The present puts into haze the story of India’s only two crypto unicorns—CoinDCX and CoinSwitch Kuber. But just a few years ago, these entrepreneurs had, even while creating the exchanges, muscled their way through adversities as these are new-world, volatile, unregulated, digital assets operating in a complex ecosystem. Not a friendly environment for regulators and policy makers to deal with.

While data on adoption and access to crypto currency differs wildly, India ranked second in the world in Chainalysis’s 2021 global crypto adoption index and sixth in the global decentralised finance (Defi) adoption index. Technology and the lure of quick money got Indians to leap towards crypto trading. After all, investing in stocks could take days to start, involving stringent KYC documentation. But for cryptocurrencies, it could take just a few hours.

All successful corporate and entrepreneurship journeys have their moments of serendipity and events attached to them. Prior to launching CoinSwitch, Ashish Singhal had been participating in several hackathons—most of them Sequoia-led—and was looking to launch his own venture, after working at Amazon and interning at Microsoft. “There was this one critical moment that wasn’t planned. It was how Vimal, our co-founder and COO, joined us in the journey," says Singhal, CEO of CoinSwitch.

In 2017, Singhal had just returned from the US and, with friend Govind Soni, had plans for a new product. This was a global aggregator service to help discover the best crypto prices on a metasearch platform.

![]() Soni and Singhal launched a Facebook page to promote the product, which was spotted by Vimal, who reached out and joined them. “They came across as a very clever, enterprising and energetic team, which was a strong signal for us. Their coin exchange business was always profitable," says Shailesh Lakhani, managing director of Sequoia India. “They got more ambitious with time. If you had suggested in 2018 that they would become as big and successful as they are today, I don’t think they would have believed it, but they kept on pushing themselves to see what they could achieve."

Soni and Singhal launched a Facebook page to promote the product, which was spotted by Vimal, who reached out and joined them. “They came across as a very clever, enterprising and energetic team, which was a strong signal for us. Their coin exchange business was always profitable," says Shailesh Lakhani, managing director of Sequoia India. “They got more ambitious with time. If you had suggested in 2018 that they would become as big and successful as they are today, I don’t think they would have believed it, but they kept on pushing themselves to see what they could achieve."

CoinSwitch could not have an India-centric product after the Reserve Bank of India (RBI) in 2018 banned all regulated banks from facilitating crypto transactions. But the pivot for the company came when, in 2020, the Supreme Court overturned the RBI ban. It gave Singhal and his team the opportunity to create the structure they wanted to, that retail investors would understand and adopt quickly.

In four rounds of funding (including seed), CoinSwitch has raised around $302 million, from investors such as Sequoia Capital, Ribbit Capital, Tiger Global, Coinbase and Silicon Valley venture capital (VC) firm Andreessen Horowitz. The latest funding round closed in October 2021, and valued it at $1.91 billion, making it India’s latest crypto unicorn. Another two unicorns, Polygon and 5ire, are in the Web3 infrastructure and blockchain space respectively.

The 2018 RBI ban had also impacted CoinSwitch’s rival CoinDCX, which went on to become India’s first crypto unicorn in August 2021. The story goes that IIT Bombay alumni Sumit Gupta and Neeraj Khandelwal had a plan to provide cryptocurrency trading for investors through CoinDCX. They company had planned to complete its seed round of funding when the RBI move came, causing potential investors to back out.

It forced Gupta and Khandelwal to bank on their own savings and keep the business running for a few more months. When the ban was overturned, investors such as Polychain and Bain Capital helped raise $3 million in the first round.

This was followed by four more rounds, the latest being a $135 million series D funding this April from Kindred Ventures, Steadview Capital and existing investor Pantera. The crypto trading craze of 2020-21 saw CoinDCX double its valuation in eight months to $2.15 billion this April. Coinbase’s venture arm has invested in both of India’s crypto unicorns. CoinDCX officials declined to participate in this article.

The rush to earn

The overturning of the RBI circular gave a fresh lease of life not just to CoinDCX and CoinSwitch, but also helped other crypto exchanges such as WazirX, ZebPay and Unocoin build their businesses in a more robust manner, as retail investors, particularly millennials embraced crypto, which led to higher trading volumes and boosted revenues.

![]() “When these exchanges were set up, crypto prices were bullish, which helped them acquire customers very fast," says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm. Bitcoin and Ethereum prices were nearing their lifetime highs before CoinSwitch announced its series C funding.

“When these exchanges were set up, crypto prices were bullish, which helped them acquire customers very fast," says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm. Bitcoin and Ethereum prices were nearing their lifetime highs before CoinSwitch announced its series C funding.

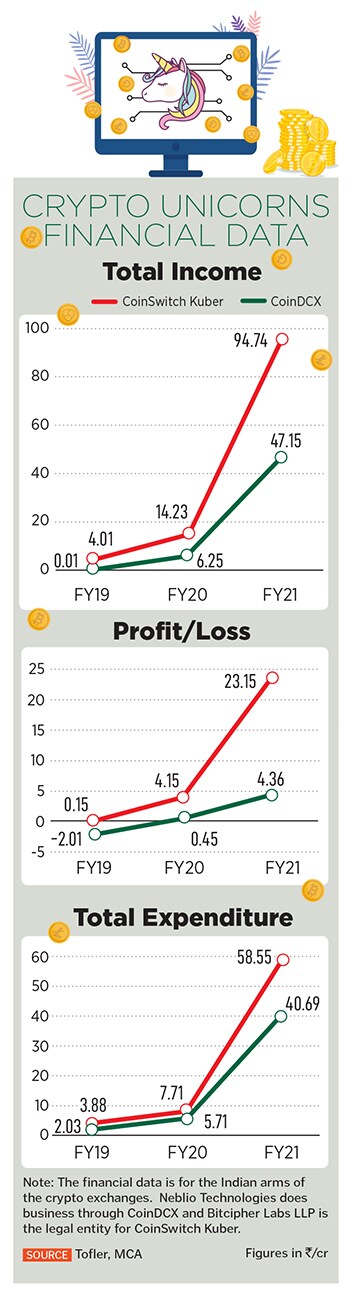

Most of India’s large crypto exchanges saw a boost to their total income and profitability from 2019 onwards—led by a surge in interest and the adoption of crypto trading in India.

Santosh Parashar, an independent researcher and crypto investor awareness and protection activist from the National Institute of Securities Market (NISM), says a social factor has started playing out in India. “The major influence youth has on savings and investment decisions of their risk-averse parents in India is being seen. But they remain at high risk due to the youth’s low digital financial literacy."

Parashar assesses that in a market where a large population of savers is financially illiterate, “any scheme, especially in the name of blockchain for fast-track multiplication works swiftly in India". In 2021, all major crypto exchanges had been advertising their brands aggressively, targeting millennials.

Most of India’s crypto exchanges have a simple formula, where income is generated through brokerage fees, matching buyers and sellers on an exchange’s platform. Investors also pay a flexible withdrawal fee when coins in an exchange wallet are withdrawn to a personal wallet. Exchanges also earn through listing fees, when crypto coins are listed at a particular exchange.

CoinSwitch buys and sells crypto on behalf of users, allowing them to invest and divest through Indian rupees. In return, it charges a trading fee and commission. The exchange, however, does not reinvest users’ crypto in any form or manner, and has zero leverage on them.

This simple and transparent trading method has spelt success for the exchanges. “Crypto is a business that touches money, forex, security and trust. The team at CoinSwitch advocates a safe, calculated and trustworthy approach to crypto investment, and is transparent," Lakhani says.

Costs that hurt

Advertising to urge Indians to invest in volatile, unmonitored digital assets is always fraught with risk. India’s leading financial and daily newspapers often had front-page advertisements splashed with messages of India’s crypto moment, where ‘crores of Indians have invested over ₹6 lakh crore in crypto assets’. But assuming that between 2 and 3 lakh Indians have invested in crypto, and most have small ticket-size portfolios, the math does not add up this could well be an exaggeration.

CoinSwitch ran television advertisements of ‘Kucch toh badlega [something will change]’ with actor Ranveer Singh. Another campaign from the exchange said, ‘Trade kar, befikar [trade, without worry]’. CoinDCX had roped in actor Ayushmann Khurrana, running advertisements saying, ‘Future yahi hai [this is the future]’, while WazirX ran advertisements without celebrities saying, ‘Crypto mein pro [professional in crypto]’. YouTuber and stand-up comedian Tanmay Bhat has also discussed the scope and evolution of crypto in India for his followers.

Parashar says that in order to channelise the surplus savings of users, crypto exchanges apply surrogacy marketing tactics and spread “misleading news" that has nothing to do with reality. “In the recent past, the extremely bullish advertisements of cryptocurrency exchanges were advised to be banned by policy makers," he adds.

The aggressive advertising led to the Advertising Standards Council of India (ASCI) introducing guidelines for the promotion of cryptocurrencies and non-fungible tokens (NFTs). But crypto exchanges carried a massive burden in terms of costs to their profit and loss. With the trading environment towards all asset classes turning risk-averse, most crypto exchanges have, since late 2021, lowered their advertising costs to try and improve profitability, even as trading volumes remain volatile.

Crebaco’s Sogani speaks about the ‘trident effect’ of the current tax structure on crypto trade and services—a 30 percent flat tax and an additional 1 percent TDS for investors an 18 percent GST to be paid by crypto exchanges—and the absence of regulations, which are continuing to impact the Web3 ecosystem in India. “The faster the government introduces regulations and guidelines along with relaxed taxation for cryptocurrencies and their intermediaries, the better it is for the ecosystem, for future investment and innovations in this space," he adds.

CoinSwitch’s Singhal claims crypto adoption has continued “to grow" for retail and institutional investors in 2022, but does not substantiate with any data. He says trading volumes have “readjusted" in a downturn. “But market cycles do not change the long-term potential of crypto. Crypto has introduced to the world a functional model of decentralised finance. Investors understand this. Traditional financial institutions such as Blackrock and Goldman Sachs are increasing their exposure to crypto. Even crypto-focussed funds such as Greyscale are doubling down and looking to bring financial instruments to the traditional investors in the US," Singhal says.

In July, blockchain startup 5ire raised $100 million from UK-based SRAM & MRAM Group at a $1.5 billion valuation. The company, founded by Indian-origin entrepreneurs Pratik Gauri, Prateek Dwivedi and Web3 financer Vilma Mattila, provides smart contract and ESG ranking services. In August, Goa Police announced it had signed an agreement with 5ire to go paperless, by digitalising offline systems, making the process eco-friendly and efficient.

Web3 infrastructure startup Polygon, which is an Ethereum scaling platform, founded by Sandeep Nailwal, Anurag Arjun and Jaynti Kanani, became a unicorn earlier this year, with a valuation of more than $10 billion. It has received investments from American billionaire Mark Cuban, and this year it raised $450 million from Sequoia Capital, SoftBank Vision Fund II, Tiger Global and Elevation Capital, among others.

Caution: Consolidation ahead

Average spot-trading volumes for most crypto exchanges have fallen by between 85 and 95 percent from their 2020 peaks. Income and profitability for FY22 and FY23 is expected to be impacted. CoinSwitch and CoinDCX have started expanding their product lines and services beyond crypto products.

Both exchanges have launched venture arms that will invest in Web3 startups that are innovating in the ecosystem. CoinDCX, on August 28, concluded a three-day hackathon ‘Unfold 2022’, during which it announced the decentralised finance app ‘Okto’—a keyless self-custody wallet—which will allow access to over 100 decentralised apps.

Sequoia’s Lakhani said CoinSwitch’s plan is to launch more crypto products, “including simple products where users earn interest on crypto holdings, besides a mix of real-world assets and traditional finance products".

Sogani says if crypto regulations are not implemented and users do not find confidence in trading on these platforms, trading volumes will suffer and revenue generation will continue to be difficult. “While the smaller exchanges are likely to shutter, the larger ones will find the going difficult. The future of the two crypto unicorns is shaky they will need to rework their business models to survive," he says.

He, however, adds that if regulations come in, institutional money will flow in, which will revive the market quickly. However, large corporates—which have technology, capital and a large customer base—may also enter the crypto ecosystem. Lakhani says he is “optimistic" about the demand for crypto returning, “but it could come back with different narratives and themes".

Singhal expresses concern over the slow progress in establishing a policy framework in India to enable innovations. “Over the last year, several countries, including the US, Australia, Japan, UK, and even UAE, have made rapid progress in establishing a crypto framework. My worry is that if India doesn’t keep pace, we may miss the bus in developing frontier technologies at home," he says.

While the RBI’s stance on crypto is unlikely to alter quickly, the government has sought global collaboration to regulate crypto. The Basel-based Financial Stability Board (SFB), which monitors financial systems and proposes guidelines to prevent crises, is expected, in October, to give its recommendations to the G20 countries on how to regulate crypto. This could create a framework for the government to consider. Whether India will see more crypto unicorns in future years will depend on a range of these factors and the creation of regulated exchanges.

Soni and Singhal launched a Facebook page to promote the product, which was spotted by Vimal, who reached out and joined them. “They came across as a very clever, enterprising and energetic team, which was a strong signal for us. Their coin exchange business was always profitable," says Shailesh Lakhani, managing director of Sequoia India. “They got more ambitious with time. If you had suggested in 2018 that they would become as big and successful as they are today, I don’t think they would have believed it, but they kept on pushing themselves to see what they could achieve."

Soni and Singhal launched a Facebook page to promote the product, which was spotted by Vimal, who reached out and joined them. “They came across as a very clever, enterprising and energetic team, which was a strong signal for us. Their coin exchange business was always profitable," says Shailesh Lakhani, managing director of Sequoia India. “They got more ambitious with time. If you had suggested in 2018 that they would become as big and successful as they are today, I don’t think they would have believed it, but they kept on pushing themselves to see what they could achieve." “When these exchanges were set up, crypto prices were bullish, which helped them acquire customers very fast," says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm. Bitcoin and Ethereum prices were nearing their lifetime highs before CoinSwitch announced its series C funding.

“When these exchanges were set up, crypto prices were bullish, which helped them acquire customers very fast," says Sidharth Sogani, founder and CEO of Crebaco Global, a crypto and blockchain market research and ratings firm. Bitcoin and Ethereum prices were nearing their lifetime highs before CoinSwitch announced its series C funding.