What happens when gaming meets finance?

With growing crypto adoption, blockchain and NFT-based gaming is coming into its own. But even as gaming firms are looking at leveraging NFTs using the earn-while-you-play model, the risks associated

Mumbai-based Pransh Khemka entered the world of NFT and blockchain gaming last May, mirroring the footsteps of an influencer he was following to gain mining knowledge. Khemka, 21, invested ₹35,000 in blockchain-based games CryptoMines and Farmers World, both operating on a play-to-earn (P2E) model.

Simply put, using non-fungible tokens (NFTs), these games allow users to earn money as they play. NFTs are unique digital collectibles on the blockchain, a feature that makes them appropriate for use in games as representations of characters, as consumables and other tradeable items—an avatar could be an NFT, digital items one finds while playing could also be an NFT. Since no two NFTs are the same, it gives each digital asset a real-world value.

NFT games have gained popularity in the GameFi (or the blending of gaming with finance) world as a way to earn income. Gamers can sell their in-game NFTs to other collectors and players, and even earn tokens with P2E models. Through P2E NFT games, a player is rewarded with tokens and occasionally NFTs, earning more the longer they play. The tokens earned are often needed as part of the game’s crafting process. Some of the most successful P2E games are CryptoKitties, Decentraland, the Sandbox and Axie Infinity.

To swap, create and implement NFTs within a game, developers create smart contracts—self-executing pieces of code stored on a blockchain—that make up the rules for the NFTs used. The blockchain games allow gamers to track and analyse every action they’ve taken as well as other players" moves. There is a lot of transparency in these games, says Khemka. Instead of gamers wondering what is happening on the server of the game they’ve invested hours in, they can review every action taken by developers and other gamers.

The P2E model requires a gamer to make an initial investment in the form of buying NFTs, which are unique to each game. By using these NFTs, the player is also required to perform some action simultaneously. For example, in CryptoMines, a player has to buy spaceship NFTs and go on expeditions to earn rewards in their in-game token. The in-game token is always listed on decentralised exchanges like PancakeSwap where the player can swap the token for mainstream cryptocurrencies like ethereum, BNB and so on.

“For the initial investment and frequency of playing the game, players are rewarded with the in-game token. The developers own all of the in-game token that has not been distributed. As and when more people play the game, their cryptocurrency is traded more and the value of the in-game token increases, which is technically a profit for the developers," he adds.

“For the initial investment and frequency of playing the game, players are rewarded with the in-game token. The developers own all of the in-game token that has not been distributed. As and when more people play the game, their cryptocurrency is traded more and the value of the in-game token increases, which is technically a profit for the developers," he adds.

But it can also lead to a loss. When Khemka started playing CryptoMines, its in-game token was trading at $250. It managed to generate a lot of hype and many influencers started posting videos on how to play the game. Within a week it jumped to $400 and two weeks later up to $800, an all-time high. But it dropped to $9 in two days when the developers decided to shut down the game, saying they would be back with a revised version. Though the token is still trading at $0.27 today, it cannot be used in the new game. CryptoMines shut down last December, and the revised version, CryptoMines Reborn, was released in April 2022, which Khemka continues to play.

Though NFT-based gaming is in a nascent stage in India, with mounting crypto adoption blockchain and NFT-based gaming firms are gaining attention.

According to a report by RedSeer, a market research and consulting firm, India’s paid gamer base (of both gaming and NFT-based gaming) is set to touch about 235 million in 2025, from 80 million in 2020. A gamer spends an average of about $16 a year on gaming. Real-money games attract the highest spend on a monthly basis, with users spending an average of about $3.50 per month.

“Users are the most important part of any gaming ecosystem. They make the game what it is, and for all their loyalty, time and money, they get very little in return," says Harsh Savergaonkar, who along with Aditya Kasibhatla co-founded CricInShots in 2019 as a cricket data analytics app, later pivoted it to fantasy gaming and is now transitioning it into building the first Web3 play-and-earn cricket strategy game..

Traditional communities, games or collectibles only allow fans to engage in limited ways, basically no return on investment, he adds. In Web2, the time and money spent on games, assets collected, coins earned, all amount to zero if the game decides to shut down. But in Web3, even if a game is shut down, other developers or even the community can build experiences around assets owned by the users of this game.

Web3 refers to the third generation of the internet, which many expect will be driven by decentralised infrastructure and machine-based understanding of data. According to a report by blockchain tracking firm DappRadar, decentralised apps (Dapps) reached an all-time high of 2 million daily unique active wallets worldwide in October 2021, and about 55 percent of this traffic comes from blockchain-based games.

Another blockchain-based gaming startup Sportzchain, founded in April 2021, bridges the gap between sports teams and fans through the power of sports tokens (aka fan tokens), NFTs (digital and phygital), metaverse and GameFi. The startup integrates the casual and fantasy gaming world with the blockchain world. The idea is to bring fans closer to their favourite teams and sports personalities by using digital assets to get access to exclusive money-can’t-buy experiences.

Another blockchain-based gaming startup Sportzchain, founded in April 2021, bridges the gap between sports teams and fans through the power of sports tokens (aka fan tokens), NFTs (digital and phygital), metaverse and GameFi. The startup integrates the casual and fantasy gaming world with the blockchain world. The idea is to bring fans closer to their favourite teams and sports personalities by using digital assets to get access to exclusive money-can’t-buy experiences.

“India will probably become one of the fastest-growing markets in Asia, probably only behind Vietnam and Indonesia. We have a vast user base for this, but the projects would not only need to be attractive and fun enough for the players, but they would also need to provide routes for players to convert their winnings (crypto/NFTs to fiat currency)," says Siddharth Jaiswal, one of the three founders and CEO of Sportzchain. He adds that sports will be a key sector to drive mass adoption for P2E games and solutions and “at Sportzchain we are working on a few innovative concepts that will help us onboard more Web2 users to the Web3 world". Jaiswal, who has previously worked at companies like KPMG and Aranca, has over 15 years of experience in the field of strategic consulting, private equity, blockchain and fintech.

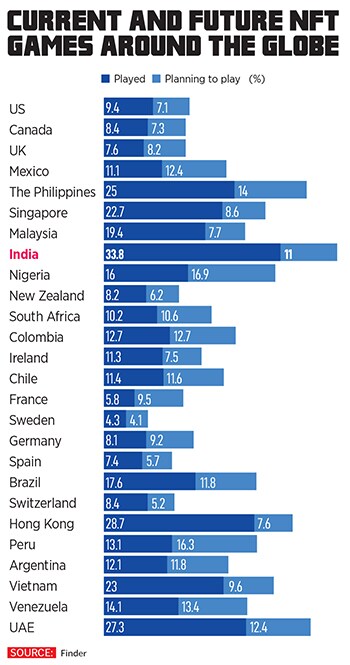

A recent report on NFT gaming adoption by Finder revealed that 34 percent of Indian respondents have played P2E games. Hong Kong ranks second with 29 percent while the United Arab Emirates (UAE) is third with 27 percent.

In order to cash in on the huge interest in cryptos and NFTs, gaming firms in India have also begun exploring ways to incorporate them in electronic sports (esports) and games, as well as develop new games that will run atop blockchains. Most of them are in the development phase.

In the esports industry, Nazara Technologies plans to foray into the Web3 space through its freemium gaming business. The company is working on creating a cricket offering in Web3 with its subsidiary Next Wave Multimedia. Next Wave Multimedia’s flagship title is World Cricket Championship (WCC), which claims to be the largest mobile-based cricket simulation game. It has released two sequels so far—WCC2 and WCC3.

In the esports industry, Nazara Technologies plans to foray into the Web3 space through its freemium gaming business. The company is working on creating a cricket offering in Web3 with its subsidiary Next Wave Multimedia. Next Wave Multimedia’s flagship title is World Cricket Championship (WCC), which claims to be the largest mobile-based cricket simulation game. It has released two sequels so far—WCC2 and WCC3.

“Web3 offers a completely new way to engage and deliver value to our gaming community through in-game NFTs, play-to-earn models and deeper community involvement and engagement," says Nitish Mittersain, founder and managing director of Nazara Technologies. “Next Wave has an extremely popular franchise in World Cricket Championship and a very loyal community and we plan to leverage the best that Web3 has to offer along with our cricket games to launch a unique proposition for our gamers." The company has invested in a couple of venture capital firms with an active Web3 and gaming portfolio, such as Bitkraft Ventures and Griffin Gaming Partners. “A potent combination of NFTs, blockchain and virtual reality will take the gaming experience to the next level and it’s time to be Ready Player One," says Mittersain referring to a 2018 science fiction action adventure movie.

JetSynthesys, a mainstream gaming firm, is building a unique blockchain-first game to be released by 2022-end. The company is experimenting with ways to leverage NFTs in games. In addition to adding Web3 features to Web2 games, it is also including NFTs in its largest gaming titles in cricket.

“The future of Web3 gaming in India is much brighter than it looks, especially with Web3 growing steadily over the last five years," says Rajan Navani, vice chairman and managing director of JetSynthesys. In fact, a KPMG report states that the Indian online gaming market will treble in value and reach $3.9 billion by 2025. According to Navani, this momentum will aid in bolstering India’s blockchain-based gaming and esports category as the industry is still scratching the surface when it comes to this novel technological revolution.

“We, as a country, have some fantastic software talent pool to develop games that have come right in time as the world moves from Web2 to Web3," says Navani. “This generation of Indian game developers has experienced the world of video games since they were children and are equipped with historical knowledge of what a player wants." However, there might be some challenges such as the complexity of the concept and the regulatory framework around digital assets. “Nevertheless, as an industry, we can tackle it together," he adds.

According to Navani, P2E gaming is bringing a new economic model to the industry. It empowers the players as decision-makers and adds real-world value to their virtual assets. The P2E economic model incentivises the players with small financial gains rewarding them for their time and efforts. The NFTs allow players to retain assets and transfer, sell or exchange them with other players and monetise them, “making gaming more fun and rewarding". During the third quarter of 2021, the Blockchain Game Alliance reported revenues of $2.3 billion for the industry. Nearly 22 percent of NFTs were associated with blockchain games. “It is safe to say that blockchain gaming is on top of the NFT scene. The gaming market will grow in multiples owing to the above factors. Companies like ours are building to dominate the play-and-earn category of games."

However, there are gaps that need to addressed. For instance, the games, says Pune-based Savergaonkar of CricInShots, need to be ‘gameplay and utility first’. Most gaming studios are chasing valuations by doing NFT drops and then figuring out what game experience to build around the NFTs that they have dropped, which does not make sense in the long run. “A lot of gaming metaverse companies are building with the top-down approach that is metaverse first, then NFT drops in the metaverse, and then mini experiences in the metaverse, which might or might not lead to proper massive gameplay experience in the said metaverse. Basically, a lot of these metaverses are ‘empty GTA cities with none of the missions’," says Savergaonkar. He is trying to address this problem by building with the bottom-up approach.

Another area of concern is the regulations around NFTs. Though industry experts are optimistic about the future of Web3 gaming, the government is still sceptical about the use of virtual digital assets. Sportzchain’s Jaiswal suggests that the government only has to look to the UAE on why it needs to start accepting the blockchain future. The UAE is capitalising on the metaverse opportunity and is expected to house a $4 billion industry directly contributing to its economy. It is no surprise that Indian entrepreneurial and tech talent will be the mainstay of this industry. The brain drain has started and will intensify if the current stance continues, he says. “It is a golden opportunity for the government to capitalise and undo what they missed in the internet era. Having said that, considering blockchain is decentralised and over the internet, slowly and steadily Indians who believe in blockchain and earning potential will adopt this even if the government is sceptical."

Meanwhile Khemka, who is into Web3 gaming and has to date lost about ₹50,000 in a year due to crypto market crashes, games shutting down and the price of the in-game token plummeting, has a word of advice. “Do your research and be thorough with it before investing. Do not blindly trust what influencers or YouTubers say. And invest the amount you would be comfortable losing completely."

First Published: Jun 13, 2022, 17:17

Subscribe Now