A Samsung veteran for over two decades, Jongbum Park, popularly known as JB, had been handling the mobile division at Southwest Asia and parts of Southeast Asia since 2012. Over six years into the role, umpteen visits to India, and a diligent warrior who had learnt the craft from the best at the headquarters, JB was more than familiar with the country where he was about to start a new innings. Familiarity, though, was of little comfort. JB’s predecessor in India had just completed 12 months. “Usually, it is three to four years before they (headquarters) swap people. So, it was too soon," underlines JB, who, during the lunch duration, was haunted by one overwhelming question: “Am I ready?"

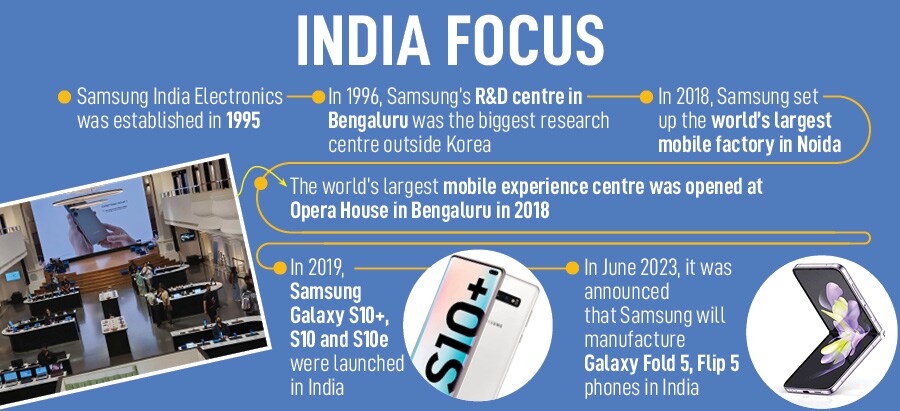

Back in 2018 in India, it was the right question to ask. JB’s familiarity was not of much use. India was no longer the land of Nokia. Though Samsung, which started operations in India in 1995, toppled the Finnish handset major to lead the Indian market with a thumping 33 percent market share in 2012, a bunch of homegrown and foreign players were fast emerging as potent challengers. In 2012, Micromax had cornered 8 percent of the market and was third in the pecking order after Microsoft. With a differentiated product and positioning, BlackBerry too was coming up as a serious threat and had 6 percent share, according to data shared by global mobile and technology market research firm Counterpoint. Fifth in the stacking was Karbonn, another desi player with a 5 percent share.

The market was dynamic, and it remained so over the next few years. In 2013, the pecking order changed. Though Samsung was still on the top of the charts, it was followed by four local hustlers—Micromax, Karbonn, Lava and Maxx Mobile. BlackBerry and Microsoft, which bought Nokia in 2013, were no longer threats. The next year, there was a rejig in the ranking again. While the top three remained the same, Lava and Lenovo displaced Intex and Motorola. For Samsung, though, warning signs had become visible. It slipped to 28 percent and Micromax raced ahead to 19 percent.

In February 2015, the unthinkable happened. Micromax ousted Samsung to become the biggest smartphone brand in the fourth quarter of 2014, declared another global research firm Canalys. Micromax was 22 percent, Samsung was 20 percent, and India was in the midst of a 100 percent fierce battle for the top billing.

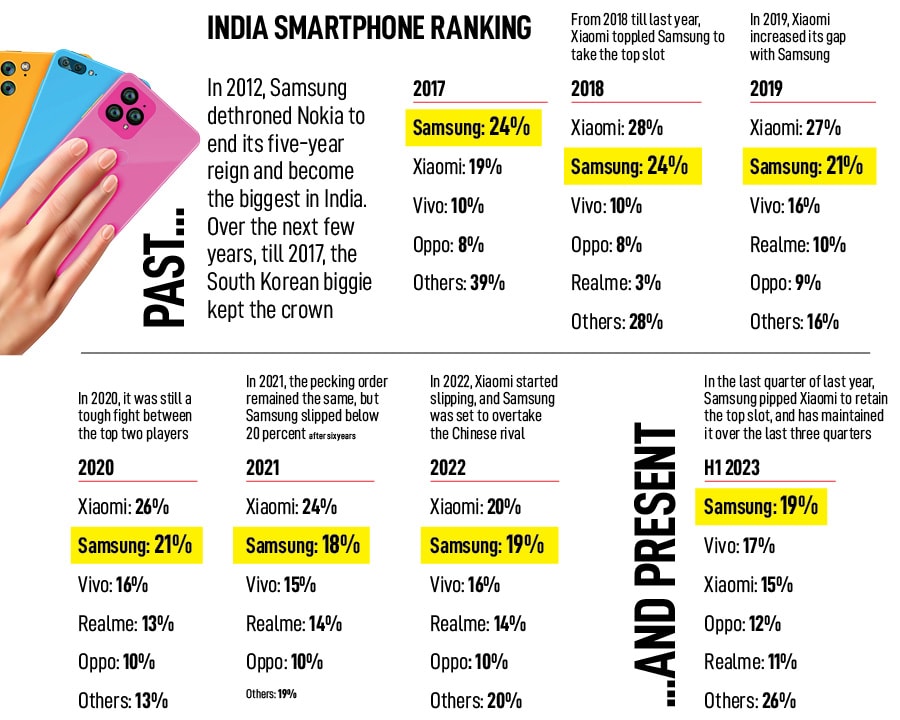

![]() The fight and the churn among the top five players intensified over the next two years. Jio and Xiaomi joined the party in 2016 by displacing Lava and Lenovo. The next year, there was a deluge of Chinese players, and a major shake-up in the stacking. Xiaomi pipped Micromax to become the second-biggest brand with a 19 percent market share. The next two players were new entrants: Vivo and Oppo. Samsung was still the biggest.

The fight and the churn among the top five players intensified over the next two years. Jio and Xiaomi joined the party in 2016 by displacing Lava and Lenovo. The next year, there was a deluge of Chinese players, and a major shake-up in the stacking. Xiaomi pipped Micromax to become the second-biggest brand with a 19 percent market share. The next two players were new entrants: Vivo and Oppo. Samsung was still the biggest.

The game for Samsung, though, was about to change from early 2018. There were twin blows. First, in the fourth quarter of 2017, Xiaomi raced ahead of the Korean biggie by grabbing 26.8 percent share. Samsung, which slipped to second position after five long years, had 24.2 percent. Second, in the same quarter, Jio toppled Samsung in feature phones. There was, in fact, a third punch as well. In the premium smartphone segment (Rs30,000 and above), Chinese upstart OnePlus routed Samsung, which was losing ground on all fronts.

![]()

Back in December 2018, when JB landed in India, Samsung was no longer the leader—every quarter, the gap with a much-aggressive Chinese rival was widening at an alarming pace and by the end of the first quarter of 2019, Chinese brands had a 66 percent market share. Samsung, which had made a buzz with the Galaxy S10 series, was fast losing ground in the mass segment, and was squeezed in the premium segment by OnePlus and Apple. Though JB knew a bit about the Chinese rivals because of their presence in the Korean market, the knowledge was not sufficient. Why? Due to heavy subsidies from telecom operators, users jumped from feature phones and entry-level smartphones to iPhones. There was bloodbath. Most of the local players, including heavyweights like LG, exited the market.

Samsung, though, fought hard to protect its turf. “Our DNA is to fight to death," says JB, underlining the resilient nature of the Korean players. He explains the survival mindset. Korea, he underlines, is a peninsula, which is surrounded by sea on three sides. If somebody invades from the North, there is no exit route. “There is no shortcut. You need to fight," he says, pointing to the history of Koreans, who since ages, had fought to defend themselves. Outlining the four seasons experienced in Korea—winter, spring, summer and fall—JB reckons that one will starve to death in winter and spring if one has not harvested excessively in summer, and preserved in winter. “That"s always preparing for tomorrow. It’s in our DNA," he says.

![]()

Back in India, the homegrown warriors had lost the battle, a bunch of deeply funded Chinese rivals was ruling the market, and the fight was getting intense. “It was a non-stop game of chicken," reckons JB, who was surprised by the ferocity of the competition. “We dropped our price, they dropped their price," he recalls. For somebody who loves golf and healthy competition, the battle in India was far from healthy as the weapon of discount was used indiscriminately by Chinese rivals. “It was a very difficult time for Samsung," he confesses. “The Chinese brands hit us hard," says JB, who quickly realised that fire can’t be fought with fire. He stepped back and tried to figure out his next steps. Amidst loads of uncertainty for a brand that has always been among the top three—in fact, Samsung never slipped to No 3 in its history in India—there was only one thing that made sense. “We knew we can’t compete with them on cost," says JB, adding that the brand needed to change its tactics and strategy in India.

The Korean warrior went back to the basics of warfare. To defeat the enemy, one must know the enemy. “There are a lot of things that they must be doing better than us," he told himself. To dig deeper, JB set up a taskforce, and raised a war cry. “Let"s dissect the Xiaomi phone," he ordered his team. From PCBA (printed circuit board assembly) to display to battery… every component of the handset was studied thoroughly.

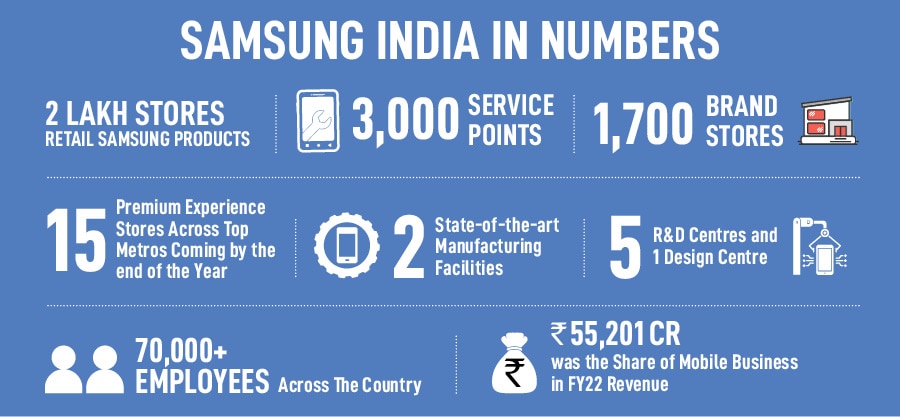

![]()

There was another front which got special attention from the Korean honcho, who was elevated as CEO of Samsung Electronics India and Southwest Asia last December. While talking about the Korean peninsula and Korean history, JB underlined that the invaders always took the water route. So, the direction was predictable. Back in India, Chinese rivals stumped Samsung by taking the online route to reach out to consumers. The extensive offline and retail footprint built by Samsung for over two decades suddenly looked obsolete. Flash sales, online discounts and online marketplace-only models became the new rules of the game. JB decided to venture into the online territory, and take on the rivals on their turf.

An extensive online blueprint was drawn. Samsung created a monster series named M and tied-up with Amazon. “Galaxy M10, M20 and M30 smartphones were launched in 2019," says JB. Samsung also partnered with Flipkart and rolled out the F series. Though the move worked in countering the onslaught of Chinese brands, it created another set of problems. In fact, it was collateral damage. For years, Samsung had built and nurtured an army of offline partners. The online-first and heavy approach now miffed the army, who felt let down. “They had been loyal to us for over 20 years, and we couldn’t see them unhappy," he says. Samsung had to think and act fast to keep its offline army intact.

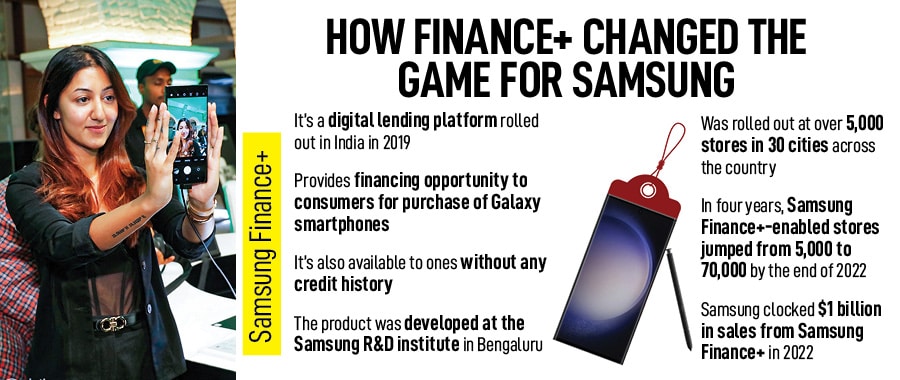

JB decided to criss-cross across the country. The idea was to study the market, see the extent to which the rivals had penetrated, and find out the needs of the offline partners. JB found the antidote by discovering two sets of things. First, there was an intricate play between income disparity and aspiration. “Everybody wanted a brand, and many didn’t have the means to buy it," he says. Second, though people wanted to upgrade to a better phone, they didn’t have a credit card or any credit history which could make them eligible for loans. The offline retailers, JB recounts, rued the missed opportunity. “But what if we partner with NBFCs?" he asked his team.

![]()

The idea was promising. But there was a glitch. “What if the buyer defaults… they don’t have a credit history?" the NBFCs retorted with their apprehension. “What if they stopped paying?" JB had an answer: “If they don’t pay their EMIs, their phones will get locked," he said, alluding to Knox, Samsung’s defence-grade mobile security platform which is inbuilt in devices. “But what if the defaulters unlock the phone?" was another worry voiced by the NBFCs. JB smiled. “It"s a hardware lock. You can’t unlock it unless you tear off the phone," he assured. Subsequently, Samsung rolled out Finance+, its digital lending platform in 2019. “We started going town by town, and convinced the dealers, who started nudging the buyers to upgrade," he says.

On the online front, JB scripted a differentiated play. The ones buying online, he points out, exhibited a different buying pattern. JB explains. They are fast adopters, know the latest technology, and change phones within six or eight months. What this means is that the affordable EMIs of 18 to 24 months—which Samsung Finance+ provided to the offline consumers—didn’t mean anything to the online counterparts. “Phones are like fashion," he says. Samsung started offering a variety of M and F series, and moved the price ladder from Rs25,000 to Rs40,000.

![]() Samsung’s fight, though, was multi-dimensional and waged on multiple fronts. Raju Pullan was one such veteran fighter. The senior vice president (mobile division) of Samsung India, who joined the Korean electronics giant in 2008, had seen enough competition over the last decade. “We"ve seen many moons of competition," he says, adding that one of the things that helped Samsung survive was innovation. “It kept us ahead of the curve," he adds, underlining that the brand kept adapting and evolving in its journey in India. In fact, competition helped. Take, for instance, the bunch of desi players like Micromax, Lava, Karbonn and Intex, who swept the hinterland and garnered market share. The Indian rivals, he added, taught Samsung the need to recalibrate its rural strategy and go deep and wide. With hyper-aggressive and unrelenting Chinese rivals, though, Pullan innovated his style of fight.

Samsung’s fight, though, was multi-dimensional and waged on multiple fronts. Raju Pullan was one such veteran fighter. The senior vice president (mobile division) of Samsung India, who joined the Korean electronics giant in 2008, had seen enough competition over the last decade. “We"ve seen many moons of competition," he says, adding that one of the things that helped Samsung survive was innovation. “It kept us ahead of the curve," he adds, underlining that the brand kept adapting and evolving in its journey in India. In fact, competition helped. Take, for instance, the bunch of desi players like Micromax, Lava, Karbonn and Intex, who swept the hinterland and garnered market share. The Indian rivals, he added, taught Samsung the need to recalibrate its rural strategy and go deep and wide. With hyper-aggressive and unrelenting Chinese rivals, though, Pullan innovated his style of fight.

The first move was predictable. He, along with seven-eight people from the leadership team, went to China, and studied the Chinese market. The method, though, was unpredictable. The pack split into three teams, shunned top cities like Beijing, and moved into the hinterland. Unlike India where one would see the offline retailer having her identity or name on the billboards and hoardings—Hari Om Mobile, Chennai Mobile, Vasant Mobile—China was all about ‘green’, ‘blue’ and ‘orange’, which represented Oppo, Vivo and Xiaomi, respectively. “This is how they approached retail markets," says Pullan, who came back to India, reached out to retailers and reiterated that the brand will always be sustainable and predictable rather than tactical.

If the Chinese brands were occupying space outside the shop, Samsung started going deep into the shop. “We invested in retail experience," says Pullan, adding that the task of training and upskilling the offline partners was undertaken on a war footing. While the exercise gathered steam over the last few years, in 2022, Pullan armed the electronics giant from the Korean peninsula with ‘sharks’. He made 50 teams across the country, called sharks, which included close coordination among Samsung executives, offline partners and every stakeholder, including large-format retailers.

![]()

The plan was to come up with ideas to grow offline sales. One of the ideas was bundling. So, when the S23 was launched, Samsung bundled it with a smartwatch. Another idea—opening of small retail cafes—came from a shark in Karnataka. But why call them sharks? Pullan explains. “If we are the number one brand, we need to have the behaviour of a shark," he says. “We need to eat into competition, and we need to eat into a lot of opportunities."

Advertising offered another set of opportunities to stay differentiated. While every handset brand was talking about 5G, Samsung did more than that. It went with 5G to the masses. The brand drove home the message that a 5G handset could be bought at just Rs44 a day. “This is less than the cost of a burger. Right?" asks Pullan, adding that the brand made 5G accessible, and claims that for the last five consecutive quarters, Samsung continues to be the biggest 5G handset player.

![]()

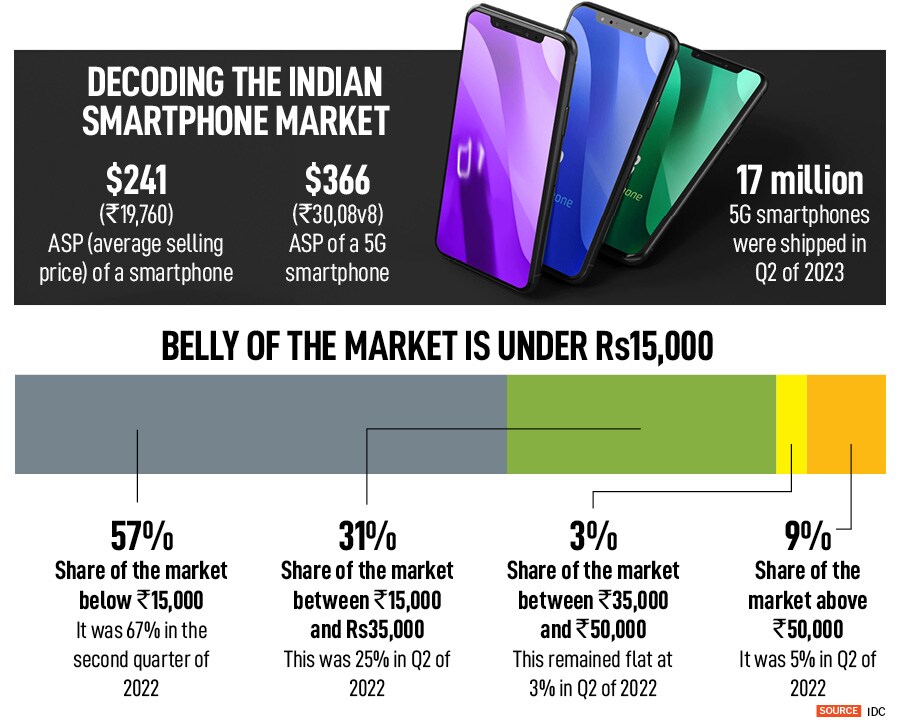

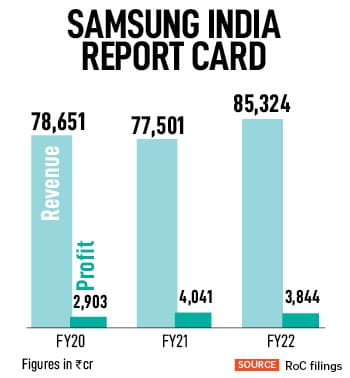

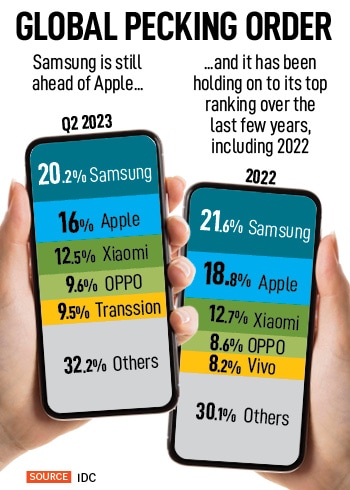

Fast forward to August 2023. Samsung is much more than a leading 5G player. It toppled Xiaomi during the October-December quarter of last year to regain the top slot, and has been leading for three successive quarters. In the second quarter of this year, it pipped Apple to become the top brand in the premium segment, and clocked $1 billion in sales from Samsung Finance+ in 2022. Rolled out across 5,000 stores in 30 cities in 2019, Finance+ was available at 70,000 towards the end of last year. The dominance is reflected in other areas as well. Last year, Samsung was the second-biggest brand in smart TVs. With 10.2 percent share, it has narrowed the gap with Xiaomi which had 10.5 percent, according to Counterpoint.

Samsung’s performance in India, reckon industry analysts, reflects its resilience. “Samsung has been in India for over 27 years," says Ankur Bisen, senior partner and head (retail, consumer products and food) at Technopak. “And no Korean company has failed in India." From Samsung and LG to Hyundai to Kia and Lotte, Korean companies have taken a long-term view of India, and stayed committed to the market. “They understood the nuances, and built a strategy around those," says Bisen. “GM came and exited, and Ford came and exited," he says, alluding to how companies from other nationalities failed to crack the Indian market. “Even Apple was slow to start for a long time," he adds. What gives Samsung an edge over its Chinese or American rivals is the fact that it"s omnipresent. “There is a bit of Samsung in most of the households," he says. A TV, fridge, AC, laptop, phone, tablet, washing machine… there is a slice lying in one of the corners of a home.

![]()

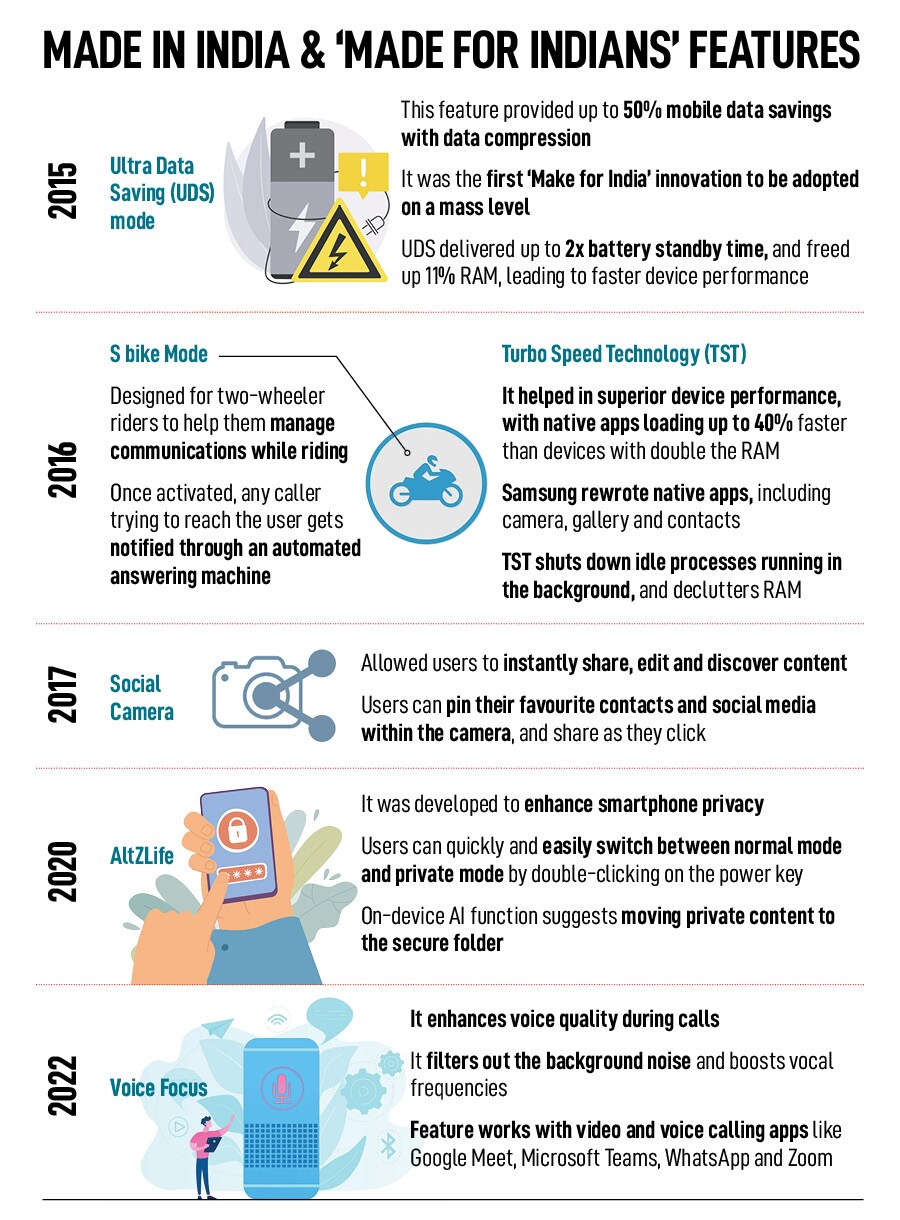

In handsets, Samsung’s superpower comes from two factors. First, it straddles across price points: From mass to class—from under Rs10,000 to above Rs1 lakh, there is something for everybody. Second, the brand has always pressed the innovation pedal (see box). From Voice Focus (to enhance the quality of voice) to AltZlife (to enhance privacy) to ultra-data saving mode and social camera, Samsung has stayed ahead of the curve, reckons Tarun Pathak, research director at Counterpoint.

Harish Bijoor points out another facet of the brand which is easy to miss, but hard to ignore. “They seamlessly replaced Nokia in terms of credibility and trust," contends the brand strategist. Samsung, he underlines, might not be a price warrior, but what the brand enjoys is priceless. “Is there any Chinese brand that can talk about winning consumers’ heart and trust?" he asks. “How many brands would have survived the ‘burning phone’ crisis?" he asks, alluding to a massive crisis in September 2016, when Samsung suspended sales and recalled Note 7 because manufacturing defects in the battery caused heating and fire. “Trust is priceless," he reiterates.

![]()

Though it has been a remarkable comeback by Samsung over the last few years, the going won’t be easy. The relentless pressure from Chinese brands continues. Xiaomi has been replaced by Vivo, which, according to IDC, had pipped Samsung in the second quarter this year. On the premium end of the smartphone spectrum is Apple, which has become aggressive and expanding its presence across India at a furious pace.

JB, though, is not worried. “I believe in healthy competition," he says, adding that there is no joy in being the sole runner in a race. “It’s really boring. You keep looking back and there is nobody," he smiles. If somebody overtakes you, then you run faster. “I enjoy this," he adds. If Vivo succeeds in India, will it be a worry for Samsung? “Not necessarily," says JB, underlining that Samsung is much bigger than smartphones. “We have semiconductors, we have display, battery and all kinds of components," he says, adding that the parts made by Samsung are partially sourced by its rivals. “One of our biggest customers also happens to be one of our biggest foes," he smiles.

Is he ready for another gruelling round of fight? JB smiles and repeats what his boss remarked in November 2018. “You are always ready, JB. Always."

The fight and the churn among the top five players intensified over the next two years. Jio and Xiaomi joined the party in 2016 by displacing Lava and Lenovo. The next year, there was a deluge of Chinese players, and a major shake-up in the stacking. Xiaomi pipped Micromax to become the second-biggest brand with a 19 percent market share. The next two players were new entrants: Vivo and Oppo. Samsung was still the biggest.

The fight and the churn among the top five players intensified over the next two years. Jio and Xiaomi joined the party in 2016 by displacing Lava and Lenovo. The next year, there was a deluge of Chinese players, and a major shake-up in the stacking. Xiaomi pipped Micromax to become the second-biggest brand with a 19 percent market share. The next two players were new entrants: Vivo and Oppo. Samsung was still the biggest.

Samsung’s fight, though, was multi-dimensional and waged on multiple fronts. Raju Pullan was one such veteran fighter. The senior vice president (mobile division) of Samsung India, who joined the Korean electronics giant in 2008, had seen enough competition over the last decade. “We"ve seen many moons of competition," he says, adding that one of the things that helped Samsung survive was innovation. “It kept us ahead of the curve," he adds, underlining that the brand kept adapting and evolving in its journey in India. In fact, competition helped. Take, for instance, the bunch of desi players like Micromax, Lava, Karbonn and Intex, who swept the hinterland and garnered market share. The Indian rivals, he added, taught Samsung the need to recalibrate its rural strategy and go deep and wide. With hyper-aggressive and unrelenting Chinese rivals, though, Pullan innovated his style of fight.

Samsung’s fight, though, was multi-dimensional and waged on multiple fronts. Raju Pullan was one such veteran fighter. The senior vice president (mobile division) of Samsung India, who joined the Korean electronics giant in 2008, had seen enough competition over the last decade. “We"ve seen many moons of competition," he says, adding that one of the things that helped Samsung survive was innovation. “It kept us ahead of the curve," he adds, underlining that the brand kept adapting and evolving in its journey in India. In fact, competition helped. Take, for instance, the bunch of desi players like Micromax, Lava, Karbonn and Intex, who swept the hinterland and garnered market share. The Indian rivals, he added, taught Samsung the need to recalibrate its rural strategy and go deep and wide. With hyper-aggressive and unrelenting Chinese rivals, though, Pullan innovated his style of fight.