Amit Burman and Rohit Aggarwal Want To Scale Up Their Food Business

Amit Burman and Rohit Aggarwal built a food retail business with 12 brands and multiple formats. They now believe that their company Lite Bite can be scaled up

It’s a busy lunch-hour on the third floor of Ambience Mall, a popular shopping and eating destination in Gurgaon. People are streaming in and are spoiled for choice at the food court, which has at least 15 brands dishing out Indian, Chinese, Lebanese and Italian fare. Next to the food court are restaurants that also include some of the famous names in business. Competition is intense as the staff in the stalls hand out menus to customers walking by. Their counterparts at the restaurants stand at the entrance trying to attract the attention of prospective customers.

Many of these brands run the risk of drowning in the clutter, but Amit Burman and his friend-cum-business partner Rohit Aggarwal are sitting pretty. Food stalls, or quick service restaurants (QSR) and restaurants, or casual and fine dining restaurants (CDR and FDR), run by the duo’s Lite Bite Foods are a dominant force on the third floor of the mall. Of the 15-odd QSR brands in the food court, six come from the Lite Bite stable. And among the 10-odd restaurants, four are owned by Lite Bite.

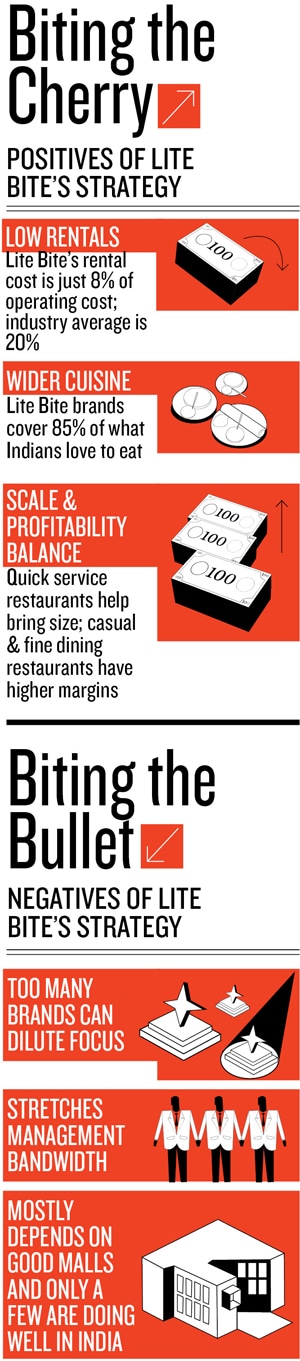

The company’s brands cover 85 percent of what Indians usually eat while dining out, including north Indian, south Indian, Chinese and Italian cuisines. To top it all, the food court is managed by Food Union, another Lite Bite brand, that buys retail space in bulk from mall developers and turns it into a food court with own and other brands like Café Coffee Day.

“We want to make sure that Lite Bite’s menus not only provide a range of food, but also function at varying price points,” says the 41-year-old Burman, who is also the vice chairman of family company Dabur. True to his word, Lite Bite’s QSR brand, Street Foods of India, offers a plate of raajma-chaawal for Rs 70 and at CDR brand Zambhar, a thali is priced at Rs 595.

The varied formats and menus, Burman believes, are important because in the coming days more and more Indians will get out of their houses to eat. “Right now, Indians venture out only four times a month outside their homes to eat. In Singapore, it is more than 40 times!”

There is also a financial side to Burman and his fellow St.Columba's School alumni Aggarwal’s strategy. While rentals in malls can make up to 20 percent of operating costs for food stalls and restaurants, for Lite Bite it is just 8 percent. That is not just because it buys retail space in bulk the company also saves a lot of space in logistics.

“With more than one brand at a single location, we save space by having a common place for receiving and storing our ingredients. Also, while each of the CDRs might have an individual kitchen, they share space for cutting vegetables, preparing sauces and even staff area,” says Aggarwal, who comes from a family that has been trading in textiles for more than three generations. Not surprisingly, at Ambience, three of Lite Bite’s CDR brands—Punjab Grill, Asia 7 and FresCo—are situated next to each other with common backrooms.

Says Raj Singh Gehlot, owner of Ambience Mall: “Right now, there are few organised players that have a mix of small and large format restaurants like Lite Bite. Unless you have good food, it is tough to retain footfalls in a mall.”

The model has helped Burman and Aggarwal to script one of the fastest growing food retail businesses in the country. Within a space of four years, the number of brands in the Lite Bite portfolio has increased from one to 12 and the outlets have shot up from less than five to 62 by April 2012. “Even McDonald’s took more than a decade to reach its first 50,” says Aggarwal.

In the just-concluded financial year, Lite Bite reached a turnover close to Rs 100 crore compared to Rs 79 crore last year. With an EBITDA (earnings before interest, tax, depreciation and amortisation) of close to 20 percent, Lite Bite is performing better than the industry average of 16 percent for QSRs and matches that for CDRS/FDRs.

“Having a mix of short and bigger formats in your portfolio makes sense as you can get both volume and margins,” says Raghav Gupta of consulting firm Booz and Co. QSRs are typically high on volume and low on margins and it’s vice-versa for the bigger formats. “With CDRs and FDRs you can create a Rs 200 crore business, but a QSR-company can top Rs 2,000 crore in annual revenues,” adds Gupta.

Aggressive Plans

However, the Burman-Aggarwal partnership’s real test might just be beginning. The duo’s plan to scale up the business looks aggressive even by their standards. In the next three years, the young company wants to add almost 100 outlets and achieve revenues of Rs 500 crore. In the process, it also wants to make sure it maintains profitability. “While most of the expansion will be driven through malls, we will be present at high streets, airports and metro stations too,” says Rakhi Jain, chief financial officer, Lite Bite Foods.

The company’s present mix has 65 percent of its outlets operating out of malls. That, according to industry experts, could add high doses of risks. “Only about a quarter of malls in India are doing well and this could be a limitation for companies looking to expand through the mall route,” says Saloni Nangia of Technopak.

To pull off the high stakes, Burman and Aggarwal have put in place a professional management that is high on experience in the industry. A successful expansion would put them well placed for a planned initial public offering by 2014.

The only other success story from the industry that is listed on the Bombay Stock Exchange is Jubilant FoodWorks that runs Domino’s Pizza in India. But Domino’s story is of a single brand and of a predictive menu that is easier to scale up. As friend and partner Zorawar Kalra, who till recently ran Punjab Grill and Street Foods of India under a joint venture with Lite Bite, says, “Food business is a tough business and you can lose your shirt… many have!” Interestingly, two lessons from the initial days of Lite Bite will be crucial for both Burman and Aggarwal. Lite Bite has now bought out Kalra’s stake in the joint venture.

The Beginning

Burman and Aggarwal didn’t know each other at St.Columba's School, but met in Delhi’s social circles where both shared common friends, including Ajay Bijli, owner of PVR Cinemas. It was during one of those social outings that the two hit upon the idea to get into retail food business. “It was around early 2002. We had gone to watch a movie with Ajay in Saket, South Delhi,” recounts Aggarwal. Coming out of the theatre, the two saw a newly opened outlet of Subway. Burman was well aware of the brand from his days in the US. “But for me it was new and I was blown away by the quality,” adds Aggarwal. The two made enquiries and within a month they became a franchisee of Subway and opened their first outlet at Rajouri Garden in West Delhi. Lite Bite Foods was born.  But the start was about one struggle after another. It was also a learning process. First, the location of the outlet is of prime importance. Subway’s first store was in a predominantly Punjabi neighbourhood that didn’t warm up to the ‘thanda sandwiches’. The outlet soon closed down and the second one at another West Delhi location didn’t do any better. It was only with the third outlet—a small one at a petrol pump in the diplomat neighbourhood of Chankayapuri that had a huge expat crowd—that Lite Bite tasted its first success.

But the start was about one struggle after another. It was also a learning process. First, the location of the outlet is of prime importance. Subway’s first store was in a predominantly Punjabi neighbourhood that didn’t warm up to the ‘thanda sandwiches’. The outlet soon closed down and the second one at another West Delhi location didn’t do any better. It was only with the third outlet—a small one at a petrol pump in the diplomat neighbourhood of Chankayapuri that had a huge expat crowd—that Lite Bite tasted its first success.

The second learning was about real estate costs. The rent at the first Subway outlet was a steep Rs 2 lakh a month that saw the partners bleeding. “In food retail business, food costs and people costs are fixed. The only variable is real estate and Subway was a lesson for us,” adds Burman.

The Push

The lessons helped the partners when, in 2007, they decided to take a bigger dip in the retail food industry. Burman had set up a new food processing division at Dabur that produced now well-known brands like Real juice and Homemade pastes for cooking. Within a year, he would merge the new unitwith the parent Dabur and was itching for another entrepreneurial foray. Aggarwal’s family business was growing at a steady pace and he was open to “more opportunities.”

Burman noted the trend—the success story of Domino’s and McDonald’s and the increasing tendency of ‘young India’ to eat out. “The big corporate houses were going for major retail ventures. I saw a vacuum in the niche, organised food retail,” says Burman.

Meanwhile, Zoravar Kalra, son of celebrity chef Jiggs Kalra, was looking for money and partners to expand two brands he had created—Street Foods of India and Punjab Grill. Within a month, the two sides formed a joint venture under the Lite Bite umbrella to run the two brands.

The real push came from Ajay Bijli, who had bought out the entire third floor at Ambience Mall from Gehlot. Bijli planned to set up a multiplex in the mall and wanted to bring down the real estate cost by buying space in bulk. He asked Burman to develop the food court next to the theatre. Food Union was created. More partnerships followed, including with Europe’s Eat Out Group that owns Fresc Co.

The Future

Burman and Aggarwal have already taken their brands outside Delhi. Through Punjab Grill’s new outlet in Singapore earlier this year, the first international foray has also been made. The biggest push though is coming in December this year. At least five of its brands are opening nine outlets in two malls in Pune. The planned entry in Bangalore and Chennai is also intended through malls.

Burman admits that “it is one thing to open 10 outlets of a single brand like Pollo Compero in a year and a completely different challenge when you add two outlets each of Punjab Grill and Zambhar and another 10 of Baker Street.” An upcoming central kitchen in Gurgaon will ease the load in Delhi. A similar one in Pune is in the planning stage to take care of the expansion in western India.

Burman reiterates he understands the risk of depending too much on malls. So, he is tweaking his strategy and wants each of his brands to create enough equity for themselves to prosper even outside malls. Punjab Grill, FresCo and Zambhar are already present on high streets as standalone restaurants.

Among the QSR brands, Burman and Aggarwal have consciously tried to rope in well-known brands like Subway and Pollo Campero, which don’t need to be part of a food court to get customers. “We don’t need to have all the brands at a single location. According to the location and customer profile, we can tweak the mix,” says Amit Gupta, assistant vice president planning & operations at Lite Bite Foods.

Burman and Aggarwal would need to perfect this mix as they increase their footprint and compete with the likes of Blue Foods. Burman, a self-proclaimed fitness freak, and Aggarwal, who at 46 is rediscovering his appetite for entrepreneurship, will need all the calories at their disposal to take Lite Bite Foods to a higher level.

First Published: May 08, 2012, 06:54

Subscribe Now