Will raging bulls of IPO survive markets storm

The surge in primary markets in India appears unstoppable as the IPO rush gains fresh momentum

![In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database.

Image: Shutterstock](https://images.forbesindia.com/blog/wp-content/uploads/media/images/2024/Oct/img_239487_ipo.jpg?im=Resize,width=600,aspect=fit,type=normal)

![In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database.

Image: Shutterstock](https://images.forbesindia.com/blog/wp-content/uploads/media/images/2024/Oct/img_239487_ipo.jpg?im=Resize,width=600,aspect=fit,type=normal)

Companies are raising funds through initial public offerings (IPOs) in Indian capital markets at a tearing hurry despite inflationary pressures and monetary tightening. The run to the stock markets by companies for money is no surprise, however, as funds from private equity and venture capitalists are getting squeezed out.

Adding to the overall exuberance for IPOs in India is the super performance of equities with both the benchmark indices, Sensex and Nifty, surging around 18 to 20 percent, while BSE mid and small cap jumped around 34 percent from January. Primary markets activities in India accelerated in the last two months with some of the biggest issues going public, contrasting with the global scenario where there was a mild slowdown.

In the last two months [August and September], 22 companies collectively raised ₹28,135 crore via IPOs, shows a Forbes India analysis based on data provided by Prime Database. Except two [Ceigall India and Western Carriers], shares of all companies that made their stock market debut in the last two months closed at higher returns compared to their respective issue price.

The large issues launched in August and September include Bajaj Housing Finance (₹6,560 crore), Ola Electric Mobility (₹6,146 crore), FirstCry owner Brainbees Solutions (₹4,194 crore), Premier Energies (₹2,830 crore) and PN Gadgil Jewellers (₹1,100 crore). All the companies that launched their IPOs during this period saw an overwhelming response from investors with high subscriptions. The surprise in the pack was Bajaj Housing Finance which received an overall subscription of over 65 times despite being a large-sized IPO. Total bids worth ₹3 lakh crore were placed for Bajaj Housing Finance, the highest ever for any IPO in India.

The enthusiasm of retail investors to opt for new listings in India has been going strong as two issues—in August and September—received over 100 times retail bids. Unicommerce eSolutions (₹277 crore) received retail subscriptions at 136 times, while those for Gala Precision Engineering (₹168 crore) were 102 times.

“Financial markets are undergoing shifts. In the primary equity market, there is a surge of interest in small and medium enterprises’ (SMEs) IPOs, including from domestic mutual funds, with massive oversubscriptions," says Reserve Bank of India (RBI) in its September bulletin.

The central bank says a growing number of listed companies are turning to qualified institutional placements for raising capital, estimated at around ₹60,000 crore in the first eight months of 2024. With intermittent corrections on global cues, benchmark indices in the secondary market have moved up, and the outlook remains bullish.

In the global context, primary markets activities saw a mild slowdown from the beginning of 2024, with market participants adopting a cautious approach in the face of escalating uncertainties, says EY. IPO activity in the Asia-Pacific region picked up over the last quarter, contributing to stabilisation of global IPO figures. Despite a slow IPO quarter overall, the US and India were among the few markets that continued to witness heightened listing activity.

In the global context, primary markets activities saw a mild slowdown from the beginning of 2024, with market participants adopting a cautious approach in the face of escalating uncertainties, says EY. IPO activity in the Asia-Pacific region picked up over the last quarter, contributing to stabilisation of global IPO figures. Despite a slow IPO quarter overall, the US and India were among the few markets that continued to witness heightened listing activity.

India launched more than 100 IPOs in the July to September period, marking its highest level of public offerings in a single quarter over two decades. In terms of the total amount raised, India accounts for 12 percent of total proceeds raised through IPOs from January to date.

“Price-to-earnings (PE) ratios are relatively high in the US, India and the Middle East, making them favoured destinations for IPO candidates and investors. Strong capital markets in key regions such as the US, Europe and India are further bolstering positive sentiment," says EY.

Ahead of the US Federal Reserve’s first major rate cut in late September in more than four years, investors around the world remained cautious, favouring companies with strong fundamentals. They have also grown more prudent in the wake of underwhelming post-IPO returns from several high-profile unicorn debuts in 2023, says EY. This has led some unicorns to pause before going public until market conditions improve.

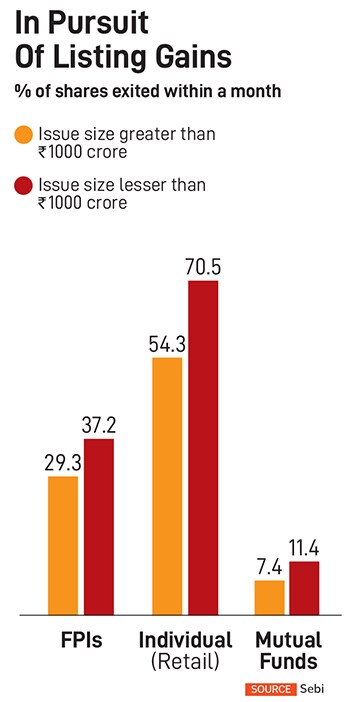

According to market regulator Securities and Exchange Board of India (Sebi), investors in IPOs have a flipping behaviour. It says about 54 percent of IPO shares (in value terms) allotted to investors (excluding anchor investors) were sold within a week from listing, based on a study of 144 main board IPOs listed between April 2021 and December 2023. And 79.8 percent shares allotted to banks were sold within a week. Mutual funds tend to stay invested for a longer time, exiting just about 3.3 percent within a week, and exiting less than a third of the allotted shares after a year.

However, the selling spree by retail investors is severe if returns are higher in any new listings. When returns were high, exits by retail, non-institutional investors (NII) and qualified institutional buyer category investors were higher than their respective averages. Individuals exited 67.6 percent shares within a week, when returns were extremely high and exited just about 23.3 percent, when they were negative.

However, the selling spree by retail investors is severe if returns are higher in any new listings. When returns were high, exits by retail, non-institutional investors (NII) and qualified institutional buyer category investors were higher than their respective averages. Individuals exited 67.6 percent shares within a week, when returns were extremely high and exited just about 23.3 percent, when they were negative.

The study also throws light on a grim reality of greed or listing pops expectations of retail investors. Out of all the shares sold (in value terms) on listing day, individuals sold 54.3 percent followed by corporates (19.9 percent). Banks contributed 15.2 percent to the gross selling on listing day.

The IPOs that gave a gain of more than 20 percent within a week—considered very high return IPOs—witnessed NIIs exiting 79.1 percent of their shares within a week (compared to an average exit of 63.3 percent), says the Sebi study. Similarly, retail investors exited 61.9 percent shares when returns were high (compared to an average exit of 42.7 percent).

Demographically, 70 percent of the IPO investors in the period considered are from the top four states—Gujarat, Maharashtra, Rajasthan and Uttar Pradesh. Retail investors from Gujarat received 39.3 percent of the allotment in the retail category followed by Maharashtra (13.5 percent) and Rajasthan (10.5 percent).

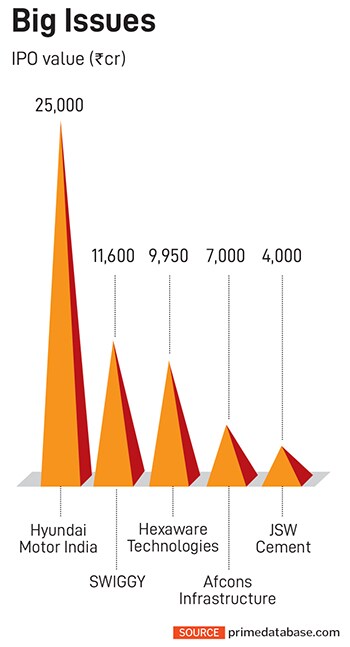

The robust IPO primary market in India is expected to expand manifold with over 26 companies that have received Sebi approval to go public raising a collective sum of ₹71,150 crore. The biggest ever IPO that will hit the Indian markets is Hyundai Motor India which has received Sebi approval in September to raise ₹25,000 crore.

The robust IPO primary market in India is expected to expand manifold with over 26 companies that have received Sebi approval to go public raising a collective sum of ₹71,150 crore. The biggest ever IPO that will hit the Indian markets is Hyundai Motor India which has received Sebi approval in September to raise ₹25,000 crore.

Zomato’s rival Swiggy will also go public soon with its IPO value estimated at ₹11,600 crore. On the last day of September, 15 companies filed offer documents for IPO taking the total number to 41 in the month, the highest ever in India, shows NSE data. Some of the other IPOs waiting in the pipeline are Vishal Megamart (₹8,000 crore), National Securities Depository (₹4,500 crore), Niva Bupa Health Insurance (₹3,000 crore), Hero FinCorp (₹3,668 crore), JSW Cement (₹4,000 crore) and Ather Energy (₹4,500 crore).

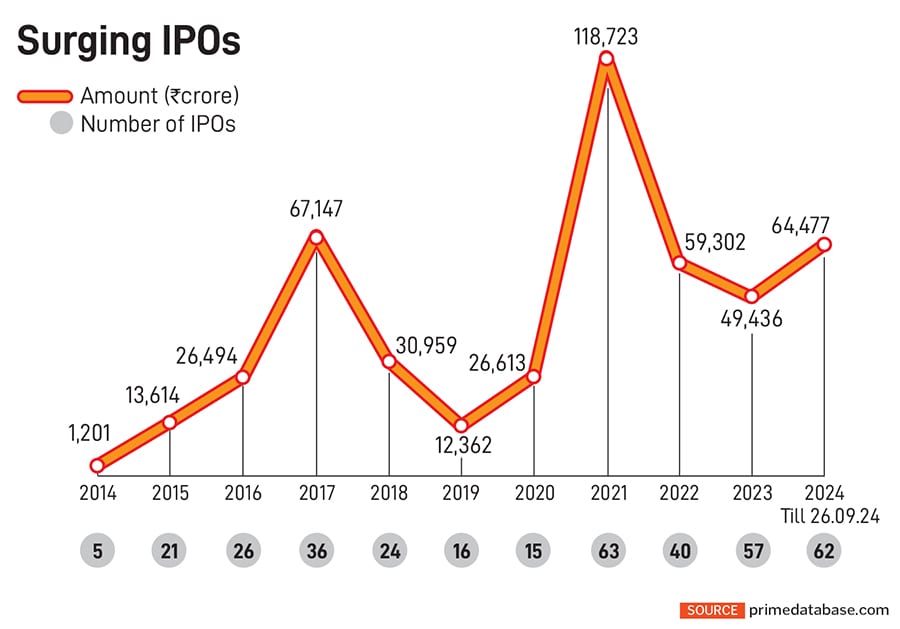

In 2024, so far, 62 companies have raised funds via IPOs worth ₹64,477 crore which is much higher than the ₹49,436 crore funds mobilised through 57 issues in the full year of 2023. It was in 2021 that the highest funds were raised through IPOs. The Covid-hit economy was grappling with slowdown issues then, but stock markets were on a surge. In 2021, 63 companies went public, raising ₹1,18,723 crore through IPOs.

First Published: Oct 08, 2024, 14:05

Subscribe Now