Investment special: What to do in times of panic and pain at the markets

Coronavirus and a sluggish economy have dented investor confidence. Experts warn of tough days ahead and advise a conservative approach to investing

Illustration: Chaitanya Dinesh Surpur

Illustration: Chaitanya Dinesh Surpur

Investors know they need to brace themselves for bad times when a central bank announces a large and unscheduled cut in interest rates to protect economic activity. In March, the US Federal Reserve announced half a percentage point cut in rates—its first and sharpest since the 2008 slowdown—to support their economy from the novel coronavirus (Covid-19).

The concern is not unfounded as Americans are China’s largest consumers. Other countries, too, are worried because China accounts for 15.1 percent share of the world’s GDP. When the last epidemic, Severe Acute Respiratory Syndrome (Sars) hit the world in 2003, this figure stood at just 4 percent.

Global equities—particularly the Dow Jones index’s record fall of 1,190 points on February 28—echoed the nervousness caused by the outbreak. There is a clear financial panic for the first time since the global meltdown of 2008. It is evident that companies across the globe, particularly those that depend on sourcing raw material or technology from China, will face a tough business cycle in the coming months.

Crude oil prices have crashes the most since 1991, to multi-year lows, after Saudi Arabia slashed prices and planned for larger supplies next month. Today (March 9) WTI Crude was at $32.2, down 21 percent while Brent Crude was at $36.07, down 20.3 percent from its previous close. This led to global equities crashing further.

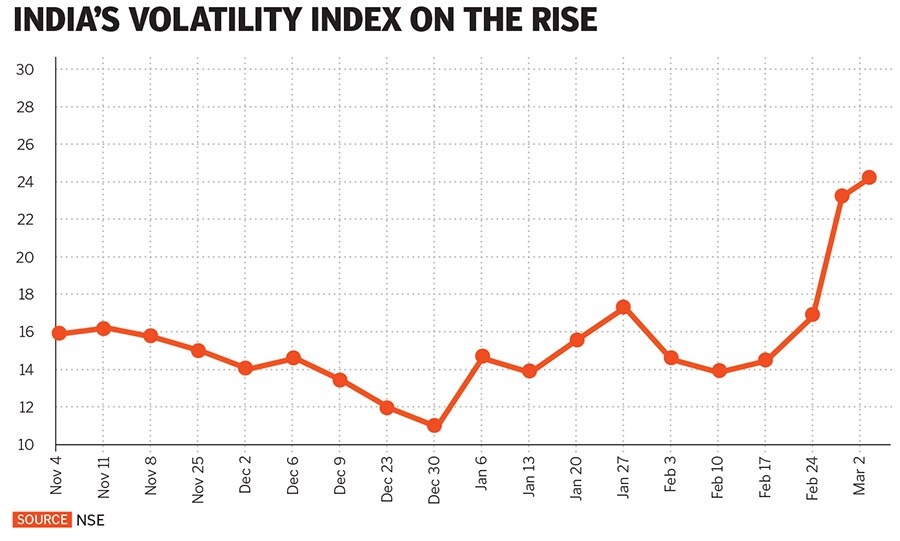

India is not an exception to the coronavirus scare. About 18 percent of India’s merchandise imports (worth $85 billion) come from China, with everything from consumer durables, electronics and select auto components to sea food, solar panels and some pharmaceutical bulk drugs highly dependent on imports from China. India’s benchmark 30-share Sensex index has fallen 14 percent and the Nifty 50 14.2 percent year-to-date. Volatility, through the India VIX index, has also risen in this period, led by the weakness across global equities (see chart).

Uncertainty prevails

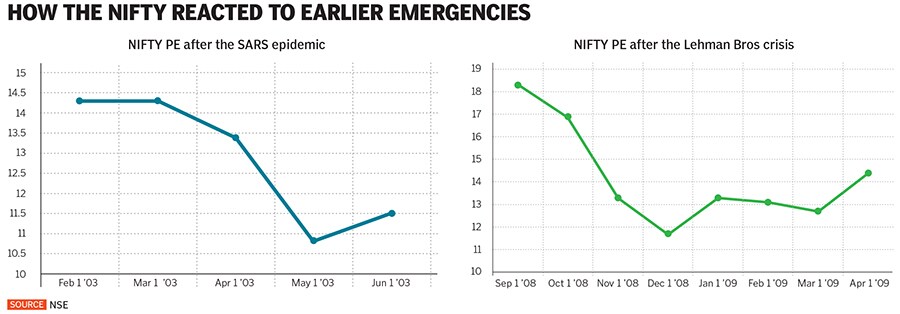

Coronavirus is likely to have a deadlier financial impact than Sars—8,098 cases of the respiratory illness were reported apart from 774 deaths globally. “China represents an incredible supply point for almost every imaginable product. If this is broken, a lot of companies are going to be in trouble,” veteran investor and emerging markets fund manager Mark Mobius tells Forbes India. “You should compare the current situation to the 2003 Sars impact or the post-Lehman crisis of 2008. The Sars situation was more transparent… a lot was revealed. The trouble this time is that China has a firewall and the information flow has not been good.”

In case of increasing uncertainty, investors usually tend to retreat to cash or stay liquid by pulling out of riskier equities and parking them with bank deposits. But in a regime of low interest rates, this might not be the best bet. “Hang on to your gold or fixed income instruments or dividend-paying stocks which have low debt these would be good bets,” says Mobius.

Gold has already taken advantage of the rapid fall in equities, gaining 11.6 percent this year to ₹44,930 per 10 gm in the Mumbai market as of early March. But it is highly price-elastic, which means demand for gold—as jewellery—will continue to fall as prices rise.

Gold, as an investment through bonds or ETFs, is a better bet but gives limited returns. India’s sovereign gold bond scheme offers a 2.5 percent return per annum without compounding, while the top performing gold ETF schemes gave higher one-year returns of between 22 and 30 percent in FY20. These fall to around 5 percent if you had invested three years earlier.

Raamdeo Agrawal, chairman of Motilal Oswal Financial Services, says it would be difficult to ascertain which way India’s equity markets will go, but warns investors to be ready to stomach losses. “If you can’t see losses and sustain a 50 percent correction of your portfolio, you are not cut out for equities,” he says. [Agrawal is not implying a 50 percent correction from current levels but implying that they need to be able to face the risk of that sharp a correction to their portfolio].

India limps

Finance Minister Nirmala Sitharaman has attempted to quell rising concerns of the coronavirus impact in India. The World Health Organization has said the world is in “unchartered territory”, after declaring Covid-19 a public health emergency of international concern in January. At least 110,110 have been infected across 109 countries, while 3,831 have died because of the virus. India recorded 43 cases as of March 9.

At CNBC TV18’s India Business Leader Awards in early March, Sitharaman said talks were on with several corporates to deal with raw material shortages, lack of technical support and manpower movement to and from China, and movement for some export-focussed companies in the wake of the outbreak.

The impact of the virus has hit India at a time when its economy is struggling to pull out of a slowdown. While Sitharaman introduced several tax and fiscal reforms for FY21 to boost consumption demand, the pace of growth remains at a seven-year-low of 4.7 percent for the December-ended quarter.

Agrawal emphasises on the need for a stable fiscal policy. “The government is on the right path in terms of monetary policy. But what India needs are stable and predictable fiscal rules, and not necessarily fiscal benefits. The problem is that the rules of the game are constantly being changed. It is like playing a 90-minute hockey game and its rules being changed every 10 minutes.”

Private consumption, which contributes about 60 percent to the GDP, is growing at 5.7 percent in 2019-20. Considering that various sectors stand to be impacted, their earnings will remain sluggish in Q4FY20 and even the June-ended quarter.However, Agrawal believes that the coronavirus scare offers India a unique ‘Y2K’ moment [Indian software firms fixed a global coding issue in computers which were programmed to use only two digits to signify the year] which its entrepreneurs should take advantage of. “This [situation in China] is a Y2K moment for manufacturing in India. We have to become complementary to China,” he says. If industries or companies are sourcing 100 percent of their raw material or technology from China, they will now want to have a second source. “India must start being able to provide that 10 percent sourcing to them. We must get our foot in the door and then increase our presence swiftly,” says Agrawal.

A Crisil impact report of February on coronavirus points out that in some cases such as leather, where India has a lower import dependence on China, Indian firms have the capacity to absorb any sudden influx of orders from the US and European Union players. Similarly, in plastics, India stands to gain from a reduction in cheap Chinese imports.

Stay invested

Both Mobius and Munot believe India’s equity markets are not in an oversold position. Mobius says the stock markets could slip to lower levels before starting to improve, which could happen by May or June. Munot is a little more confident of a broader market rally once the dust settles. “We will see a broader rally from here on. The green shoots will be a good monsoon and a pick-up in rural demand,” he says. Munot also strongly believes that as the spread of the virus eases, China will plan for new stimuli and do a detailed inventory restocking across sectors, which will help boost recovery.

As volatility prevails, Munot’s office has been fielding calls from high net worth individuals. “The most common question we are being asked is: Should we invest now or do an STP (systematic transfer plan)?” he says. “Nobody has asked whether exiting the markets is prudent.” Munot says timing the markets did not matter and that investors should spread out investing over a few months.

Mutual fund investors in the country have shown a rare level of maturity in recent years. This can be understood from the fact that while India’s stock markets have been volatile and mutual fund returns in equities have been muted over the past 1-2 years, SIP inflows continue to move up. SIP assets under management have risen by 20 percent to ₹324,868 crore in January 2020 from ₹269,621 crore last April.

Fund managers continue to advise the principle of “investing for goals” through SIPs. This has meant that investors have continued to invest in SIPs irrespective of whether their near-term or long-term goals have been met.

Dhirendra Kumar, founder and chief executive of Value Research, a financial advisory firm, believes that SIPs are “behaviour moderating”. It will help them to stay disciplined. “The key is that [in tough times] people should define their goals clearly and align and rebalance their portfolio constantly to those,” he says.

At the other end of the spectrum, gold is finding it difficult to find takers in tough market conditions. Jewellery brand Tanishq, part of Tata-group company Titan, witnessed a 9 percent jump (in value terms) for like-for-like products (earnings from similar stores or products) for the quarter-ended December. “Circumstances are such that many things are going against rapid growth,” says Sandeep Kulhalli, senior vice president (retail and marketing), jewellery division of Tanishq. “Nine percent is better than what we can expect.”

Kulhalli says that due to the jump in gold prices, the quantum of purchase per customer is dropping. “But we are confident that we could see double-digit growth in demand for gold jewellery,” he adds. Volume growth, however, could be flattish or marginally negative.

The next few months will test not just the investment strategies of experts but also their nerves. There is going to be no quick-fix, neither in terms of investment returns nor an economic recovery. The need is to go back to the old world wisdom of investing in high dividend-paying companies, strong on governance and low in debt.

First Published: Mar 09, 2020, 16:06

Subscribe Now