5G expansion: Sluggish and silent

Lack of compelling use cases for 5G from consumers is a reality telecom companies need to deal with. Even as a fresh tariff hike is on the cards, the monetisation of 5G is becoming a real concern for

By end-November 2022, a month after 5G services were launched in India, Shrenik Kanodia, a day trader (name changed) in Ahmedabad, recharged and opted for the ‘true’ 5G network plan on a Reliance Jio plan for his iPhone 12. It was, and still is, a free feature on his Rs2,545 package for 336 days, where 5G is unlimited with 1.5 GB 4G per day. “The biggest benefit of a 5G service is that data does not get exhausted while using the phone or while streaming," Kanodia tells Forbes India.

5G’s most persuasive factor for consumers has always been the low latency and high speeds. But Kanodia has not seen much of a difference between 4G and 5G when it comes to video buffering. “It’s been equally fast in both networks."

While largely working out-of-home, Kanodia does not actively check whether his mobile is on a 4G or 5G network. “Even while not using Wi-Fi, very often, the network switches back to 4G from 5G, even while I continue to work from my work desk. But it is not making a difference to my life," he adds.

The fact that for customers like Kanodia there is no clear differentiator between 4G and 5G technology is what makes the 5G story—not just for telecom companies, but also for individuals—less compelling to tell with each passing day. “The fact that 5G is free makes things easier. If I have to pay for it, I would not use it. The problem is that 5G drains my mobile battery. Even when I am on a 5G network, I keep my phone on data saver mode, so it moves back to a 4G service, but my life continues as normal," Kanodia says.

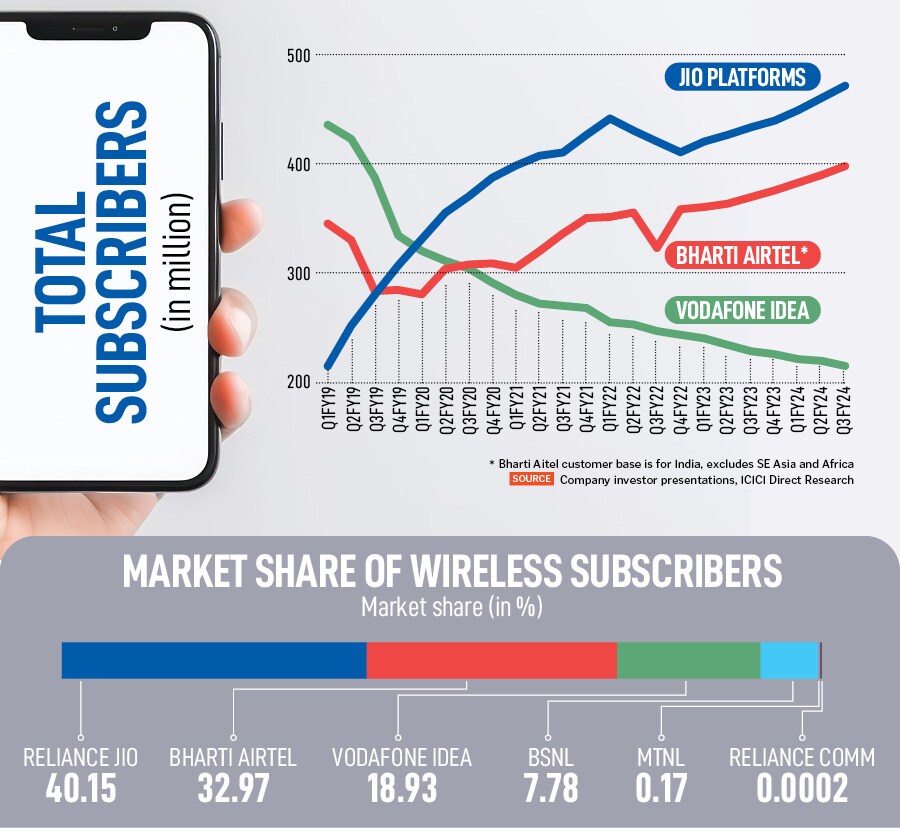

Consumer subscribers’ data by end-2023 showed that 5G users with Reliance Jio rose to 70 million (out of around 460 million total wireless subscribers) and 55 million for Bharti Airtel (of 345 million total subscribers). Assuming a 30 percent rise in 5G customers in the first quarter of 2024, we would still be looking at approximately 175 million pure 5G subscribers, of a total of 1,164 million total subscribers, which works out to an approximate 15 percent market share.

Cash-strapped and debt-ridden Vodafone Idea (VI) is yet to roll-out 5G technology and Adani Data Networks, part of the Adani Group which acquired spectrum for their private captive networks in ports and logistics projects, is yet to have a 5G network in the 26GHz band.

But to understand sluggishness in the demand and usage of 5G, we need to step back and look at what made 4G a success.

3G technology was barely successful in India because it could not solve any purpose and ended up just as a voice tool. Experts have called it a “lame, half-way house", which fell by the wayside. But 4G LTE allowed for quick downloads of data, which made the migration from voice to data really quick. It has since then been the technology most widely used, across Asia, Middle East and Africa.

But the hype for 5G technology grew faster than its usage. The technology is obviously useful, but there are very few use cases to test the capabilities of 5G. “5G features like low latency are more relevant for industry (for example retail, manufacturing, robotics etc). The higher speed is hardly a game changer for consumers. 5G’s role will increase as Internet of Things (IoT) is deployed more widely," says Mahesh Uppal, director of consulting firm ComFirst India, which specialises in policy and regulatory issues relating to telecom and the internet.

In recent months telecom operators in India have continued to shift their focus towards B2B from B2C, building hopes on the growth of Indian enterprises, which need private 5G networks. The inadequacy of fixed-line infrastructure was apparent over the past two decades. 5G will mean acceleration of the automation process and creation of new products and revenue streams.

“Across the globe, 5G was a push from regulators, government and infrastructure providers, forcing telecom companies to hasten the availability of 5G network. But this is now getting mundane," says a former telecom CEO on condition of anonymity.

“Two years ago at the Mobile World Congress, 5G was the hero. This time AI (artificial intelligence) was the buzzword. The biggest concern for 5G technology—amortization—has to play out. The aftermath it is going to leave is that a well-established polygopoly model is now thinking of converting into a duopoly," the telecom consultant says.

Was the 5G expansion then an ill-planned idea? Telcos are not saying that. “5G helped both Jio and Airtel to debottleneck their 4G networks. Telecom companies have also gained from the zero spectrum usage charge, based on spectrum which was picked up in the August 2022 auction," says Balaji Subramanian, vice president at IIFL Securities, who tracks the telecom sector.

According to Balaji, it led to a reduction of 200 bps on spectrum usage and improved Ebitda for both Jio and Airtel. In Airtel"s case on FY23 mobile revenues of Rs75,925 crore, this would work out to saving Rs1,520 crore, which is substantial.

Airtel has said earlier that it carries about 10 to 15 percent of 4G traffic on 5G networks. So wherever telecom companies have a capacity issue, they are refarming towards 5G and wherever they have a coverage issue, they are putting it towards 4G. “One must remember that 30 percent of the sites result in 70 percent of the traffic," the telecom consultant says.

The Telecom Regulatory Authority of India (TRAI) is planning for new 5G guidelines to display network coverage maps on their websites, so that there is transparency in network coverage on availability of 4G and 5G technology.

Even as these issues are being ironed out, the biggest concern for Jio and Airtel is monetisation of 5G technology. Airtel’s MD and CEO Gopal Vittal, in the Q3FY24 earnings call held on February 6 with analysts, said that given the capex which has gone towards 5G, the monetisation has been “modest", though the fixed wireless access (Airtel Xstream AirFiber) and the expansion of private 5G networks (Airtel business) will give it some ability to monetise.

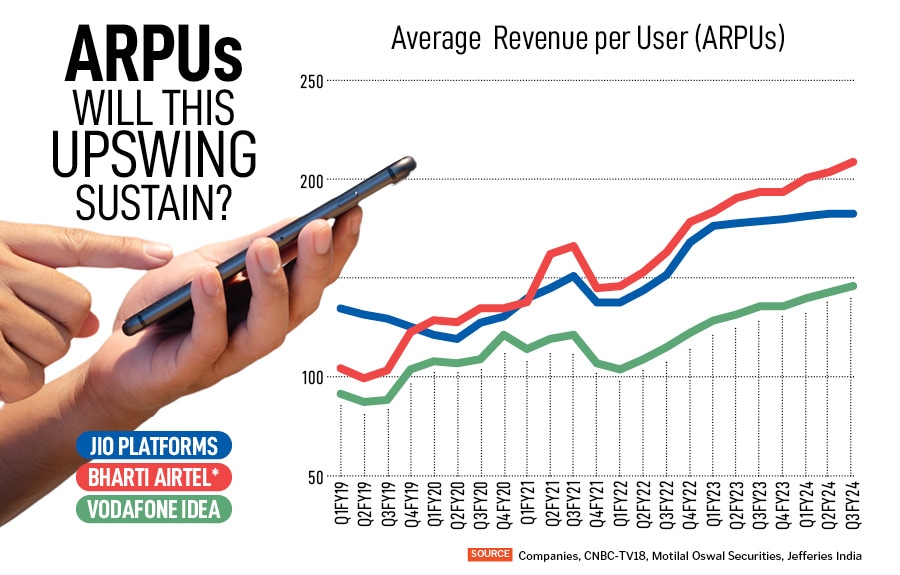

Experts Forbes India spoke with and media reports strongly indicate a 15 to 20 percent hike in telecom tariff after the general elections, possibly between July and September. The previous hike took place in December 2021. Any addition price hike over the next 18 months will boost revenues. Average revenue per user (ARPU) has been increasing in recent months, even in the absence of a price hike (see chart), mainly due to the premiumisation model where customers have upgraded to higher value plans.

With most of the spectrum towards 5G expansion already bought, experts forecast a lukewarm response to the upcoming spectrum auction, planned for June.

IIFL’s Balaji says Airtel is likely to bid for the 900 MHz in new circles and make some selective 4G spectrum purchases and top ups. Reliance Jio has most of the spectrum it needs and it has been calibrated in its 5G rollout. “We expect a lukewarm auction. Most telcos have purchased an adequate amount already and could be expected to top up their inventory, where necessary. They can afford to wait a little longer," Uppal tells Forbes India.

India’s third-largest telecom player Vodafone Idea is in the phase of raise capital. The VI board has already got approval to raise Rs2,075 crore from the Aditya Birla Group, which would bring the authorised capital to Rs1 lakh crore. The company is also finalising plans for a Rs20,000 crore size follow-on public offer (FPO), possibly by next week.

VI, which continues to lose both wireless subscribers and market share (see chart) to Jio and Airtel, in recent years, has a rocky road ahead. IIFL’s Balaji says VI then plans for an additional Rs25,000 crore debt raise from lenders, which would result in a Rs50,000-Rs55,000 crore of fund raising (debt+equity). This would be used for capex, to improve 4G coverage.

Assuming a tariff hike post general elections and another one two to three years down the line, VI hopes that its ARPU could rise materially from Rs145 today. “A lot of these factors have to play out for VI to emerge as a viable third-largest telco," says Balaji. Uppal says VI has an existing 4G network which is fairly competitive. “The challenge for VI is the amount it owes to the government and its assets are not enough to repay the government. So, everyone—except its competitors—stands to lose if the company folds up," Uppal says.

Sunil David, a former AT&T regional director and now co-chair, digital communications working group at IET Future Tech Panel, says the growth of 5G was comparable with that of 4G. It could have been better but “5G handset costs were high in the first half of 2023" and prices fell to sub-20K levels in the second half. “We are still using the same apps, social media platforms… the introduction of a killer app has not happened," David tells Forbes India.

A fresh tariff hike is likely in 2024 and telecom companies are likely to bank more on the growth of fixed wireless access lines and private 5G captive networks. But more meaningful monetisation of 5G needs to be seen for telcos to breathe easier.

Disclaimer: Network18, the publisher of Forbes India, is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

First Published: Apr 11, 2024, 14:46

Subscribe Now