted to date.

The company is also bullish on its India business (services through brands like Spaces) which presently accounts for only 5 percent of its topline, but has the potential to grow to as much as 20 percent beyond 2020, says Dipali.

While they don’t talk business anymore, the WIL team is in touch with Target as well, apprising them of the process improvements. “Our internal target is to get Target back,” Goenka says. And he is confident that it will happen. If it does, it will call for a big celebration.

First Published: May 12, 2017, 07:51

Subscribe Now