Food tech startups: Pivoting to survive

A look at technology startups in the F&B and hospitality sectors that have pivoted their businesses to survive the pandemic

Rajeev Karwal, founder & chairman, Milagrow HumanTech, with humanoid robots RoboNano (facing him) and RoboELF that have been deployed in hotels and hospitals

Rajeev Karwal, founder & chairman, Milagrow HumanTech, with humanoid robots RoboNano (facing him) and RoboELF that have been deployed in hotels and hospitals

Image: Madhu Kapparath[br]As the Covid-19 pandemic led to a nationwide lockdown and people remained apprehensive about stepping out of their homes even when restrictions eased, hospitality became one of the worst affected sectors. India’s hospitality industry witnessed a decline of 52.8 percent in revenue per available room between January and September 2020, compared to the same period last year, according to JLL’s Hotel Momentum India Q3 2020, a quarterly hospitality sector monitor.

The food and beverages industry (F&B) is witnessing a structural change because of the pandemic. As normal restaurant operations have been severely restricted, and consumers prefer home deliveries over dining out, restaurants and hotels are looking at a digital future. The industry has seen many businesses pivoting their offerings in a bid to survive.

Tourism contributes 10 percent ($275 billion) to India’s GDP and is the backbone of the hospitality sector. With the travel, aviation and F&B sectors facing a severe blow, unique transformations are being developed by stakeholders to keep them up and running. We look at some companies that have successfully developed innovative methods of operations in the F&B and hospitality sectors.

Milagrow HumanTech: Robots to the rescue

At 43, Rajeev Karwal had given up trying to be a part of the corporate rat race, and launched a robotics startup Milagrow HumanTech in 2012. “I have seen a number of evolutions, from handsets to smartphones, TV sets to LED screens... I realised the next big thing is likely to be robotics even if the first couple of years are slightly slow,” he says.

The company started in the commercial and residential robots space, with robots for floor cleaning and window cleaning. “Things were going well, but demonetisation and GST hit us badly, and our sales fell by 50 to 60 percent,” says Karwal. Their first pivot was to enter the most relevant industry for their home-cleaning robots: Hospitality. From lawn-mowing robots to pool-cleaning robots, all their products turned out to be extremely successful.

With top hospitality players such as ITC Hotels, Taj Hotels and Oberoi Hotels and Resorts as clients, all was going well for Milagrow, until the pandemic struck. Although they shut down operations completely due to the lockdown, Karwal was resilient. “We had completely moved out of the residential sector. But during the lockdown, calls from friends and families started pouring in, inquiring about our floor-cleaning robots,” he says. Karwal realised, almost immediately, that this was likely to be their silver bullet. “Apart from nuclear families, 25 percent of our user base is senior citizens who couldn’t call their domestic help anymore,” he says.

Milagrow also expanded to the health care sector to help workers and doctors. “We deployed humanoids in various hospitals that could move inside Covid-19 wards to provide patients with basic amenities and disinfect floors. These could be controlled by health care workers and doctors sitting outside the ward,” explains Karwal. These humanoids have been deployed in Reliance Hospitals, Manipal Hospitals as well as Fortis Hospitals. In case of any issues with the robot, the Internet of Things (IoT) technology inside the robot ensures that any technician can fix it with a simple code.

This pivot has worked well for the company. Karwal claims sales for its residential robots have grown by 750 percent (in terms of revenue) compared to last year. The company has earned ₹8 crore so far this year, and is hoping to close the year with a revenue of ₹15 crore. “We could’ve earned a lot more, but the issues with the initial lockdown set us back a little,” he says.

During the pandemic, revenue from the hospitality sector—which had earlier generated 70 percent of earnings—dropped to zero, while residential robots now account for almost 70 percent of total revenue. Apart from pivoting to a new sector, Milagrow also experimented with its distribution channel. “We went live with the residential robots on ecommerce platforms like Amazon, Flipkart and TataCliq,” he says. This has helped them expand geographically as well. “Last year, seven cities controlled 95 percent of our turnover, and now 20 cities contribute 95 percent.”

With economic activities now increasing, growth in the hospitality sector is likely to pick up. The company is looking to expand into the F&B sector as well, along with facility management and education. “I think it look a pandemic to nudge people into realising that robotics are useful,” Karwal says. [br]Dotpe: The digital route

[br]Dotpe: The digital route

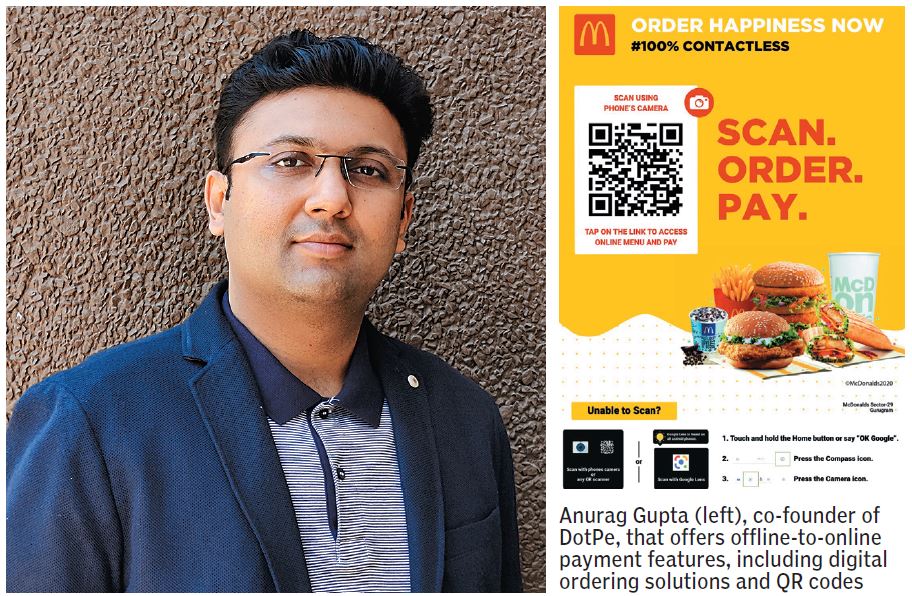

Gurugram-based fintech startup DotPe aims to digitise the retail sector in India. It offers offline-to-online (O2O) payment features to retailers and customers, which includes direct communication and digital ordering solutions, QR codes, and WhatsApp-based scan-order-pay features.

DotPe started its operations this February—around the time India began to witness a rise in coronavirus cases—and has collaborated with several marquee clients, including Starbucks, Haldiram’s, Big Chill, McDonald’s, Barista, and Smoke House Deli. “We witnessed a 15 percent week-on-week growth at a time when digital solutions amidst social distancing were the need of the hour,” says Anurag Gupta, co-founder, DotPe.

“Considering that typical restaurants or retail stores in both big and small cities may not be able to access tools to tackle their problems with technology, we have been democratising digitisation for such businesses to help them operate online without the need to rely on third-party service providers. Retail brands and brick-and-mortar restaurants can use QR codes and WhatsApp-based scan-order-pay solutions, which don’t require any technical expertise,” says Gupta.

On the consumer side, DotPe enables them to discover food outlets on Google by the popularity of individual catalogue items, scan QR codes on their smartphones to place digital orders, and then make payments via online payment platforms. For further transactions, the customer can interact with these brands via WhatsApp, Facebook, SMS and other messaging platforms.

“We are serving more than 1.7 million merchants in India, and target a 60-million network of offline business enterprises that are yet to make the full digital transition,” says Gupta. DotPe charges flat fees from merchants, unlike other aggregators who provide a percentage-based commission model, thus ensuring a higher margin for merchants, he adds.

“DotPe envisions becoming the primary enabler and disruptor in the O2O segment by effectively blurring the line between offline and online in the near future,” says Gupta. The company plans to gain 30,000 enterprise retailers, five lakh long-tail merchants, and a million daily transactions on their digital commerce and payment solutions platform by the end of the current financial year. “As a veritable industry-agnostic tech enterprise, we also intend to venture into sectors such as pharmacy, modern trade, fashion, retail, etc that have a massive potential for further digital transformation,” he adds.  Staqu Technologies’ audio-video analytics solution ‘Jarvis’ offers facial recognition technology and can also conduct hygiene checks. In order to make it relevant during the pandemic, it has added functions like safe distancing measures, mask detections and fever detections. The startup has tied up with hospitals and warehouses, and is now foraying into the F&B sector[br]Staqu: Hygiene check

Staqu Technologies’ audio-video analytics solution ‘Jarvis’ offers facial recognition technology and can also conduct hygiene checks. In order to make it relevant during the pandemic, it has added functions like safe distancing measures, mask detections and fever detections. The startup has tied up with hospitals and warehouses, and is now foraying into the F&B sector[br]Staqu: Hygiene check

Gurugram-based startup Staqu Technologies has developed a technology that was helping the police in Uttar Pradesh monitor CCTVs in prisons, using artificial intelligence (AI).

Its flagship technology is an audio-video analytics solution called Joint AI Venture for Video Instances and Streams or Jarvis, which offers facial recognition technology that can detect faces even in low-resolution video feeds. It can also conduct hygiene checks, including floor mopping and temperature detection, and track employee productivity, drive attendance, and intrusions. This was pre-Covid-19. In order to make it relevant during the pandemic, Staqu has added functions like safe distancing measures, mask detections and fever detections.

It has tied up with hospitals and warehouses, and is now foraying into the F&B sector. Through Jarvis, the startup is providing hygiene and safety monitoring solutions for kitchens and restaurants. With restaurants opening up recently, monitoring staff members individually is tough, so Staqu’s Jarvis does it for them and sends real-time alerts to restaurant owners. “Using the existing CCTV camera for monitoring, Jarvis will ensure hygiene and safety adherence such as face-mask detection, hand wash detection, hand gloves check, queue management, heat-map and footfall detection, and crowd analysis,” says Atul Rai, co-founder and CEO, Staqu. Each of these solutions is customised as per the restaurants’ requirements.

This pivot has worked well in the startup’s favour. In the last financial year, it clocked a turnover of $1 million and this year it is targeting $3 to $4 million. “Jarvis has helped us secure partnerships with several F&B players, including Faasos, Dineout, Travel Foods and others,” says Rai, adding that they are in talks with a bunch of other restaurants too.

First Published: Dec 09, 2020, 12:58

Subscribe Now