Vodafone Idea FPO: Is Rs 18,000 crore enough to save a wreckage?

Will the FPO improve the fortunes of VI only in the short-term? Shrinking market share and high debt may make revival challenging, despite network expansion

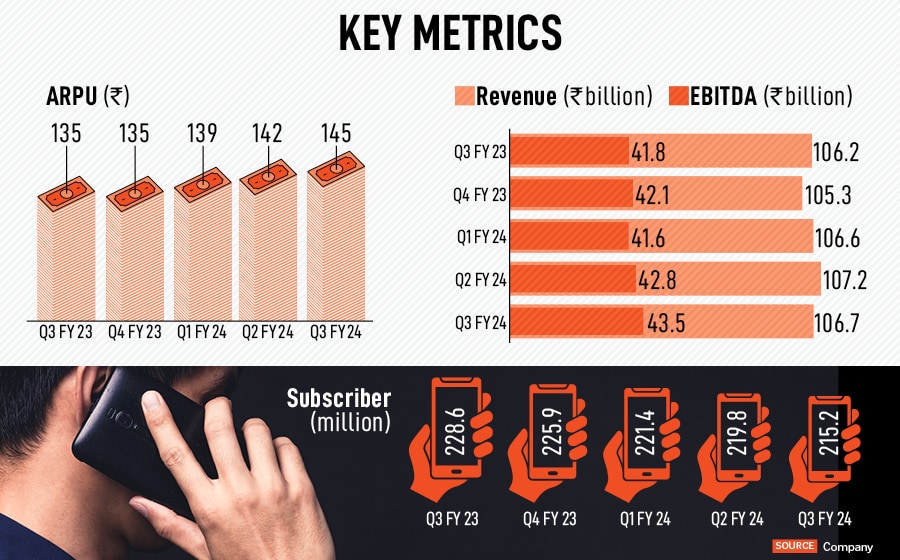

With Vodafone Idea (VI) gradually losing grip of the market, as debt liability piles up, the most essential life saviour is cash, and a lot of cash. But is Rs 18,000 crore enough to revive a cash-strapped VI? Perhaps not. The amount may significantly improve VI’s cash flow position, but it will not be able to save it from facing a cash shortfall.

VI is planning to raise Rs 18,000 crore through a follow-on-offer (FPO). India’s largest FPO will open for subscription from April 18. The sale, which will close on April 22, has set a price band of Rs 10-Rs 11 apiece. At the upper band, the issue is offered at percent discount to the closing price of Rs 13.16 on Monday.

Post issue, Rs 18,000 crore works out to be about 25 percent of the total market cap at Rs 11 per share. Though the stock has seen some momentum in the last few days, based on the revival plan, but overall it has been shaky.

“The FPO may improve VI’s fortune in the short-term, but long-term revival is still contingent on the government," say Aditya Bansal and Anil Sharma, analysts, Kotak Institutional Equities. They explain that the fundraising plan is a step in the right direction, but it is much delayed. However, the FPO should help in bridging the network coverage gap and improve competitiveness versus peers to some extent.

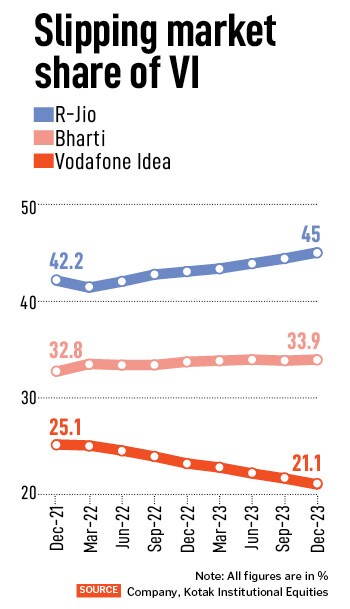

Further, with a sharp reduction in VI’s bank debt, Bansal and Sharma believe the company will be able to secure further funding from banks. They don’t expect Vi to gain any meaningful market share from peers, and remain concerned about potential large equity dilution on the conversion of government dues. “Potentially, the GoI could own over 80 percent stake in VI on a fully diluted basis in the worst case, which would limit any meaningful upside for VI’s minority investors," Bansal and Sharma explain.

The fundraising plan, if successful, will allow VI to ramp up its network capex and narrow the gap with peers on 4G coverage and 5G rollouts, but challenges remain. As VI has been battling issues on all fronts, a mere fundraising will not be enough to protect the telco from uncertainties, especially in a business led by two giant rivals Bharti Airtel and Reliance Jio.

The fundraising plan, if successful, will allow VI to ramp up its network capex and narrow the gap with peers on 4G coverage and 5G rollouts, but challenges remain. As VI has been battling issues on all fronts, a mere fundraising will not be enough to protect the telco from uncertainties, especially in a business led by two giant rivals Bharti Airtel and Reliance Jio.

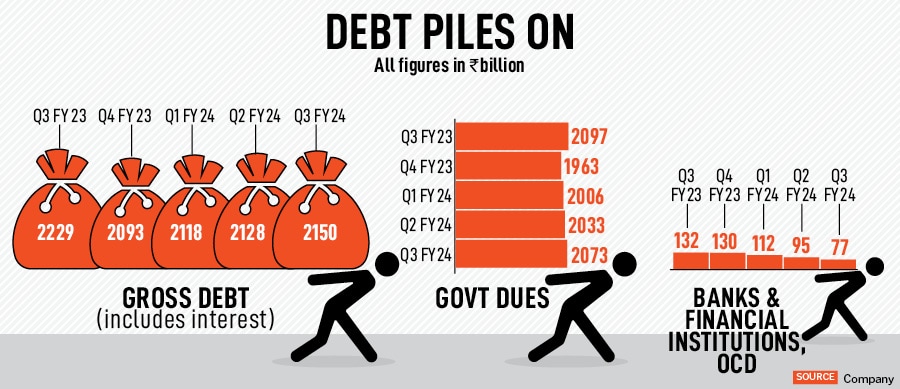

“Combined with a potential tariff hike after the elections, and the possibility of adjusted gross revenue (AGR) relief, this should significantly boost VI’s cash flow position. It may, however, still face a cash shortfall from the second half of FY26 once the ongoing moratorium on the government’s AGR and spectrum repayments ends. Unless the government exercises the option to convert these dues into equity, this remains a key uncertainty from both a cash flow and an equity dilution perspective," say Saurabh Handa and Prerna Goenka, analysts at Citi Research. VI’s AGR dues reportedly amount to Rs 58,254 crore, of which it has paid Rs 7,854 crore by October last year.

They highlight two potential scenarios for VI’s cash flow situation: The first assumes higher tariff hikes, government dues are converted to equity, and some AGR relief, while the second is more conservative on all these fronts. The sharp increase in capex over the next few years under both scenarios bodes well for Indus Towers, which is an indirect wholly owned subsidiary of Vodafone Group.

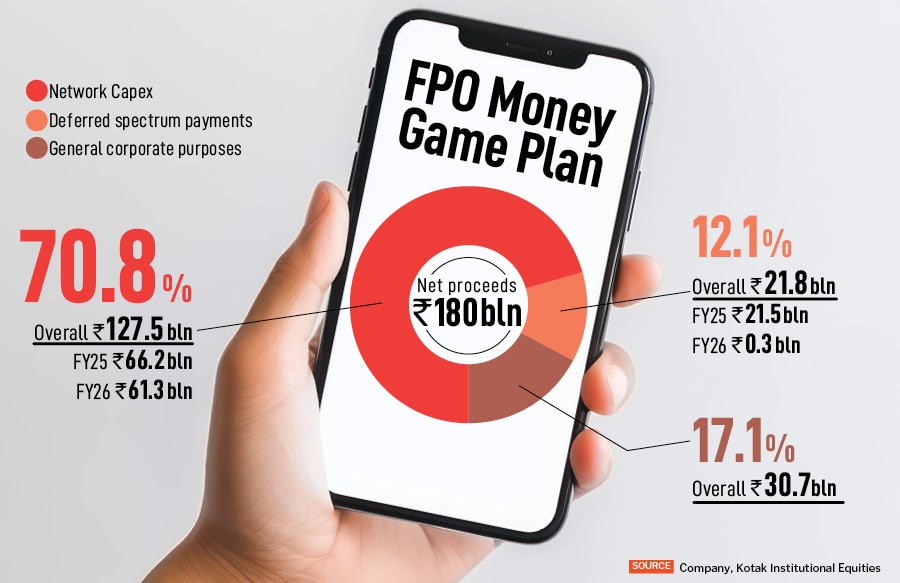

Most of the money raised through the FPO is likely to be spent on capex, expansion of network and rolling out of 5G networks. Around Rs 12,750 crore is expected to be used for buying equipment for expansion of network infrastructure. This will include setting up new 4G sites and expanding the capacity of existing and new 4G sites, setting up new 5G sites, the company says in its RHP.

VI plans to use 70 percent of the FPO proceeds to boost 4G coverage (26,000 sites), 4G capacity (40,800 sites) and 5G rollout (22,000 sites) Rs 2,175 crore will be used for paying deferred payments for spectrum to the Department of Telecom and the GST. The balance amount of Rs 18,000 crore will be used for general corporate purposes. “We believe that increased 4G coverage will help arrest market share losses on 4G in the near term," Bansal and Sharma add.

In addition to the FPO, the VI board has also approved a preferential share issue to raise Rs 2,075 crore from an Aditya Birla Group (ABG) entity. The shares will be issued at Rs 14.87 apiece to Oriana Investments Pte Ltd, VI said in a notice to the stock exchange on April 13.

Reviving VI’s falling market share is still a tall task. It lost 19 percent market share since the merger due to its inadequate network spends. While Kotak Institutional Equities analysts expect VI to bridge the network coverage gap on 4G and arrest some of the market share losses, the gap in 5G coverage (versus larger peers) would remain significant. “Further, VI’s peers should benefit more from any potential tariff hike and can outspend VI on customer acquisition, which would prevent any meaningful market share gains from Bharti and Reliance Jio," they add.

Debt of the telecom operator is rising at an alarming rate. It owes Rs 2.1 trillion to the government, with a large part of it under moratorium until first half of FY26. VI would have repayments of Rs 29,100 crore in the second half of FY26. It has to pay Rs 43,000 crore annually over FY2027-31. “The fundraise and potential tariff hike should improve VI’s financials. However, we don’t see a credible case where VI’s cash Ebidta would increase sufficiently to meet large annual dues to the government" Bansal and Sharma say. While there could be an extension of the moratorium, a partial waiver (relief on AGR dues) and further relief from the government, writing off government dues in entirety for a specific company will be difficult.

Bansal and Sharma expect VI to convert a large part of the government dues into equity over time, which could potentially lead to large equity dilutions for VI’s non-government investors. In the worst case (100 percent of government dues converted to equity at Rs 10 per share), the government could end up with an 81 percent stake, with existing promoters stake diluted to 9 percent (versus 49 percent currently and 38 percent post fundraise) and non-promoters’ stake diluted to 9 percent (from 16 percent currently and 36 percent post fund-raise).

First Published: Apr 16, 2024, 12:51

Subscribe Now