“They went through a lot, and they’ve been there a long time waiting for this," says the 59-year-old Harris. “Having grown up [near DC], it’s very personal for me. Obviously, you have to deliver, right? I stay up at night thinking about that."

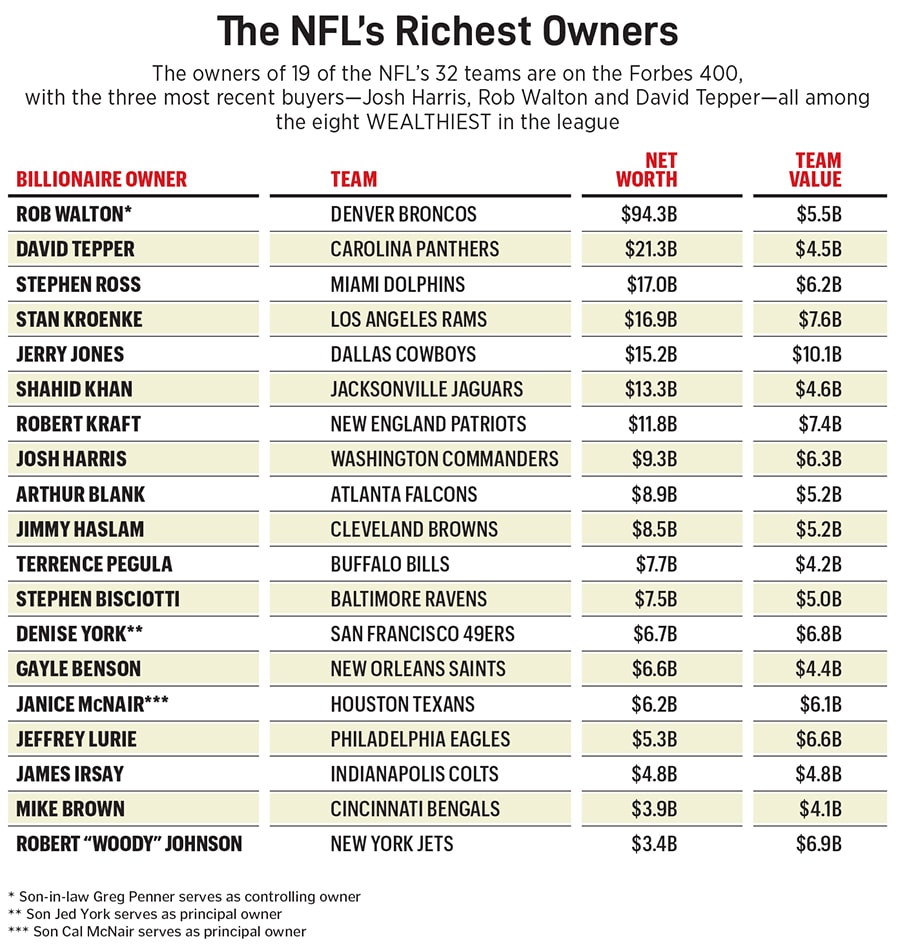

As the Harris era begins, there’s a lot at stake. The $6 billion he paid for the Commanders last year—besting interest from the likes of billionaires Jeff Bezos and Tilman Fertitta—ended Daniel Snyder’s scandal-plagued tenure and set a record for the sale of a National Football League (NFL) team. To get the deal done, Harris assembled a 23-person ownership group that included David Blitzer—a top exec at Blackstone and Harris’ partner in his other sports endeavours through Harris Blitzer Sports & Entertainment—as well as basketball legend Magic Johnson and billionaires Mitch Rales (Danaher Corp.) and Eric Schmidt, the former Google CEO.

Harris didn’t make any rash changes after the deal closed in July 2023, but after a disappointing 4-13 season, he cleaned house, bringing in a new head coach, general manager and quarterback, Heisman Trophy winner Jayden Daniels, the second pick in this spring’s draft. For a kid who grew up in Chevy Chase, Maryland, whose parents spent 25 years on the waiting list for season tickets to see the then–Washington Redskins play at historic RFK Stadium, it’s a dream come true. It also fits nicely into the private equity titan’s sports portfolio, which includes basketball team Philadelphia 76ers, the National Hockey League’s New Jersey Devils, English soccer club Crystal Palace and Nascar team Joe Gibbs Racing.

Soon Harris is likely to be joined in the exclusive NFL owners’ club by more of his buyout-fund brethren. Last month the NFL became the last major professional league to open its doors to private equity firms, with owners voting 31-1—Cincinnati’s Brown family was the only dissent—to allow a group of approved firms to buy up to 10 percent of each team, subject to other restrictions, such as a minimum holding period of six years. It’s a watershed moment for a league that has seen team values skyrocket into the multibillion-dollar range, severely limiting the pool of potential buyers.

Even Harris, worth an estimated $9.3 billion, worried that owning a professional football team would soon be out of reach. When hedge fund heavyweight David Tepper bought the Carolina Panthers in 2018 for $2.3 billion, it was the most anyone had ever paid for an NFL franchise. No other team came up for sale until 2022, when Pat Bowlen’s heirs put the Denver Broncos on the market. Harris put together a group to make an offer, but a group led by the Walton family outbid him to pay a staggering $4.7 billion, doubling Tepper’s record.

“The way the NFL was heading, forget about The Forbes 400," Harris says. “You had to be in The Forbes 50."

![]() While Josh Harris can thank private equity for his initial billions, sports are making him richer faster Image: Cody Pickens for Forbes

While Josh Harris can thank private equity for his initial billions, sports are making him richer faster Image: Cody Pickens for Forbes

Inviting Wall Street to the NFL party is a game changer. The eight private equity funds approved by the NFL to invest, including Blackstone, Carlyle, Arctos and Ares Management, currently have dry powder in excess of $160 billion. That’s a lot of firepower. It will ensure that franchise values, which by Forbes’ reckoning have appreciated more than 60 percent in the last three years, continue to rise. In fact, barely two weeks after the ink was dry on the NFL’s ownership rule change, Arctos was in talks with Stephen Ross, owner of the Miami Dolphins, to buy a stake in his team that would value it north of $7 billion.

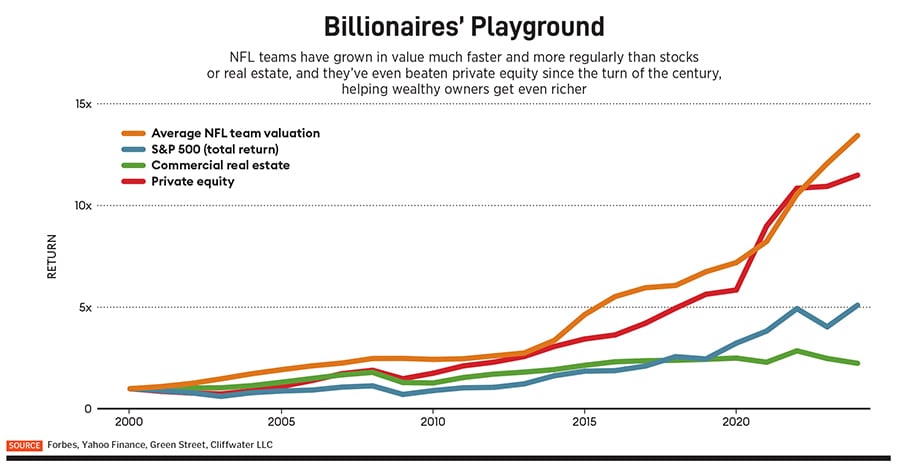

For private equity firms like Arctos, it’s a no-brainer. NFL teams are underleveraged, yet they rake in so much from media rights deals it’s almost impossible not to turn a profit whether they win or lose. Since 2000, NFL teams have significantly outperformed nearly every other asset, including stocks, real estate, bonds—and, yes, private equity funds. If you adjust for risk, the numbers look even better.

“In business you’re graded by Ebitda and stock price and cash flow," Harris says. “In sports you’re graded by creating positive memories."

Joshua Harris, the eldest son of an orthodontist who was a collegiate rower at the University of Pennsylvania in the 1950s, is a lifelong sports devotee. Growing up in Maryland, he played Little League baseball, basketball and soccer. When he was 9, he found his true love, wrestling, after winning a tournament at summer camp. He would go on to compete competitively all the way through high school at the Field School in DC and in college at Penn.

![]()

After excelling in economics his freshman year, he transferred to the Wharton School and, like many of the college’s Reagan-era graduates, made his way to Wall Street. He landed at Drexel Burnham Lambert during the peak of Michael Milken’s junk bond–fueled profitability. He worked for two years in mergers at the firm’s New York office under the tutelage of Milken’s right-hand man, Leon Black. During Harris’ short stint at Drexel, the firm was making headlines for its involvement in the Ivan Boesky insider trading scandal, and Milken’s operation came under investigation by the SEC and the US Attorney’s office. Harris left in 1988 to pursue an MBA from Harvard and in 1990 accepted a job at Blackstone. Just two months later, however, he quit to join Leon Black and Marc Rowan, both refugees from Drexel’s collapse, to start Apollo Advisors.

The trio spent the next 30 years building Apollo into one of the world’s largest private equity firms, now managing $700 billion in assets. Harris was known to be demanding and obsessive about details. His most notable deal was acquiring Dutch chemical maker LyondellBasell in 2008, using $2 billion of its distressed bank debt. After managing it through a prolonged bankruptcy and a 2010 IPO, Harris and partners wound up netting a $10 billion profit by the time they fully cashed out in 2013. Black became tainted by his close ties to disgraced financier Jeffrey Epstein, whom he paid $158 million for tax and estate planning services, and when Black stepped down under pressure in 2021, Apollo’s board picked Rowan, not Harris, to succeed him as CEO.

Harris quit later that year but didn’t stay away from private equity for long. He launched 26North in 2022 and has already built it to $23 billion in assets, announcing its first buyout—of ArchKey, a Missouri-based electrical contractor for commercial buildings—in September for more than $1 billion.

“The ability to generate alpha was harder with over half a trillion or a trillion dollars, so I wanted to go back to basics," he says. “I wanted to go back to what I had done when Apollo was much smaller."

The rise of any asset class is often easy to understand in hindsight, but when Harris first became interested in sports ownership after Apollo’s 2011 IPO gave the billionaire newfound liquidity, it was far from a sure thing that franchise values would continue to go up. The National Basketball Association (NBA) was having a particularly difficult year, dealing with a dispute with its players’ union over revenue sharing that came to a head in a five-month lockout, shortening the 2011-12 season.

“This was post–Michael Jordan, and people were saying maybe the best years of this league were behind us. Certainly, we didn’t believe that, but that’s what a lot of people in the market were saying," says NBA commissioner Adam Silver, then the league’s deputy commissioner under David Stern. “Josh took a long-term view, and he was very analytical in his approach. He did as thorough a due diligence process with the league as any owner had done in my time in the league up till then, and I got here in 1992."

![]()

The Philadelphia 76ers won their last championship in 1983, in the spring of Harris’ freshman year at Penn. He recalls marveling at how the team united and delighted the city. But ever since, the franchise had been stuck in a cycle of irrelevance. It was losing $25 million a year and attendance was sagging. Harris felt that the team’s owner, cable TV giant Comcast, was more passionate about the Flyers, the city’s hockey team, than basketball, and was open to making a deal.

Harris and Blitzer, the Blackstone banker whom Harris had befriended while working in London during the financial crisis, pulled a page from their day jobs to orchestrate a corporate carve-out for $280 million to acquire the team with a group of investors made up of mostly Penn alumni and Philadelphia natives who remembered the Sixers’ 1980s heyday.

“I remember David Stern saying, ‘You don’t realise how good a deal you’re getting’—as he insisted we pay more in revenue share," Harris says.

After acquiring the team, Harris decided the way out of mediocrity was to first get worse. He oversaw the rebuilding phase in which the team traded veterans for future draft picks and earned its own high draft picks with poor play on the court. The dark period coined a forlorn rallying cry that fans would chant at games: “Trust the Process."

Unfortunately, it took longer than Harris envisioned, with five straight losing seasons from 2012 to 2017. But it eventually worked. Philly has made the playoffs in each of the past seven years and fans have come back in droves, selling out every game since 2017.

“The Sixers are a top-quartile franchise in the NBA. Philly cares about sports. They’re tough and they’re demanding," Harris says. “And Washington is a top-quartile franchise in the NFL. If you just do the right thing, you know you’re going to make money in those franchises."

![]()

That’s why the cost of admission to the NFL didn’t dissuade him. The league makes around $10 billion per year from its media rights deals, a number Harris expects to rise significantly when it renegotiates its contracts following the 2028-29 season. According to Nielsen, 93 of the 100 most-watched TV shows of 2023 were NFL games—and three of the other seven were college football games. An average of 17.9 million people watched run-of-the-mill regular season games last year, while a record 120 million tuned in for Super Bowl LVIII. Compare that to nationally televised NBA games garnering 1.6 million eyeballs on average. The NBA still inked an 11-year, $76 billion TV deal in July that will take the league through 2036.

“The NBA media deal per viewer hour is now multiples of the NFL deal," Harris says. “It does feel like there’s upward pressure on the NFL media deal."

It’s not as if NFL owners have to pinch pennies until the media rights are up for renewal. The NFL pools its TV revenue, plus sales from league-wide sponsorships and merchandising. That money is distributed equally to its 32 teams. Each team also contributes 34 percent of its ticket sales to the general pool. That helps smaller-market franchises stay competitive. Last year, each NFL outfit received $400 million from the league, covering around two-thirds of annual revenue for a typical team.

It’s a type of corporate socialism that guarantees every team will make heaps of money. According to Forbes’ estimates, every NFL team netted at least $50 million in operating income last year, and most exceeded $100 million. Whether you win the Super Bowl or are stuck in last place hardly matters. The Carolina Panthers have had an abysmal record on the field since Tepper bought them in 2018. But the team has still doubled in value, with an estimated $109 million in operating income last year. Harris’ Commanders were the worst in their division in 2023 but had strong 26 percent operating margins, making an estimated $160 million on $609 million in revenue, net of stadium debt service.

“If there’s a recession, your chemical company, your steel company, the stuff I used to do, they’ll be hit," Harris says. “In the NFL, to a large extent, 70 percent of the revenues are contracted, and then you have the 30 percent that might be hit a little, but it’s very non-correlated."

Profits are not as much of a sure thing in the National Hockey League, but that hasn’t stopped valuations from rising. Harris’ New Jersey Devils are worth $1.45 billion, 4.5 times more than his $320 million 2013 purchase price. Things are even better for NBA owners. Forbes now values the 76ers at $4.3 billion, 15 times what Harris’ group paid for them.

Harris isn’t just sitting back watching his money grow. He has already invested more than $75 million into improving concessions, parking and luxury suites at Washington’s Northwest Stadium—renamed this year following a naming rights deal with Northwest Federal Credit Union that will pay the Commanders around $8 million annually.

Long-term, Harris wants to build a new stadium to replace the ragtag 27-year-old structure. The US House of Representatives passed a bill this year to transfer ownership of the old RFK Stadium, currently cleared for demolition, from the National Park Service to the District of Columbia. If the Senate passes the bill, it could open the door for Harris to build on the same site where he used to go to games as a kid.

He’s also working from the inside. He has joined the NFL’s special committee in charge of overseeing future policies for private equity team owners. “He’ll be able to contribute a great deal," says NFL commissioner Roger Goodell. “Obviously, his understanding of that world is fantastic."

The new rules restrict private equity firms from owning more than 10 percent, but that will almost certainly change. More than half of NFL team controlling owners are over age 70. A major intergenerational wealth transfer is looming.

One of them is billionaire Robert Kraft, the 83-year-old owner of the New England Patriots, which he purchased in 1994 for $172 million ($365 million in current dollars), then the highest price ever paid for an NFL franchise. “In today’s world, sports teams and music are the only things that really bring communities together…We have a very powerful product," Kraft says, mentioning that he has been offered more than $7 billion for his franchise. “I think we’ve come up with a program that both satisfies the needs of the private equity firms but also supports the culture that we want to keep going. A win-win all around. I never thought I would sell anything out, but I’m considering it."

If Kraft—or any of the league’s owners—sells, it almost certainly won’t be to lone billionaire buyers. The prices are just too high. Wall Street firms will step in, ultimately a democratising development, as many of the league’s approved private equity buyers (Blackstone, Ares and Carlyle) are publicly traded. And that’s great news not only for Wall Street kingpins like Josh Harris but for investment-minded sports fans everywhere.