KreditBee: Credit, where it is needed

An entrepreneurial venture that started with small loans to students is now on the cusp of becoming a full-fledged financial services business

An entrepreneurial venture that started with small loans to students is now on the cusp of becoming a full-fledged financial services business.

Despite all the razzmatazz in recent years over fancy new possibilities, at the end of the day, access to an affordable loan, when one needs it the most, will remain firmly at the heart of fintech. And this is borne out by the success of KreditBee, especially the surge the digital lender has seen in FY24, the first full post-Covid year.

“Our business grew beyond 50 percent, and our PAT (profit after tax) grew close to 200 percent," Madhusudan Ekambaram, co-founder and CEO of the company, tells Forbes India.

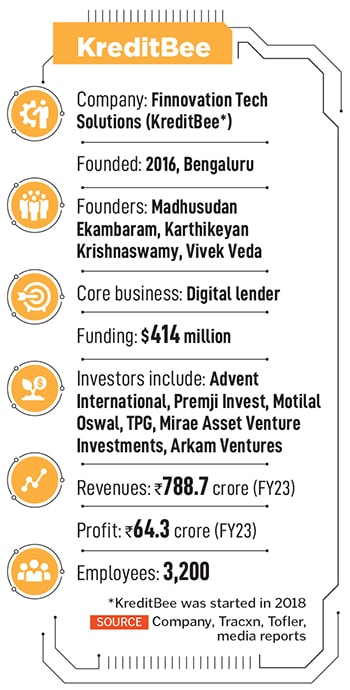

Ekambaram, after an engineering degree in information technology, spent close to 12 years in the software industry before his entrepreneurial foray with Finnovation Tech Solutions, under which he started his non-bank finance company KrazyBee Services in 2016. KreditBee, a digital lending platform, was started in 2018 as his co-founders and he expanded their business, including loans to the salaried, small businesses and so on.

Ekambaram, after an engineering degree in information technology, spent close to 12 years in the software industry before his entrepreneurial foray with Finnovation Tech Solutions, under which he started his non-bank finance company KrazyBee Services in 2016. KreditBee, a digital lending platform, was started in 2018 as his co-founders and he expanded their business, including loans to the salaried, small businesses and so on.

KreditBee, which was also a rebranding of the company, has come to represent all of its operations by way of name recall. A combination of technology, which helped achieve scale, and discipline in lending has helped the company become a profitable business, keeping bad loans down.

“What we do ultimately is lending," Ekambaram says of his fintech venture. The company disbursed Rs. 21,000 crore as loans in FY24 versus about Rs. 14,000 crore the previous year.

“What we do ultimately is lending," Ekambaram says of his fintech venture. The company disbursed Rs. 21,000 crore as loans in FY24 versus about Rs. 14,000 crore the previous year.

KreditBee has about 4.2 million active borrowers paying back their loans in monthly instalments. And those who are eligible for loans on the platform “are in the crores", Ekambaram says. The company co-lends its loans—a common risk-reducing practice—via a dozen or so partnerships with some of the biggest names in India, including Piramal, Tata group and Cholamandalam.

The challenge for India’s fintech startups is, “can you overcome all the challenges in India and begin to get to a scale of a traditional blue chip financial services company", says Bala Srinivasa, founding managing partner at Arkam Ventures, an early investor in KreditBee. And KreditBee is on the cusp of doing that, he says.

Today KreditBee’s business includes, in addition to unsecured personal loans, business loans for micro SMEs, and loans against property. An important thing to note about KreditBee is that it’s helped expand affordable credit well into smaller cities and towns—a large proportion of its borrowers are from smaller towns.

First Published: May 15, 2024, 11:21

Subscribe Now