Why Xiaomi is in a downward spiral

Three consecutive quarters of slowdown in the mass smartphone market, Xiaomi's stronghold, takes a toll on the Chinese price-warrior. As the market moves towards premium, can the company retain its th

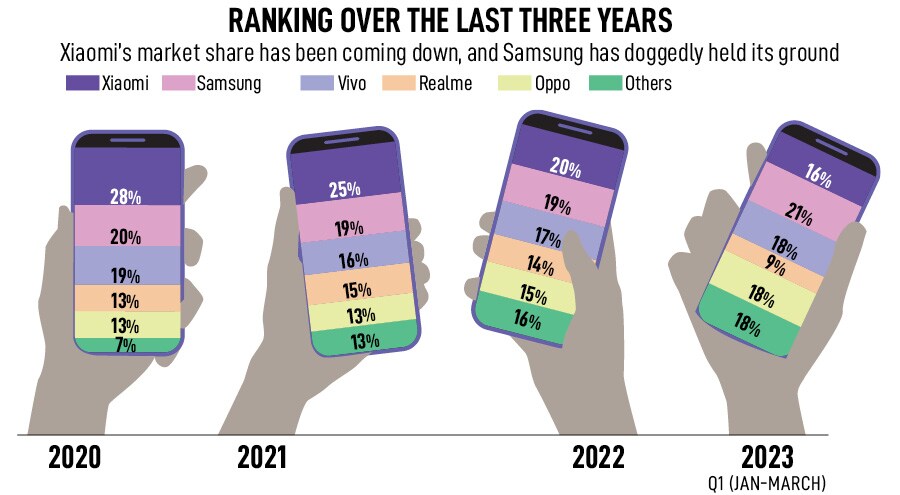

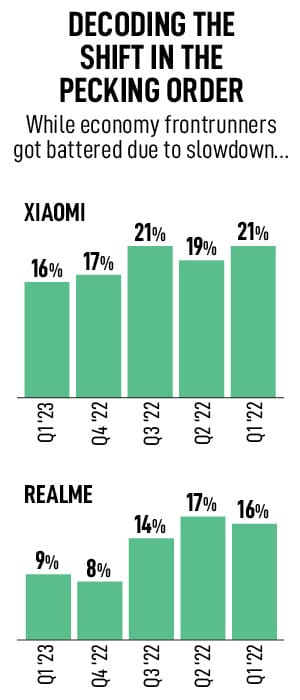

If a person loses some mass from his arm, it might go unnoticed. A drop in volume of thigh muscle, too, perhaps remains invisible. The disappearance of chubby cheeks might still not turn heads either. But when the tummy gets sucked in, it catches instant attention. That’s the story of Xiaomi, India’s biggest smartphone player, which has seen back-to-back dip in its quarterly market share for the first time in over five years. From a high of 21 percent in the first quarter of 2022, the share has slumped to 16 percent in the corresponding quarter of this year, pushing the Chinese giant out of the top in the pecking order and relegating it to fourth position behind Vivo, Oppo and Samsung, according to the latest data released by Canalys.

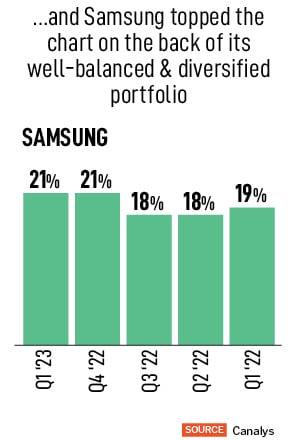

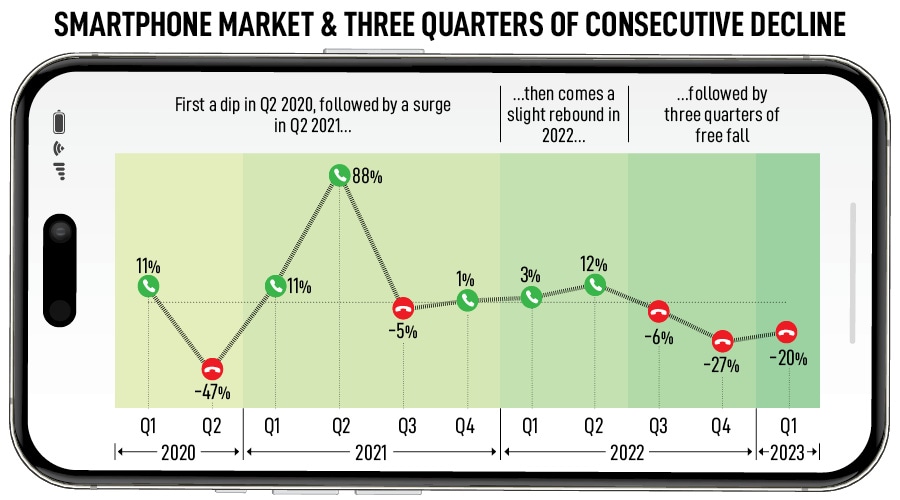

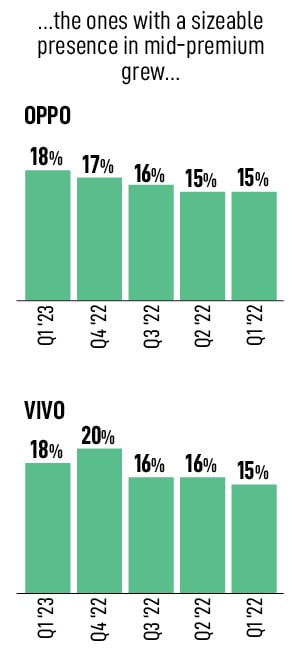

Now, one might say that Xiaomi’s misfortune has to do with a slowdown in the Indian smartphone market, which has seen an unprecedented decline for three consecutive quarters—6 percent, 27 percent and 20 percent in the last two quarters of 2022 and the first quarter of this year, respectively. But if one compares the performance of other Chinese and South Korean rivals during the same period—Q1 of 2022 and Q1 of 2023—one gets a different picture. While Oppo bettered its numbers, Vivo improved its market share, Samsung climbed to the top position.

So how does one explain a plunge in Xiaomi’s market share? Faisal Kawoosa has the answer. “Xiaomi"s muscle has got sucked out because of a dip in the mass market," reckons Faisal Kawoosa, founder of Techarc, a research firm. When that happens, the analyst reckons, people start noticing you.

Though a fall in the mass market has dealt a sucker punch to Xiaomi, the brand failed to make any dent in the premium segment of smartphones in India. Xiaomi’s plight, interestingly, is shared by another price-warrior Realme, which has a bulk of its portfolio blocked in under Rs15,000 category. Realme has slipped from 16 percent in Q1 of 2022 to 9 percent in Q1 of 2023.

The bad news for Xiaomi is that there is unlikely to be any respite in the coming months. “2023 will be challenging as the mass-market segment is still moving slowly," Sanyam Chaurasia, analyst at Canalys, points out in the latest report. The premium segment, in contrast, is poised for growth, boosting the average selling price growth of the overall market. “As disposable income gradually rises, consumers are willing to spend more on premium devices," he adds.

From being a high-priority market for Xiaomi, India has suddenly lost the charm as the parent company doesn’t want to commit more money into the brand. “How can the market grow when the stakeholders lose interest," says the analyst quoted above. There is trouble brewing on the global front as well. Last month, the smartphone maker reported a record 22.8 percent slump in its fourth quarter revenue. Back in India, it’s going to be an uphill task for Xiaomi to retain its crown. “They maintained top spot for 20 consecutive quarters. But it’s now a thing of the past," he adds.

Xiaomi India spokesperson didn’t reply to a list of questions mailed by Forbes India.

Xiaomi India spokesperson didn’t reply to a list of questions mailed by Forbes India.

Marketing and branding experts, too, reckon that it would be tough for Xiaomi to regain its mojo. “Xiaomi has struggled to make a transition from a mass brand to a class brand," says Ashita Aggarwal, marketing professor at SP Jain Institute of Management and Research. The problem, though, is not unique to Xiaomi. A mass brand usually fails to upgrade its appeal and add aspirational value. The tag of an economy brand especially hurts when consumers move towards premiumisation. “Their core (mass segment) is tottering and they are almost invisible in the high-end," she says.

Can Xiaomi stem the slide in its market share and bounce back? “It’s a tough task. But they are likely to stay in the hunt," says Kawoosa of Techarc.

First Published: Apr 20, 2023, 15:53

Subscribe Now

Let’s decode Xiaomi’s loss of mass appeal. The Chinese price-warrior, which counts India as its second biggest market, gained heft on the back of its play in the mass segment, and around 75-80 percent of the overall smartphone market lies under Rs15,000. It is this segment which has considerably slowed down over the last nine months as there is a decline in the first-time users. Feature phone consumers have become reluctant to upgrade, existing users have turned conservative in spends, and mid-premium and premium end of the market (Rs25,000 onwards) continue to swell. “Xiaomi has around 40 percent market share in sub Rs 10,000 category, and another 29 percent share in Rs 10,000-15,000 category," says Tarun Pathak, research director at Counterpoint Research.

Let’s decode Xiaomi’s loss of mass appeal. The Chinese price-warrior, which counts India as its second biggest market, gained heft on the back of its play in the mass segment, and around 75-80 percent of the overall smartphone market lies under Rs15,000. It is this segment which has considerably slowed down over the last nine months as there is a decline in the first-time users. Feature phone consumers have become reluctant to upgrade, existing users have turned conservative in spends, and mid-premium and premium end of the market (Rs25,000 onwards) continue to swell. “Xiaomi has around 40 percent market share in sub Rs 10,000 category, and another 29 percent share in Rs 10,000-15,000 category," says Tarun Pathak, research director at Counterpoint Research.

Loss of mass, though, is not the only problem for Xiaomi. The brand has seen a flurry of high-level exits over the last year, including the high-profile departure of Manu Jain. “He played a big role in establishing and growing Xiaomi in India," says Pathak of Counterpoint Research. The depletion of the core team has had an impact on the growth of the brand, he adds. But what accentuated Xiaomi’s woes is the protracted legal tussle with the Indian government. Last May, the Directorate of Enforcement (ED) reportedly seized Rs5,551.27 crore of Xiaomi India for alleged forex violations. “This has shaken the confidence of the global headquarters," says one of the market analysts, requesting anonymity.

Loss of mass, though, is not the only problem for Xiaomi. The brand has seen a flurry of high-level exits over the last year, including the high-profile departure of Manu Jain. “He played a big role in establishing and growing Xiaomi in India," says Pathak of Counterpoint Research. The depletion of the core team has had an impact on the growth of the brand, he adds. But what accentuated Xiaomi’s woes is the protracted legal tussle with the Indian government. Last May, the Directorate of Enforcement (ED) reportedly seized Rs5,551.27 crore of Xiaomi India for alleged forex violations. “This has shaken the confidence of the global headquarters," says one of the market analysts, requesting anonymity.