JSW's paint play gets premium boost with AkzoNobel acquisition

JSW's acquisition of AkzoNobel's India business gives it a chance at the number three, and possibly number two, spot

Six years after it entered the paints business, the JSW group has staked its claim as a player to be counted. A deal to acquire AkzoNobel’s India operations catapults it to the fourth largest, with a good chance at vying for the number three spot.

JSW’s acquisition comes at a rough time for the industry. After a steady growth run for a decade-and-a-half when paint volumes on the decorative side grew by 10 to 12 percent a year, the year ended this March saw a market that barely grew. As a result, revenues, margins and profitability slid for the top three—Asian Paints, Berger Paints and Kansai Nerolac.

At the same, competition in the sector had intensified, with the entry of the Aditya Birla Group through its Birla Opus brand. With a total investment of ₹9,352 across five plants in India, the brand has quickly scaled up to being the number two player in the decorative space by capacity. Its products are priced 5 percent lower than competitors.

On the other hand, JSW Paints had been plodding along in the market since 2019 with a ₹2,000 crore top line in the year ended March. While the business had a presence across 9,000 dealerships in tier 3 and 4 markets, it lacked a strong brand. Organic expansion could only take it so far. Parth Jindal, managing director of JSW Paints, was hungry to scale fast.

That opportunity would come last August when AkzoNobel decided to undertake a review of its global operations and divest the India business. Despite competing bids, AkzoNobel chose the JSW Group. “Parth has a clear vision and a clear governance structure that allows him to move quickly," said Greg Poux-Guillaume, AkzoNobel CEO and Chairman of the Board of Management, at a joint press conference announcing the sale.

That clear vision resulted in a ₹8,986 crore deal that would bring AkzoNobel’s decorative and industrial paints business to the JSW Group. Akzo retains ownership of its powder business as well as the R&D centre. It brings in intellectual property that the combined JSW paints business can use. Once competition commission approvals are in place, JSW plans to make an open offer for the 26 percent of AkzoNobel that it doesn’t own and later reverse merge the JSW paints business into a possibly rechristened AkzoNobel.

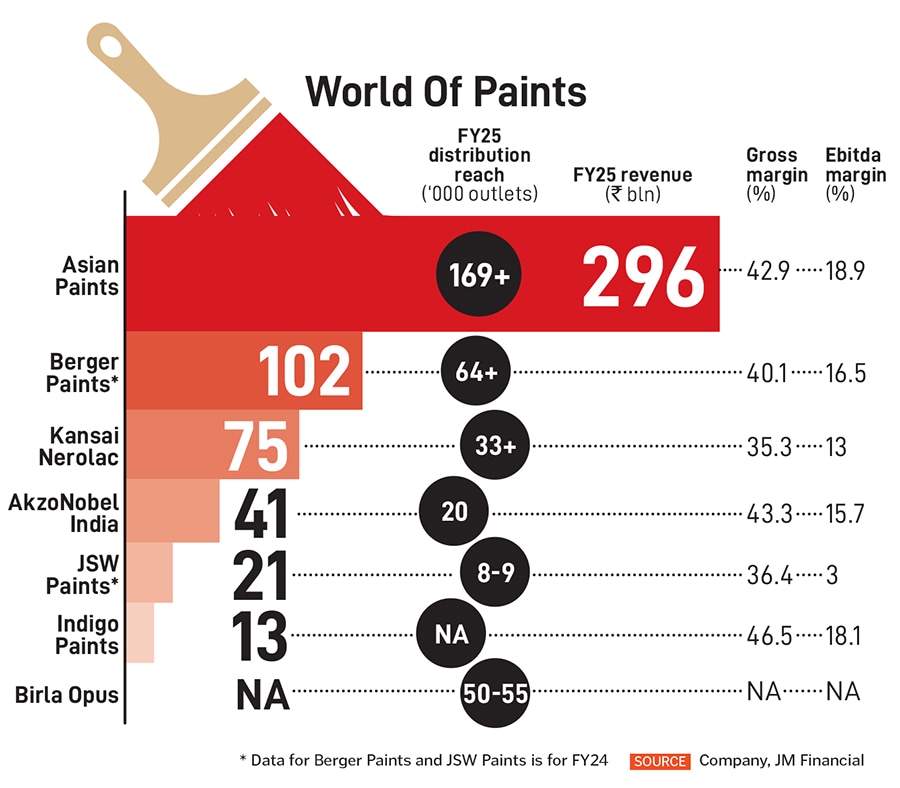

Post merger, how do the top paint companies stack up in terms of revenue. Market leader Asian Paints has a topline of ₹30,000 crore, Berger comes in second with ₹11,000 crore, Kansai Nerolac third with ₹7,000 crore and the Akzo-JSW combine fourth with ₹6,000 crore. Jindal believes the initial scaling up can happen quickly.

“We are already the number two player in the industrial space, and JSW could leverage our technical knowhow and their B2B relationships," said Poux-Guillaume.

But challenging the incumbents to the top two spots will likely be harder than it looks. For one, the industry has spent heavily on advertising in the last year and for a smaller player to match those spends will be hard. AkzoNobel has agreed to relinquish the 3.5 percent royalty charged and the combine should have ₹350 crore to spend on advertising and promotions. Jindal is willing to spend an additional ₹100 crore over the next two to three years to gain market share.

The combine’s main benefit will be the acquisition of the Dulux brand that has a 65 to 70 percent share in the premium decorative paints segment. Scaling that up as well as reenergising the brand will be key. Jindal was silent on how he plans to do that except to say that he plans to stick with the brand.

Also, distribution will be key. As of now, AkzoNobel has a strong presence in tier 1 and 2 cities, spread across 9,000 dealers. Its paints are premium products. JSW Paints that caters to the mass market is present in tier 3 and 4 towns, spread across 19,000 dealers. Jindal estimates that there is at best a 10 percent overlap between their dealers.

Lastly, there’s direct distribution—a key determinant of success in the paints industry. Dealers prefer companies that are able to supply to them daily or multiple times a day. This results in less inventory carrying costs and works well in areas where stores are small. Working with painters is another key area where synergies could be tapped.

“We expect the merged entity to be aggressive [and] to significantly ramp up distribution across the country, especially in tier 3 and 4 towns, and strengthen direct distribution in tier 1 and 2 markets," wrote analysts from Kotak Institutional Equity. The brokerage believes that the combined entity could touch ₹10,000 crore sales in FY29, if executed well. They estimate that about 62 percent of this will come from decorative paints and 38 percent from industrial coating.

For Jindal, the first step is getting to the number three spot. He’s got that as a near-term target. Post that, he plans to capitalise on the superior technology that AkzoNobel has to offer and their B2B relationships to get the industrial business firing.

As the paints industry prepares for its next phase of consolidation and innovation, all eyes will be on how JSW navigates brand repositioning, distribution challenges and category growth. Whether Jindal can paint a new picture for Dulux—and JSW—will depend on execution, speed and staying ahead in a game where colour, quite literally, meets commerce.

First Published: Jul 11, 2025, 10:46

Subscribe Now