Shock and Audi

In just five years Audi has become the second largest luxury car maker in India thanks to Michael Perschke's strategy: Focus on class defining leaders

Coming out of a meeting with Michael Perschke, it’s near impossible to think of him as anything but a cowboy who spouts wisdom from the American Wild West, of the kind Will Rogers, that cowboy and comedian from the 1920s, would. It is easy to imagine Perschke saying what Rogers had said: “There are three kinds of men: The ones that learn by reading the few who learn by observation the rest of them have to pee on the electric fence.”

Extrapolate his native wit and wisdom to the Indian luxury car space and this much is clear—there’s a gunfight on with three gun slingers at the bar. The BMW, or Bimmer as aficionados like to call it the iconic Mercedes that generations of Indians have grown up with and the newest entrant on the block, Audi. Michael Perschke heads Audi’s India operations.

It was inevitable therefore that I’d ask him what he thought about competition. A few weeks ago, at a press conference, Peter Honegg, MD and CEO of Mercedes-Benz India, said he doesn’t want to be in the numbers game. “Sorry, that’s bullshit!” Perschke told me in a matter-of-fact, gun slinger tone. “Everybody is here for the numbers because there are only four places left in the world to fight it out—China, Russia, India and Brazil. Every place else, the turf’s been taken. So if you’re not here for the numbers today, tomorrow you’re out.”

To rub it in, he added, what Mercedes is really saying is that they’ve been beaten. That they’re couching facts and trying to put it as politely as they can. It’s difficult to argue with Perschke because he’s got the numbers to prove it.

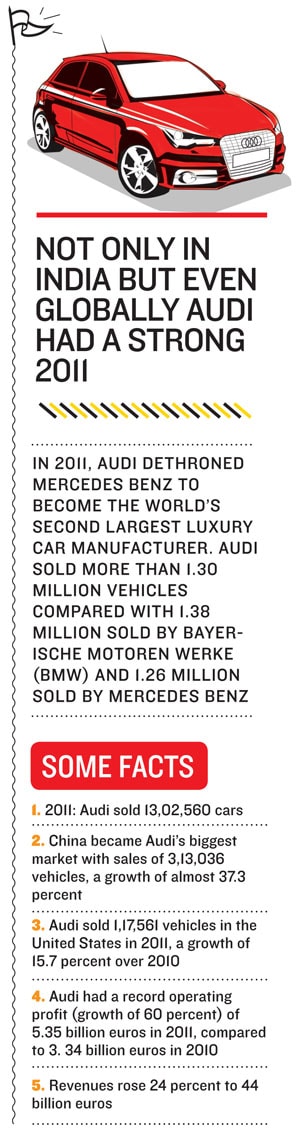

During the first three months of this year, Audi sold 2,269 cars while Mercedes sold 2,130. That makes Audi the second largest luxury car maker in the country after BMW. To put things into perspective though, BMW’s ahead of Audi by just 100 units. Pause for a moment now and take these numbers in.

l Through all of 2008, Audi just about managed to sell 790 cars.

l BMW managed to sell 2,900-odd and Mercedes a little over 2,400.

They tell you a couple of things.

l In four years, the market for luxury cars in the country had quadrupled.

l If this were a shootout, Audi is the cowboy that’s come out of nowhere, and Perschke doesn’t want to be the one who gets to pee on the electric fence. “I want to be Number One,” he says.

Call it arrogance, call it gumption on his part. But after listening to him, I’m tempted to think of him as the kind of man who’s learnt by observation. “I asked what does it take to get to be Number One? What will it take each department in the company and each dealer to get us there? The key lies in synchronising everyone. So first, you got to orchestrate that vision and take it down the entire value chain…each person in the organisation ought to know, what will be their contribution,” he says.

For 20 years, Mercedes was the undisputed king. Then BMW came in and attempted to wean the younger generation who had money on their hands. BMW got its toehold into the country by using a bottom up strategy and introducing its entry-level cars. These were readily embraced by the younger buyers. This gave BMW the confidence to launch more expensive variants and over time, the strategy allowed it to displace Mercedes as the most favoured luxury car in India.

So, five years ago, when Audi started to look at India, it had a dilemma on its hands: Mercedes had the top-end and older generation to itself. BMW was all over the place with the younger generation on its side. Where does Audi fit into the scheme of things? So Benoit Tiers, who was then Audi’s India CEO, thought up a strategy. No point competing with the big boys and stand the risk of getting lost in the crowd. So he ruled out plush sedans and looked for a niche. “We told ourselves that because many Indians don’t know Audi, we need to make a statement. And to make a statement, we need to be at the absolute top of the pyramid,” recalls Perschke.

The outcome of this thinking was the launch of the Audi Q7, a luxury sports utility vehicle (SUV). Neither BMW nor Mercedes offered anything like it in India. It got Audi the intended results in terms of brand building. One of its first buyers was actor John Abraham who latched on to it even before the model was launched. “He enquired even before we came to India,” says Perschke. He calls it the “Halo Model” around which a brand’s identity is built. Audi was content keeping it that way for a few years. In that sense, the company got lucky because celebrities wanted to be seen with the car.Over time though, Audi reasoned internally it needed to ramp up volumes in India as well. To do that, the company would need somebody who knew India well and had relationships in place to ramp up the dealer network. That’s when it zeroed in on Perschke, a former Mercedes hand.

Tiers was asked to head Audi’s operations in France and Perschke, with three years of India-experience on hand, was hired with a new mandate: Change Audi’s profile from that of a niche SUV to that of a luxury car manufacturer.

Once on board, he thought it pointless selling to the masses. Some research later, he zeroed in on the A8, a luxury sedan in Audi’s portfolio, and decided to focus on people he calls “class defining leaders”. But to do that, he figured he’d have to go back to becoming a car salesman once again—and an unconventional one at that. Because to get the people he’d defined as his core customers, he’d have to go to where they’d be. He figured the World Economic Forum at Davos would be a good place to start. Most companies know that. So they send their top sales team there.

But Perschke argued that as CEO, he’d wield a greater impact. The people he wanted to get to wouldn’t engage with his sales team. They’d engage only with people who were at par with them and who talked their language. Over the years, he had cultivated a deep network of relationships and was on first name terms with pretty much everybody who mattered in the country. And so at Davos, he started to make his pitches.

“Everybody whom you know comes by and you say hello to them. So there’s a lot of personal rapport involved in this. It’s not something money can buy. I don’t sell them a car. I reach out to them, listen and understand how to position the brand in a way they can personally associate with.”

“Baba Kalyani used to drive the Mercedes S class for 20 years. He now drives the A8. Adi Godrej is a customer. Narendra Pawar of NIIT, Malvinder Singh from Fortis, Pawan Munjal, Rahul Bajaj, Rajiv Bajaj, Sanjiv Bajaj, Abhishek Bachchan, Ranbir Kapoor…they’re all my customers today,” he rattles away.

It helped that Audi is a strategic partner at Davos and every VIP who goes there is taken around in one of its cars. “A lot of these people take a few minutes out of their busy schedule and do the Audi ice driving experience. This year alone we used the experience to convince eight-nine key people to buy an Audi. Jyotiraditya Scindia was one of them. I personally did the test drive with him in Davos,” he says.

Why he does that is clear. If Pawan Munjal, who heads India’s largest two-wheeler manufacturing company, buys an A8, it sends out a strong message to others at the top of the pyramid. If Scindia buys an A8, it translates into 100-150 potential buyers for the brand, Perschke reasons.

Not just that, Perschke goes out of his way to maintain personal relationships with all of these people even after the sale is done.

“You cannot reach that same level of traction if you go bottom up. Then you get stuck somewhere with the upper middle management. Imagine if Kushal Pal Singh who heads DLF drives around in an Audi, it makes everybody at DLF want to be seen in one as well because everybody wants to be seen with something the boss has. So I don’t waste my time at the bottom,” he adds.

But big guys don’t bring volumes, so how do you get the numbers? I ask him. His answer is a fairly routine one. “Volumes come from strong dealer networks.” But how he goes about it isn’t routine. “I look for some values when scouting for potential dealers. The first question I ask is, is he hungry enough to want to be Number One? We don’t want kids with golden spoons we don’t want portfolio investors we don’t want people who just want to add Audi as a stamp in their collection.” With that mandate clear, his team goes around the country looking for local entrepreneurs who enjoy patronage in their social circles.In Coimbatore for instance, Audi partnered with CR Anandakrishnan, the son of KP Ramasamy who founded the KPR Group, a company with interests in textiles, yarn and textile processing.

That was because he reasoned Anandakrishnan’s profile fitted the kind of personality he thought would sit well with Audi. Everybody in Coimbatore respects his family he is easily among the 50-100 most influential people there and he runs a medium-sized family business.

With somebody like that on Audi’s side, the scales could be tilted in its favour.

Gaurav Anand, Audi’s dealer in Indore, is another classic case in point. His family runs a chain in the city, called Punjab Jewellers. Because Anand met all of Audi and Perschke’s requirements, he was roped in as a dealer late last year. Perschke reckoned it was a 10-car market on the outside. In six months though, Anand’s dealership sold 100 cars, confounding all of Perschke’s expectations. For a city the size of Indore, that’s a pretty damn big number.

At the heart of Anand’s success in Indore is his entrepreneurial style. “I don’t push people to buy a car,” says Anand. “Instead, I ask people who have the money whether or not they deserve luxury,” he explains. It’s a provocative question to ask in a small city dominated by family-run businesses where it is the older generation that still gets to sign on the cheque.

This, in spite of the fact that they’ve handed the baton over to their children. For a generation that built their business in a controlled economy, buying a car that costs upwards of Rs 50 lakh is an indulgence and violates their sensibilities.

So, Anand goes about telling them that spending this kind of money on a car isn’t a vulgar flaunt, but a celebration of the success they’ve earned the hard way. When put like this, they sign on the dotted line. And it helps that Anand is one of their own.

For Perschke, these are the kind of entrepreneurs and dealers who know the potential of Tier II cities like Coimbatore and Indore. Sources say Audi has dealers in cities like these with sales targets of a 100 cars each for 2012. In Tier I cities like Mumbai and Delhi, the target is a stiffer 1,000 cars. The numbers are achievable he says because he sincerely believes in selling using “local heroes”.

The downside? It’s a one man show right now at Audi. And a lot rests on Perschke’s personal charisma. “He firmly believes in the power of the brand and everything he does has something to do with work. Right from the people he hangs out with to selecting dealers and interacting with customers, he is involved in everything,” says a former Audi executive who did not want to be named.

It’s the kind of drive that’s gotten him within striking distance of being Number One. “As an athlete going to the London Olympics, you can look at it in two ways. You can say I am happy I got a ticket to go there. Or you could say there is only one purpose. I want to get gold.” He wants gold for Audi. But whether the momentum will outlast his cowboy style remains to be seen. Because fact is, his plain speak and aggressive ways have gotten him into trouble in the past.

For instance, there was this once when in an interview with Mint, a business newspaper, he went on the record saying that at Audi’s India office, horns are treated as a category because Indians honk too much. It was a public relations disaster and his team had to work hard at cleaning up the mess it left behind. Disasters like these bother him terribly because he knows it’s bad for the brand.

But as cowboys like to say, “If you think bull riding isn’t intense, come sit on his back and try on my saddle. This a’int for tenderfoots.”

First Published: Jun 12, 2012, 06:22

Subscribe Now