The huge investment opportunity in Edtech

Particularly in India, education has been a segment steeped in a traditional brick-and-mortar delivery mechanism. The industry is different from food tech or fintech, but the big similarity is in its

From left: Krishna Kumar, founder and chief executive, Simplilearn Vamsi Krishna, chief executive, Vedantu Tanushree Nagori, co-founder, DoubtNut

From left: Krishna Kumar, founder and chief executive, Simplilearn Vamsi Krishna, chief executive, Vedantu Tanushree Nagori, co-founder, DoubtNut

Image: Nishant Ratnakar for Forbes India[br]

The leap of faith ended in a bruising pratfall, compelling Krishna Kumar to wonder if he had dreamt too big, too soon. After all, a bet on the future had his business creaking and revenue shrank from ₹8 crore to ₹2 crore, virtually overnight.

Kumar had anticipated a bumpy ride, but not a crash of this magnitude. On paper, it looked like the perfect plan.

All that Kumar and the top deck at Simplilearn had in mind was to completely move their offerings online. Until then, Simplilearn did brisk business by offering professional courses through a mix of online videos and classroom coaching at 100 cities across India, the US, Europe, Middle East and Africa. Investors like Kalaari Capital, Mayfield and Helion Venture Partners were equally ebullient, having infused roughly $28 million into the venture.

While all looked rosy on the surface, Kumar, a second-time entrepreneur—he had earlier sold TechUnified to ORG Informatics for $12 million—wasn’t exactly at ease with certain undercurrents. One, he was convinced that it was about time for Simplilearn to ride the internet wave. Second, offline classrooms had their drawbacks.

In a bid to expand rapidly, Simplilearn had junked its initial hypothesis of conducting classes with at least 10 students, a model that made the firm money after payouts to instructors and for the venue. It eventually started holding classes with even three students, which covered the expenses, but barely added anything to the bottomline.

“Our sales team tried to sell classrooms first because that was the highest ticket size and their targets were met. Ideally, you should be selling what is good for a student’s learning style,” says Kumar, founder and chief executive at Simplilearn. “Also, when freelance trainers run your classes, you are paying them to represent you in the class. But many trainers felt that they were bigger than the brand. They thought they are making only a part of the money that the company was charging and completely discounted the customer acquisition cost. Consequently, in the class, they would de-sell.”

By August 2015, Kumar had decided that his highest grosser, the classroom sessions, will have to go. Not everybody shared his conviction.

“Frankly, the board was divided,” recalls Kumar. “It was a pretty tough time for us for the next 6-8 months because our costs just didn’t go away.”

Around the same time, about 2,500 km north of Simplilearn’s Bengalaru headquarters, in Patiala, Vamsi Krishna was striving to justify his enthusiasm around online education. In 2006, Krishna, along with Pulkit Jain, Anand Prakash and Saurabh Saxena, had founded a tutorial chain called Lakshya Institute in Barnala, Punjab, with 36 students, 10 of whom cracked the Indian Institutes of Technology entrance the next year. By 2012, Lakshya was a 200-member organisation that catered to about 4,000 students, and a profitable business on an annual turnover of ₹17 crore.

The quartet wasn’t exactly euphoric at the outcome. A lot more lives had to be impacted, they thought. And the offline model wouldn’t quite help their cause. “We had realised the limitation of scaling an offline business,” says Krishna. “There were a lot of challenges. How do you get the best of the teachers? The teachers, pedagogy and content were the secret sauce. We knew how to orchestrate this to suit the level of a child. When you do that in one location it’s fine, but, when you do that in multiple locations, you have operational issues.”

Through some initial attempts at digitising the Lakshya classrooms, the founders were convinced that dabbling in both models wasn’t efficacious. They had to pick sides, and they sided with online. Lakshya was sold to MT Educare for $5 million in early 2013. After a lock-in of about two years, the quartet at Lakshya founded Vedantu, an online tutorial startup. The idea was to replicate the Lakshya model online.

But it was easier said than done. “2016 and 2017 were tough times. We were simply not scaling. It was tough to manage expectations,” says Krishna, the chief executive at Vedantu.

For Simplilearn, Vedantu and ilk, their biggest gift, the internet, looked like their biggest burden.

*****

The growth pangs endured by Simplilearn and Vedantu perhaps had more to do with the state of affairs in India than the businesses themselves. To be sure, neither Krishna nor Kumar were harbingers of digitising education in India.

The first wave was led by Educomp, Everonn Education and Core Education among others, businesses that focussed on digitising classrooms. The likes of Educomp and Everonn, both publicly traded at one juncture, soared great heights. At their peak in FY12, Educomp clocked ₹1,076 crore in annual revenue while Everonn romped home with ₹304 crore—before biting the dust.

Ebix bought Educomp in a fire sale while Everonn has been liquidated. Core Education, which posted profits of ₹158 crore on revenues of ₹1,123 crore in FY13, stopped trading on the bourses two years later.

Education software providers such as Saba, Blackboard and Degrade among others have, however, done brisk business in India. In effect, the first lot of digital education companies that operated in India targeted institutions than consumers directly.The reason isn’t far too seek. Circa 2010, it was still early days for the internet in India—sparsely available and expensive. According to industry estimates, India 10 years ago was home to roughly 10-15 million smartphone users and about 90-100 million internet users. Ecommerce was just beginning to take off with Flipkart metamorphosing from an online bookstore to a horizontal marketplace, having raised $10 million from Tiger Global Management and Accel Partners the year before. Moreover, online transaction was far from the norm. Consequently, seeking out consumers online for educational products would be akin to searching for a pin in a haystack.

Amit Bansal, chief executive at Wizklub, a cognitive learning startup for K12 students, knows a thing or two about those days. Bansal had co-founded PurpleLeap, a company that skilled technical talent, in 2006, long before the internet economy swept Indian shores.

“In 2006, when we did PurpleLeap through synchronous sessions in colleges, we had to set up a private network for bandwidth. We bought bandwidth from Insat-1C (Insat series of satellites were built by Ford Aerospace to cater to domestic communication in India), pretty much like the TV channels. We were not just doing education, but communication infrastructure also. You had to fight the battle on multiple fronts to build a successful edtech company,” recalls Bansal.

Technical challenges apart, the problem, to some extent, was also to do with the category itself. Particularly in India, education has been a segment steeped in a traditional brick-and-mortar delivery mechanism comprising schools, colleges, tutorials. Even the most enterprising parents turned risk-averse while picking educators for their children. Convention was the norm, and chances weren’t to be taken.

Education outside schools and colleges was a stranglehold of physical tutorials, largely unbranded, though offline brands such as FIITJEE, Brilliant Tutorials and Aakash Institute among others flourished. People reposed faith on a teacher’s physical proximity to students.

In that context, while online retail shops, ride-hailing, delivery and home services companies began to soar in popularity, most online education companies were left behind. Uptake was slow and venture capital investments were negligible, despite education being an essential spend.

“In education, trust has to be built. Here, the customer (parents) and consumer (students) are different and this is an intangible purchase you don’t know what you have bought until you have tried it,” says Sameer Brij Verma, managing director at Nexus Venture Partners. “In food, you knew what you were getting. It was about service, not that the food got any better. Similarly, in ecommerce the experience of buying a product got better. In education, the product is perhaps better, but the experience had to be created.”

Also, the problem lay in how online education had largely been viewed—as a distant cousin to brick-and-mortar setups, a good-to-have service if the pocket permitted, on top of tuitions and offline training.

“In education, vitamins or things which are good for you don’t work, only painkillers work. What that means is practically schools and tuitions take away the most of the market and everything else becomes good to have,” says Sarbvir Singh, managing partner at WaterBridge Ventures.

Consequently, edtech startups barring Byju’s, the most valued online education startup globally at $8 billion, have barely found favour with investors. This has scuttled their ability to spend, especially on customer acquisition and marketing, unlike some of the consumer internet peers.

“If we compare education with sectors such as foodtech or fintech, look at the money that has gone into them. A lot of money has been spent on marketing to get users hooked. A huge amount of money has gone into changing behaviour. Online education companies haven’t done that,” says Simplilearn’s Kumar.

Singh of WaterBridge says it’s a chicken and egg problem. “There has to be a clear tangible benefit and, historically, the lack of it has been a challenge.”

Consequently, edtech startups barring Byju’s, the most valued online education startup globally at $8 billion, have barely found favour with investors. This has scuttled their ability to spend, especially on customer acquisition and marketing, unlike some of the consumer internet peers.

*****

While the past was bleak, the future holds promise.

India in 2019 was home to approximately 374 million smartphone and 627 million internet users, according to Statista. A January 2019 research by price comparison site Cable.co.uk says, at ₹18.5 per GB, India has the cheapest data tariff across the globe. The global average stands at approximately ₹600 per GB.

The upshot? A Google-KPMG report estimates that the online education pie is poised to burgeon to a turnover of $1.96 billion and 9.6 million users in 2021 from $247 million and 1.6 million users in 2016.

“Earlier, consuming content online was not a habit and video content consumption was largely through TV or traditional media. Today, on an average, people spend more time consuming content on the internet than on TV. When you start consuming content on a particular device, in this case smartphones, then it becomes a natural extension for you to not just consume content for entertainment, but learning and education as well,” says WizKlub’s Bansal.

Kumar and Krishna aren’t breaking their heads over scale any longer. Most importantly, they have succeeded in selling their dreams to thousands of others.Simplilearn today is a profitable business—Kumar says net margin hovers around 3-4 percent—with annual revenues set to exceed ₹300 crore in the fiscal ending March 2020. Every year, about 1.5 lakh professionals take Simplilearn courses, jointly developed with corporates and academic institutions, similar to Coursera, Trilogy, GetSmarter or Emeritus.

Simplilearn in its current shape and form is an outcome of resilience and prudence. Back in August 2015, after the momentous slip in revenue, Kumar and his top brass were quick to shrug off the despondence. They invested generously in marketing, tweaked their offerings and grabbed every opportunity that could make Simplilearn a lucrative destination for professionals.

“We did a brand campaign. We said come to the online classroom, if you don’t like it, take your money back. In 6-8 months we were back to the same run rate and started growing faster. We also came up with flexi classes. Instead of restricting someone to one batch from one instructor, we said one can attend any number of classes from as many instructors for a particular course,” says Kumar.

Meanwhile, at Vedantu, having raised $5 million from Accel Partners and Tiger Global Management in 2015, Krishna and his team were spending time in perfecting the art of online tutoring. Vedantu, which started as a one-to-one teaching platform where courses were expensive—about ₹500 per hour—took some time in finding its mojo.

The high price point hindered the growth of the one-to-one model. Besides, the gross margin at 20 percent didn’t leave much to go around. By 2017, caught in a funding downturn, and still struggling to pin down the perfect model, Krishna let go of 25 of his 120-odd employees. Critics questioned the viability of live tutorials. The likes of Byju’s and Toppr, after all, were raising capital offering recorded classes. (Toppr has since introduced live classes.)

Deliverance was round the corner. “In September’s third quarter, Pulkit (Jain, co-founder) took a class of 65 people (up from five a couple of years ago). That was a turning point. Energy and engagement in the class sky-rocketed because of peer learning,” recalls Krishna. “The other metrics were also changing. Fees came down to ₹100 per hour and our margins went up to 70-75 percent. At ₹2,000-2,500 an hour, teachers were making ₹15-20 lakh per annum hence the quality of teachers we could bring on the platform also increased. Since the price decreased, the Tier II/III phenomenon blasted off.”

At Vedantu, they continue to tinker with the product to clone the offline learning experience. A class on the Vedantu platform entails frequent interactions: One every three minutes. They track the minutest of details, even the time a student takes to respond to a quiz. Work on facial recognition is underway, a move that will help capture something seemingly as basic as a student’s attention span.

Krishna says about 15 million unique students access Vedantu every month, while the paid subscriber base has surged to about 1 lakh. Yet in the red, Vedantu is on track to clock about ₹50 crore in revenue this fiscal, about five times the FY19 turnover. He foresees a similar growth in FY21 as Vedantu aims to bring down the fees to about ₹50 an hour from the current ₹70 and strengthen its offering for the lower grades.

The once-evasive investors are back. Between November 2018 and August 2019, the firm raised $53 million in two tranches from a clutch of investors, including Accel Partners, Tiger Global, Omidyar Network, Westbridge Capital and Chinese online education behemoth, TAL Education Group.

Krishna is clear about the path ahead. It’s not the online incumbents that Vedantu is fighting. Says Krishna, “In the long term, only that company will survive that will replace offline, rather than become supplemental to offline.”

Gaurav Munjal, co-founder and chief executive at Unacademy, a test preparation startup, agrees. “Our product is not a supplement, but a replacement.”

Munjal’s braggadocio is backed by numbers. Unacademy Plus, the company’s paid platform—Unacademy was a completely free offering for three years since inception in 2016 —has amassed about 90,000 paid users since its launch in April last year. While Munjal declined to divulge further details, people in the know say Unacademy clocks ₹18-20 crore in monthly revenue, making it one of the highest grossers among online education startups in the country. With about $88 million in its kitty, Unacademy counts Sequoia Capital, Saif Partners, Nexus Venture Partners, Blume Ventures and Steadview Capital among its investors. The firm is reportedly in talks with the likes of General Atlantic and GGV Capital to raise another $100 million.

Munjal says Unacademy started with YouTube videos of him and co-founder Roman Saini teaching. Saini is a doctor by training who also cracked the Indian Civil Services exam. The educator-first approach is ensuring a rich harvest. “The idea was if Roman (Saini) and I can create content and a million people would watch us, how about us empowering a thousand people like us,” says Munjal.

[qt]In education, vitamins or things which are good for you don’t work, only painkillers do.”

Sarbvir Singh managing partner, WaterBridge Ventures[/qt]

Tanushree Nagori doesn’t even make a vague attempt to sweeten the truth. “We are not monetising it. There is no revenue model,” says Nagori of DoubtNut, a startup she co-founded with her husband Aditya Shankar in 2017. DoubtNut lets students post math and science doubts on the platform and get video solutions to their queries.

Yet, the likes of Tencent, Omidyar Network, WaterBridge Ventures and Surge, Sequoia Capital India’s startup accelerator programme, have pumped about $19 million into the venture that doesn’t make money. There is, however, a method to the madness. Students are flocking to DoubtNut in droves.

Nagori spills some eye-popping numbers. Until November 2018, DoubtNut had 18,000-20,000 daily active users (DAUs) on the app. The number has since surged to 1.3 million. Across platforms (app and web combined), DoubtNut’s DAU stands at 2 million. A million questions are asked on the platform every day.

“About 60 percent of our students’ homes got their first internet access in the last 12 months. That means this base of internet user never existed even a year ago,” says Nagori.

Nagori isn’t losing sleep over monetisation. DobtNut’s moat is its massive distribution. There are ample examples of companies raking in hundreds of millions of dollars in revenue on the back of a gargantuan user base. Take, for instance, Slack or Facebook.

“We will make money. There can be many revenue models. We can have a subscription model or add additional services, basically, any model that is based on massive distribution. The idea here is to have strong engagement,” says Nagori.

“I expect DoubtNut to be low average revenue per user, but high volumes. But I say that with reservation because I still don’t know what businesses would want to do on it. They could pay for placing their courses over there. What platform is the best for advertising? What platform is best for nudging students towards a micro lecture or course? DoubtNut, because here we know that the student is stuck on one particular topic. DoubtNut can become a distribution platform for third-party courses, or we can launch our own micro courses,” she adds.

Such opportunities notwithstanding, monetisation remains a concern. Online education doesn’t come cheap—DoubtNut vies to be an exception—thanks to the generous amounts most businesses are constrained to fork out on Google and Facebook ads, which increase the cost of customer acquisition and, consequently, the fees. A Goods and Services Tax as high as 18 percent isn’t helping their cause either.

Pricing is a double-edged sword. “In education, there is an association of quality with price. The products are relatively expensive today because there is a paying population that’s fine with it. Once that market saturates, prices will come down,” says Vinod Murali, managing partner at Alteria Capital Advisors. “These are early days and there will be many iterations on commercialisation of these products.”

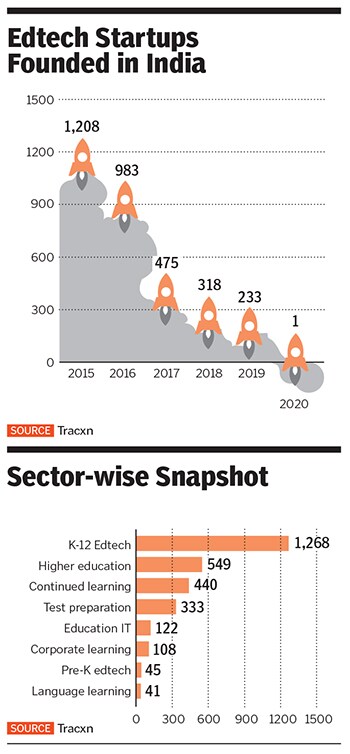

That said, DoubtNut also embodies a shift in investor sentiment towards edtech. Investors are dropping their guard, albeit slowly and gradually. While it’s still no match to sunshine sectors like online retail, food delivery or e-pharma, edtech startups founded since 2015 snared about $145 million in venture capital funding in 2019, an almost three-fold increase from the $55 million the year before, according to data from Tracxn, a startup tracker.

In true tech startup style, red in the books or minuscule revenues, aren’t a pressing matter any longer. Instead, the bet is on user engagement and reach, especially beyond the top 10 cities, much like online retail in its heyday. Niche and vertical offerings like DoubtNut, WhiteHat Jr (teaches coding to kids), Classplus (software solutions for coaching centres and tutors) and FlipClass (home tutor aggregator) are increasingly finding favour with investors.

“You can have sharply focussed businesses. The question from an investor perspective is that how much capital do they need. Maybe they can become successful with $40-50 million and not need $500 million. The market may be limited compared to a broad-based content approach, but that’s fine if you can still make a successful business out of it,” says Alteria’s Murali.

Kumar, Krishna and Nagori handle the adulation with caution. A Herculean task lies ahead—weaning students off brick-and-mortar setups. Building a reputable education business takes time and they are ready to be patient. Says Nagori, “We have barely scratched the surface.”

First Published: Feb 14, 2020, 15:18

Subscribe Now