Nifty posts positive 10-year performance

The Nifty outperformed gold, fixed deposits and government bonds in the last decade

Image: ShutterstockIn the short term, markets are driven by sentiment, but over longer decadal periods, it’s the business performance that matters. According to an analysis by brokerage Motilal Oswal, in the 10 years since 2009, the Nifty rose 8.9 percent annually versus an 8.2 percent earnings growth. A majority of the earnings growth (11 percent a year) came in the first half of the decade and it is anybody’s guess whether these valuations will sustain.

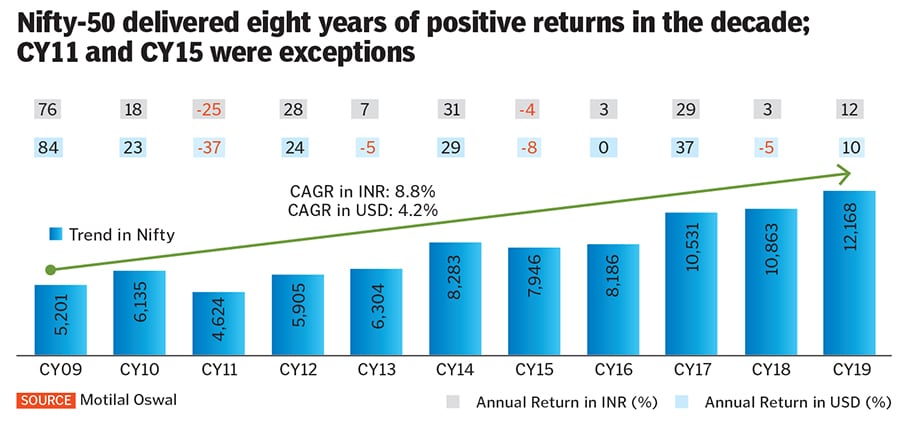

Image: ShutterstockIn the short term, markets are driven by sentiment, but over longer decadal periods, it’s the business performance that matters. According to an analysis by brokerage Motilal Oswal, in the 10 years since 2009, the Nifty rose 8.9 percent annually versus an 8.2 percent earnings growth. A majority of the earnings growth (11 percent a year) came in the first half of the decade and it is anybody’s guess whether these valuations will sustain. While the outperformance was skewed to the second half of the decade, it was led by a familiar set of businesses, with banking and financial services, consumer, auto, IT and pharma accounting for a majority of the gains. The Nifty outperformed gold, bank fixed deposits and Indian government bonds. On a global scale, the Nifty was the second-best performing market in local currency terms after the US (S&P500), but fourth in US dollar terms after the US, Japan and Taiwan.

While the outperformance was skewed to the second half of the decade, it was led by a familiar set of businesses, with banking and financial services, consumer, auto, IT and pharma accounting for a majority of the gains. The Nifty outperformed gold, bank fixed deposits and Indian government bonds. On a global scale, the Nifty was the second-best performing market in local currency terms after the US (S&P500), but fourth in US dollar terms after the US, Japan and Taiwan.

First Published: Jan 14, 2020, 10:47

Subscribe Now