Who, And What, After John Chambers At Cisco

As John Chambers turns to go, time is running out for Cisco to reverse a serious growth slump

Who’s Got Next?

Someone in this photo will succeed Cisco CEO John Chambers. From left: Rebecca Jacoby, CIO Pankaj Patel, head of engineering Wim Elfrink, EVP, industry solutions Gary Moore, president and COO Padmasree Warrior, chief technology and strategy officer Chuck Robbins, head of sales Chambers Edzard Overbeek, SVP, services Rob Lloyd, president, development and sales Blair Christie, SVP, CMO. Not shown: Frank Calderoni, CFO.

Popping open a can of Diet Coke, John Chambers sits down to talk in his tiny, windowless conference room just off his rather modest office. Behind him on the wall are 13 framed posters signed by the engineers who created some of Cisco’s billion-dollar businesses (a litany of three-letter acronyms that only a geek could love). It’s been 19 years that he’s been running Cisco Systems, the world’s largest maker of data networking gear. Chambers would like nothing more than to add a few more posters to the wall before he’s gone.

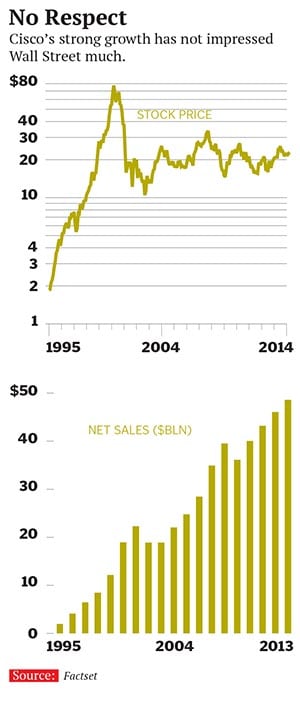

Time is running out. The consummate salesman with a rapid-fire West Virginia twang finally announced in November a fuzzy timetable for his retirement: Sometime in the next two to four years. Chambers is the fifth longest-serving CEO in tech. It’s remarkable he’s held on to the job given that Cisco’s shares haven’t broken $35 since 2001.

In November Chambers, known for his knack for forecasting fluctuations, offered a disappointing forecast and said it was “hard to read” the economic environment. In December Cisco cut the low end of its sales growth estimates for the next three to five years from 5 percent to 3 percent. The last time it cut its long-term outlook was in 2011, when it projected growth of 12 percent to 15 percent. In February the company reported a 7.8 percent drop in quarterly sales and a product gross margin of 58.8 percent, the lowest in more than a decade.

“We’re not a perfect company, nor am I the perfect leader,” Chambers says. “I have to constantly reinvent myself. If you don’t do that, you get left behind.”

The problem: Cisco is finally facing the reckoning that hit the PC and server industries years ago. Its dominant market share in routers and switches, the equipment that directs internet traffic and accounts for almost half of its sales, is being eroded by networking software and by cheaper, unbranded alternatives to Cisco’s premium-priced equipment. Customers are outsourcing their networking needs to cloud service providers such as Rackspace and Amazon rather than building their own data centres. The phone companies, governments and large businesses that are Cisco’s biggest customers have dramatically reduced spending. The question is how quickly Cisco can supplant its declining businesses with expanding ones.

Chambers calls 2014 “the year of architecture”, as the $48.6 billion (sales) company pulls together new technologies that it can sell to customers instead of just the gear that transmits digital video, voice and email. Cisco is betting a big part of its future on what it calls the ‘Internet of Everything’, a world where billions of sensors, phones and machines can be stitched together by Cisco and its customers. The company teamed with Major League Baseball this year to allow fans in a stadium to use their smartphones to get real-time statistics and replays, including unique camera angles of the play. Through a mobile app Cisco helped develop with AT&T and app developer Meridian, visitors to the Fernbank Museum of Natural History in Atlanta have access to interactive audio, video, sketchbook logs and other features that pop up as they visit specific locations in the museum. The city of Barcelona has worked with Cisco over the past few years to connect its citizens through video-enabled information kiosks tied to city hall and mobile apps that direct users to available parking spots.

Cisco has been cutting prices to fend off rivals like Huawei, Alcatel- Lucent, Juniper Networks and Hewlett-Packard, sacrificing its once unassailable gross margins. Chambers also jettisoned more than 12,000 workers and ditched poorly performing businesses, including its consumer forays into things such as Flip video cameras. In March Cisco announced plans to spend more than $1 billion over the next two years to build a global computing cloud to underpin its Internet of Everything ambitions. It set up a $100 million Internet of Everything fund that has invested in about a dozen companies in the past year.

Cisco, which has always pursued a growth-by-acquisition strategy—spending $71 billion to buy 169 companies over its history—in 2012 spent $1.2 billion to buy Meraki, a maker of Wi-Fi networking gear, and in 2013 spent $2.7 billion for security provider Sourcefire and $863 million to buy what it didn’t already own of data-centre startup Insieme Networks, which makes products that have become Cisco’s answer to the software defined networking touted by such rivals as Arista Networks, VMWare, HP and Juniper.“We will monetise [the Internet of Everything] by providing almost all the elements that connect this together,” Chambers says, “from the virtual data centre to the servers to the technology to the video to the web infrastructure. And we will combine it with everybody else—open—so the sensors companies, the manufacturing companies and others can be able to interface to it. We will provide the consultancy, and over time, if we do everything right, we’ll bring more and more applications to it.”

The Internet of Everything is far from a boon yet to Cisco’s coffers. The company has had to revise downward the growth forecast for its $11 billion (sales) services arm. Even at 7 percent to 10 percent it’s still too optimistic, says George Notter at Jefferies. Most of its services revenue comes from maintenance contracts tied to hardware sales, most of which are declining. Cisco’s nonservices revenue is forecast to drop 5.7 percent for 2014. “The math is inexorable,” says Alex Henderson, who has followed Cisco for years as an analyst for Needham & Co. “They’re a big, branded IT company in a world that’s shifting away from branded IT.”

Former Yahoo Chief Executive Carol Bartz, who has served on Cisco’s board since 1996 and has watched the company grow from $400 million in sales, says transitions are good. “It gets all the complacency out of the system,” says Bartz. “People get energised. There’s a new battle to win. That’s when teams come together.”

Chambers, who turns 65 in August, has announced his departure before, but this time he says he means it. “It was very deliberate,” Chambers says of his retirement announcement. “I’ve got next-generation leaders that can lead, that are getting ready.”

At least five executives could plausibly take over as CEO, though Chambers doesn’t call out any favourites. The likeliest front-runner is Robert Lloyd, president, development and sales, but solid candidates also include Padmasree Warrior, chief technology and strategy officer Chuck Robbins, senior vice president of worldwide field operations Pankaj Patel, chief development officer and Edzard Overbeek, senior vice president of Cisco Services.

Chambers acknowledges the company is still working on getting the “lighthouse” clients it needs as proof of concept around Internet of Everything. He expects to have those reference accounts up, running and talking in the next year. In the meantime he’s sharing Cisco’s vision with everyone from Israeli Prime Minister Benjamin Netanyahu to South Korean President Park Geun-hye, whom he pitched at the World Economic Forum in Davos in January. “She’s an engineer by background, so that helped a little bit.”

Over the past few years, Cisco executives say, they’ve been rethinking all aspects of the business, including setting up a formal programme called the Accelerated Cisco Transformation to consider ways to boost the top and bottom lines. Job cuts have been some of the more obvious efforts, but Chambers’ team is eager to talk about the less obvious internal changes.

Gary Moore, a former EDS executive who was named Cisco’s first chief operating officer in 2011 and charged with cutting $1 billion in operating costs in his first year, said his team dug into the supply chain and found that components were being purchased by individual engineering teams. By having prices negotiated on behalf of multiple groups, the company has been able to add back two percentage points to an otherwise slipping gross margin.

In one of the biggest changes from how the company has operated for most of its 30 years, all Cisco employees are now required to work together on products and services that solve customers’ business problems. It might not sound like much, but that’s a huge departure for a company where product groups worked in their own little worlds, rarely interacting with other parts of the organisation.

The openness extends even to the competition. Tom Georgens, CEO of storage-maker NetApp, says he was surprised and impressed with Chambers’ willingness to work together to integrate the two companies’ data centre products, even though Cisco already had a partnership with NetApp rival EMC. “John was looking for more avenues of success,” Georgens says, recalling that Chambers told him, “Anything we could do to create value for our customers, we’re interested in.” The companies have sold a combined $1 billion in products. “Billion-dollar businesses matter.”

Chambers gets Wall Street’s concerns. “They see new competitive models coming at us. They’re concerned can we maintain the growth in our margins,” he says. But Chambers says Cisco has always been in reinvention mode, moving from routers and switches to voice-over-IP to video communications. Cisco has edged out so many rivals over the past 20 years, including far bigger firms such as Lucent and Nortel. “We beat them all. If you look at the big picture, we’ve reinvented ourselves how many times here at Cisco?” Last time’s the charm.

First Published: May 10, 2014, 07:25

Subscribe Now