Mega companies: Superstars or super villains?

South Korea's experience shows that big is not necessarily bad

Giant firms are often cast as villains, throttling competition and stifling innovation. From Microsoft to Meta and now Google, a litany of behemoths have run afoul of antitrust laws for the power they wield. My recent research, however, suggests that the role they play in national economies may be a lot more nuanced than news headlines might have you believe.

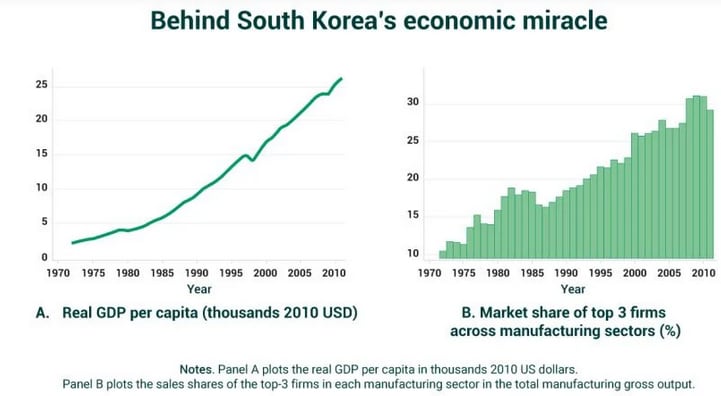

Together with three co-authors*, I analysed data spanning four decades – from 1972 to 2011 – on South Korea"s economic miracle. We found that were it not for big players such as Samsung Electronics and Hyundai Motors, South Korea’s real GDP would have been 15 percent lower by 2011. Welfare or consumers’ purchasing power would have been 4 percent lower.

Yet, this dominance did not translate to obscenely higher prices for consumers. We found that aggregate mark-ups – the difference between the cost of producing a good and its selling price – by the top firms increased by a modest 14 percent.

Between the 1960s and 2000s, South Korea transformed from a war-scarred backwater – its top export was wigs – to an economic and technological powerhouse, with outsized soft power to boot. Real GDP per capita increased nearly twelvefold from 1972 to 2011.

It is perhaps no coincidence that the South Korean economy is also dominated by sprawling firms or chaebols. As we found in our study, now published as a working paper by the National Bureau of Economic Research, these large firms played a pivotal part in the growth miracle of the country of 52 million people.

Using detailed firm- and sector-level data, we found that the top firms weren"t just big they became dramatically more productive compared to their smaller counterparts. In the early 1970s, the top three firms in each sector were about 2.6 times more productive than other firms by 2011, they were 11 times more productive.

The data suggest that these companies became dominant primarily by innovating and becoming more efficient, rather than through anti-competitive practices or government favouritism.

The top South Korean firms were also more successful in tapping into foreign markets, especially from the mid-1990s onward. At their peak in 2007, the largest firms" foreign demand was nearly eight times higher than that of other firms.

What did all this mean for the South Korean economy? Our modelling and counterfactual experiments indicate that if the top three firms across sectors hadn’t grown in productivity as they did, South Korea’s real GDP would have been 13.7 percent lower in 2011. The impact rises to 15 percent when the firms’ foreign market access and favourable government policies are factored in. Welfare (in net present value) would have been 2.8 percent lower, or 4 percent when foreign exports and government policies are included.

Importantly, mega companies did not abuse their market power in South Korea, at least in terms of pricing. As mentioned earlier, aggregate mark-ups by the top three firms across sectors increased by only 14 percent over four decades, compared to 4 percent on average.

Let"s put this into context with a couple of corporate heavyweights: Samsung Electronics and Hyundai Motors. By 2011, these two firms alone accounted for nearly 10 percent of South Korea"s total manufacturing output. What if they had grown at the same rate as the average firm in their sectors?

Our analysis shows that without Samsung"s outsized growth, South Korea"s GDP and welfare would have been 6.4 percent and 1.04 percent lower respectively in 2011. Hyundai"s impact was smaller but still significant. The company accounted for about 1.1 percent of GDP at the peak of its influence around 2000 and 0.49 percent of welfare over the four decades covered by the study.

We expanded this analysis to all the top three firms across sectors. We found that the vast majority of these large firms were "superstars" – companies that not only outperformed their peers but also contributed positively to overall GDP growth. Besides Samsung and Hyundai, other examples include POSCO, a steel maker, and LG Chem, a chemical giant.

This isn"t to say that every big firm was a force for good. Some "super villains" outperformed other firms while dragging down GDP. But these were the exception rather than the rule. The superstars accounted for 21 percent of aggregate sales in 2010 while the supervillains contributed just 3 percent.

So, what can we learn from South Korea"s experience as we grapple with questions of market power and antitrust policy in the United States and elsewhere?

First, it"s a reminder that size isn"t everything. What matters more is how companies use their scale and resources. In South Korea"s case, many large firms leveraged their size to drive innovation and tap into global markets, benefiting the broader economy. In fact, the World Bank advises middle-income countries (see page 19 of the World Development Report 2024) to “move away from coddling small firms or vilifying large firms" to boost growth.

Second, it underscores the importance of looking beyond simple metrics like market share when assessing the impact of large firms. The relationship between market concentration, or dominance by a relative few, and economic outcomes is complex and can vary significantly across different contexts.

When a firm is large because of productivity or success in the global markets, then making it artificially smaller will not help the economy. On the flip side, when the firm is large because it is cozy with the government, then removing its favourable treatment could benefit the wider economy and improve welfare.

Finally, our study highlights the need for nuanced, data-driven approaches to antitrust policy. While vigilance against anticompetitive practices is crucial, we should be careful not to assume that all instances of market concentration are harmful.

As we watch the slow-burning drama of antitrust actions against tech giants like Google, it"s worth remembering the lesson from South Korea: The rise of corporate giants, at least in their early years, can contribute to broader economic growth and welfare.

The challenge for policymakers is to foster an environment where all firms can grow and innovate, while ensuring that this growth translates into benefits for both economy and society.

*Jaedo Choi, Federal Reserve Board of Governors Andrei A. Levchenko, University of Michigan and Younghun Shim, International Monetary Fund.

First Published: Nov 18, 2024, 15:26

Subscribe Now