A Second Chance for Ratul Puri at Hindustan Powerprojects

With the initial success of his energy generation company, Hindustan Powerprojects, the 42-year-old entrepreneur hopes the world will forget his not-so-stellar stint at Moser Baer

Ratul Puri is a man in a hurry. His single-point agenda: To exorcise the ghosts of past failures and salvage his credibility and business. And, so far, he has made some rapid strides. Within six years of entering the power generation business with Moser Baer Projects—it was renamed Hindustan Powerprojects Pvt Ltd (HPPPL) late last year—he has emerged as the man behind the largest solar power generator in the country. The entrepreneur has earned the grudging respect of his peers and competitors, many of whom expected him to fail in his latest venture. But not everyone is singing his accolades, not yet anyway. Investors have yet to forget Puri’s first business foray when, under the aegis of his father’s company, Moser Baer India Limited (MBIL), he started manufacturing solar panels only to see the venture flounder.

Puri, however, is confident that history will not repeat itself. In his latest endeavour, the 42-year-old Delhi-based HPPPL chairman is working at breakneck speed to cash in on the early-mover advantage in the renewable energy sector: He is among the first to set up solar plants across India, in Tamil Nadu, Gujarat, Rajasthan and West Bengal, among other states.

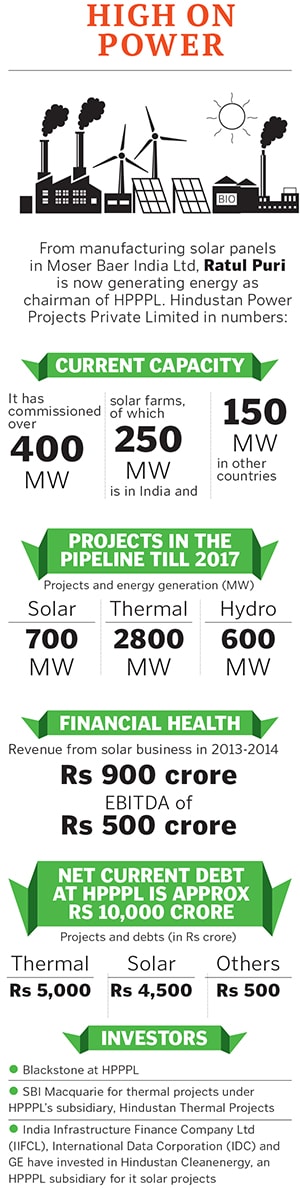

Since the launch of his company in 2008, Puri has commissioned 400MW-worth of solar power projects (250MW for India and the rest for overseas). The aim is to generate 5,000MW of energy by 2017.

HPPPL’s first thermal project will be operational later this year. He is also building hydropower assets and has taken the first steps in wind power. That’s not all: Puri wants to develop another 6,100MW of power generation capacity using conventional (thermal) and non-conventional (solar, wind, hydro) energy sources in the long term.

The company’s solar business alone generated Ebitda, or earnings before interest, tax, depreciation and amortisation, of Rs 500 crore in FY2014 on revenues of Rs 900 crore. When the first phase of the thermal asset becomes operational later this year, he expects HPPPL’s Ebidta to increase to nearly Rs 3,500 crore by FY2016.

Puri is investing Rs 35,000 crore towards all these projects by 2017: By the end of FY2014, HPPPL would have put in Rs 20,000 crore, and will raise the remaining Rs 15,000 crore over the next three years. If the company meets its deadlines, it will probably be the first private or government undertaking in India to generate more than 1GW of solar energy.

“By opting for solar power for short term, thermal for mid term and hydro power for long term, the company has aligned itself with India’s power generation strategy,” says Puri, who has set a brutal pace for himself and HPPPL.

Once Bitten, But Not Shy

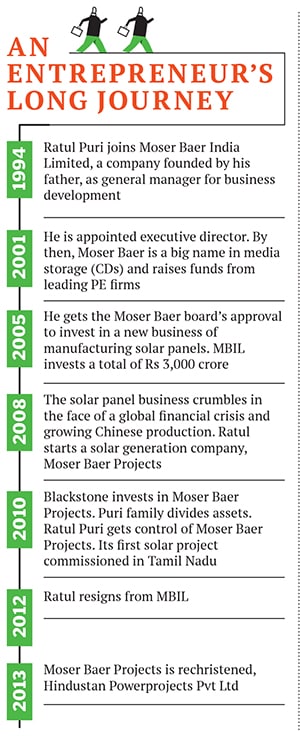

The pace of work is similar to what Puri had followed in his first avatar as a second-generation entrepreneur when he entered Moser Baer India Ltd—the once-iconic media storage company founded by his father Deepak Puri. He joined MBIL in 1994 as general manager for business development, and was appointed executive director in 2001, by which time Moser Baer’s CDs and other optical media storage devices were a household name.

From 2000 to 2004, MBIL’s revenues jumped from Rs 154 crore to Rs 1,501 crore, and profits rose about eight times to Rs 323 crore. The company became the world’s second largest optical media manufacturer. But even at the height of its success, MBIL was aware of the Chinese threat. Deepak Puri saw his business impacted by the government-supported manufacturing prowess of Chinese companies. Technology, too, was changing at a speed that was impossible for MBIL to match.

The junior Puri then began his search for the next big thing. In 2005, he convinced MBIL’s board of directors that manufacturing solar panels was the future. Over the next three years, MBIL would invest over Rs 3,000 crore—a considerable amount given that the company’s revenues were Rs 1,343 crore in 2005— in setting up facilities to manufacture crystalline silicon and thin-film panels and buying the required technology.However, a combination of factors, including the financial crisis of 2008 and oversupply of panels due to aggressive Chinese production, saw Puri’s bet falling off the cliff. “The solar panel business had been in distress since its inception,” he admits. And MBIL is still reeling under the impact of this unsuccessful foray: In the nine months ending December 31, 2013, it had incurred a loss of Rs 695 crore.

Solar panel manufacturing remains one of MBIL’s core businesses even though the company last reported a profitable year in 2007. Its media storage and entertainment businesses have declined in share, but according to industry experts, they are still performing better than solar panel units.

For obvious reasons, this is a chapter in Puri’s entrepreneurial journey that he wants to forget. Stories on his Moser Baer blip still appear high on search engines, and that isn’t acceptable to the ambitious entrepreneur. (Forbes India recently received a message from an email ID claiming to be Puri’s, requesting that older stories on the company be removed from the magazine’s website. His spokesperson clarified that the mail did not come from Puri and was, in fact, spam.)

In many ways, then, HPPPL is Puri in his 2.0 version. This time around, his investors are happy with him. “Ratul’s execution skills remind me of a young Mukesh Ambani (chairman of Reliance Industries Ltd). We had reviewed almost 30 companies in the sector before investing in HPPPL. And the investment was mostly driven because of Ratul,” says Akhil Gupta, chairman of Blackstone India, the local arm of the global private equity giant. After first investing $300 million in HPPPL in 2010, Blackstone upped its stake in the company earlier this year. (Neither Blackstone nor HPPPL were willing to disclose investment details.)

Also “pleasantly surprised” is Suresh Goyal, managing director of SBI Macquarie. The private equity firm has invested in HPPPL’s thermal project in Anuppur, Madhya Pradesh. “There might be a delay in the project and cost overruns, but it is not substantial. Given the regulatory environment and how other players in the sector have fared, we have found Ratul to be a resourceful promoter,” says Goyal. Puri expects one unit of the first phase of this project to be functional by November.

Goyal accepts that “one can’t ignore that information” (on what happened with the solar manufacturing business in Moser Baer). But both SBI Macquarie and Blackstone India put the blame on the “global environment” for the business failure. “It was not run down due to mismanagement,” adds Goyal.

Family Division

Does Puri think he was responsible for the problems at Moser Baer? In a moment of reflection, he accepts that “a good manager” should anticipate how the industry will behave in the future. But then he gets defensive: “It was very difficult to anticipate the kind of overbuild that happened in the sector. In a matter of three years, the Chinese manufacturers of solar panels had built a capacity of 40GW and accounted for nearly three-fourth of the demand. Global production over-capacity was 151 percent in 2009.”

Puri doesn’t believe that he alone should be blamed for MBIL’s abysmal showing. “The reality is that any decision that was made at Moser Baer was a collective decision,” he says. (MBIL officials were unwilling to talk to Forbes India about this.)

Puri, at that point, began separating himself from the parent company. He identified solar energy generation as the next big opportunity given that the global economic slowdown of 2008 had consumed the solar panel industry. The opportunity was self-evident: India was battling a huge power deficit, and government support for this sector made it an attractive option for the entrepreneur.

On the family front, in 2010, the Puris divided their assets in a non-acrimonious settlement: While Deepak Puri, later aided by his daughter Sabena (who runs a restaurant called Junoon in California), would look after MBIL, Ratul got sole proprietorship of Moser Baer Projects (now HPPPL). In 2012, he resigned from MBIL and severed all ties with his father’s company. MBIL has no stake in HPPPL. The separation was complete, but MBIL’s lenders and investors felt they had been short-changed and saddled with a debt-ridden company especially because Ratul, who was one of the main promoters for the solar panel venture, was no longer a part of MBIL.In a June 2013 article, The Financial Express reported that a corporate debt restructuring package for MBIL was stuck with “promoters unwilling to furnish a personal guarantee”. Banks refused to take the company brand as collateral. “[Ratul] Puri was the promoter when the company was getting admitted to the Corporate Debt Restructuring (CDR) cell and now he cannot wash his hands off by saying that he is no more the promoter,” the report quoted a banker who didn’t want to be named.

In an email to Forbes India, Ratul Puri’s spokesperson responded to these allegations: “Promoters’ personal guarantee has been provided that is how company is still functioning… The restructuring of Moser Baer India Limited was based on a techno-economic valuation study which was conducted by an independent third party consultant appointed by the Central Bank of India. The company had executed the Master Restructuring Agreement… and also fulfilled pre-required conditions for implementation of the CDR Scheme.”

Puri declined to give more details. A request from Forbes India to meet Deepak Puri was turned down due to his “travel schedule”.

It doesn’t help that the Kingfisher experience is still fresh in everyone’s mind. Vijay Mallya had used the Kingfisher brand as collateral against the burgeoning debt in the non-functioning carrier. The consequences have been dire for Kingfisher lenders, and MBIL’s investors are worried that they will go down the same path. In its December 2013 annual report, the company says that it has restructured a total debt of about Rs 4,000 crore.

Burnt by Solar Panels

Reimagining the solar panel business has become inevitable for many companies. For instance, when Puri was convincing his board to invest in solar panels, another second-generation entrepreneur, HR Gupta, was making a similar move. Gupta’s father, BK Gupta, had built the Halonix lamp brand and had sold it to private equity firm Actis in 2006. The father-son duo then zeroed in on solar panels, and listed their company, Indosolar Ltd, on the Bombay Stock Exchange (BSE). But in a series of events similar to Puri’s MBIL situation, the Guptas, too, became mired in debt, which now stands at Rs 1,000 crore. From a high of Rs 580 crore of revenues in 2008, Indosolar made just Rs 53 crore in FY2013.

But things are looking up, says HR Gupta. It’s a sentiment that MBIL also echoes. “Because of the Jawaharlal Nehru National Solar Mission (the central government scheme that promotes solar power generation) and increasing viability of the business, there is huge investment taking place in the sector,” says HR Gupta.

In July, Indosolar declared that it has secured full capacity utilisation for the present financial year. The recovery is reflected in its stock movement on BSE: Its share price has risen from a low of Rs 1.5 in August 2013 to Rs 7 a year later. MBIL’s share price has also gone up from Rs 2.30 to Rs 9.9 during the same period.

Puri is optimistic about his father’s business. These days, though, he’s immersed in HPPPL’s success. Rather than manufacturing solar panels, he’s setting up power plants, and is determined to prove his naysayers wrong.Forbes India spoke to two of Puri’s peers and competitors. While they admit that HPPPL’s solar generation business has done well, both point to his not-so-great report card at MBIL and question his aggressive strategy. “MBIL is still struggling to pay its interest rate obligations,” says the promoter of a solar generation company.

Despite this lack of faith, financial institutions seem to be changing their opinion about Puri. An officer from an institution that gave loans for one of Puri’s Gujarat projects says, “Yes, MBIL’s defaults do weigh on our minds. But in HPPPL, Puri has been excellent. The execution of projects has been timely and the management is also good.”

So what has Puri done right?

Not A Risk-taker

Puri insists that his father, Deepak—who hails from a zamindar (land owners) family in West Bengal—is a true-blood entrepreneur. After studying mechanical engineering at Imperial College in London, Puri Sr returned to India to start a not-so-successful metal furniture business in Kolkata. He left it to build Moser Baer in 1983, and got his big break when he decided to enter the media storage market.

There were a lot of factors in Deepak’s favour: Riding on the back of the growing presence of personal computers was consumer storage media, which was evolving rapidly. Entrepreneurs could choose between two technologies in storage media, magnetic (floppy disks) and optical such as CDs and later DVDs. Deepak’s gut feeling worked well when he chose optical media. This decision cemented Moser Baer’s place in the international market. “My father has the entrepreneurial ability to take risks. He made decisions based on his gut feeling, and most of the time, those decisions proved correct. Against the popular perception, I’m a risk-averse person,” says Ratul.

And that is probably true. As Rajya Wardhan Ghei, CEO of Hindustan Cleanenergy Ltd, the solar unit of HPPPL, says, “Ratul has a penchant for numbers and is known to spend hours putting his head down on something that he wants to have a hang on.” Most of his decisions come out of this intense research and diligence. (In 2005, it was through a 77-slide presentation that he had convinced the MBIL board about the solar panel foray.)

On his second venture, he spent six hours with Akhil Gupta of Blackstone addressing each and every risk that could come in the way of the new solar generation business. “It was not about what we have done, but about what we haven’t done,” says Puri on HPPPL.

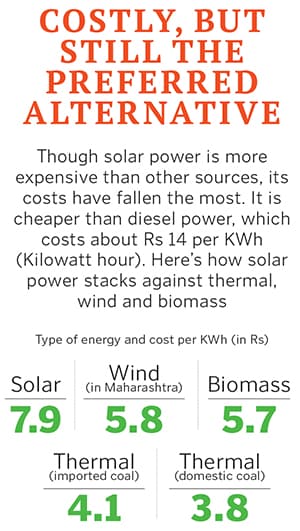

He called right on four things: HPPPL didn’t venture into gas-based plants (inconsistent supply) based its strategy on domestic coal, not imported coal (more expensive) did not participate in aggressive biddings like the Sasan project that Reliance Energy won on a tariff bid of Rs 1.196 per unit of power and, lastly, focussed on solar and not wind power. “When we started off, wind and hydro were more popular as a renewable source. But today, solar has emerged, helped by 40 percent reduction in costs of solar panels,” says Sushil Bhagat, chief financial officer, HPPPL.

At the time Puri constructed his first 5MW solar project in Tamil Nadu in 2010, it cost Rs 20 crore to produce one mega watt of energy. Today, it costs about Rs 7-8 crore per MW.

It could be by design or just a stroke of luck, but the disadvantage at MBIL is now working in Puri’s favour in HPPPL. He sources solar panels from his father’s company, among others he says that it is through competitive pricing, but declined to give details.

His international foray in solar generation is also turning out to be a solid bet. “We had invested Rs 400 crore in setting up solar plants in Europe, including Germany, Italy and the UK. We have already recovered that investment,” says Puri, who follows a build-commission-sell model for his international business, and has sold 35MW of solar assets to investors. He has now expanded his footprint to Japan. He’s also experimenting with wind-based renewable energy. In the last six months, he has been developing a wind power project in Germany.

Industry trends seem to be in his favour, for now. “We see solar costs coming down further in the coming years,” says Manish Gupta, director, Crisil Ratings. Solar costs are much cheaper than diesel-based power generation. Experts say it costs Rs 15 to Rs 20 per MW when diesel is used to generate electricity.

Even as his business sees sunnier days, HPPPL’s chairman is trying to change his ways. Puri is still the

same suave and well-dressed entrepreneur who talks quickly and has all the numbers on his finger tips. But his Marlboro days are over (“I take Nicorette spray instead,” he says).

He’s learning to step back and not micromanage. In office, he remains as particular about details as before, but is trying to shift gears as HPPPL makes the transition from executing projects to monitoring them. “He will need to delegate more,” says Gupta of Blackstone.

The Last Mile

It’s still too early to say that Puri’s second entrepreneurial journey is a success. He needs to commission his thermal assets and get at least one of the hydro projects online. Executing projects is important, but monitoring and running plants calls for a separate skill set, one that Puri has yet to prove he can master.

It’s also crucial for him to tie up all the capacity to be sold to electricity distributors at a rate that will assure an internal rate of return between 13-15 percent. (At present 70 percent of the Anuppur capacity has been signed up.) Only then will banks be assured that their loans won’t go bad.

It’s not just Puri whose reputation is on the line. Gupta of Blackstone too is optimistic that the Indian arm of the PE firm will live up to its international reputation through HPPPL. Though the private equity giant has invested close to $2 billion in India, it is yet to get a blockbuster return on any of the investments. Gupta is hoping to turn a corner through HPPPL— and his faith in Puri who, on his part, wants to take the company public he’s been talking about a listing since 2011. And while he’s given himself a deadline of “another two to three years,” sources close to the company say this will happen sooner rather than later.

A successful and oversubscribed IPO will vindicate Puri and validate his roller-coaster journey.

Yes, Ratul Puri is in a hurry.

First Published: Sep 16, 2014, 06:57

Subscribe Now