Bitcoin halving explained: What it means and when the next BTC halving is due

Learn what the Bitcoin halving cycle is, its importance, and how it impacts the crypto market. Also, know the details of the past BTC halving events

Bitcoin has come a long way since its launch in 2009. As the oldest cryptocurrency, it initiated the entire crypto movement that we see today. Decentralisation, digital ledgers, and peer-to-peer currency powered by Bitcoin blockchain technology have transformed the global industries. Since then, thousands of altcoins have emerged, each adding new features or trying to solve different problems. But Bitcoin (BTC) remains the most widely recognised and valuable crypto asset, often called the ‘digital gold.’

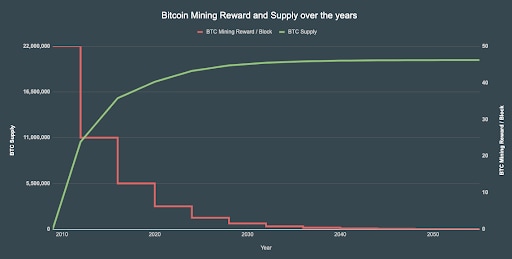

With a maximum supply of 21 million coins and over 19.8 million BTC already mined, Bitcoin focuses on a deflationary economic model and scarcity. One event closely tied to this limited supply is the Bitcoin halving cycle. In this post, we’ll discuss what Bitcoin halving is, its impact, and the details of the past events. We’ll also see when the next BTC halving will occur.

The Bitcoin halving cycle is a built-in feature of the blockchain network. When crypto miners validate transactions, they solve complex cryptographic puzzles as part of Bitcoin’s proof-of-work (PoW) mechanism. Each time they succeed, they earn a block reward - the newly minted bitcoins. This reward started at 50 BTC but is reduced by half after every four years.

Source | Bitcoin halving cycle: Reducing rewards by half and controlling supply

The idea is to limit how fast new coins enter circulation. With a fixed cap, the BTC halving event helps slow the pace at which supply grows, which can affect scarcity and price. It’s part of how Bitcoin controls inflation without relying on any central authority. The Bitcoin halving cycle is predictable, keeping miners, investors, and the wider market aligned with the network’s monetary system.

Now that we’re clear on what the Bitcoin halving cycle is, let’s understand its importance in the crypto market:

The Bitcoin halving cycle happens every 210,000 blocks - roughly every four years. So far, there have been four halvings, each marking a shift in Bitcoin’s supply structure and often influencing price movements.

Each Bitcoin halving cycle is a shift in its economic structure. While this is not a crystal-clear indicator of future prices, it remains a critical factor shaping crypto market psychology, investor behaviour, and the asset’s long-term narrative.

Here are some key market impacts observed around past halvings:

The next BTC halving is expected around April 12, 2028, at block height 1,050,000. At that point, the block reward will drop from 3.125 BTC to 1.5625 BTC, further tightening the supply. Bitcoin is nearing block ~898,450, so the next halving is roughly 150,000 blocks away. With over 94 percent of the 21 million Bitcoins already in circulation, each BTC halving event brings us closer to the total cap, restricting the supply of new coins.

How many more BTC halvings are left?

Four of the 32 Bitcoin halving cycles have been completed, leaving 28 to be completed by the year 2140, until block rewards drop to zero.

Will Bitcoin mining be profitable after halving?

The 2024 BTC halving event reduced block rewards to 3.125 coins, so miners now earn less for the same effort. Due to lower mining rewards, profitability will depend more on transaction fees and Bitcoin’s market price.

How does the BTC halving event impact other altcoins?

Bitcoin halving cycle reduces its supply, and if demand holds or increases, it can boost BTC’s price. This often triggers a ripple effect across altcoins, causing price swings as traders adjust their positions based on Bitcoin’s movement.

First Published: Jul 31, 2025, 14:42

Subscribe Now