Can Apple upset Samsung's applecart in India?

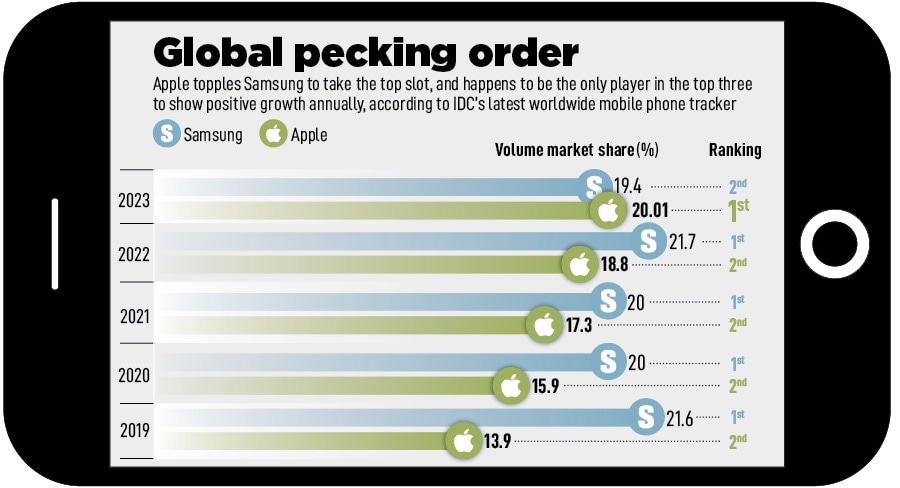

Apple recently ended Samsung's 12-year streak at the top by becoming the biggest smartphone maker globally in 2023. Can the American biggie topple the South Korean giant in India as well?

The ‘fruit brand’—that’s how Samsung honchos derisively address Apple in private conversations—has finally got the prized dressing for its global salad. Recently, Apple ended Samsung’s 12-year unbroken streak at the top by dislodging the South Korean biggie and becoming the biggest smartphone brand in the world. Though the gap is wafer-thin—Apple had 20.01 percent volume market share against Samsung’s 19.4 percent in 2023—one can be assured of an intense and bitter fight over the next few quarters. Now, the bigger, and fascinating, question to ask is: Can Apple repeat its global feat in India? Can the iPhone maker topple Samsung’s galaxy in the world’s second biggest smartphone market, which also happens to be Samsung’s second largest globally?

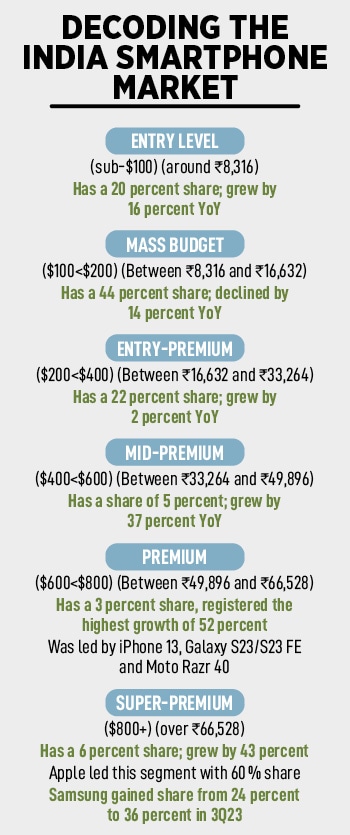

Well, just like two sides of a coin, there are two answers to this question. Let’s start with the first. In the near term, Apple stands a slim or next-to-slim chance to beat Samsung in India. The reasons: First, Samsung has a wider play in the Indian market. It straddles from entry-level phones (around Rs8,316) to mass handsets (between Rs8,316 and Rs16,632) to premium (between Rs49,896 and Rs66,528) and super premium (over Rs66,528). What this means is that Samsung has a presence across all price points and caters to every segment of consumers. A wider play, therefore, results in a bigger volume, and gives it a massive edge over its rivals.

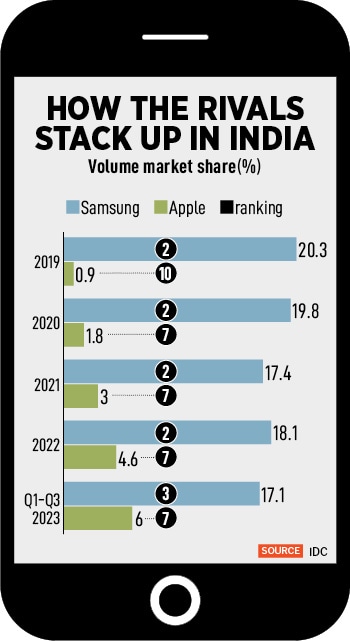

Second, the vast geographical offline footprint of Samsung and its deep inroads in Tier II, III, IV and beyond give it a massive retail advantage over others. This is something that even a Chinese brand like Xiaomi—which stumped Samsung with its online-only play to begin with—has failed to replicate so far in India. Third, the market share gap between Samsung and Apple—the South Korean, with 17.1 percent, is almost three times bigger than the American counterpart—is too much to be closed or narrowed over the next two years. Samsung, in all probability and in all possible and worst scenarios, will continue to outstrip Apple.

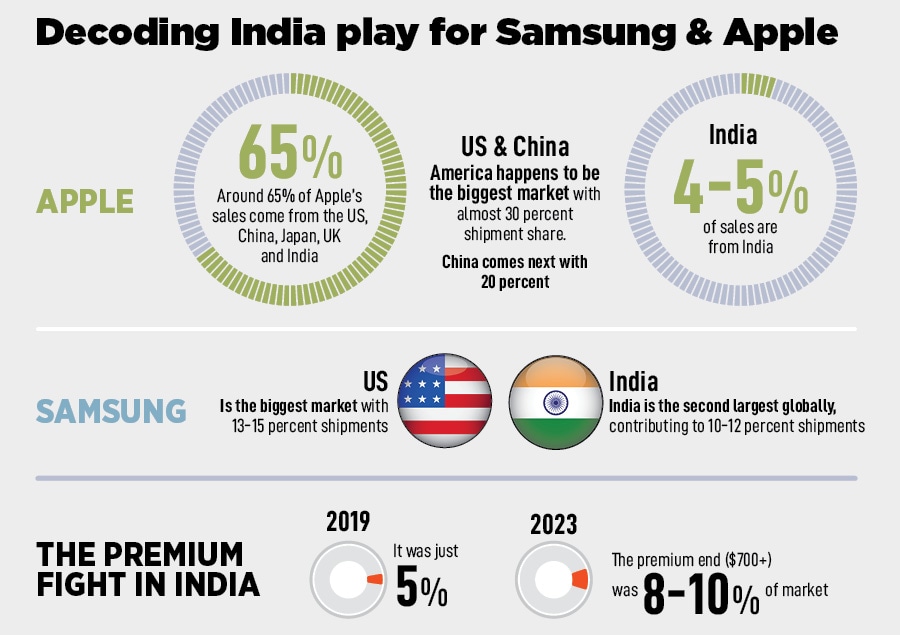

Samsung, reckon handset experts and industry observers, doesn’t have a near-term threat from Apple in India. “For Samsung, India is the second largest market globally after the US, and contributes to 10 to 12 percent to its shipments," contends Navkendar Singh, associate vice president (devices research) at IDC. Though India is crucial, given the fact that it happens to be the second largest market globally, Apple’s share is still not significant enough to contribute meaningfully to its global performance yet. Samsung’s portfolio, Singh underlines, spans across entry, mid, high and premium segments, which are relevant for the price-conscious India market. Apple, in contrast, is still a premium and super premium brand in India, and is likely to remain so over the next few years (see box).

Samsung, reckon handset experts and industry observers, doesn’t have a near-term threat from Apple in India. “For Samsung, India is the second largest market globally after the US, and contributes to 10 to 12 percent to its shipments," contends Navkendar Singh, associate vice president (devices research) at IDC. Though India is crucial, given the fact that it happens to be the second largest market globally, Apple’s share is still not significant enough to contribute meaningfully to its global performance yet. Samsung’s portfolio, Singh underlines, spans across entry, mid, high and premium segments, which are relevant for the price-conscious India market. Apple, in contrast, is still a premium and super premium brand in India, and is likely to remain so over the next few years (see box).

Can Apple pose a serious challenge in the long term? Yes, and the threat is quite realistic. Let’s look at the numbers. In 2019, Apple’s volume market share in India was a meagre 0.9 percent. The same year, Samsung was lording at a staggering 20.3 percent. Two years later, in 2021, the corresponding numbers were 3 percent and 17.4 percent. Cut to 2023, Apple has jumped to 6 percent, and Samsung has managed to hold on at 17.1 percent. What this means is that in just four years—from 2019 to 2023—Apple amped up its share from 0.9 percent to 6 percent, making it the seventh biggest smartphone player in India. During the same period, Samsung slipped from 20.3 percent to 17.1 percent. Now when put in context—back in 2019 and over the next year or so, Apple was not bullish on manufacturing in India—Apple has not only beefed up its production capabilities and India play, but it has also been aggressively ramping up its offline retail presence. This is what will change the dynamics and market share of Apple over the next four years.

Apple, though, has a formidable rival in Samsung. Though Apple has managed to get a stronger foothold in the premium market in India over the last few years, Samsung too has upped the game by not just relying on new launches but also pushing the older generation flagship devices clubbed with discounts and offers. “The form factors like fold and flip are the icing on the cake," says Singh of IDC, adding that Samsung is upping the ante with its latest flagship product—Galaxy S24 series, which is powered by Google AI. “With the Galaxy S24 series, we’re introducing ‘Circle to Search’, Google announced on its blog recently. The feature helps users search anything on an Android phone without switching between apps. “You can now select images, videos or text on your phone that you’re curious to learn more about with a simple gesture—whether that’s circling, highlighting, scribbling or tapping anything on your screen," the blog underlined.

Looks like the Samsung-Apple rivalry is likely to unfold at a furious pace over the next few quarters. The game is on!

First Published: Jan 18, 2024, 15:38

Subscribe Now