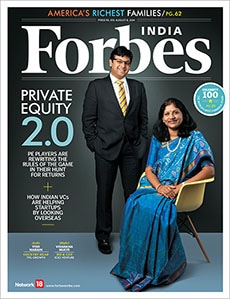

An India Model for Private Equity

Being a passive investor does not often work. 'Equity' may be the suffix in PE, but in India, some players have learnt to dabble in debt too

The simple assumption, that gung-ho entrepreneurship and a rising economic tide will lift all PE boats proved to be overoptimistic. Even accounting for business cycle and market ups and downs, PE players in India have had to tweak their imported models of investment and relearn the business. That, substantially, is what this issue’s cover story by Deepti Chaudhary explains. One important change for PEs, for example, has been to become more aggressive in monitoring how their investee companies fare, and making changes in management when required. Being a passive investor does not often work. ‘Equity’ may be the suffix in PE, but in India, some players have learnt to dabble in debt too. “What kept the industry going earlier is no longer entirely valid,” Sanjay Nayar, CEO of KKR India, told us.

If private equity has found the going tough, can its younger siblings in venture capital be doing any better? With shallower pockets and a different mandate, they too have had to adapt. For example, they are finding safety in numbers. They prefer to invest together (two or more sharing a deal) in the hope that using two heads to do due diligence will be better than just one.

The other highlight of this issue is from Forbes—on the dominant business dynasties of the US. In India, we are accustomed to thinking in terms of business houses, with wealth being handed down from generation to generation. This is, of course, thanks largely to the absence of a hefty inheritance tax. The American system of taxing the estates of the wealthy is better at inter-generational equity, but it has also created several famous business dynasties that continue to proliferate and flourish. The retail behemoth built by Sam Walton now has six inheritors who are collectively valued at $152 billion. They are America’s No 1 business dynasty. Take a peek at this listing.

Best,

R Jagannathan

Editor-in-Chief, Forbes India

Email: r.jagannathan@network18online.com

Twitter id: @TheJaggi

First Published: Jul 25, 2014, 06:31

Subscribe Now