Can PayPal Win the Wallet Wars?

PayPal is in the centre of two battles: One for control of every transaction on the Planet, the other for control of its own destiny

The clogged roads of San Jose teem with Priuses, which merely serve as earnest slalom gates for David Marcus to blow through in his black Porsche Panamera Turbo on a January afternoon. The 40-year-old president of PayPal has been in a rush since taking the top job 21 months ago. He’s overseen a sweeping overhaul of the payment company’s technology. He’s rolled out a passel of new products to let his 143 million users pay with their phones. And he’s seen his parent company, eBay, become a public target—Carl Icahn has quietly amassed a 2 percent stake, ahead of a just-promised proxy fight—as the division he runs increasingly appears more valuable than the core business that purchased it.

Eager to show off some of the magic, we’re racing to Birk’s, a bustling Silicon Valley chophouse that accepts PayPal from diners. Marcus fires up the PayPal iPhone app, which locates him in the restaurant and allows him to scan a bar code before the meal and watch the cheque update on his phone in real time. The idea is to bring the speed and simplicity of internet shopping into the physical store. “I like to think of it as The Matrix,” grins Marcus, a slight accent revealing his French and Swiss upbringing.

But there’s a glitch in this matrix. The restaurant is not running the latest program. There’s no bar code to scan before the meal and none on the cheque. Instead, Marcus must type in a seven-digit code attached to the bottom of the cheque. When the cheque arrives the code is missing. “The challenge,” Marcus says, trying hard to mask his frustration, “is not only scaling the technology but having people understand it on the merchant side.” Ten minutes later, the waiter returns, code in hand. Marcus enters a tip, pays the bill via iPhone and sighs: “When it actually works, you don’t have to wait.”

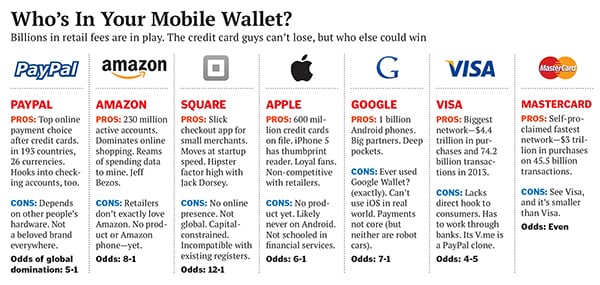

Marcus and PayPal have neither the luxury of glitches nor of waiting. Money is going mobile, and the race is on to control the flow of bits and cash across a billion smartphones and at millions of online and physical locations. Research firm Gartner estimates that mobile payments will top $720 billion a year by 2017, up from $235 billion last year. The upside remains enormous: Humans made $15 trillion worth of retail transactions in 2013. Whoever ends up with controlling interests in this new digital ecosystem will reap billions in transaction fees, collect massive amounts of consumer data and control the type of targeted advertising that makes marketers drool. Giants such as Apple, Amazon, Google, Visa and MasterCard all want to be your mobile digital wallet, as do several well-financed startups, including Square, founded by Twitter billionaire Jack Dorsey.

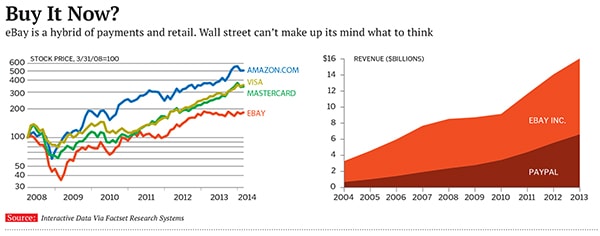

Right in the middle of it all: PayPal, the precocious child of the last dotcom boom, which is now inflicting as much disruption on its parent company as it hopes to on global banking. It moved $180 billion in 26 currencies across 193 countries last year, and its revenue grew 20 percent to $6.6 billion—41 percent of eBay’s total revenue and 36 percent of its profits. It’s no longer fair to call eBay an online auction company. PayPal, purchased in 2002 for what everyone thought was an outrageous price of $1.5 billion, is now worth at least half of eBay’s $70 billion market capitalisation.

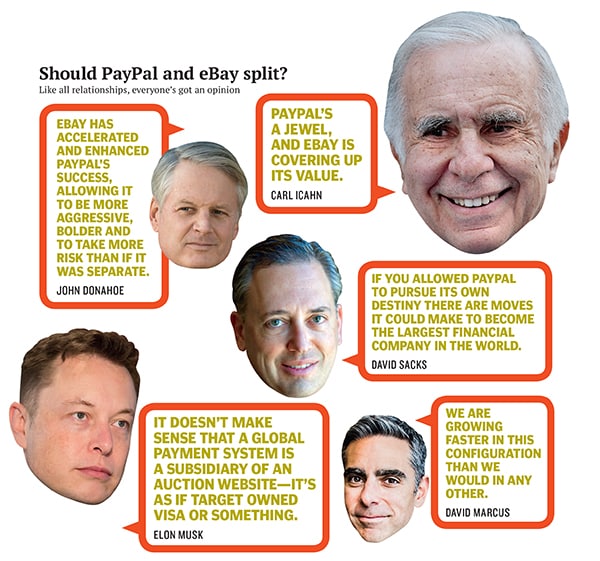

“If you just went out and took it public you’d get a huge premium because of growth,” says Icahn, who is demanding a sale or spinoff. Elon Musk, the billionaire polymath behind Tesla and SpaceX who made his first fortune co-founding PayPal, is even more direct: “It doesn’t make sense that a global payment system is a subsidiary of an auction website. It’s as if Target owned Visa or something.” PayPal, he adds, “will get cut to pieces by Amazon Payments, or by others like Apple and by startups if it continues to be part of eBay.” Such sentiments add another layer to this gold rush. The winner of the brewing mobile-payment showdown will first be predicated on who wins the battle to control PayPal.

That eBay, one of the most innovative startups of all time, now finds itself positioned as a lumbering giant has some historical basis. PayPal has a legitimate claim, based on future successes, to the most entrepreneurial founding team ever. Musk (Tesla, SpaceX) was originally joined by Peter Thiel (Facebook, Palantir) and Max Levchin (Yelp, Slide), with an initial mission similar to what Bitcoin is trying to do 15 years later: Create an electronic currency independent from governments and central banks. Soon to join: Reid Hoffman (LinkedIn), David Sacks (Yammer), Jeremy Stoppelman (Yelp) and Chad Hurley and Steve Chen (YouTube). It’s almost impossible to find a major startup in Silicon Valley untouched by the PayPal “mafia”.

Its first great success was figuring out how to beam dollars between Palm Pilots and, later, transferring cash via email. Like credit card companies, PayPal charged the seller a fee of about 3 percent of the transaction, but the founders figured out how to make a decent profit in the low-margin business of transaction processing by encouraging people to fund payments with checking accounts, which let PayPal avoid having to remit that 3 percent fee right back to credit-card issuing banks. To this day, that direct link to bank accounts is an advantage that Amazon, Google and Square lack.

Its speed, convenience and security made PayPal popular with eBay’s small-time sellers, and by late 2000 the service had amassed more than 3 million customers. One of the first IPOs after the September 11 attacks, PayPal jumped more than 50 percent on its first day of trading. Less than a year later, eBay bought it for $1.5 billion. The original PayPal team waited until their lockup agreements expired and then were gone, en masse. By that point, most of eBay’s founding team had moved on as well.

“Ebay had a very different way of doing things,” says Eric Jackson, the CEO of Caplinked, who was PayPal’s VP of marketing during the transition and later wrote the book The PayPal Wars. “Lots of meetings, lots of PowerPoint slides, lots of committees, decision-making slowed down.”

Its engineering department turned into a slog of nine groups fighting constantly over resources and often building redundant products (log-in screens, sign-up forms, checkout pages). Programmers across the globe wrote tiny strips of code without knowing, or caring, about the final product. “They would just reinvent the wheel,” says Hill Ferguson, PayPal’s chief product officer. “Every time you changed something you had to do it 30 different times. It was a staggering technical debt.” Instead of a few days, it took almost two months to add a new server, and nearly 70 days to change text on the home page. “Under the old format, many great technologists left,” says Marcus. “If you had a choice between Google and PayPal, you’d go to Google.”

Its website design was clunky and its customer service so poor that websites exist for the sole purpose of trashing the company. Says eBay CEO John Donahoe, with the understatement only a former management consultant can muster: “Our consumer and merchant products needed to be updated and refreshed.”

For Donahoe and former PayPal head Scott Thompson, global growth trumped chasing the product innovations from startups like Square. “Would you rather have a big, global payment system working at scale or refocus on a domestic system for a device attached to an iPhone for a very small, mostly offline merchant?” says Thompson. “It’s tough to debate, that. The only way you’ll get to the right answer is to look back ten years from today.” Under Thompson, PayPal’s revenue more than doubled from $1.9 billion to $4.4 billion.

To Icahn, however, PayPal has just been riding a wave. “I don’t think eBay is a well-run company. When the tide is rising high, everyone looks good. Just compare eBay to Amazon. PayPal is a jewel, and eBay is covering up its value.” While eBay shares are up 80 percent since Donahoe took over in March of 2008, over the same period Amazon is up 400 percent Visa and MasterCard are each up 245 percent.

The new Icahn-eBay feud only makes more complex PayPal’s ongoing war with tech’s most dangerous giants. Google released a wallet product for its nearly billion Android users and inked a deal with MasterCard to get access to millions of retailers. Apple has been able to use its retail stores as laboratories. It thinks it can convert its nearly 600 million iTunes customers to use the service offline and has slapped thumbprint readers on its iPhone 5s, with the idea of replacing credit card signatures. Amazon just announced that it’s developing a Kindle-based payment system for its 230 million customers.

Most frustrating to PayPal: The rise of Square, which had none of the inherent advantages of the tech giants and yet has built a platform, from scratch, that could become a mobile payment standard. “I was shocked that PayPal didn’t already have something like this,” says Marcus, who took over as the division’s president two years ago. Says former PayPal COO David Sacks: “If you allowed PayPal to pursue its destiny there are moves it could make to become the largest financial company in the world.” But first it must get its act together.

The man in the middle of this swirl arrived almost by accident. Until August 2011, David Marcus was a serial entrepreneur who never managed more than 250 employees. He hit it big on his third try with a mobile payment company called Zong, which he sold to PayPal for $240 million in cash. Marcus no longer had to work—he confirms that he owned a “great deal” of Zong—but Thompson, aware of the hole they had dug for themselves on the product side, asked him to run PayPal’s mobile division.

The challenge intrigued him. Born in Paris and raised wealthy in Geneva (his grandfather was a successful entrepreneur), Marcus was a full-fledged computer geek by the age of 8, eventually programming games on his Mac 512K. He studied at the University of Geneva, until a currency bet by Dad went horribly south after the Berlin Wall fell, putting the family in financial peril. “It was terrible at the time,” says Marcus, who dropped out of school and took a job at a bank to support the family. “But it was probably the best thing that ever happened to me.”

That’s because the bank gig made him realise that building companies was better than banking for them. When Switzerland deregulated its telecom industry, Marcus started his own phone company, built it into the third-largest fixed-line carrier in Switzerland and sold it in 2000 to Atlanta’s World Access for around $50 million in stock. He was 27 years old and worth $10 million—on paper. But then, the internet bubble burst. World Access went bust, taking Marcus’ shares with it.

Marcus shook off the loss and started Echovox, which made voice recognition software for cellphones (think Siri for old-school Nokias). That didn’t work out, so the company shifted to text-based marketing and running the voting system for the European versions of American Idol. At the time, social-gaming companies like Zynga were catching fire on smartphones, but no one wanted to take the time to enter their credit card information to spend less than $1 on a Farmville cow. Marcus created an Echovox spinoff called Zong that let people charge inexpensive virtual goods to their mobile bill. In April 2008, he moved his entire family to the Bay Area to build the business. Three years later, PayPal bought Zong, and suddenly Marcus was running mobile.

On his first day in the office, he set about creating a Square-killer, now called PayPal Here, that lets small merchants take a credit card using a phone or tablet. It took seven months. “Honestly, it was probably the first real major product launch at PayPal in years,” says Marcus. Around the same time, Thompson left to run Yahoo (a gig that quickly imploded, after Thompson got caught with a false computer science degree on his résumé). For three months, eBay’s Donahoe cast about for a successor. “I didn’t think for a second they would think of giving me the job,” says Marcus. But, eventually, Donahoe did: “Mobile was coming up as an important platform shift. We wanted someone with really strong product skills and consumer instincts.”

Marcus was hesitant. “In startups you work your ass off, but you get to decide that 100 percent of the time.… Here I’d be scheduled up to the minute. I’d travel more and see less of my wife and kids. I thought, Do I really want to do this?” That night, he and Donahoe grabbed drinks to discuss the role. Drinks turned into dinner at a strip mall in Portola Valley and more drinks as Donahoe tried to persuade Marcus to accept. Marcus told Donahoe that if he took the job, he’d need the power to change the place “bottom to top.” Donahoe assured him that if he wanted status quo, he would have given the job to someone more traditional.

So Marcus is staging what he calls an “invisible turnaround”, re-engineering PayPal while revenue growth is still strong. He quickly blew apart the nine-silo system and adopted a single, more adaptable set of software tools. PayPal organized engineers into small groups that would build a product from start to finish. On top of that, PayPal recruited serious tech talent from Netflix, Google, Amazon and Box, while laying off about a third of the engineering team.

Most of all, Marcus has returned PayPal’s culture to its roots, snapping up nearly $1 billion worth of startups in areas he considered weak points, and stacking the division’s top ranks with career entrepreneurs—most of whom, like himself, have entered PayPal through acquisition. “It’s unusual for a multinational to have as its head of corporate strategy some Russian guy with no business degree and who doesn’t believe in strategy,” says Stan Chudnovsky, whose data company IronPearl was bought by PayPal last spring. “[In 2013] we launched 28 products. The year before? Basically zero,” says chief product officer Hill Ferguson, who helped build Zong. Marcus’ personal sandbox—mobile payments—has surged from $750 million in 2010 to $27 billion in 2013.

The newer, nimbler PayPal now has a mission as simple as it is momentous: put PayPal into the centre of every transaction, everywhere. Platform agnostic. Online or physical.

“One thing a company should ask itself is, if it didn’t exist, would it create an unfillable hole in the lives of people? I want that to be PayPal,”says Marcus. “There’s not many in tech—Google and Apple and that’s it.” Unfortunately for Marcus, they’re his top competitors.

For its part, PayPal remains a juggernaut in internet transactions, and Marcus’ purchase of startup Braintree in December for $800 million will help it defend its turf: The one-click payment software, embedded in popular services such as Uber, Fab.com and HotelTonight, can easily and cheaply be dropped into any mobile app.

Winning over real stores, however, is where the rest of the pack has made inroads. And given that the old system of cash and plastic works well enough for merchants and shoppers, there must be big incentives for each to switch payment systems—especially when that system isn’t already buried in a consumer’s device.

PayPal is instead focusing on the merchants, licensing its software for use in point-of-sale equipment covering more than a million physical retailers. PayPal now enables mobile checkout at Home Depot, Foot Locker, Toys “R” Us, Jamba Juice and Dollar General. Marcus is hoping that the retailers will then figure out the best way to get their customers to use a phone to pay.

It could mean hands-free payments, line-cutting capabilities, personalised coupons and instant credit. Different stores need different features, and Marcus is not attempting to create a one-size-fits-all product. Just as Apple and Google have done with apps, Marcus aims to build the operating system for mobile payments, laying out the key network, programs and hardware that will allow retailers and software developers to create the products. “It has to be the experience you have online today,” says Marcus. “You’ll get what you want really fast, pay really fast and get out. And the merchant will know more stuff about you, and that will make your experience better.”

To see how mobile money—PayPal specifically—might be better, go to your local Starbucks. The coffee chain says that nearly 10 million customers pay with its mobile app—powered by both PayPal and Square—making about 5 million mobile transactions a week. The app lets you load money onto your Starbucks account, pay by phone and automatically collect rewards points. More use means more perks—free food, free refills and free digital music. You can also locate open stores, search the menu and gift drinks to friends. While not earth-shattering, the app allows more convenience, more information and more savings—enough, PayPal hopes, to keep your wallet at bay.

As for hardware, later this year Marcus is rolling out Beacon (not to be confused with Apple’s similar iBeacon)—a cheap, matchbook-size Bluetooth transmitter that connects your smartphone to the store’s payment system. Coupled with PayPal’s new mobile wallet app, Beacon will let you pay via credit card or bank account, use coupons and collect various loyalty points without removing your phone from your pocket.

Cultural issues remain. In its soul, eBay remains leery of PayPal, as Donahoe maintains that the ties to eBay have allowed it to act more aggressively. The natural synergies are fading—of PayPal’s $180 billion in online transactions last year only 30 percent took place on eBay, down from 51 percent in 2008—even if the old mentalities aren’t. “It’s a 13,000-person company where we’re changing everything and rewiring the whole culture,” says Marcus. “It’s really brutal. … At large companies you always find someone with reasons not to do something—the self-preservation thing is highly frustrating.”

And that’s the exact sentiment—plus the prospect of unreleased value, ready to drop into his own pocket—that fuels Icahn. It’s not that he thinks PayPal should be a standalone he says he would prefer if eBay simply sold it to a more natural fit, such as a Visa. “Another giant in the space would pay a huge premium for PayPal.”

Musk and other former PayPalers like Sacks would prefer that it operate as a standalone, arguing that, once unchained, it could eventually be worth $100 billion (compared with the $40 billion or so it’s valued at today). “It will either wither or be spun out,” says Musk. “Carl Icahn can see it, and he’s not exactly super tech-savvy.”

Musk has a point. Icahn, a notorious Luddite, may not know exactly how PayPal works—he talks about it in the generalities of someone who still doesn’t use e-mail—but he senses potential. And the larger question for PayPal shouldn’t be whether Icahn can eventually get it spun off. It’s whether people like him will eventually use it.

First Published: Mar 08, 2014, 06:02

Subscribe Now