Smartphone market falls 3 percent in Q2; Vivo pips Samsung: IDC

Premium smartphones post the highest growth to corner 9 percent market share in the second quarter

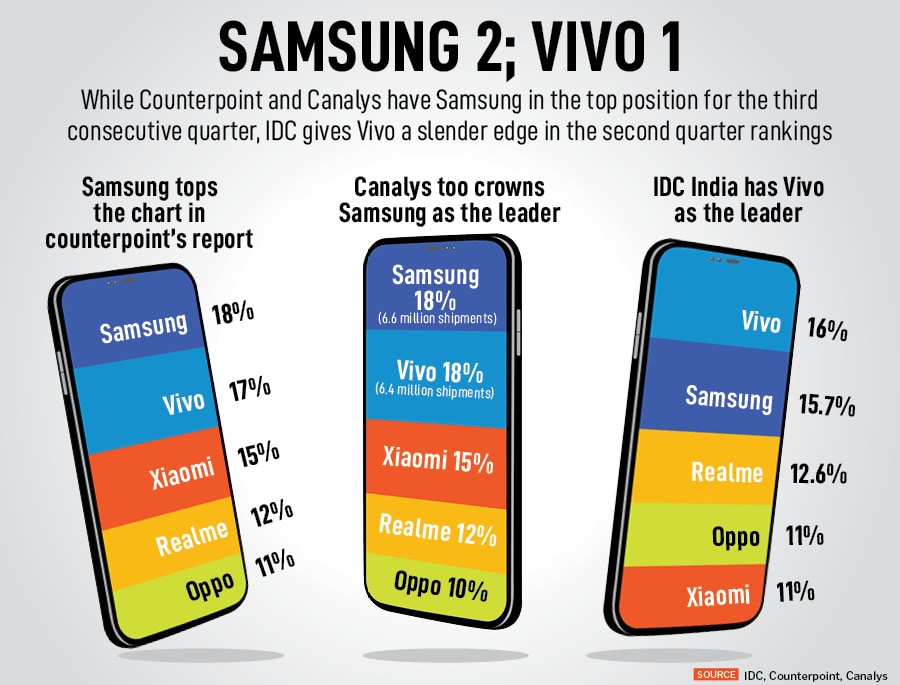

Three years after it raced ahead of Samsung in the first quarter of 2020, Vivo has pipped the South Korean giant for the second time in India. With a 16 percent market share in the second quarter this year, the Chinese player had a slender edge over Samsung, which was close on the heels with a 15.7 percent share, according to the latest data by IDC India. Interestingly, two more research bodies—Canalys and Counterpoint—have Samsung in the lead for the third consecutive quarter, with a close fight from the Chinese rival (see box).

The Indian smartphone market, meanwhile, continued with its YoY (year over year) slide. While in the first six months of the year, there were 64 million units shipped—a decline of 10 percent YoY—in the second quarter this year, the shipments declined by 3 percent YoY with 34 million units. However, in sequential terms, the second quarter grew by 10 percent over the last quarter. The vendors and channels, underline the IDC quarterly mobile phone tracker report, focussed on clearing the inventory by offering discounts, special schemes, and price drops ahead of the festive season which starts in the second half of the year.

In a declining market, though, premiumisation gathered steam. The premium segment ($600, around Rs49,000) grew the highest, up by 75 percent YoY, and cornered a 9 percent market share. “Consumers are opting for premium offerings, driven by easy and affordable financing options," says Upasana Joshi, research manager (client devices) at IDC India. “We expect this momentum to continue in the upcoming months." Apple, with the highest ASP (average selling price) of $929 (around Rs76,823), registered a massive 61 percent YoY growth. During the upcoming festive season, IDC points out in its report, brands will try to spur demand with affordable 5G launches, pre-booking offers, loyalty and upgrade programmes clubbed with festive discounts. “The market requires strong double-digit growth in the next few months to see high growth in 2023, which looks unlikely as of now," says Navkendar Singh, associate vice president (devices research) at IDC.

For Vivo, this is the second time it has raced ahead of Samsung. The last time was during the first quarter of 2020 when it grabbed 19.9 percent share and took the second spot from the South Korean major (18.9 percent). Back then, Xiaomi topped the chart with a thumping 30.6 percent share, according to Canalys. A few quarters down the line, Xiaomi has slipped to the fifth spot in the second quarter stacking of 2023.

For the Chinese brands, it has been a tough ride over the last few months as they have been swamped with allegations of tax evasion. In July, minister of state for electronics and IT Rajeev Chandrasekhar informed Parliament that Oppo, Vivo and Xiaomi committed tax evasion of around Rs9,000 crore. In a reply to an unstarred question in the Rajya Sabha, the minister revealed that the tax evasion involved customs duty and GST, and was detected between 2018-19 and 2022-23. The government has managed to recover Rs1,214.83 crore from Oppo, Rs168.25 crore from Vivo and Rs92.8 crore from Xiaomi, according to official data. The cumulative turnover of the Chinese mobile handset companies in India in FY22 was estimated to be Rs1.5 lakh crore.

First Published: Aug 03, 2023, 13:13

Subscribe Now