India's private financial wealth shrugs off demonetisation woes, clocks 11% grow

Wealth in the hands of Indian households crossed the $2 trillion mark in 2016, according to BCG

Most of the increase in wealth in India can be attributed to new household savingsImage: Danish Siddiqui/ReutersIndian private financial wealth grew by 11 percent year-on-year to over $2 trillion in 2016, according to a recent report titled ‘Transforming the Client Experience’ by the global management consulting firm Boston Consulting Group (BCG).

Most of the increase in wealth in India can be attributed to new household savingsImage: Danish Siddiqui/ReutersIndian private financial wealth grew by 11 percent year-on-year to over $2 trillion in 2016, according to a recent report titled ‘Transforming the Client Experience’ by the global management consulting firm Boston Consulting Group (BCG).

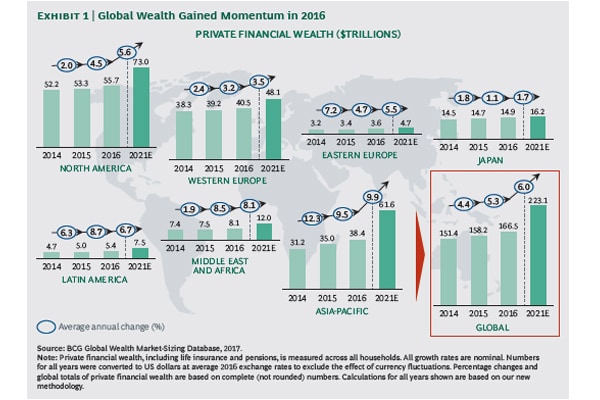

The double-digit growth in private financial wealth—defined as the financial assets held across households in the country, including life insurance and pensions—was head and shoulders above the global growth rate of 5.3 percent. However, it did remain in the shadows of China’s 13 percent. Global private financial wealth currently stands at $166.5 trillion, according to the BCG report.

The report also noted that the growth of wealth in India was consistent with the strong growth recorded in the Asia Pacific region (9.5 percent). “All regions experienced an increase in overall wealth, and Asia Pacific once again was the fastest-developing region.” The slowest-growing regions were Japan and Western Europe. Graphic source: Boston Consulting Group's 'Transforming the Client Experience' report

Graphic source: Boston Consulting Group's 'Transforming the Client Experience' report

Most of the increase in wealth in India can be attributed to new household savings, according to the report. This is consistent with trends for Asia Pacific as a whole, where the report predicted that strong GDP growth would lead to new savings over the next five years.

Prime Minister Narendra Modi’s move to demonetise Rs 500 and Rs 1,000 currency notes in late 2016 was expected to weigh on India’s GDP growth and correspondingly impact wealth growth. GDP growth in the third quarter of fiscal year 2016-17 was 7 percent, below the 7.3 percent observed in the second quarter.

Despite the reduction in GDP growth in the last three months of 2016, household savings grew in 2016 and India managed to maintain a double-digit wealth growth rate. The report also projected that “significant growth in wealth” would continue in India.

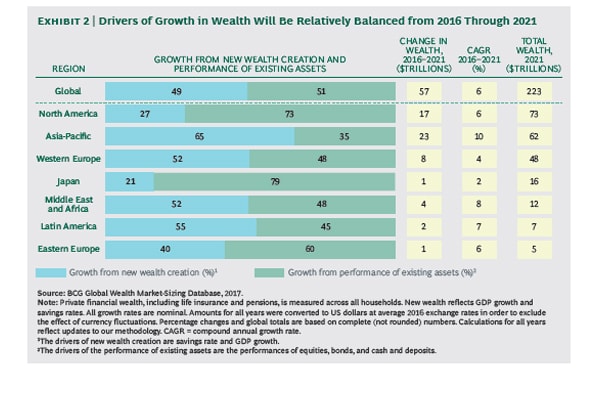

While new savings are expected to be the key drivers of wealth growth in Asia Pacific between 2016 and 2021, the performance of existing assets is expected to be the main component of wealth growth in North America, Japan and Eastern Europe. In Latin America, the Middle East and Africa, and Western Europe, wealth growth is predicted to be driven in nearly equal proportions by both new savings and the performance of existing assets. Graphic source: Boston Consulting Group's 'Transforming the Client Experience' report

Graphic source: Boston Consulting Group's 'Transforming the Client Experience' report

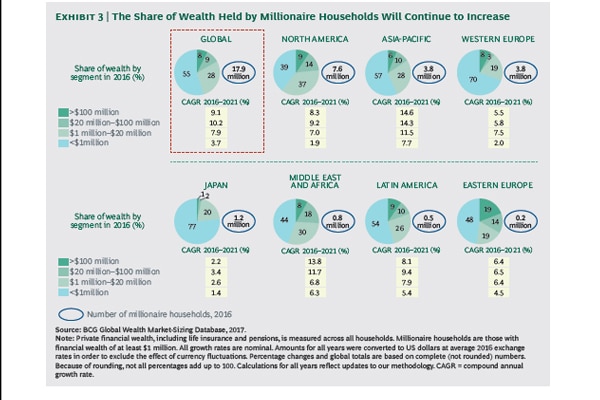

Regarding wealth distribution, strong growth in the global equity market caused the number of millionaire households to increase at a faster rate in 2016 than in 2015. Millionaire households’ share of global wealth also increased in 2016, which is part of a continuing global trend.

North America had the largest number of millionaire households (7.6 million), and it also had the highest percentage of wealth held by millionaire households (61 percent). However, millionaire households were expected to grow at the fastest rate over the next five years in Asia Pacific. Graphic source: Boston Consulting Group's 'Transforming the Client Experience' report

Graphic source: Boston Consulting Group's 'Transforming the Client Experience' report

The report comes at an important time with the Modi government set to review job creation and employment data collection on Sunday. There has been criticism that GDP growth has not led to more job opportunities in India.

Even though the impact of GDP growth on job creation may not be entirely clear, the report does claim that overall private financial wealth in India did grow at a significant rate in 2016 and will likely continue to grow.

However, it also evidenced a trend of greater wealth concentration among the wealthy worldwide and in Asia Pacific, which could be problematic for less affluent segments of the population.

First Published: Jun 14, 2017, 19:26

Subscribe Now