The necessary 5G gamble for telcos

The entry of enterprises into the 5G technology ecosystem increases revenue uncertainties for telcos. The 5G rollout is imminent by 2022-end, but monetising this is going to be tough

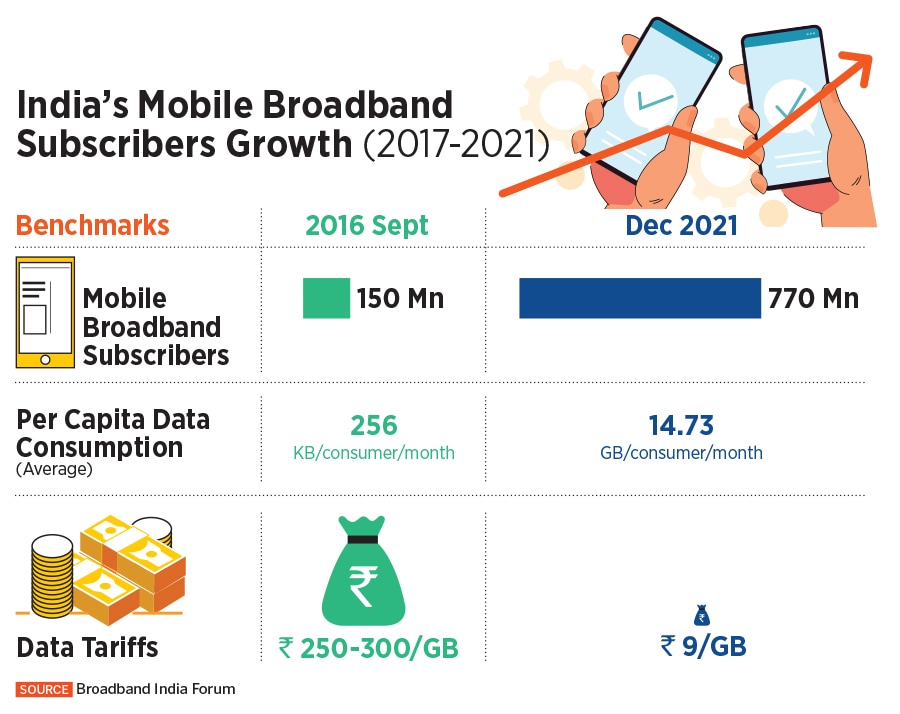

India’s telecom companies Reliance Jio, Bharti Airtel, Vodafone Idea and, to a limited extent, MTNL, had, for the past six-eight months, expressed their preparedness for the implementation of fifth generation (5G) telecom network and technology services by conducting regular trials across different parts of the country. The Department of Telecom (DoT) had allotted trial spectrum across three different bands in May last year to these companies for 5G trials in urban, semi-urban, and rural areas.

The buzz for the auctioning of spectrum by the regulator has grown louder and starting July 26, spectrum will now be offered to successful bidders. But this year will be like no other, marking a historic occasion in India’s digital transformation journey.

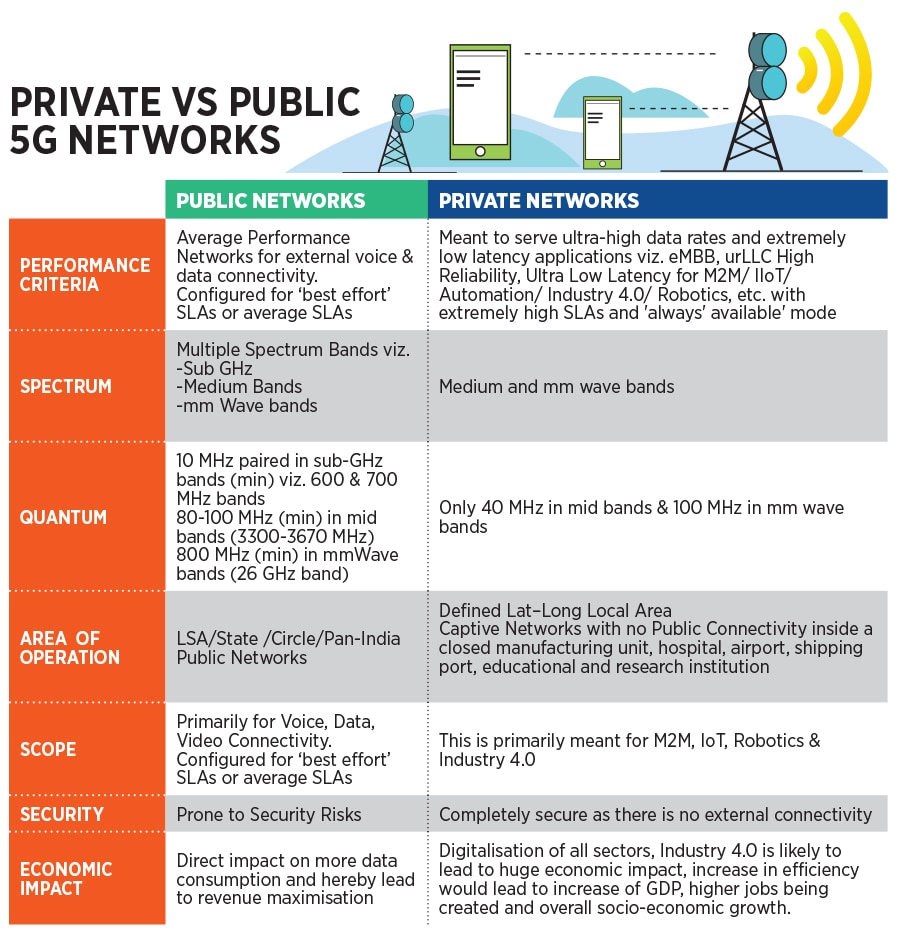

For the first time ever, India will reserve part of its telecom spectrum for private 5G networks that can be run by various enterprises, including large technology giants such as Google, Tata Consultancy Services (TCS) or Infosys. Enterprises will also be allowed to lease spectrum from service providers to run a network.

Private 5G networks are likely to be similar to the public 5G (which telecom companies will bid for), but is expected to be cheaper and connectivity will be limited to the space of the enterprise.

Depending on which industry you belong to, this decision has become divisive. The telecom companies are not going to be happy, and, obviously, the enterprises will be thrilled. It will be a transformation for enterprises from hospitals to ports, IT companies to engineering giants which need 5G capabilities to drive their application across factories or other service lines, as part of their digital transformation.

Also Read: How Nokia became the invisible force of Indian telecom

By their characteristic, a private 5G network is one that allows the owner to provide priority access or licensing for its wireless spectrum and they do not share traffic with other nearby cellular networks.

Telecom minister Ashwini Vaishnaw told an industry summit that 5G deployment will start in 20-25 cities and towns by 2022-end.

TV Ramachandran, president of the Broadband India Forum (BIF), a think-tank for digital transformation, which represents large technology enterprises—including academia, research institutes and patron members such as Google, Amazon, Intel and Qualcomm—is obviously cock-a-hoop.

“5G is not a telecom technology any more. It is the first G to go out of telecom and go to other verticals also. With the move to allow private 5G networks, enterprises will be on the global playing field," Ramachandran tells Forbes India on call from the United States.

Ramachandran says the decision to allow private 5G networks “is equal to or bigger than" the Atal Bihari Vajpayee’s government decision relating to NTP-99 which transformed the telecom sector by doing away with fixed licence fees and helped speed up economic growth through higher tele-density.

The Global mobile Suppliers Association (GSA), a not-for-profit organisation representing mobile companies, found that at least 794 organizations in 68 countries and territories are deploying private mobile networks based on 4GLTE or 5G technologies. The manufacturing sector has been the largest adopted of these private networks, followed by education and mining companies.

The global market for private 5G network is estimated to reach $31,589 million by 2030, a compound annual growth rate (CAGR) of 42.4 percent in the next eight years, from the current size of $1,372 million in 2021, according to a recent report by Acumen Research and Consulting. This data indicates that the rollout of private 5G networks is still poor, with a huge potential to expand.

Companies such as Larsen &Toubro, TCS, Tech Mahindra, Maruti Udyog and ITC are likely to be front runners to bid for spectrum. L&T and TCS declined to comment on their immediate plans to apply for spectrum, at the time of going to press. Ramachandran, who formerly worked with Vodafone Essar, believes India has the potential to have at least 200 to 300 private 5G networks in coming years.

There is no doubting the need and the potential for the growth of 5G private networks. 5G is about providing high speed connectivity (which is largely being dealt with through fibre optic usage or even 4G), low latency applications and use cases, and Internet-of-Things (IoT), where millions of devices operate in a concentrated environment to provide solutions to customers. This is where 5G technology works best.

Telecom companies such as Reliance Jio, Bharti Airtel and others make their money primarily by rolling out access infrastructure. They have done the heavy lifting for several years by investing capex, have to reinvest in new technologies consistently and often struggle to monetise these investments. They have always favoured a protectionist stand, where spectrum is to be auctioned to licenced companies only. Technology and OTT companies are low capex outfits. 5G, being a new technology, might be offered cheaper to them and they may be willing to work with smaller margins.

“Telcos fear that with all the use cases that people build up, the IT companies will have an edge given an uneven playing field. This could be true, because IT firms (like TCS and Infosys) have the prowess of dealing with B2B better than telcos," says former Bharti Airtel CEO Sanjay Kapoor, who is now an entrepreneur and TMT consultant advising various telecom companies.

The Cellular Operators Association of India (COAI), to which Jio, Airtel and Vodafone Idea are members, had told minister Vaishnaw that the “business case for telecom service providers will get severely degraded" if independent entities were allowed to set up private captive networks. The biggest fear is loss of revenues, which would later make the complete rollout of 5G networks non-viable.

IIFL Securities’ AVP research analyst Jayesh Bhanushali warns of revenue losses for telcos. “If such private captive networks are allowed, it will diminish the revenue of these telcos. The enterprise services are expected to generate around 40 percent of the 5G revenues and hence, if private captive networks are allowed, the telcos are likely to face uncertainty in the enterprise services revenue stream and impact the overall 5G business.

The telecom companies are not likely to pull out from the auction altogether, but they would have to rethink their auction strategy," Bhanushali tells Forbes India. Experts say there appears little relief for telcos from here on if they chose to contest it legally, telecom licences being non-exclusive.

Kapoor questions the brewing debate of private verses public networks. "Is there a need to have a discord on the ownership of 5G spectrum? It may be more important, at this stage, to concentrate on getting the ecosystem to collaborate and explore bankable use cases," he says. The jury is out on whether India has created a short-term mess or whether there will be enough space for all to operate.

Enterprises can look forward to a new revenue stream but the going will be tough. They do not have the experience of putting in heavy capex or rolling out infrastructure networks. They will also need to ensure low latency (minimum communication delay) and also learn how to monetise on this 5G technology.

If a player has to provide low latency or IoT, it cannot afford black spots in the network coverage. For enterprises where machines are lifting materials, a high latency will not work, so the network coverage will need to be dense.

“Eventually, telcos and enterprises will have to work jointly for a win-win outcome. A telco can work with a TCS, Infosys or Google to provide the right customer experience and solutions," Kapoor adds. United States has been successful in building private 5G networks, driven by communications technology giant Ericsson, while Nokia has done the same in other Asian economies. Right now, in India, enterprises may try and set up networks individually which may be suboptimal given their scale and experience in this field.

The government will auction a total of 72,097.85 MHz of spectrum with a validity period of 20 years. Telcos will have the option to make full or partial upfront spectrum payments, while Vodafone Idea, has in 2021, accepted a four-year moratorium on adjusted gross revenue and spectrum payments.

India, as an ecosystem, is ready for 5G technology. The average selling price for entry-level 5G devices has hit the sub-Rs10,000 mark, IIFL’s Bhanushali says, which indicates that the device ecosystem is already ready. “This was not the case during the 3G and 4G era when the technology was launched but people were not able to use it," he adds.

However, the adoption from the end-users is likely to be slow initially as has the trend been for 2G to 4G upgradation. Telcos are unlikely to be aggressive bidders at a higher price for spectrum, considering that there are just three players–and realistically–only two (Jio and Airtel) looking to make serious investments.

Jio, Airtel and Vodafone Idea declined to comment on the private captive networks or their exact 5G-related rollout plans.

“The 5G networks are ready, the core networks are ready, the transport networks are ready, and you just need to hire and put on those radios that are of that particular band that will potentially be auctioned and bought by any operator. You just need to put that onto the site," Bharti Airtel’s managing director and CEO Gopal Vittal told analysts during the FY22 (March ended) earnings call on May 18.

“I would say that this is going to be a modular rollout. Is this going to be an aggressive rollout in the short term? The economics do not suggest that it can be, simply because the ecosystem is still very nascent. So, I think it is a game that we are going to wait and watch and see how it plays up," Vittal added at that time.

Bhanushali says, “In the 5G trial runs, all the three giants were able to get 8-10x more speed compared to 4G, and hence we expect them to be ready to capitalize on this technology."

Bharti Airtel has managed to raise Rs1.35 lakh crore of funding to strengthen its balance sheet over the past few years, which includes funding from Google into Airtel, estimated at Rs7,700 crore ($1 billion) for multi-year commercial agreements.

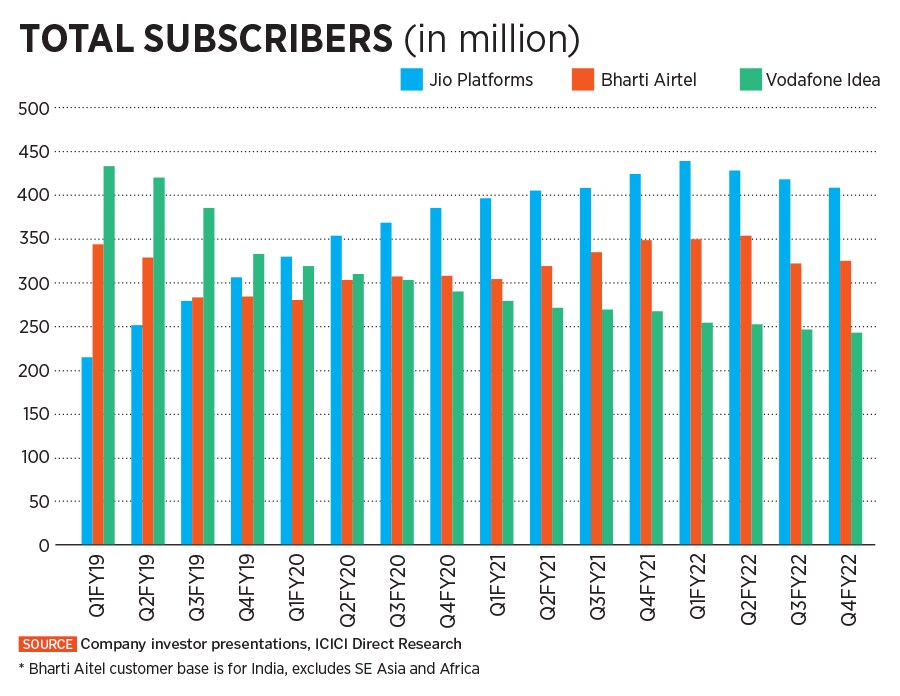

The total fund raising has helped improve its leverage (net debt to ebitda) to 2.51 times in FY22 this year from 2.95 times a year earlier. Bharti Airtel lost three lakh wireless broadband subscribers in April 2022, bringing its total wireless subscriber base to 36.1 crore. Vodafone Idea lost four lakh subscribers (total wireless subscriber base to 25.9 crore) and Jio added four lakh subscribers (total wireless subscriber base to 40.5 crore).

For Airtel, the home BB segment saw 1.85 million new home passes and an increase in reach to 175 new cities during the quarter on the back of the Local Cable Operator (LCO) partnership model. The partnership model with LCOs has yielded significant capex savings while reducing the time to market. The enterprise segment witnessed a 13 percent year-on-year revenue growth and Airtel has outperformed peers in each sub-segment (such as data connectivity, Communications platform-as-a-service, data centers, security and cloud hosting).

While Jio’s wireless subscriber base has grown, IIFL’s Bhanushali sees Jio’s strengths in the fact that its cash capex on its network has risen to Rs 22,800 crore in FY22, 105 percent higher over the previous year. Jio, in 2020, announced foreign investors, including technology giants Meta (Facebook), Google, Silver Lake, TPG, General Atlantic and others, raised over Rs 1.52 lakh crore for a 33.5 percent stake in Jio.

“Jio utilises the latest 4G LTE technology which is further supported by Voice over LTE. This makes it steadier and more versatile for offering 5G services," Bhanushali says.

Vodafone Idea (VI) had, in May this year, recorded top download speed of 5.92 Gbps during the ongoing 5G trials on a single test device being conducted in Pune, on a combination of mid-band and high-band (mmWave) 5G trial spectrum. To boost innovations further, VI will test 5G-based solutions on Aerial Traffic Management and Motion Capture System, as part of its ongoing 5G trials.

But the problems for VI go beyond competing with Jio and Airtel on 5G trials. VI, which has been in losses since the merger of Vodafone India and Idea Cellular in August 2018, continues to lose subscribers to Jio and Airtel. It needs to raise close to Rs25,000 crore to stay competitive, analysts say. In May-end, media reports had emerged that Amazon and some private equity firms will invest up to Rs20,000 crore into VI. VI later said there was no such proposal being discussed with the board.

The biggest concern for VI is that it still needs to pay back its dues, estimated in excess of Rs50,000 crore, back to the government—which holds a near 35 percent stake—when the moratorium ends. A strong 5G rollout only raises more concerns of business continuity for the company.

“For VI, 5G investments is a case of "damned if you do, damned if you don"t". If VI zealously rolls out 5G, the most worried entities might be the government (to which it will owe bulk of the dues) and infrastructure providers both active and passive (which would help provide necessary infrastructure)," says Kapoor. How aggressive VI will be during the 5G spectrum auction and how it rolls out this technology will need to be closely watched.

In 2022, the VI stock has fallen 47 percent to Rs 8.2 while Bharti Airtel stock has slid 6.8 percent in the same period, at the stock exchanges.

Telcos have already, in the past 12-15 months, taken steps to shore up revenues and cash flows by raising tariffs regularly. Besides having to maintain strong financial muscle by ensuring upfront or partial spectrum payments, the biggest challenge for telcos will be to monetise 5G technology. And this has been a tough task across several countries.

Customers who use 20x more data in 4K content (compared to the current HD) are not, necessarily, willing to pay 20x more for the 5G technology they use. Also, India remains a price sensitive market.

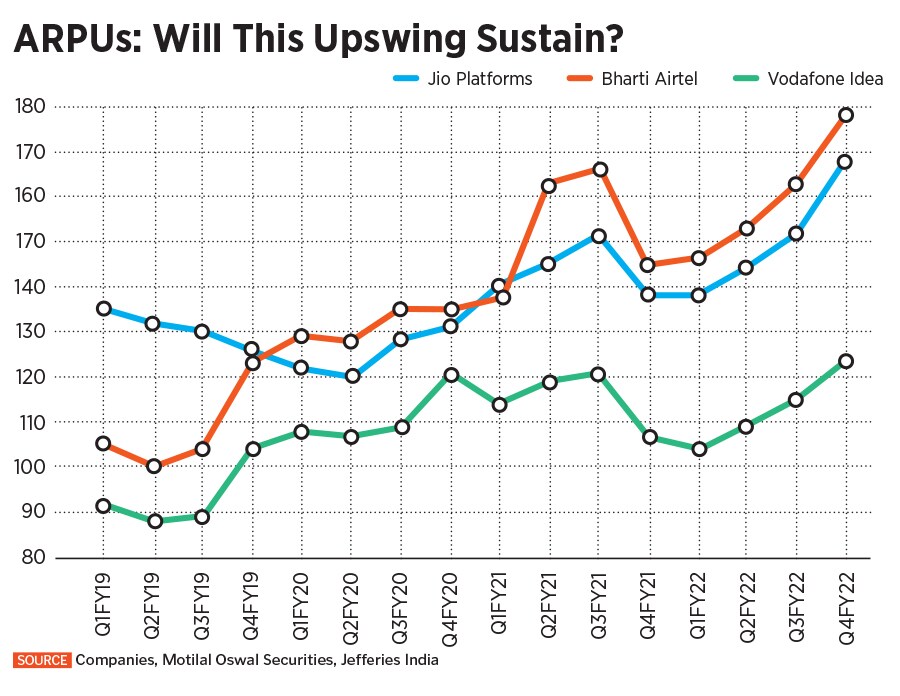

Kapoor suggests that telcos need to raise tariffs before the 5G rollout. Average Revenue Per User (ARPU) for telcos currently range between Rs124 and Rs175. If 5G comes, ARPUs at Rs300 to Rs500 may not be sustainable, analyst fear. Being one of the lowest ARPU markets in the world, the capability for telcos to absorb further shocks during 5G are limited.

Bhanushali forecasts a marginal rise in ARPUs initially as companies are likely to price 5G at just above the 4G rates to increase adoption from the users. “As more users start migrating to 5G, we expect the companies to gradually start increasing the tariffs. A clearer picture can be obtained once the spectrum auctions are completed," he says.

Airtel will need one more price hike, maybe in 2022, for its ARPUs to get to the Rs 200 goal post. For Jio, with healthy gross adds and resilient data usage, its tariff hikes seem to have been absorbed well, despite inflationary pressures and concerns around rural market weakness. For VI, ARPU rose eight percent quarter-on-quarter to Rs124 due to the flow-through of the December 2021 tariff hikes.

With the deployment of 5G, it will become even more important for the telecom industry to remain profitable and contemporary. The telcos have to increase prices significantly for their own sustainability. And customers will need to pay higher prices for these in coming months.

“There has been a noticeable change in the mood of the government and they are seeing the telecom industry in a new light—they have been liberal on cash flows from the telcos—and abolishing the spectrum usage charge (SUC) from 5G and therefore reducing operational costs for telcos," Kapoor says.

However, there remains room for more assistance, especially in bringing down the reserve price of spectrum, lowering revenue share and supporting fibre roll outs.

After all, the government and the regulator understand that 5G is no more a technology it is a highway on which we are going to be driving a lot of economic growth.

First Published: Jun 20, 2022, 12:44

Subscribe Now