Should you opt for the new Income Tax regime?

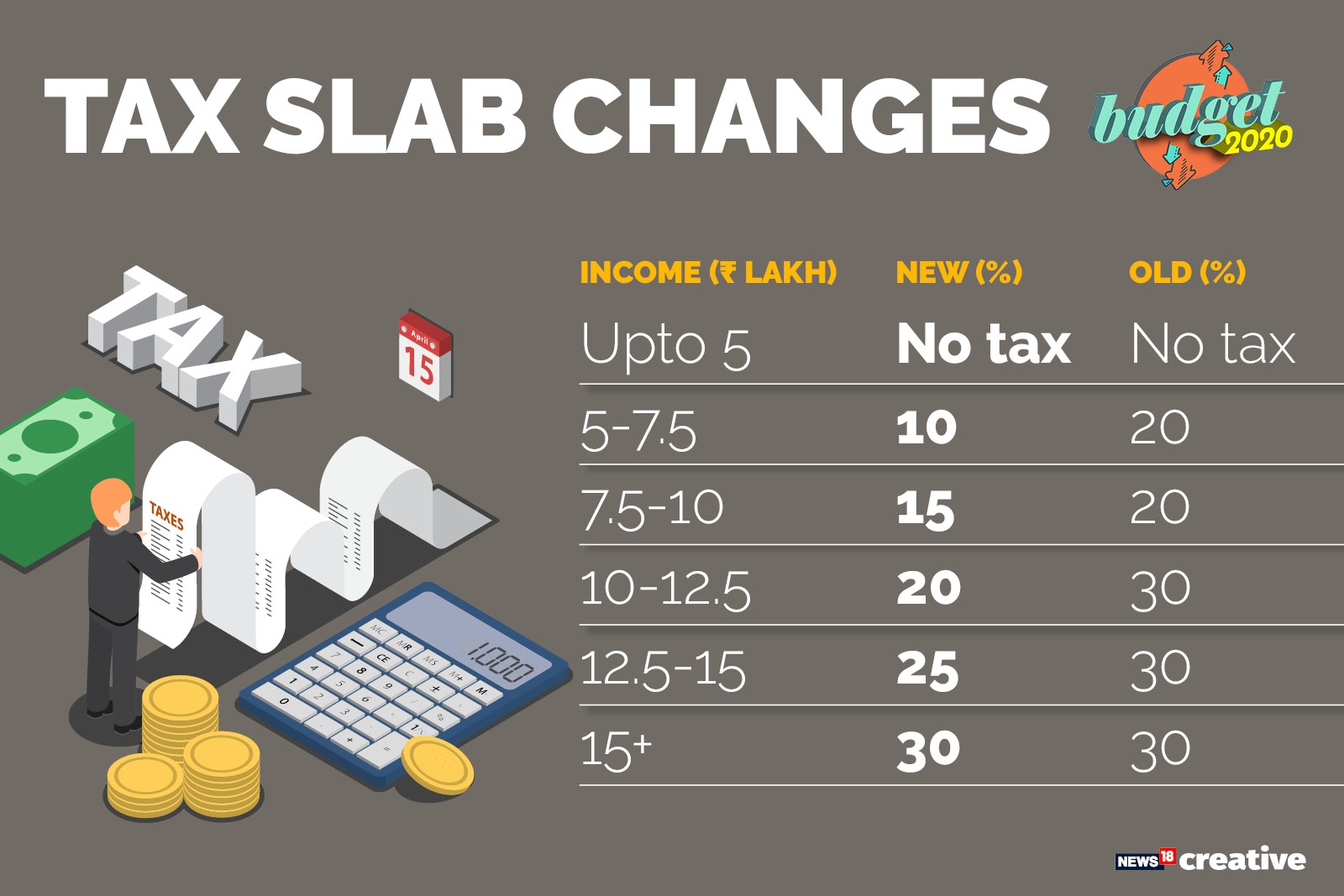

A tax planning expert decodes the 'optional' tax brackets that Nirmala Sitharaman introduced in her Budget 2020 speech, and whether you should forego exemptions for it

Image: ShutterstockPeople opting for the new tax regime will have to forego some of the most popular tax benefits as those available under chapter VI-A—Section 80C (PF, PPF NPS, Mutual funds ELSS or Life insurance premium) Section 80D (Health insurance premium) the interest you pay on your home loan and the deductions for the donations made under section 80G. Similarly, tax benefits for the allowances like LTA, HRA and standard deductions will also not be available.

Image: ShutterstockPeople opting for the new tax regime will have to forego some of the most popular tax benefits as those available under chapter VI-A—Section 80C (PF, PPF NPS, Mutual funds ELSS or Life insurance premium) Section 80D (Health insurance premium) the interest you pay on your home loan and the deductions for the donations made under section 80G. Similarly, tax benefits for the allowances like LTA, HRA and standard deductions will also not be available.

Now, it will be interesting to see how the new tax slabs will benefit tax payers. This will require them to do a thorough calculation basis their income and overall investments that offer tax benefits. Every individual will have to work out his or her own tax working and figure out what will help them more, the old tax regime or the new one.

Let me give you an example: A taxpayer who doesn’t have a home loan and thereby not paying any interest and principal, and also does not want to invest under section 80C, may stand to gain by opting to pay under the new tax regime. Now, many people would be having home loans and existing investments, which qualifies for section 80C deductions. That is why each individual needs to do their own calculations to select a tax regime that helps them save. The promise of making taxpayers’ lives easy may not hold true because of the introduction of a new tax regime, which will confuse the tax payers and also put the onus on them to work out the best plan. In fact, this goes against the basic idea that the Finance Minister said in her speech, about wanting to reduce the taxpayers’ dependence on tax professionals to manage their own personal tax.

The promise of making taxpayers’ lives easy may not hold true because of the introduction of a new tax regime, which will confuse the tax payers and also put the onus on them to work out the best plan. In fact, this goes against the basic idea that the Finance Minister said in her speech, about wanting to reduce the taxpayers’ dependence on tax professionals to manage their own personal tax.

Here’s a look at some of the other changes announced:

Dividend to be taxed in the hands of individual taxpayer: Now, every dividend income will become taxable in the hands of a taxpayer so be it mutual funds or stocks, the same will be taxable basis the applicable tax slabs. It remains to be seen that how this will affect overall tax liability, considering the other tax benefits as announced in the Budget.

Measures to stop Tax Harassment: A new tax charter will be introduced to reduce tax harassment, apart from amending the I-T Act to allow faceless appeals.

Introduction of ‘Vivad se Vishwas’ scheme: This scheme will allow a taxpayer to pay the disputed tax only and save on any interest and penalty, if paid on or before March 31, 2020. The scheme will further remain open till June 30, along with a fine.

Aadhaar-based verification: Now, the allotment of PAN will be done instantly on the basis of Aadhaar.

Deferment of Taxability on ESOPs: ESOPs form a substantial part of employee income, especially those who are working with startups. At present, this is taxable the same tax liability is deferred by five years or till the employee leaves his or her company or sell their stock options, whichever is earlier. This will help these employees manage their cash flow in a much better way.

The author is a Chartered Accountant and founder and Chief Gardener of Money Plant Consultancy, a tax and investment advisory firm.

First Published: Feb 03, 2020, 12:48

Subscribe Now