How focusing on diverse strategies helped Mahindra CIE

Through operational excellence and aggressive but well thought-out acquisitions—Mahindra CIE has created scale and delivered handsome returns to its shareholders

Hemant Luthra's original plan for MCIE was to achieve $1 billion revenue and valuation in five years, powered by acquisitions

Hemant Luthra's original plan for MCIE was to achieve $1 billion revenue and valuation in five years, powered by acquisitions

Image: Joshua NavalkarLife was good for Anil Haridass, a first-generation entrepreneur. The year was 2015 and Bill Forge, the company he had started in 1983, was making a name for itself in the forgings space, growing at a compounded annual growth rate (CAGR) of 20 percent over the past five years. Its revenue had crossed Rs 500 crore and the Bengaluru-based company boasted enviable operating margins in the industry.

It was, therefore, a content Haridass who received a call from Hemant Luthra, chairman, Mahindra CIE Automotive Ltd (MCIE), in 2015. “Why don’t we join hands to become a global powerhouse in the forgings space with a strong low-cost country base?” Luthra asked him during a brief conversation. MCIE’s chairman, a consummate dealmaker, had been tracking Bill Forge for over 18 months. “Though I agreed to talk, it was a deal I did not want to do,” Haridass, 59, tells Forbes India over the phone from Bengaluru.Trust developed over many rounds of golf and beer. No middlemen were involved—not even investment bankers. That senior executives from CIE, MCIE’s Spanish parent, flew in for the talks gave Haridass an added comfort. “I saw them as a group that integrated like-minded businesses to grow,” he says. The deal was finalised in September 2016 for Rs 1,331 crore. Haridass was paid in cash and through MCIE stock. His family now owns a 4 percent stake in MCIE and he continues to run Bill Forge independently. “The acquisition of Bill Forge falls in line with MCIE’s strategy of expanding in India and the Asean region. Moreover, Bill Forge’s strong track record can aid in improving MCIE’s profitability trajectory,” an ICICI Securities research report dated February 27, 2017, said.

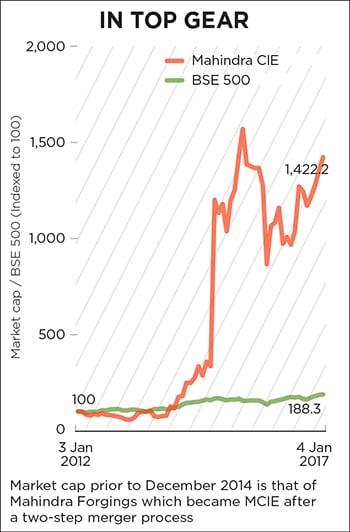

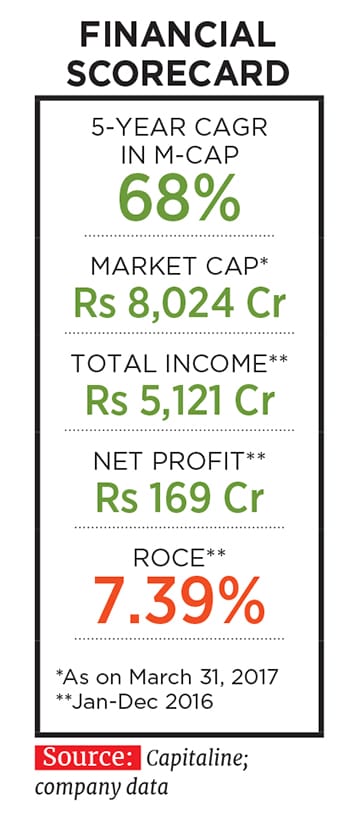

Deals like this—the company does not call them acquisitions but integrations—and a unique set of operational parameters (more on that later) have helped MCIE deliver strong value to its shareholders consistently. Its market cap, Rs 8,024 crore as on March 31, 2017, has grown at a CAGR of 68 percent over the last five years. MCIE, in which parent company Spanish auto component major CIE Automotive owns a 51 percent stake, has operations in India and five countries across Europe it is engaged in forgings, stampings and castings apart from manufacture of gears, composites and magnetic products. It posted a revenue (net of excise duty) of Rs 5,121 crore in 2016 (MCIE follows the calendar year) and profit after tax of Rs 169 crore. “We think the market recognises our clear profitable growth strategy, strong governance and global view,” Ander Arenaza Alvarez, who took over as CEO of MCIE in July 2016, tells Forbes India in an email. A CIE veteran based in Bilbao, Spain, Alvarez points to “a thrilling success story awaiting us” in the future. Luthra, 68, substantiates that with numbers: “We want to double MCIE’s market cap from the current $1.25 billion levels to $2.5 billion by 2020,” he says.

MCIE is a relatively new beast in the global auto component space. It all began in 2002 when Mahindra & Mahindra (M&M) bid for Finnish tractor company Valtra. The bid failed as M&M did not have access to a global low-cost auto component supply base. This set the M&M group thinking. Luthra, who was then the group executive vice-president of corporate strategy, came up with a proposal in 2004 for an auto component business that is global in nature but leverages India’s low-cost advantage. Powered predominantly by acquisitions, Luthra proposed to achieve $1 billion revenue and $1 billion valuation in five years.

undefined MCIE’s market cap, Rs 8,024 crore as on March 31, 2017, has grown at a CAGR of 68 percent over the last five years [/bq] Anand Mahindra, chairman of the M&M group, called it an “outrageous ambition of an irrational CEO”, recalls Luthra, but gave the nod and asked him to spearhead the business. Within the group the business was called Systech. Luthra put his diverse past experience—18 years in The Thapar Group, founder of a PE fund for ING group, CEO of Essar’s telecom business and a brief stint as head of Enron’s broadband business—to full use.

He engineered 15 acquisitions between 2004-05 and 2008-09, and Systech’s revenues grew from Rs 35 crore to Rs 3,500 crore, in the period. More than two-third of this came from Europe, half of which was from Germany where Systech had acquired a large truck forging company.

Five years after Mahindra’s green signal, Luthra had partially succeeded in achieving his “outrageous ambition”. Systech’s revenues touched $700 million and its valuation was pegged at around $400 million (against the stated $1 billion in both cases).

But further progress was stymied by the 2008 financial crisis and its fallout. Truck sales in Europe fell by 60 percent and Systech’s truck forging business in Germany took a massive hit.

The company responded by cutting costs and letting go of workers. Consequently, demand, when it returned in 2011, could not be handled effectively in the absence of skilled people. Also, one of the plants located in a residential area of Gevelsberg in north west Germany could not be operated 24x7. Attempts to outsource machining led to a customer claiming damages to the tune of Rs 30 crore. “Our Ebitda margin declined sharply from a peak of 11 percent pre-financial crisis and continued its downward spiral,” says Vikas Chandra Sinha, senior vice president—strategy, MCIE. The truck forging business became a drag for Systech and it realised the need for some help.  Ander Arenaza Alvarez, CEO of MCIE, says 'a thrilling success story' awaits the company in the future

Ander Arenaza Alvarez, CEO of MCIE, says 'a thrilling success story' awaits the company in the future

Image: Joshua NavalkarEnter CIE, the Spanish auto component major which was scouting for opportunities in India. The company, started in 1996, had registered scorching growth with revenues of $1.6 billion in 2011. Its strategy: Aggressive acquisitions and a strong focus on operational excellence which ensured that it did not suffer a single quarterly loss. Luthra saw a potential for an overarching partnership but CIE was looking for specific associations in the stamping space. After initial parleys, Anand Mahindra flew in to Bilbao, where CIE is headquartered, in February 2012 to meet Anton Pradera, chairman, CIE Automotive. “Both Anand and Anton had a vision of a global company. They got along well,” says Luthra. “They agreed on the broad contours of an overarching deal.”

Negotiations on the finer details were not easy and took time. It took Luthra another set of rounds of golf and drinks—this time red wine—in Bilbao and Barcelona to firm up the deal which was signed in October 2013. A two-step merger was initiated through which most of Systech’s businesses along with CIE’s forgings business in Europe were brought under one entity and by December 2014, MCIE in its current form began operations.

The deal required plenty of give and take. Anand Mahindra unusually allowed CIE to have a controlling stake (51 percent) in MCIE. Pradera, on his part, agreed to retain Luthra as chairman and continued with the Indian management. He also asked Mahindra to invest (the money the M&M group got for transferring Systech assets to MCIE) in CIE. M&M now holds a 12.4 percent stake in CIE which is even more than Pradera’s 11 percent. “Both Anand and Anton took unusual steps as they were creating a global auto component player with a strong low-cost manufacturing base,” says Luthra.

[qt] We want to double MCIE’s market cap from the current $1.25 billion levels to $2.5 billion by 2020.” [/qt] More than two years on, MCIE’s gear business in Italy has been turned around and drastic steps, including closure of a plant and pruning of the product portfolio, have been taken to restore profitability margins at the truck forging business in Germany. “After a difficult 2016 due to a restructuring exercise in our German operations, we have had a positive Q12017 and we continue to improve quarter by quarter,” says Alvarez. The company’s operating margins have risen to 11 percent in 2016 from 8.5 percent in 2015 and earnings before interest and tax (EBIT) margins have gone up to 6.3 percent (from 1.1 percent). “We continue to factor in a turnaround in [MCIE’s] Europe margins driven by improvement in operational efficiencies and product/location optimisation,” says an Ambit Capital research report.What attracted Anand Mahindra and Luthra to CIE was its business model that focussed heavily on operational excellence, diversification, cost control and a differentiated inorganic growth strategy apart from its unique five parameters to measure success. “They [CIE] spend a lot of money in improving processes and in acquiring latest technologies to do so rather than invest in product R&D,” says MCIE’s Sinha. This focus on operational excellence has led to better operating margins in Europe than even in Asia.

Their margins are high for another reason—diversification, across geographies, sectors and customers. “This enables them to give up orders if the returns are not commensurate,” says Luthra. In fact, MCIE acquired Bill Forge for precisely that reason. With a strong focus on the cars and two-wheeler segments, it reduces MCIE’s dependence on M&M and Tata Motors. It is also for this reason that CIE has chosen to remain a tier-II player becoming a tier-I supplier would increase dependence on a single automaker.

CIE also constantly attacks costs, especially fixed costs. For instance, it has just 12 people in its corporate office in Bilbao. It has also perfected an acquisition strategy that has enabled it to grow its revenues to euro 2.8 billion in 17 years. It seeks out like-minded promoters for partnerships, builds trust and offers the promoters a combination of cash and stock as part of the deal.

“By offering a stake, CIE builds a long-term relationship with the promoter. They did the same with Anand Mahindra and we did the same with Haridass,” says Luthra. The existing management has a free hand—they just need to meet CIE’s five operating parameters: EBIT of 10 percent or more return on capital employed (ROCE) of 20 percent or more debt of less than twice the Ebitda recoup investment in a plant in three years and free cash flow being equal to 50 percent of Ebitda (this helps the company create cash flow for other needs by keeping non-operational costs low this has enabled CIE to achieve its rapid pace of growth with just one equity dilution).

MCIE is yet to achieve most of these parameters. “…we expect to be there [achieve it] for all [parameters] by 2020,” says Alvarez.

After the first phase (2014-17) of consolidation, MCIE has now entered phase-II (2017-2020) where the focus for Alvarez will be to strengthen integration with the CIE management culture, accelerate achievement of CIE deliverables and kick-start growth. “Achieving CIE parameters will create more value for our shareholders. At the same time, we are eyeing growth. We can’t double our market cap without growth,” says Luthra as he rushes off for a game of golf where another deal could well be in the making.

First Published: May 18, 2017, 02:07

Subscribe Now