Nine Indian Cities in JLL's latest 'Global 300' rankings

While Mumbai and Delhi have the scale to match their global counterparts, they are under-performing in terms of direct real estate investment

By Forbes India

Jun 03, 2017, 08:47 IST1 min

Commercial Attractiveness Index rank: 155

Economic Size rank: 116

Image by Shutterstock.com

2/4

Commercial Attractiveness Index rank: 90

Economic Size rank: 63

Image by Shutterstock.com

Advertisement

Advertisement

3/4

Commercial Attractiveness Index rank: 153

Economic Size rank: 92

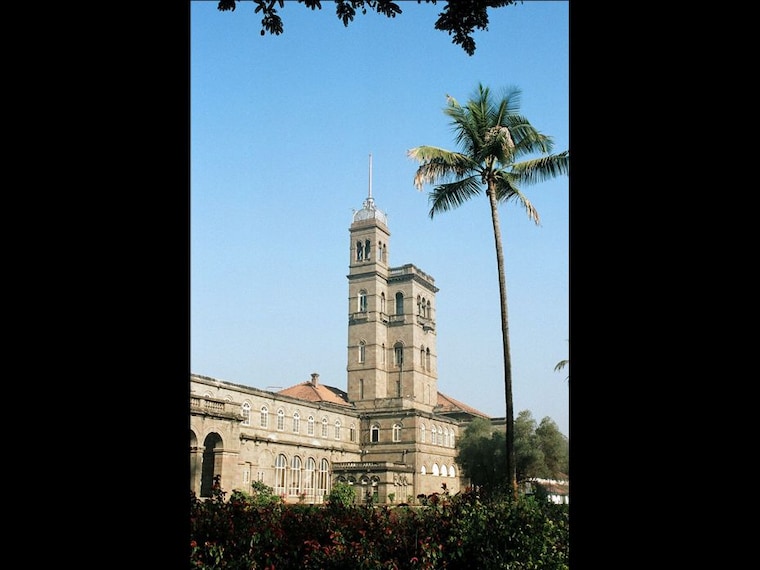

Image by Shutterstock.com

4/4

Commercial Attractiveness Index rank: 289

Economic Size rank: 111

A number of key policy-level changes taken by the Indian government in recent times such as RERA, REITs, simplification of taxation, easing of FDI restrictions, are expected to be beneficial. Along with completion of new high-quality stock by commercial developers, which will increase the amount of investable assets across India, these developments are encouraging increased interest from international investors of the likes of Blackstone, GIC and Brookfield.

Image by Amit Dave / Reuters (for illustrative purposes only)

Advertisement

Advertisement

Photogallery

- Home /

- Photogallery /

- Slideshow /

- Nine-indian-cities-in-jlls-latest-global-300-rankings

Latest News

Advertisement

Advertisement