The growth of the Indian economy and fintech space is paving the way for these soonicorns. As per Startup India, an initiative by the Ministry of Commerce and Industry to promote startups in the country, the market size of India’s fintech industry is expected to reach $150 billion by 2025.

Mayank Jain, principal investor at Stellaris Venture Partners, says that recent regulatory announcements, such as credit line on UPI, are opening new avenues of growth for fintech startups in India. He says the collaboration of fintech startups with banks has fuelled the growth of fintech startups and the finance ecosystem in India.

While some top fintech unicorns in India, such as Zerodha, Razorpay, Paytm, and Pine Labs, are leading the way, below are the top five soonicorns, offering a diverse range of financial services, that could soon join the league of fintech unicorns.

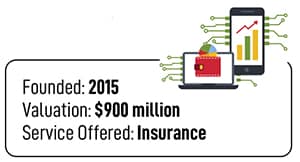

Choosing an insurance plan is a cumbersome process. Turtlemint offers a hybrid marketplace to provide third-party insurance and connect customers with advisors.

Dhirendra Mahyavanshi and Anand Prabhudesai, co-founders of Turtlemint, started the company in 2015 and steadily managed to onboard over 45 insurer companies on the platform. Today, it provides health, life, bike, and car insurance services on its platform and claims to have served over 40 lakh customers. Turtlemint’s revenue has increased from Rs.63 crore in FY21 to Rs.156 crore in FY23. The company earned a profit of Rs.6.28 crore in FY23.

![]()

While most of Turtlemint’s competitors directly deal with customers, Turtlemint’s USP lies in serving the customers through its network of agents. Mahyavanshi says, “We firmly believe insurance is a business of relationships and that an offline person can never be taken away, and that’s why we have the expert whom we empower. We advise even the customers to come through an expert only. We have over 3,50,000 insurance advisors spread over 17,000 pin codes."

Money View

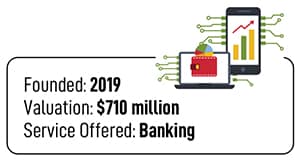

Founded by Puneet Agarwal and Sanjay Aggarwal, Money View started off as a personal finance management solutions provider company and soon entered into the money lending business in 2016. The company saw an opportunity in Tier 2,3 cities where 200+ million people working in the informal sector were underserved by the banks and traditional financial institutions. Today, 75 percent of Money View’s customers come from Tier 2,3 cities.

![]()

Backed by investors such as Accel, Ribbit Capital, and Tiger Global, Money View has seen exponential growth in its valuation, revenue, and profit over the years. Its valuation has increased from $625 million in 2022 to $900 million, and operating revenue jumped from Rs.222 crore in FY22 to Rs.577 crore in FY23. The company turned profitable in FY23 registering a profit of Rs.163 crore in FY23, while it incurred a loss of Rs.6 crore in the previous fiscal. Most of Money View’s revenue comes from interest from borrowers, facilitation charges, and processing fees.

Today, Money View offers instant loans of small amounts from Rs.5,000 to Rs.10 lakh. It boasts over 50 million app downloads, over 12,000 crore loan disbursement, and services in 500 cities and 19,000 locations across India.

Jupiter

Jupiter targets tech-savvy Indians through its digital-only banking services and user-friendly interface appeal. Its services include saving accounts, debit cards, credit cards, mutual funds, and expense tracking systems. Jupiter got an NBFC licence from Reserve Bank of India and partnered with Federal Bank.

![]()

Jitendra Gupta is the founder of Jupiter and has a long career in finance. Earlier, he founded Citrus Pay and worked as the managing director of PayU. Jupiter is valued at $710 million. Matrix Partners, Sequoia, Beenext, and Nu Holdings are major investors in Jupiter. In FY23, Jupiter generated Rs.7.11 crore in operating revenue, while its expenses amounted to Rs.383 crore, leading to a loss of Rs.327 crore. Still in its early development phase, Jupiter has yet to make any profit.

Neo banking is an emerging market in India, and Jupiter faces competition from neo banks such as Freo, Fi Money, and Niyo. Jupiter aims to address the needs of working professionals through its expenses and wealth management offerings. Jupiter has amassed over 5 million app downloads and about 2.2 million users.

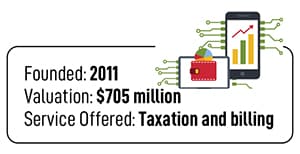

Clear

Clear, earlier known as ClearTax, is making a mark by simplifying finance for Indian taxpayers and businesses. Clear provides taxation and financial solutions to businesses and individuals. For individuals, it offers ITR filing and tax consultation solutions, and for businesses it offers a wide range of services such as GST filing, TDS return, and e-invoice.

![]()

Clear was founded by three friends, Archit Gupta, Ankit Solanki, and Srivatsan Chari. Today, over 5 million taxpayers, 600,000 SMEs, 2,000 big brands, and 60,000 tax practitioners use Clear for their tax payments and invoicing. The company claims that $300 billion worth of B2B invoices are generated through its platform annually and it files individual income tax within seven minutes.

Clear’s operating revenue in FY23 amounted to Rs.106 crore, almost twice of FY22. However, its total expenses amounted to Rs.336 crore in FY23, leading to a loss of Rs.232 crore. The company is expecting a decrease in losses as the income from subscriptions is expected to rise in the coming years. Clear is backed by strong investors such as Y Combinator, Sequoia Capital, and Elevation Capital.

Clear is competing with companies such as Zoho, Focus Lyte, and CaptainBiz and has managed to capture about 10 percent of the market share in B2B invoices in India. To further strengthen itself, clear has acquired four companies, including Xpedize and CimplyFive, to cater to the needs of larger companies as well as MSMEs.

Navi

Navi was founded by Sachin Bansal, co-founder of Flipkart, and Ankit Aggarwal, a former banker, in 2018. It started with the money lending business and soon ventured into general insurance, health insurance, and mutual funds services. Navi offers cash and home loans to its customers. Navi is leveraging its network of 10,000 hospitals nationwide and a 20-minute cashless health insurance claim.

![]()

Navi is valued at $535 million, and it has turned profitable in a very short period. Its operating revenue reached Rs.2,040 crore in FY23, while its expenses stood at Rs.1,744 crore, leading to a profit of Rs.264 crore. The company has also made four acquisitions in asset management, fintech, and IT services. Sachin Bansal is the principal investor and the majority stakeholder in Navi.

Navi’s acquisition of Essel Finance and DHFL General Insurance aims to expand into mutual funds and insurance services and provide customers with a comprehensive suite of services. It has also acquired Maven Hive, a software company, to strengthen its in-house technology development.

Navi claims to have served over 1.5 lakh customers since its inception. It is focusing on increasing its customer base in the coming years. According to several reports, Navi might soon raise funds for its expansion, which could lead to its valuation to increase to over $1 billion.