Slice, of luck and a bigger pie for Rajan Bajaj

Rajan Bajaj's company is the only unicorn of the 30 Under 30 club this year, and has survived several pivots to become a formidable company

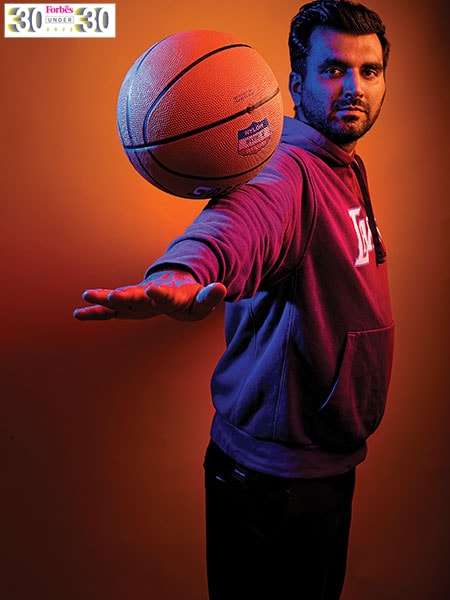

Rajan Bajaj, founder of freshly-minted unicorn Slice, is eyeing explosive growth

Rajan Bajaj, founder of freshly-minted unicorn Slice, is eyeing explosive growth

Image: Selvaprakash Lakshmanan for Forbes India

Stylists: Vaybhav Acharya And Geethanjali Manjunath Hair & Make Up: Glossnglass

Trouser: Rare Rabbit Production: Ovez Bakshi (Studio O Productions)

Rajan Bajaj, 29

Founder, Slice

Rajan Bajaj starts the conversation by talking about the ‘luck’ factor. The IIT-Kharagpur alumnus started his entrepreneurial journey in 2015, and, over the next few years, his fledgling venture underwent a couple of pivots, and a few near-death experiences. The business, though, miraculously survived. And Bajaj’s trust with slice of luck continued.

In June, Slice—the fintech startup rolled out by the former Flipkart employee—raised $20 million. In November, Bajaj raised a staggering $220 million, taking Slice into the unicorn club. “Luck is super important. It plays a very big role," says the 29-year-old. “At least thrice, we had just one-month’s runway left," he recalls. Anything could have happened. “We were lucky to survive."

The founder goes on to explain the role of hard work in his success. “One has to keep trying and stay persistent," he says. One needs to be in the game to win the game, he adds. Backed by marquee investors such as Tiger Global, Insight Partners, Gunosy, Das Capital, Finup, Blume Ventures India, Simile Venture Partner and others, Slice is striking an annual revenue run rate of $60 million, claims to have close to 5 million registered users on its app, and has aggressively ramped up monthly credit card issuances from 20,000 in January last year to over 3 lakh in December. “Over the next five years, we want to be known as the best neo-bank in the world," says Bajaj.

The investors are impressed with the performance. “Rajan has grown phenomenally as an entrepreneur over the last six years," reckons Ashish Fafadia, partner at Blume Ventures. In spite of a tough phase in the first five years of business, the founder managed to run the business closer to the breakeven levels. “He has emerged as a market leader," he adds.

Credit card is a large under-penetrated market with high average revenue per user. “Slice has a differentiated value proposition for a well-defined target customer group," says Sakshi Chopra, managing director at Sequoia.

First Published: Feb 09, 2022, 14:58

Subscribe Now