Jar: How to build your own pot of gold

Jar nudges you to make investing in gold a daily affair, by providing the means to invest in it with as little as Rs 10 or Rs 20, to turn your small, ad hoc savings, to systematic daily savings that c

Another cool innovation that’s emerging in India’s fintech sector is investing in gold via a smartphone app without the hassle of going anywhere to pick it up and then worrying about how to secure it.

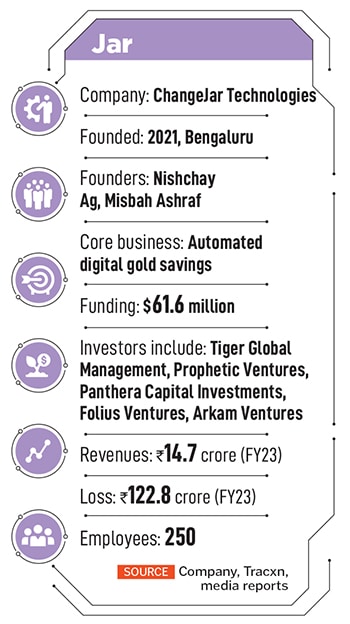

And that’s not even the best part, as ChangeJar Technologies (Jar) is showing us. The power of digitalisation comes through in this “use case"—one can invest as little as say ₹10-20 to buy gold. And the app nudges you to make it a daily affair to turn your small, ad hoc savings, to systematic daily savings that can be automated.

The app also offers an interface to keep track of how much gold one has—stored away in a gold bank like MMTC PAMP—check prices and, when needed, sell the gold.

India’s emerging startup scene, almost 10 years ago, brought the company’s founders Misbah Ashraf and Nischay Ag together. The former was a coding sensation and prolific startup spinner-off-er from a small town in Bihar and the latter was from another town, two to three hours from Bengaluru, who was already working for another venture in the tech capital.

The story goes that Ag couldn’t invest in Marsplay, Ashraf’s previous venture, as he’d just bought a car and was out of cash. They’d kept in touch and explored some partnerships between Bounce, the ebike taxi venture-turned-mobility business, where Ag was working, and Marsplay, a community-led ecommerce venture. When Ashraf successfully sold Marsplay by December 2020, the two engineers teamed up on Jar in 2021.

The story goes that Ag couldn’t invest in Marsplay, Ashraf’s previous venture, as he’d just bought a car and was out of cash. They’d kept in touch and explored some partnerships between Bounce, the ebike taxi venture-turned-mobility business, where Ag was working, and Marsplay, a community-led ecommerce venture. When Ashraf successfully sold Marsplay by December 2020, the two engineers teamed up on Jar in 2021.

“We have scaled our transaction volumes to almost a million transactions a day now," Ag says, adding that each passing month has seen Jar surpass the previous month’s performance. Some 20 million people have signed up on the app, and upwards of 5 million people are active monthly, he says.

In March, Jar announced it was teaming up with the NBFC LenDenClub to offer peer-to-peer lending—connecting borrowers and lenders directly.

From here on, there are two broad areas of focus, Ashraf says. One, how to make Jar relevant pan-India across age groups and income levels. “How do you make sure they are on the journey of financial fitness, they don’t drop off in between, they keep going as they grow on the platform," he says. He gives an example of the technical challenges involved: It may not be enough to say the app offers a Hindi interface.

On the business front, “the magic is in distribution, because everyone is fighting their own battle" in life, Ag says.

And in the middle of all that, how do the 250 or so people at Jar make it a super relevant platform. They aim to show us in the years to come.

First Published: May 23, 2024, 15:11

Subscribe Now