BSNL and Vodafone Idea: It's time to perform

The government has done enough to assist these two debt burdened, loss-making telcos. As both continue with their different 4G expansion journeys, all their stakeholders are watching. There may not be

A flurry of encouraging news in recent weeks should have got the fortunes for the government-owned, debt burdened telecom operators Bharat Sanchar Nigam (BSNL) and Vodafone Idea (VI) to be on the mend. The government has, since 2019, announced three revival packages for BSNL, the latest of Rs89,047 crore coming in June. In May, BSNL placed a $1.83 billion (near Rs15,000 crore) order with a TCS-led consortium, for the rollout of its 4G network services.

For cash-strapped VI, reports came in June that its promoters UK’s Vodafone Group Plc and the Aditya Birla Group are likely to infuse up to Rs9,000 crore of fresh capital into the company to revive its business. But a closer look indicates these announcements are just too little to move the needle.

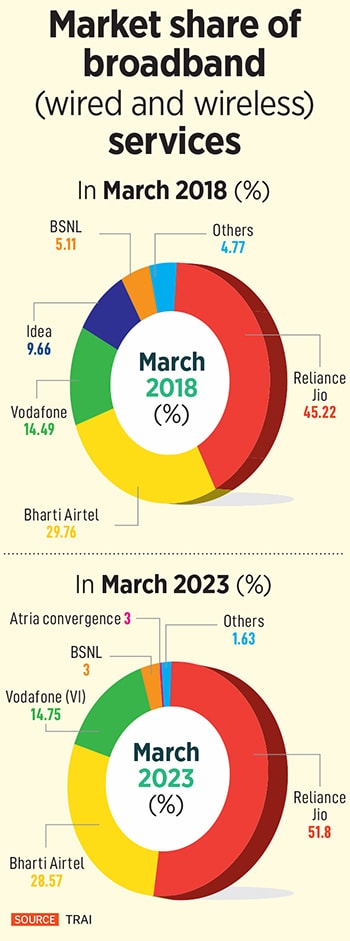

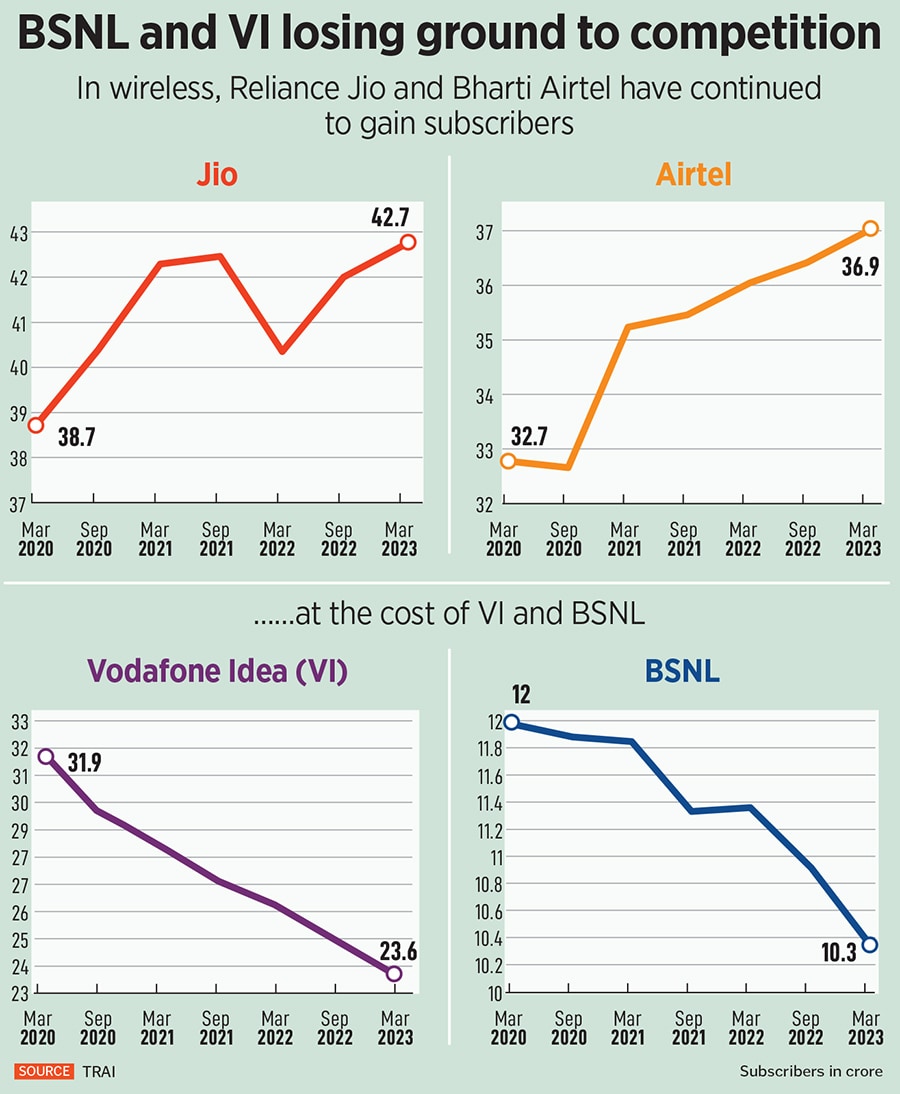

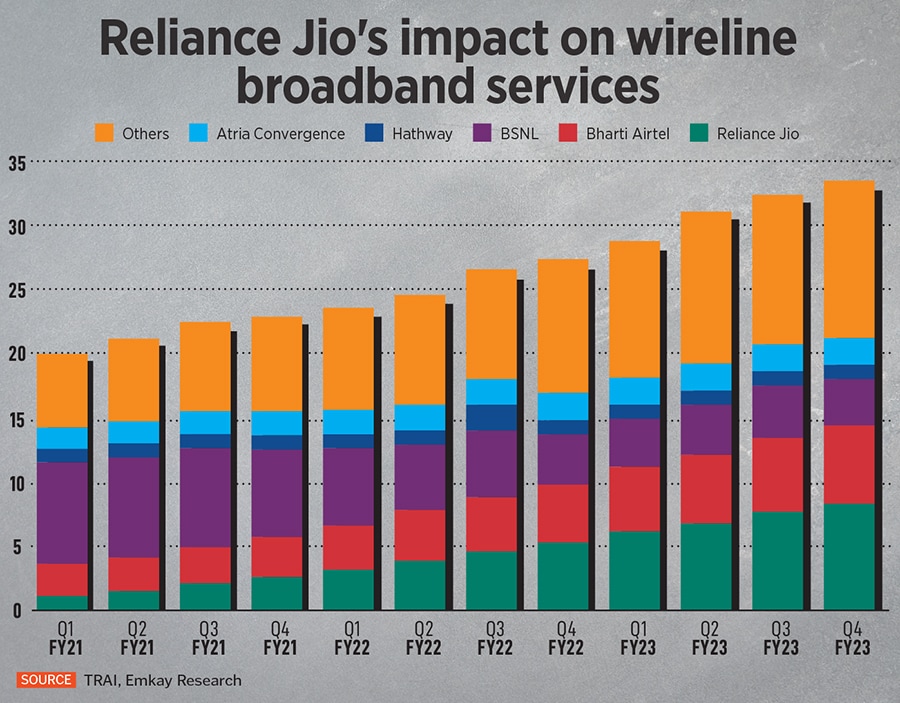

Both have little time on their hands they need to be battle-ready to take on larger, well-funded rivals Reliance’s Jio Platforms and Bharti Airtel, who have been aggressively rolling out their 5G services across India. BSNL and VI have continued to lose market share and subscribers to Jio and Airtel, for years now.

Disclaimer: Network18, the publisher of Forbes India, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

There then appears to be little to cheer the government or investors in each company respectively.

There was a need for the BSNL revival, at least from the government standpoint. After Reliance Jio had entered the telecom ecosystem, much of the competition had reduced drastically. “The industry had shrunk to a level that the government was not happy with," says Vivekanand Subbaraman, a telecom and media analyst at Ambit.

BSNL and MTNL were debt-laden, mismanaged companies whose investments were in legacy infrastructure assets. “VI"s concerns were real and with the government realising that it could not emerge as a credible rival to Jio or Airtel, needed a reliable public sector player to grow to become a trustworthy third player," Vivekanand tells Forbes India.

In BSNL’s case, the rollout of an effective 4G service across India and the creation of an effective, customer-facing redressal system are real challenges it faces. The total relief from the government to BSNL is estimated to be Rs3.22 lakh crore through three revival packages, comprising allocation of pan-India free spectrum for 4G and 5G services, financial support to boost capex and de-stressing the balance sheet and settlement of AGR (adjusted gross revenue) dues to the government. The increase in authorised capital is about Rs60,000 crore.

After announcing the third revival package, telecom minister Ashwini Vaishnaw spoke about the strategic advantages that BSNL brings to the telecom ecosystem.

“The government sees BSNL as a company that needs to be kept going because it meets their other strategic requirements. This involves functions such as ensuring secure government-linked communication channels and security," says Mahesh Uppal, director of consulting firm Com First India, which specialises in policy and regulatory issues relating to telecom and the internet.

But Uppal adds there is a sense in the government that “BSNL is the operator of last resort, particularly in sensitive areas or in regions where the services would not be lucrative or profitable for other private telecom operators." BSNL has started to rollout its 4G services in some states.

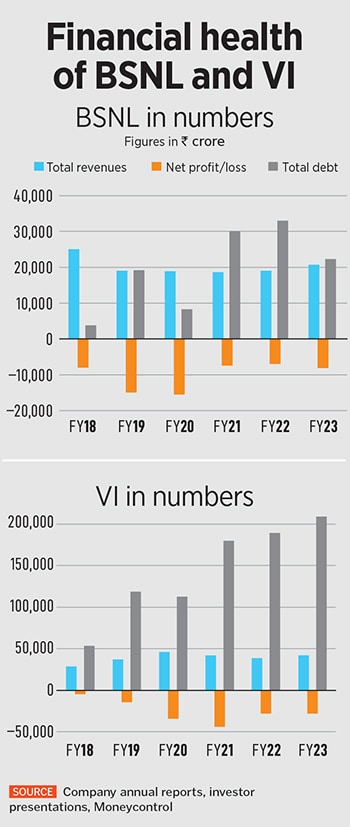

But it is the absence of these commercial interests that turned BSNL into one more loss-making state-owned venture. Though its debt has narrowed to Rs22,289 crore in FY23 from around Rs33,000 crore levels a year earlier, it has remained a loss-making venture for the past 13 consecutive years, since FY10. It raises the pertinent question of good money being thrown behind bad.

The losses had mounted for BSNL due to AGR-related dues, the delay in the rollout of 4G services and intense competition. Over the years, the government’s views on dealing with Chinese vendors changed when companies such as Huawei and ZTE were gaining market share in India. “Chinese vendors were no longer kosher in India and the government decided to ban them as geo-political relations with China changed. So telecom companies reduced their reliance on Chinese vendors and opted for private European vendors, all of which delayed BSNL"s 4G rollout plans," says Vivekanand.

BSNL declined to participate in this story with insiders indicating the chairman and managing director Pravin Kumar Purwar wanted to give some concrete deliverables before giving interviews.

BSNL headquarter at Janpath Road in Delhi, BSNL TelecomImage: Shutterstock

BSNL headquarter at Janpath Road in Delhi, BSNL TelecomImage: Shutterstock

Telecom analysts say BSNL’s revival plan has little to do with trying to turn it into a fierce competitor to Jio and Airtel. It has more to do with showcasing that India has the capability to execute telecom solutions, indigenously, across the country, without having to depend on global competitors.

When Tata Consultancy Services (TCS) announced in May this year, of a consortium which it led, to bag an Rs15,000 crore ($1.83 billion) advance purchase order from BSNL to build a 4G network across India, it signaled a synergic win-win for several parties in India’s telecom ecosystem.

For TCS—which missed street expectations in its March-ended quarter earnings—it meant one more ‘mega’ deal (after those with Phoenix Group, Marks & Spencer) at a time when the uncertain macro-economic environment has meant it had acquired more medium sized deals, rather than massive ones in its order book. For the rest of the consortium, which includes Tata Group subsidiaries Tejas Networks and Saankhya Labs, it means giving an impetus to test 4G technology indigenously and involving domestic vendors and BSNL to partake in these trials.

Bengaluru-based Tejas, a telecom equipment company, is riding on the deep-tech focus which it executes for companies. For FY23, it reported its record revenue of Rs919.57 crore and highest-ever order book worth Rs1,934 crore, which has also led to a 20 percent jump in the stock in 2023 and 65 percent for the past twelve months to Rs729.3 at the Bombay Stock Exchange (BSE). In FY23, it filed for 445 patent filings and over 330 semiconductor IPs.

With the government’s spectrum allocation towards BSNL and the indigenisation programme, “the posturing of the government is that India should be seen as a China Plus One country. India is positioning itself in a compelling manner to participate in these global trade supply chains and for that, proving that they can deliver. BSNL is important not just to compete in telecom services, but also as a test case to demonstrate that India’s technologies work. India is positioning as voice of the global south," Vivekanand says.

But Uppal argues that “Given that the products are new, there is very little evidence of the success of indigenous technology in a commercial network. Commercial players tend to be reluctant to deploy "untested" equipment," he says. In BSNL"s case, since the government owns and controls it, it can ensure the use of Indian technology. “However, whether these technologies will succeed or give a competitive advantage to BSNL over private players, only time will tell," he assesses.

********

VI has different battles to tackle. While it still trying to work towards a pan-India 4G presence, Jio and Airtel are in the process of carrying out one of the world’s fastest 5G rollout in the country. Jio has rolled out 5G in 5,657 cities and towns while Airtel has launched the services across 3,500 cities and towns across India. Recently, Jio and Airtel have also laid emphasis on increasing their presence in rural markets and this is likely to increase competitive intensity in these circles.

Also see: 55 percent Indians willing to pay higher tariff for 5G services

Analysts are concerned that in the absence of massive capital infusion into VI, its capex towards 5G will just not take place. This week, VI has indicated it has started to scout for vendors for a 5G rollout in the future, it this is obviously subject to fresh investments coming in. Even in the case of the June news on fresh capital likely to come in from the two parent promoters, there has been no official corporate announcement to the same.

Akshaya Moondra, CEO of VI told analysts in their May 26 earning call that “Promoters have contributed equity in the past and they are also ready to contribute some more equity. The third leg of funding has to come from external investors to bring in equity and currently multiple discussions are on. We are progressing well on at least three discussions which are ongoing. And we expect to make progress on this and conclude funding."

To understand how much of a ‘strong third’ player VI will emerge behind Jio and Airtel, one has to assess the company from the standpoint in 2025-26 by when the moratorium period ends and it needs to start paying the government its dues.

“The subsistence of VI post FY26 will become increasingly difficult, as the company may face funding shortfall of approximately Rs250 billion in FY26 and of Rs360 billion in FY27 that will require steep tariff hike of 85 percent and 122 percent, respectively, for making payments," Emkay Global’s research analysts Santosh Sinha and Inaara Bardai said in a May 2023 report. The brokerage has a ‘no rating" status for VI “amid concerns around continued market-share loss, delay in fund raise and possibility of equity dilution."

The VI stock is up 6.43 percent in the past four weeks, but down 6.87 percent in 2023 and now, despite narrowing Q4FY23 losses, several brokerages such as CLSA, Motilal Oswal, Nuvama Research (formerly Edelweiss), Yes Securities and Kotak Institutional Equities remain bearish for the stock.

Hemang Khanna, research analyst (telecom and energy) at Nomura says: “VI is facing headwinds due to capital constraints and needs significant fund raise to bridge its 4G coverage gap and commence its 5G rollout. While there have been increasing discussions on a likely fund raise, its quantum and timing are important."

Besides the capital for 5G expansion, VI could have been better off if prepaid tariff prices had been hiked, but there has been none since November 2021. Delays in a fresh tariff price hike from telecom operators only raises concerns about VI’s revenue growth momentum. In April, Jio narrowed the pricing gap between itself and Airtel by hiking its postpaid base tariff to Rs299 from Rs199.

From a technology and customer preference standpoint, BSNL and VI need not be too concerned about whether their respective efforts towards 4G will come to nothing, as Jio and Airtel continue with their 5G expansion. “The relevance of 5G is yet to be assessed. Noticeable difference will be seen in the enterprise, private networks segments, where 5G technology brings in better features," Ambit’s Vivekanand says. Nomura’ Khanna agrees. “5G at this stage is not creating a material difference for user experience vis-à -vis 4G. There are some use cases in the form of gaming, AR/VR, albeit these are still in nascent stages," he says.

Hemang adds that it is different for the enterprise business where there are “several use cases in manufacturing, automobiles, retail, warehousing, healthcare, education, smart cities, data centres, cloud computing etc. which can drive significant value creation, albeit it will take a few years for use cases to reach maturity and be monetized."

On the retail individual side, if customers were abandoning 4G, VI would not have registered growth in average daily revenue and 4G subscribers in recent quarters, though the pace of growth has been slowing and rivals are grabbing market share.

“If 5G were that big a differentiator, VI would not be able to continue to add 4G subscribers to its base. BSNL’s 4G rollout will be extremely critical to its customer franchise. They might have lost a lot of accounts but this is a unique opportunity to showcase execution and emerge as a credible department," Vivekanand adds. Independent expert Uppal suggests BSNL will need to launch a “comparable bundle of products to attract customers."

There is no doubt that to support an operator like BSNL, for the considerations discussed here, in a market which is very competitive, is a tricky undertaking. It requires a different thinking from the government"s current approach. “Concerned ministers have said they expect BSNL to be revived and stay competitive, but deep down they know this is not happening. They probably don’t know how to sell the idea that they want BSNL for a different set of reasons which are equally important," Uppal says.

So BSNL’s relevance in the ecosystem will continue (but not as a strong third player) and with some question marks still surrounding VI, we could stare at the possibility of a duopoly.

There is no doubt that BSNL needs to prove itself and has huge ground to catch up —on coverage, technology, market and revenue share, it lags in every department. The government has indicated that this is the last bailout it will be doing for BSNL. “The company definitely needs to prove its usefulness, but we must be skeptical of the enforceability of threats or how accountable the government can hold the BSNL management," a second telecom expert says, on condition of anonymity.

With that reality, analysts are pointing towards the possibility of a merger of VI and BSNL. “It is not being discussed but the reality is that the financial backing is with BSNL while VI has the customers," says Vivekanand. “There is still uncertainty surrounding VI"s future viability."

The government is VI’s largest shareholder with a 33.1 percent stake, followed by UK’s Vodafone Group Plc (32.3 percent), the Aditya Birla Group (18.1 percent) and the balance 16.5 percent is public shareholding.

The Rs16,000 crore of interest on spectrum and AGR-related dues resulted in an equity dilution of 33 percent for VI. Imagine how the company will manage to pay the overall Rs1.9 trillion of dues (as of March 2023). “The best situation should have been the government nationalised VI. Now a second option would be to consider merging VI with BSNL that would be the best way out for the government," the second expert says.

First Published: Jun 26, 2023, 10:48

Subscribe Now