Mercedes-Benz: Breaking the class ceiling

By reimagining the way it operates in India, through new launches, creative financial solutions and improved customer perception, Mercedes-Benz is back on top of the country's luxury car market

Roland Folger, MD and CEO, Mercedes-Benz India, says the company is prepared to deal with an increase in demand for luxury cars in India

Image: Mexy Xavier

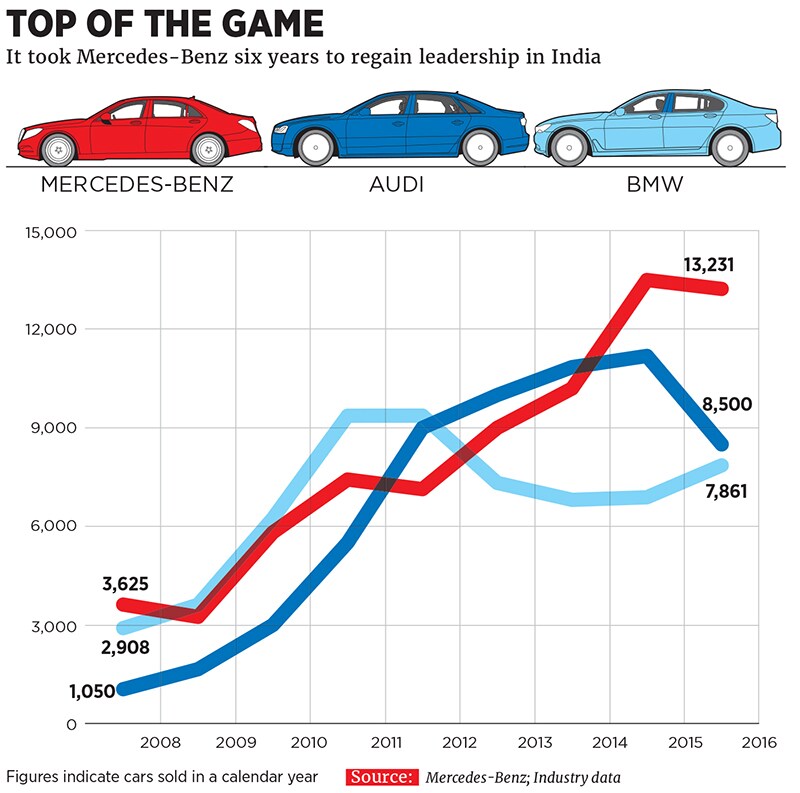

The year 2012 was a particularly bad one for Mercedes-Benz in India. Its performance hit its nadir as the company dropped to third spot, in terms of sales volume, in the luxury car market, behind compatriots BMW and Audi. The Stuttgart-based carmaker, which had entered India independently in 1994 and dominated the market for a decade-and-a-half, posted rare losses as well (Rs 11.6 crore in 2011-12 and Rs 12.8 crore in 2012-13).

Its problems began with the entry of BMW and Audi into the Indian market in 2007. The duo, being late entrants, unleashed a product offensive at attractive prices. Like Mercedes-Benz, their vehicles too had the famed ‘German engineering’ DNA. But what caught the fancy of customers was their modern design and styling. Mercedes-Benz, on the other hand, had a more dated design architecture. What made matters worse was that it lacked a strong SUV portfolio. Its traditional communication strategy and approach also did not suit the changing customer profile and soon the brand was perceived as one suited to people with an older age profile. BMW, Audi and other players like Jaguar Land Rover and Volvo gained in reputation and, consequently, customer attention. In 2009, BMW overtook Mercedes-Benz, and Audi followed suit in 2012. The fact that Mercedes-Benz had lost the crown globally to BMW in 2005 did not help either. With the parent itself facing strong headwinds, the ability of the Indian operations to react strongly to the altering market environment was impaired.

“We got complacent. We were the only player in the market and in a monopoly situation, you do not satisfy customers as you should. The year 2009 was a wake-up call,” Roland S Folger tells Forbes India during the course of an interview in Pune. Folger, who took over as managing director and CEO, Mercedes-Benz India, in October 2015, recalls how the poor performance had sent the Mercedes-Benz India management team into introspection mode to understand what had hit them and what needed to be done to regain market leadership. The need to completely reimagine the way it ran its operations became clear. The company labelled 2013 ‘The Year of the Offensive’ and did exactly that.

The results followed in a couple of years. By 2015, Mercedes-Benz had regained market leadership in India. As per its filings with the Registrar of Companies, Mercedes-Benz’s profits in 2014-15 stood at Rs 302.4 crore. In 2016, it consolidated its lead further despite being badly hit by the ban on the sale of big diesel cars in the National Capital Region (NCR) as well as by demonetisation in the first quarter (January-March) of 2017, it posted its highest ever sales (3,650 units) with those of SUVs growing by 13 percent. The perception that it is not a brand for younger people was changing as well—the average age of its customers dropped from 45 to 37 years. Globally, too, Mercedes-Benz regained its leadership in 2016 after over a decade.

Mercedes-Benz’s recovery in India began with the launch of the A-Class in 2013. The car, which came with a modern design language, ran up 400 bookings in just 10 days. More launches followed, including in the SUV segment. In 2015, as many as 15 models were launched, followed by another 13 in 2016. This year (2017) has already witnessed three launches—the new E-Class with a long wheelbase, Night Editions of the A-Class and B-Class models, and the S-Class Connoisseur’s Edition. “The new launches helped us cover all the white spots in our product range,” says Folger, a 57-year-old Mercedes-Benz lifer who headed the Malaysia business before coming to India. “Our new launches this year will be more or less the same as last year.”

This product blitzkrieg has helped the company erase its ‘slow mover’ image while offering customers multiple options across segments —be it a compact car, sedan, SUV, dream cars (like Cabriolet) or performance vehicles such as AMG.  Car line-up, Mercedes-Benz India: (From left) The new long wheelbase E-Class, AMG SLC43, GLC, CLA and AMG GT S

Car line-up, Mercedes-Benz India: (From left) The new long wheelbase E-Class, AMG SLC43, GLC, CLA and AMG GT S

Image: Mexy Xavier

Even as the company launched new models, it realised that the new class of customers it was wooing was different from its traditional buyers in many respects. For instance, entrepreneurs (in the startups space and otherwise) and professionals who had tasted success early in their career wanted to own a Mercedes-Benz but found it somewhat unaffordable. The company adopted a multi-pronged strategy to tackle this challenge.

First, it put its Rs 1,000-crore manufacturing facility at Chakan near Pune, with a capacity to assemble up to 20,000 cars, to better use by assembling more vehicles in India. “Today, we locally assemble nine models that account for 80 percent of our volumes,” says Folger. That apart, the company focussed heavily on localisation. For most of these nine models, the local content is around 60 percent. “These measures enabled us to reduce our prices by 20 to 30 percent. This helped our volumes and improved our profitability,” he says.

Today, any model that sells over 500 units a year presents a business case for the company to assemble locally. This applies to top-end cars as well. India is the first and the only market outside Germany where a right-hand drive, long wheelbase E-Class (launched recently) is assembled locally. The same is the case with the Mercedes-Maybach S 500 and S 600, priced at Rs 1.67 crore and Rs 2.6 crore respectively. “It is testimony to the fact that we can produce cars of the same quality as Germany with no discernible difference at all,” says Folger. “Such is the quality of the people at our plant that when Mercedes-Benz started a plant in Brazil, workers from here were sent to train people there.”

The company also adapted cars that came as CBUs (completely built-up units) for the Indian market in a bid to make them more affordable. For instance, AMGs were launched globally with 4-litre V8 engines but the company felt they were too powerful for Indian conditions apart from the fact that their cost was high (Rs 1.3 crore). Instead, the company opted for a 3-litre V6 engine, which offered a relatively lower horsepower and torque, but worked well for local conditions and came with a lower price tag of Rs 75 lakh.

The affordability factor was also tackled through some innovative financing products. Daimler Financial Services India (DFSI), the captive financing company, came in handy here. “The challenge before us was to make a Mercedes-Benz car more accessible to customers who wanted to own it but were unsure of servicing a large equated monthly instalment (EMI),” says Fred Wick, managing director & CEO, DFSI. STAR Agility, a finance solution created by Mercedes-Benz India with Mercedes-Benz Financial, launched in April 2013, gave buyers the option of making a balloon payment at the end of the contract and take ownership of the car or exchange it at the end of the contract period with a new model. STAR Agility reduced the EMI by 40 percent making the cars affordable for a wider pool of customers. Today, STAR Agility accounts for 10 percent of all vehicles financed by DFSI and its acceptance is growing fast. Leasing products that cut the cost of the vehicle by 50 percent have also been launched.

“Mercedes-Benz learnt from its past mistakes and understood the need to make its products attractive and affordable to the new breed of customers. By doing so, it has come back strongly,” says Amit Jain, partner, BMR Associates. “It also built a strong management team to go deeper into the country.” With 89 sales and service outlets across 41 cities, Mercedes-Benz has the densest network among all luxury car players in the country, and 35 percent more than its nearest competitor.“Our ‘Go to Customer’ strategy, a qualitative network expansion, has been the key to our growth story as we wanted to be close to the customers. We have tried to unleash the potential not only in the key metros but also in emerging T2 and T3 markets,” says Michael Jopp, vice president, sales & marketing, Mercedes-Benz India.

This widespread network was useful when the company rolled out its next biggest differentiator—My Mercedes-My Service. Till a few years ago, the total cost of ownership, or TCO—a metric that looks at the cost a buyer incurs while using a car—was never a factor in the luxury car space. But for the new crop of buyers who happened to own a luxury car for the first time, a high maintenance cost (spares as well as service) was proving to be a big deterrent in buying a Mercedes-Benz. To address this issue, the company extended the warranty period to three years (two years is the norm in the industry) for all cars.

It did not stop there. It began offering attractive service packages. “For the recently launched new E-Class (petrol version), we are offering a package where for Rs 64,700, all the service needs of the customers are taken care of for two years and unlimited mileage,” says Santosh Iyer, vice president, after-sales and retail training, Mercedes-Benz India. “This offers customers immense peace of mind.” These packages come in various forms. Each car has 45 different packages that enable customers to choose a plan based on their usage pattern—three years or 30,000 km, 3 years or 60,000 km and even 10 years or 200,000 km. The company has used big data (being the oldest luxury carmaker in India, it has over 10,00,000 cars on the road) to study how the cars performed over a period of time and then designed competitive service packages that deliver as much as 40 percent savings to customers. About 30 percent of all new car buyers have opted for the My Mercedes-My Service scheme after it was launched in July 2016. “My father always said you learn how to save money from rich people,” says Folger.

The My Mercedes-My Service scheme also ensured that the needs of new-age customers, a critical pain point for the company, were taken care of. It offered Digital Service Drive, where customers can book a service online, speak with a service advisor at a dealership through Skype or FaceTime besides getting estimates of cost and status of service online. This means that a customer need not go to the service centre at all. Today, 95 percent of all workshop throughput is done digitally.

The scheme also has what the company calls a ‘Premier Express Service’ across eight cities in the country. For an additional payment of Rs 2,000, a customer can get the car serviced in just two hours. This is also targeted at younger buyers who do not have multiple cars and need the car back quickly for their daily needs. “Our dedicated Premium Express bays across all our dealerships are full through the day,” says Iyer. “These measures have ensured that we become a brand of choice, especially among younger customers.”

Mercedes-Benz is surely back on a firm footing. As a market leader it is setting the pace for others to follow. It has attracted a good share of younger customers and what pleases Folger even more is that many of their traditional customers who left the brand in 2009-10 are returning. “They tried out other brands and realised that the grass is not always greener on the other side,” he says. If at all something worries him today, it is the larger issue of growth in the Indian luxury car market. For many years now, the volumes have remained almost flat. Between 2013 and 2016, the segment added just 4,000 units and in 2016, growth declined by 5 percent to 34,176 units. The high duty structure seems to be an impeding factor. “The exorbitant duty structure makes luxury cars quite prohibitive in pricing in this market. Any reduction in excise duty would have grown the volume and the fear of revenue loss would have been more than aptly balanced,” says Jopp. Adds Folger, “India is still a bit socialist in its thinking.”

But that is changing from a customer’s perspective. “Buying a luxury car is not a taboo any longer and customers now perceive a luxury car as an extension of their lifestyle and also as an achievement,” says Jopp. Agrees BMR’s Jain, “The Indian market is upping the ante. People want to own a luxury car.” The numbers sure justify the potential headroom for growth. In India, the share of luxury cars among total new cars registered, at 1.2 percent, is among the lowest in the world. In Indonesia it is 2.5 percent, Malaysia 5.4 percent, China 8 percent and Germany 24 percent. “I am confident the market will grow,” says Folger. And Mercedes-Benz has never been better prepared to take advantage of any sharp increase in demand for luxury cars in the country, he adds.

First Published: May 02, 2017, 07:43

Subscribe Now