Five years ago, Rashesh Shah was fighting for survival. A large bet that Edelweiss, the financial services conglomerate he founded, had taken on real estate loans turned sour. Out of a total 100 developer loans, as many as 40 were not paying on time. When interest payments are not made, loans have to be marked as non-performing. On its part, Edelweiss had to continue to meet its obligations to debtors. It was a classic asset-liability mismatch and it almost sunk the group.

Today, Shah, who turned 60 recently, is in a feisty mood. His sense of optimism over the future comes out multiple times during an hour-long interview with Forbes India. Admittedly he still has a long way to go in deleveraging the group, but he can take heart from the fact that most loans were paid off and others sold to asset reconstruction companies that buy bad loans on the cheap. He wound down Edelweiss’ loan book at a furious pace from Rs20,000 crore to Rs4,000 crore at last count, and plans to bring it closer to Rs1,000 crore in the next few years. In the process, Shah got a lifeline and lives to fight another day. For now, his stated aim is to work on making Edelweiss a leaner machine that incubates businesses and spins them off.

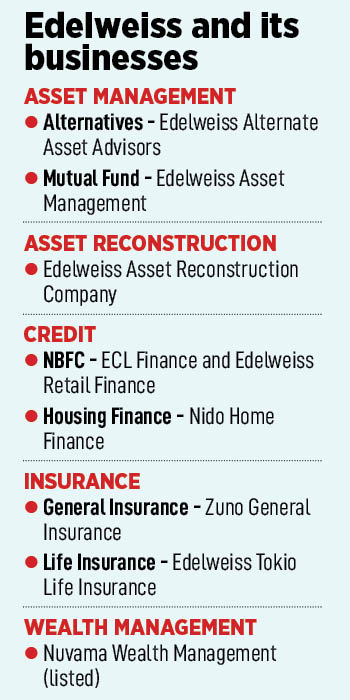

Part of his thesis is that since the India long-term opportunity is bright, the company should spend 20 to 25 years incubating businesses before spinning them off as separate companies. “Our ambition is to build businesses with a 20-25 horizon, unlock capital (through listing) and then repeat this ad infinitum," says Shah. In the last 28 years since he set up Edelweiss, the company has set up eight businesses and exited one. The jury is still out on how he’s done. The market cap for Edelweiss stands at Rs6,844 crore and profitability stands at about Rs400 crore a year with a return of equity of 5 percent. Clearly, the group needs to get more profitable, and fast.

In spinning off businesses, Edelweiss has had its first success. In September, Nuvama Wealth Management was listed and trades at a market cap of Rs11,000 crore. (Earlier in 2021, Edelweiss had raised Rs2,400 crore by selling a stake in the business to Pacific Asia Group.) The company was set up in 2001 and known as Edelweiss Broking. It received an estimated Rs100 crore in investment from the Edelweiss group over the years. Shah aims to do this eventually with each of the other businesses he runs. He’s got seven of them, but the company says it has still not decided which one has reached the exit stage yet. His efforts to sell some of his businesses have come a cropper.

As he takes us through each of his businesses, it’s clear that Shah has had to get back to the drawing board. Take the case of his non-banking finance company that made the developer loans that nearly bankrupted the group. In the pre-IL&FS era when liquidity was abundant, financiers had no problem raising money through mutual funds or through bonds. Large amounts of debt were available for the taking and assets could be kept on their balance sheet. Post IL&FS, that option dried up and NBFCs started working together with banks to disburse loans. “NBFCs are very efficient if they can be asset-light and capital-efficient by focusing on origination, underwriting and collections, but they have to partner with banks due to the cost of fund advantage that banks have," says Shah.

This is a playbook that has been adopted by most NBFCs that are not part of corporate houses—Bajaj, Aditya Birla, Hero. They (Edelweiss included) are unable to raise funds cheaply and so work with banks to originate and underwrite the loans, while banks aid them with their lower cost of funds. A bulk of the loans sit on the bank balance sheet and this allows the NBFCs to get some fee income for sourcing the loans, taking their return on equity usually north of 15 percent. Still, it must be noted that serious problems with the legacy real estate book remain, and gross stage three bad loans are at Rs945 crore or 21 percent of net worth (post the spin off of Nuvama), according to a credit report by Crisil.

So, it is not surprising that gone are real estate and other forms of bulk lending as Edelweiss has pivoted operations to make loans to small and medium enterprises. Underwriting credit for them has become a lot easier as GST returns, credit bureau scores and account aggregation allow lenders to make sense of the size of their operations, cash flow and ability to pay. “Our book is now a little over Rs1,000 crore and we’ve scaled up from disbursing Rs10 crore a month to Rs100 crore a month in the last year," he says. Expect this business to move up rapidly in Edelweiss’ reckoning of businesses. Shah knows he’s latched on to something big when he says, “Twenty years ago, India was all about corporate loans, then came along loans to individuals and housing finance. The next decade will be the decade of small business financing." In addition, Edelweiss is also in home loans and loans against property.

For Shah, the core of his empire is probably the alternatives business. He bet on this when there was hardly any talk about this in the Indian market. Investing in special situations, real estate funds, loans to companies and yielding assets like Invits all form a part of this. From the first fund in 2011, which raised Rs100 crore, Venkat Ramaswamy, who heads the alternatives business and is also vice chairman of Edelweiss, and his team have been given a free hand to run the operation and now manage AUM (assets under management) of Rs50,000 crore. The business is tied neck-and-neck with Kotak’s alternatives business and now regularly raises billion-dollar funds.

![]()

Shah has also realised that lending money to real estate and companies is much more suited to this platform where one doesn’t have to worry about quarterly payments. “They work on an IRR format and not a quarterly format," he explains. Capital here is longer term and so it is possible to restructure loans midway without having to mark them as NPAs. Market observers say that while it is still early days, and the business generated a profit of Rs78 crore last year, this could be a prime candidate for value unlocking.

It helps that alternatives is one of the few spaces where the team has stayed constant through the years. Shah has lost several able and close associates over the years with Vikas Khemani of Edelweiss Securities and Nitin Jain, former CEO of Edelweiss Wealth Management, being key losses. But he puts on a brave face and if he feels disappointed that several long-time associates have left him, he doesn’t show it. “Churn is healthy," is all he says. New people bring in a new crop of ideas and he points to the hires they have done over the last three years. They include RK Bansal to head Edelweiss Asset Reconstruction and Ananya Suneja as chief financial officer of Edelweiss Financial Services.

While hires have brought in new ideas, it is the latter half of his businesses that will still require time to scale up. Take insurance, where Shah believes they should break even by 2026-27. As of now, they are loss-making as GAAP accounting law losses have to be recognised whereas under IFRS, losses can be capitalised. The two businesses, life and non-life, have together a premium of Rs2,100 crore as of March. It would take Edelweiss a long time to scale up.

On the asset reconstruction front, Shah points to their large Rs45,000 crore book that he says has done reasonably well. The sale of Essar Steel and Binani Cements bad loans were a shot in the arm, but industry veterans say it’s anybody’s guess how well the rest of the book will perform. Shah believes the business can churn out Rs400 crore in profit every year and says that they are now moving towards picking up more retail assets. “Let’s say a Rs1 crore outstanding home loan goes bad. We will then move in and help the borrower either restructure payments or sell the house and realise the value of the security," he says. The corporate bad loan book would be very cyclical (the ARC still has 80-85 percent corporate loans). but he hopes that retail loans help smoothen it out.

As we get to the end of our conversation, a question on the Bharat Bind ETF lights up Shah’s face. India has seen several innovations in the equity markets—from the dawn of dematerialised shares to ETFs and SIPs. But Indian debt markets that globally are far larger than equity markets by a factor of five have hardly changed in terms of the products offered. This changed in December 2019 when Edelweiss Mutual Fund launched the Bharat Bond ETF. “We tested it out for two years, loading AAA PSU bonds, and then back-testing the data," says Shah.

While equities are easy to buy and own, bonds are far more complex. They have different maturities and coupons. The ETF may be bought on a particular day, but the coupon may have paid out earlier. Adjustments have to be made for bonds maturing and exiting the ETF. All in all, it is a complex task and not one that is easy to replicate. “On paper, it is easy to replicate Bajaj Finance, but how many people have actually done it," explains Shah. Bharat Bond accounts for an AUM of Rs60,000 crore out of total AUM of Rs105,000 crore in the mutual fund.

It is in credit markets that Shah sees the most innovation happening in the next two decades. “We started Edelweiss 28 years ago when equity markets were coming of age and they have become very robust since then," he says. On the other hand, the credit markets are still shallow and driven by banks and the IL&FS episode exposed their vulnerabilities. Shah is in his element when he bemoans the fact that we don’t have a bond repo market or that we don’t have interest rate futures. The bond market consists largely of government bonds or AAA corporate bonds. There is no junk bond player of scale in India. These are all areas that Edelweiss can get into.

But while the long-term opportunity remains bright—the economy doubles every seven years, the rupee depreciates by 3.5 percent every year against the dollar—the short term can be messy. Very messy, Shah knows that too well. A little before the pandemic, he was dragged to court by the Anil Ambani Group for enforcing their loan obligations by selling their shares. Edelweiss was raided by the Enforcement Directorate. Shah clearly had a tough time, but says one has to be stoic and bear it.

Now that Shah has steered his ship and prevented it from floundering, he’s put in place his objectives for the next year. Chief among them are growing his seven businesses rapidly and building in financial resilience by reducing debt. In the fiscal year ended March, Edelweiss paid Rs2,500 crore as interest payments. Net worth stood at Rs6,750 crore while borrowings were Rs19,000 crore. Ratings agency Crisil states that “the group’s profitability remains subdued owing to lower net interest margin and a substantial credit cost in the lending business".

In the past, Shah’s calls haven’t worked exactly as intended. Now he has some promising businesses in asset management (alternatives, mutual fund). The rest will take time to scale up. The markets are keeping a close eye on him and will wait for firm numbers before they re-rate the company any further.

Shah has also realised that lending money to real estate and companies is much more suited to this platform where one doesn’t have to worry about quarterly payments. “They work on an IRR format and not a quarterly format," he explains. Capital here is longer term and so it is possible to restructure loans midway without having to mark them as NPAs. Market observers say that while it is still early days, and the business generated a profit of Rs78 crore last year, this could be a prime candidate for value unlocking.

Shah has also realised that lending money to real estate and companies is much more suited to this platform where one doesn’t have to worry about quarterly payments. “They work on an IRR format and not a quarterly format," he explains. Capital here is longer term and so it is possible to restructure loans midway without having to mark them as NPAs. Market observers say that while it is still early days, and the business generated a profit of Rs78 crore last year, this could be a prime candidate for value unlocking.