Spot trading volumes at crypto exchanges have been acutely impacted globally. Binance, which is the largest cryptocurrency platform by trading volume, has seen its market share decline to its lowest level in eight months, according to CCData, a platform for digital asset data and indices. The cryptocurrency exchange’s market share has dipped consecutively over the past three months after reaching a yearly high of 57 percent in February this year. Its market share fell to 43 percent in May, while its spot trading volume dropped to $212 billion, recording the lowest monthly volume recorded since November 2020, when it traded $176 billion. In April, the exchange saw $287 billion worth of trading volume.

Founded in 2017 by Changpeng Zhao, Binance has suffered scrutiny from US regulators and has closed its operations in Canada due to regulatory concerns. The global exchange also has a dispute going on with Indian crypto exchange WazirX. Last year, in August, the Enforcement Directorate (ED) raided WazirX"s parent company, Zanmai Labs "for assisting accused instant loan app companies in laundering fraud money via the purchase and transfer of virtual crypto assets".

Immediately after the ED froze WazirX"s funds, Binance CEO Zhao tweeted to clarify that his company doesn’t own any equity in Zanmai Labs and only provides wallet services to WazirX as a technology solution.

The series of these events led to WazirX announcing layoffs in September 2022, firing almost 65 percent of the workforce, as claimed by one of the laid-off employees. "The trading volumes were constantly declining, and the business was not going anywhere. There was hardly any clarity about the future. There was zero communication from the founders. In fact, they were busy building their new startup and raising funds," says an ex-employee of WazirX who was laid off. Nischal Shetty, one of the co-founders, shifted base to Dubai last year in April to focus on a new project.

These are regular effects of the bear market, not just in crypto, but in major industries around the world, explains Rajagopal Menon, vice president of WazirX. "Even Microsoft, Facebook, Google, and other major companies have had significant layoffs in this bear market. Crypto exchanges are no exception. When the tides turn and bull markets approach, team sizes rapidly increase."

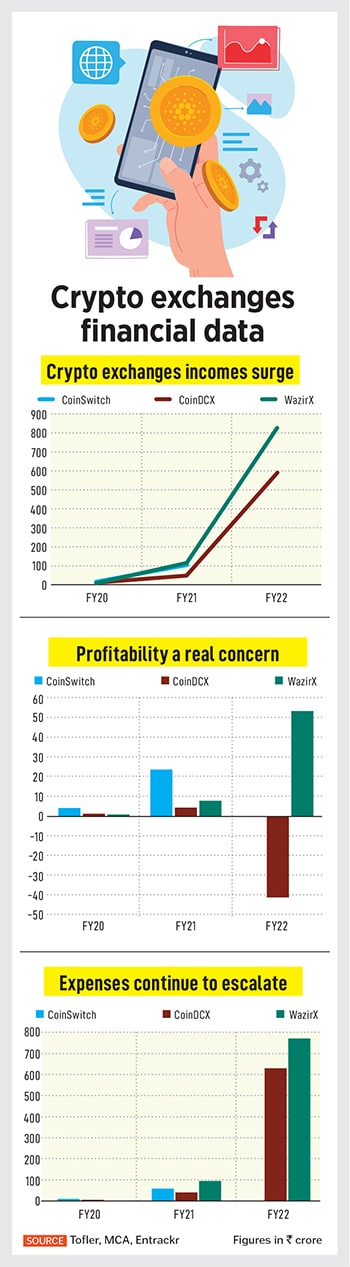

Ever since the government brought crypto and virtual digital assets under the tax ambit last year, Indian crypto exchanges have been badly hit. Trading volumes across Indian cryptocurrency exchanges fell by around 70 percent. Recently, in March, the government brought crypto assets under the purview of the Prevention of Money Laundering Act, 2002 (PMLA). This move is considered a step forward in regulating the industry.

Indian retail investors moved over $3.8 billion (Rs32,000 crore) worth of crypto investments to global exchanges between February and October 2022, according to a study by tech policy think tank Esya Centre. The government announced a 30 percent tax on profits from crypto trading at the Union Budget last year and added a one percent tax deduction at source (TDS) later.

"There is a liquidity crunch on Indian exchanges and usually a one-two percent difference in buying and selling rates. And if one wants to sell something big in value, they will likely get five-six percent less compared to global exchanges because there is a shortage of buyers at the prevailing rate. So you end up selling your coins cheaper," says a 35-year-old retail investor from India who wants to keep their identity anonymous. This investor used to trade on Indian exchanges earlier but gradually moved to international exchanges like Binance, OKX and Bybit because the experience was much smoother and more convenient to use.

On the contrary, Kunal Thakkar, a Mumbai-based third-year engineering student, prefers trading on Indian exchanges over global ones. Rupee-to-dollar conversion and paying conversion fees is a hassle for him, and hence he chooses to trade on Indian exchanges CoinDCX, CoinSwitch, and WazirX. Trading on the Indian exchange is nothing different than the global one, he says. However, when the market is volatile, "all the trading platforms, including WazirX and CoinDCX, disable the withdrawals. So at times there is fear among the users whether they will get their money or not, but in the end everything turns out to be fine," he says.

Finding Alternative Business Models

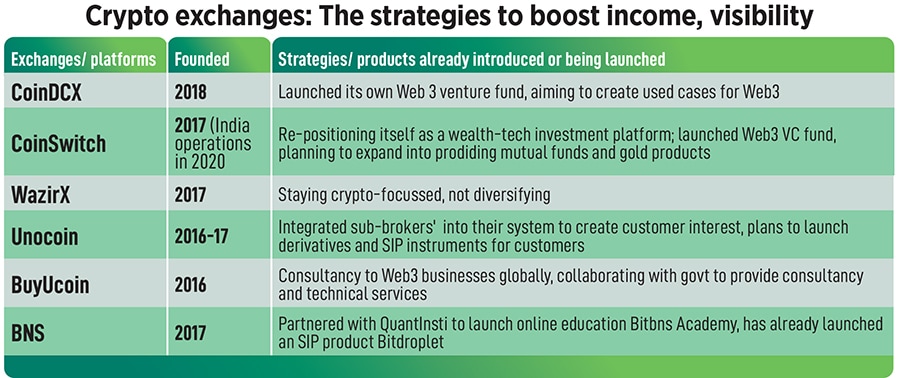

After experiencing so many ups and downs in the sector, some Indian crypto exchanges are tapping into new revenue streams. The businesses are evolving the way they are because in a down market, new user acquisitions become harder, explains Ashish Singhal, CEO of CoinSwitch. The startup is planning to expand into other asset classes like stocks and mutual funds. “This is the right time to diversify because our users" needs are evolving. As the risk appetite changes over time, they [users] will want to branch out—not saying that they will move away from crypto, but instead of going 100 percent in crypto, they will try to diversify into stocks and mutual funds," Singhal says.

CoinSwitch claims to be the largest crypto platform in India and now aims to position itself as a wealth-tech investment platform. Founded in 2017, it has raised over $300 million and currently has a user base of close to 20 million. "We have a healthy runway of about five plus years. We continue to build for our users and solve their problems in the financial industry by making money equal for them," says Singhal.

Its peer, CoinDCX, is now investing and building in Web3 and decentralised finance (DeFi) ecosystems. The startup is investing heavily in innovation and technology to meet the needs of their users. For instance, they recently launched the DeFi wallet Okto, which allows users to swap tokens and earn from vetted decentralised finance services. In 2022, CoinDCX received Series D funding of $135 million.

There has been a significant uptick in India’s consumer interest in crypto, and the same is reflected in the government"s sentiment, explains Mridul Gupta, COO, CoinDCX. "Recent discourse around regulatory developments is encouraging. Including virtual asset service providers (VASPs) under the Prevention of Money Laundering Act (PMLA), as well as the CERT-In and ASCI framework, are all noteworthy positive developments in the space." CoinDCX, the first Indian crypto firm to get unicorn status in 2021, has around 13 million users.

However, bootstrapped crypto exchange BuyUcoin does not plan to diversify and plans to remain focused on crypto. "Within the crypto space, we are going to launch derivatives trading very soon. It is in the pipeline, and we have already tested it with some early users. "We are planning to launch it in the next three months," says Shivam Thakral, CEO, BuyUcoin. The startup has amassed over one million users, out of which 15-20 percent are actively trading on the platform.

Unocoin, India’s oldest exchange – which has been around for nearly a decade – has launched a new programme sub-broker, sign up on platform and bring in their clients. “This is a new programme and we are talking to the sub-brokers, so that they can help onboard customers to buy a newer basket of crypto and non-crypto products," says Unocoin’s Co-founder and CEO Sathvik Vishwanath. “We are in a bearish market. Given that scenario, we may end up launching derivatives for crypto in the 3-4 quarters. It is more about staying healthy, not losing employees, till we see a bullish trend." Unocoin is unlikely to tweak its existing model for at least two years and says it has enough runway in terms of capital till 2025. Unocoin has a team of 55 employees with 2.3 million customers.

“This is the third such cycle we have seen. In the tough times, waiting for a bull run means like waiting for never. But we know this will end too," Vishwanath says. “We have to continue to retain the customers’ trust and build on that."

![]()

New Models: Avoiding or Accelerating Demise?

All of these business models are going to be tested but they could be game-changers for several crypto companies, depending on whether they are being introduced for a survival or a growth strategy. For adequately funded platforms such as CoinDCX and CoinSwitch, the new businesses could well be avenues for growth.

Not all new innovations, however well thought out, are likely to succeed in a risk-averse, bearish phase. The thorny part is that some of these exchanges will not have more time on their hands to rework strategies, if this one fails.

Sometimes, capital constraints aside, small and lean entrepreneur-led exchanges are better positioned than the larger ones to deal with tough situations. “They can grit their teeth and increase their financial runway infinitely in adverse conditions larger organisations with deeper resource brains find it more difficult to reverse some positions," says Ajeet Khurana, crypto advisor and investor, and former CEO, ZebPay.

Did they have options to consider before launching new product lines? Not really. On an average, transaction fees have, representatively, fallen off 99 percent since 2014 to around 0.1 percent today from about 15 percent in 2014. In this scenario, they could not have thought of raising fees and hence chose the path to increase product lines.

“It remains to be tested whether the solution that exchanges have found is going to avert their demise or accelerate their departure. Customer acquisition costs, marketing costs, technology costs all could prove fatal if customers don’t want to adopt the new products and if it does not generate income," says Khurana, also a founder of Reflexical, which enables Web3 startups to accelerate growth. Exchanges might then be forced to either scrap the product or scout for customers outside the crypto base.

Another concern is that most of the exchanges have focussed on the product-end (not the customer), who might have a different strategy or goal on risk-reward. Would a crypto investor be keen to buy mutual funds through the exchange compared to a regular investment plan linked to his/her bank? It is impossible to assess at this stage. The only advantage these exchanges have at this stage is that they are not directly in competition with other wealth investment companies.

![]()

G20: Giving Direction, Not Solutions

The possibility of establishing a global crypto regulatory framework, based on expected recommendations from the Financial Stability Board (FSB), the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), is the most hopeful information available through the ongoing G20 discussions across India.

“The progress on the regulation of crypto assets at a global level is a welcome move that will help boost investor confidence whilst also allowing innovation to progress," says Punit Agarwal, founder of KoinX, a crypto taxation platform for investors.

Dialogues seeking a resolution are always welcome but it is most likely that the G20 talks will be protracted. “The G20 [talks], per se, are unlikely to solve anything, but could give a direction, which is also welcome," Khurana adds.

This week, news has emerged that the central banks of Hong Kong and the United Arab Emirates have joined forces to boost financial cooperation. They have decided to collaborate on cryptocurrency regulations and promotion of financial technology development.

But it is quite likely that with India’s stringent tax requirements, it will have to devise its own specific laws and guidelines.

The one percent tax deducted at source (TDS) deduction on each sale of virtual digital assets continues to impact liquidity for traders, diminishes their trading capital and hurts sentiment. Several have migrated to offshore, non-tax-compliant platforms for their trading activities, says Agarwal. The total TDS collected in India under Section 194S is Rs157.9 crores up to March 20, 2023, the Union Minister of State for Finance, Pankaj Chaudhary, said in response to a question posed in the upper house of Parliament.

The crypto exchanges are in the process of computing twelve months data ending June 30 relating to the Tax Deducted at Source (TDS), to reflect how the 1 percent duty impacted their business. “The data is expected to include how many customers were onboarded in this period, the fall in trading volumes across all exchanges in India and the reclaiming of TDS. This will be compared to the global trends of a year earlier," a crypto industry source says, declining to be named. This will be presented to the Income Tax authorities and then the finance ministry.

Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm, calls the trading scenario in India “dry", due to poor liquidity. “New [Web3] projects which are keeping the vibe in India going are operating from Dubai, Singapore and some European nations. The developers have moved out," he adds.

The longer the delay towards fresh regulations, the more the uncertainty for investors and exchanges. This will also mean that new customers are unlikely to get into such trade and existing customers will continue to minimise current positions.

Going ahead, however, any relaxation in the tax or especially the TDS will significantly enhance crypto traders" and Investors" sentiment, KoinX’s Agarwal says.

Regulators and exchanges will eye recommendations which the FSB is set to release by July on the regulation, supervision and oversight of crypto assets activities and markets. After that, in September, the FSB and the IMF are expected to jointly present a synthesis paper integrating the macroeconomic and regulatory perspectives of crypto assets.

Assuming that there are banking problems that are not deal breakers and the regulatory climate remains suspicious and uneasy but does not worsen, and if the bearish market environment extends for one-two years, Khurana still does not see a “bloodbath" in the crypto ecosystem here.

Much of India’s crypto trading market has already shrunk and has now seen a certain amount of stability. Various remedial actions in terms of introducing new business activities, becoming cost-effective and leaner while retaining customers, have all been carried out during the harshest of crypto winters. The next 12-18 months will determine if all these moves emerge productive for these crypto intermediaries. The global macro-economic recovery could be the game changer.