How to help small businesses survive COVID's next phase

For small businesses that have survived the coronavirus so far, what's next? Karen Mills outlines steps that business owners and government should take immediately

Image: Shutterstock [br]America small-business owners moved quickly when COVID-19 started shuttering shops in March. Fine dining restaurants shifted to takeout. Book shops introduced curbside pickup. Gyms offered classes online.

Image: Shutterstock [br]America small-business owners moved quickly when COVID-19 started shuttering shops in March. Fine dining restaurants shifted to takeout. Book shops introduced curbside pickup. Gyms offered classes online.

Business owners, it seemed, just needed to face this once-in-a-lifetime calamity and get through a few months, when normalcy would resume. The Paycheck Protection Program (PPP)—government-funded forgivable loans designed to help businesses pay their employees—would help them weather the storm.

Six months later, there’s still no end in sight to the pandemic and no easy answers for small-business owners trying to survive. Strict safety protocols haven’t been enough to get customers through the door for some small businesses, and many owners—crushed by inventory and overhead costs—are grappling with hard choices.

“This is the worst small-business crisis of my lifetime, and I’ve seen a number of tough moments,” says Karen G. Mills, senior fellow at Harvard Business School. “I’m quite concerned that we haven’t even seen the tip of the iceberg of business closures.”

Yelp, the online review website, estimates that almost 73,000 small businesses in the United States had closed permanently as of July 10. And almost half of owners surveyed in late June by the online business network Alignable said they lacked enough cash to get through one month and were taking in less than 50 percent of their pre-pandemic sales.

“We’re finding that you can’t save businesses by just allowing them to reopen,” Mills says. “Until it’s safe, their employees don’t want to come back. Their customers don’t want to come back. There’s no one out shopping on Main Street.”

The situation appears bleak, but owners still have options, says Mills, who led the US Small Business Administration from 2009 to 2013 and was an Obama cabinet member. Getting through the coming months will require extreme ingenuity and shrewdness from business owners, and additional waves of aid from the federal government.

Three moves small-business owners can take now

Mills offers three recommendations to cash-strapped business owners:

Focus on social media and email to reach customers. The coronavirus pandemic forced many analog companies to embrace digital technology, such as contactless payment tools and online booking software. During the last week of August, about 25 percent of respondents to the US Census Bureau’s Small Business Pulse Survey said they were increasingly using online platforms to promote goods and services.

However, businesses don’t need a comprehensive digital strategy—or even a website—to succeed online. An Alignable survey found that 25 percent of respondents were turning to social media to reach customers while 18 percent were engaging them through email.The key is to harness the most effective outlet for a firm’s products and services, Mills says, citing the experience of milliner Linda Pagan, owner of The Hat Shop in New York.

“She decided to create these crazy videos and put them on Instagram, and they’ve taken off,” Mills says. “She still takes customer orders over the phone, but now she has a few more sales per day and says that’s enough to make it through.”

Scrutinize every cost. Every dollar matters now. Companies hanging by a thread should try to renegotiate contracts with suppliers and landlords, and refinance debt. Is there a new supplier for a key item the company uses? Would opening only during high-traffic hours reduce electricity bills?

Perhaps for the first time, small-business owners accustomed to monthly accounting might need to track day-to-day spending so they can react quickly to changing economic conditions. Free and low-cost tools from banks and fintech firms can synthesize financial performance on real-time dashboards, making monitoring less onerous.

“Small-business owners tend to focus on their customers, and on their products and services,” Mills says. “They often don’t have time for the accounting and paperwork. But knowing your cash situation is mission critical in tight times like this.”

Concentrate on the best profit opportunities. Small-business owners must identify their most valuable products and services and eliminate everything else. If a restaurant’s tried-and-true burger has a stronger gross profit margin than its artisan cheese platter, it’s time to dump the cheese, at least for now.

It’s equally important for firms to understand their most loyal and profitable customers—who they are, what they buy, and how to engage them. Beyond their purchasing power, loyal customers can become a company’s best advocates, providing powerful word-of-mouth advertising that’s authentic and free.

Innovation like this has been paying off. Sixty-four percent of small-business owners say they can continue operating under current conditions for more than a year, up from 34 percent three months ago, according to a CNBC/SurveyMonkey survey of small-business owners.

For government: Aid that’s easier to access

The US government also needs to do its part and extend aid efforts, Mills says. The Paycheck Protection Program allocated $659 billion in forgivable loans to small businesses that agreed to retain employees and maintain salaries. Almost 73 percent of respondents to the Census Bureau’s weekly Pulse Survey said they had received PPP assistance as of August 29. The program, which expired on August 8, increased a participating business"s self-reported survival odds by 14 to 30 percentage points and likely reduced the number of firms that permanently closed, according to a new HBS study.

While the loans helped many businesses get through temporary shutdowns, critics argued that aid tended to go to wealthier, connected applicants and, in some cases, to publicly traded companies. Despite these problems, Mills considers the program a step in the right direction during an unprecedented crisis.

“PPP was designed to bridge small businesses for eight weeks,” says Mills, who has been advising congressional and business leaders about aid strategies. “No one could have predicted how long this would go on.”

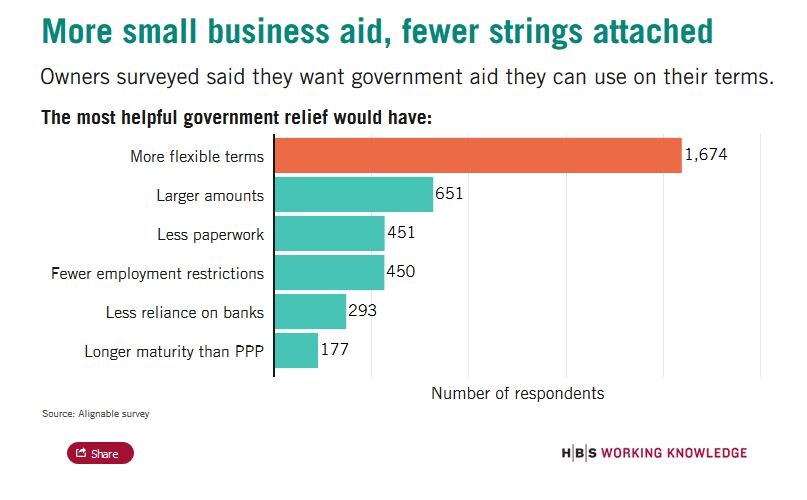

Mills recommends that the US government replenish and restart the Paycheck Protection Program, but find additional ways to support the smallest, most vulnerable businesses, many of which tend to be women- and minority-owned. Alignable’s June survey suggested that PPP applications from minority-owned businesses were twice as likely to be rejected. Mills says that future loans should be simpler, easier to access, and provide more flexible terms to encourage participation.Before the COVID-19 pandemic, small businesses provided almost half of the country’s private sector jobs and accounted for 44 percent of US gross domestic product. While policymakers are starting to appreciate the economic might of small business, these firms collectively lack the lobbying firepower of large industries at a time when they need aid most, Mills says.

“This is a critical moment for small businesses,” she says. “If we lose too many, it will create a long drag on the ability of the economy to recover. We must move now to provide all the support that we can, from congressional action to just remembering to ‘shop small.’”

Danielle Kost is senior editor of Harvard Business School Working Knowledge.

First Published: Sep 15, 2020, 10:59

Subscribe Now