New regime tax sops may benefit senior citizens more than the salaried

Minus exemptions, the new structure might incur a greater tax liability than the older one

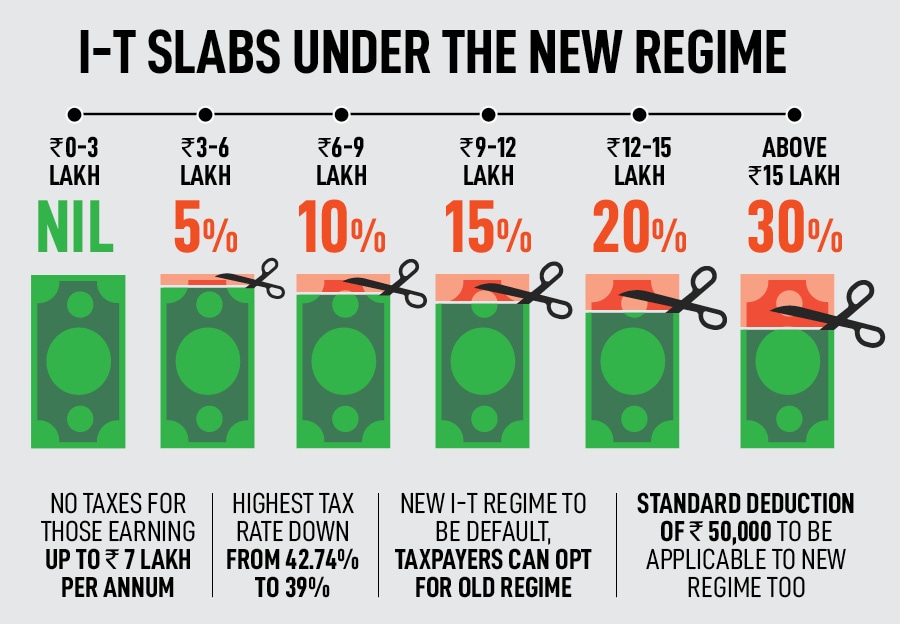

In this government’s last full Budget before the general elections in 2024, Minister of Finance Nirmala Sitharaman lavished sops on the salaried middle class, exempting those earning up to Rs 7 lakh per annum from paying any taxes. So far, incomes of Rs 5 lakh were entitled to such a rebate. The minister has also reduced the number of tax slabs, from six to five, and increased the exemption limit to Rs 3 lakh for those who have opted for the new regime (see graphics).

“An individual with an annual income of Rs 9 lakh will be required to pay only Rs 45,000. This is only 5 percent of his or her income. It is a reduction of 25 percent on what he or she is required to pay now, ie, Rs 60,000," said Sitharaman in her speech. “Similarly, an individual with an income of Rs 15 lakh would be required to pay only Rs 1.5 lakh or 10 percent of his or her income, a reduction of 20 percent from the existing liability of Rs 1,87,500." She has also brought down the highest tax rate from 42.74 percent to 39 percent, and applied standard deductions of Rs 52,500 to incomes above Rs 15.5 lakh. However, these tax benefits would be applicable only to the new regime, which was introduced by the FM in 2020.

Sitharaman also announced that the new regime, henceforth, will be the default one, even though taxpayers will have the option of choosing the old one. But given that the new structure eliminates exemptions like HRA and LTC, does it make sense for taxpayers to shift to it?

Not for regular middle-class salaried individuals, feels Rohit Shah, an investment advisor and the founder and CEO of GYR Financial Planners. How does the maths stack up for a salary of Rs 15 lakh per annum? In the new regime, at 30 percent, it attracts a tax liability of Rs 1.5 lakh without the deductions. “But in the old model, it is Rs 1.2 lakh," he says.

While Shah doesn’t see a big uptake for the new regime among the salaried class, he says it will make life easier for senior citizens or foreigners, who aren’t looking at long-term, tax-saving investments. “The structure will simplify taxes for those investors who do not want to get locked in," he says.

The FM has also extended more benefits for the elderly, doubling the Senior Citizen Savings Scheme limit from Rs 15 lakh to Rs 30 lakh. The limits of the Senior Citizen Monthly Income Scheme have also been raised from Rs 4.5 lakh to Rs 9 lakh for individuals and from Rs 9 lakh to Rs 15 lakh for joint accounts.

First Published: Feb 01, 2023, 18:59

Subscribe Now