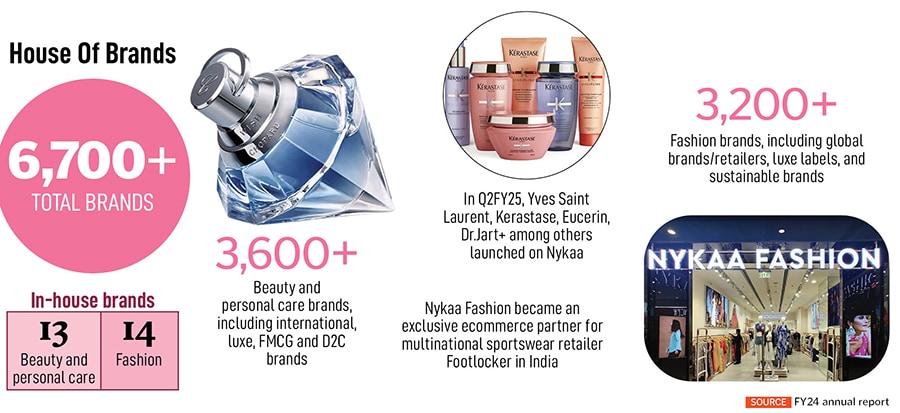

These strategic decisions made early on have helped the brand establish a loyal customer base, thanks to trustworthy products, superior delivery timelines and a seamless customer experience. Twelve years later, Nykaa has disrupted India’s beauty industry landscape. Across beauty and fashion, Nykaa has 6,800 brands available on its platform, of which over 170 beauty brands and more than 260 fashion brands were launched in Q2FY25 alone.

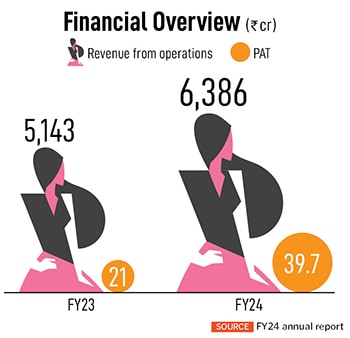

As per the Q2FY25 financials, Nykaa’s profit after tax (PAT) was up by 66 percent to ₹13 crore compared to Q2FY24. Revenue surged by 24 percent for the same time period—from ₹1,507 crore to ₹1,875 crore. The company turned profitable in FY21, and has been on that path ever since. Nayar has been one of the gainers on the 2024 Forbes India Rich List at rank 89, with a net worth of $3.64 billion.

However, Nykaa now faces growing competition with rivals like Flipkart’s Myntra, Tata Cliq and Reliance’s Tira making their mark in the beauty sector. Add to that the rise of quick commerce players selling beauty products. The burning question now is—will Nykaa manage to disrupt, yet again?

![]()

Intensifying Competition

The company currently has a 30 percent market share for the beauty vertical, 37 million cumulative customer base and 210 stores. “With this, we are the largest beauty retailer network in the country," claims Nayar.

![]() The beauty vertical consists of the beauty ecommerce platform, physical retail stores, owned brands as well as the eB2B business called Superstore—all of which are scaling fast. The beauty business for Nykaa has been its core revenue driver, accounting for 73 percent of the consolidated GMV (gross merchandise value)—which is at ₹12,400 crore in FY24, a 28 percent year over year increase.

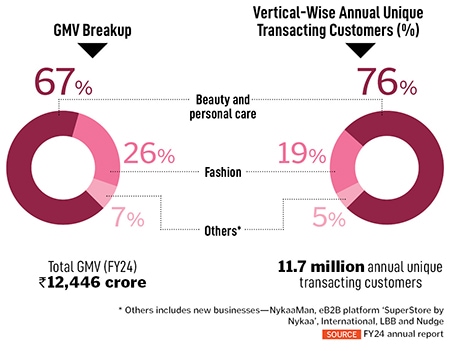

The beauty vertical consists of the beauty ecommerce platform, physical retail stores, owned brands as well as the eB2B business called Superstore—all of which are scaling fast. The beauty business for Nykaa has been its core revenue driver, accounting for 73 percent of the consolidated GMV (gross merchandise value)—which is at ₹12,400 crore in FY24, a 28 percent year over year increase.

Competition, though, is heating up for Nykaa. Most established players such as Reliance (Tira) and Flipkart (Myntra) are jumping on the beauty bandwagon following Nykaa’s playbook. Even quick commerce players now have a ‘Beauty Store’ within their respective platforms. But Nayar remains positive.

When the ecommerce boom happened, people continued to buy their beauty and personal care products from neighbourhood stores or pharmacies. “So, it is common for beauty products to also be sold in various other stores… which is why despite quick commerce coming in, it is possible for multiple channels to coexist," Nayar tells Forbes India.

Currently the size of India’s BPC (beauty and personal care) market is around $20 billion, “with its ecommerce penetration in the late teens", she writes in the company’s FY24 annual report. By 2037, the BPC market in India is expected to reach $90 billion, with $40 billion expected to be driven by digital, representing a 45 percent ecommerce penetration. Additionally, premiumisation continues to grow, yet the share of premium BPC is only five percent in India compared to 38 percent in China. Evidently, there is a lot of scope for penetration.

In this, she believes competition is good, since it is helping the category grow and raise further awareness. But Nykaa “continues to approach it [competition] from the perspective of being an expert, bringing the best of global brands, growing homegrown brands and providing a high-quality education about complex products to consumers", says Nayar.

![]() Experts believe that Nykaa continues to have a first-mover advantage. “Multiple firms—platforms (quick commerce and ecommerce), private label-based ones have tried to make inroads in BPC during the past three years, but have failed to scale up… Nykaa retains its market leadership in the BPC segment with growth rates in line with the industry average Nykaa maintains its moat in online BPC ahead of its peers," says Karan Taurani, senior vice president–research analyst, Elara Capital. “The concern for them is improvement in terms of margins, because of increased competition, most other platforms are resorting to discounts. Hence, margin improvement is going to be a challenge for Nykaa," he says.

Experts believe that Nykaa continues to have a first-mover advantage. “Multiple firms—platforms (quick commerce and ecommerce), private label-based ones have tried to make inroads in BPC during the past three years, but have failed to scale up… Nykaa retains its market leadership in the BPC segment with growth rates in line with the industry average Nykaa maintains its moat in online BPC ahead of its peers," says Karan Taurani, senior vice president–research analyst, Elara Capital. “The concern for them is improvement in terms of margins, because of increased competition, most other platforms are resorting to discounts. Hence, margin improvement is going to be a challenge for Nykaa," he says.

In about 110 cities, almost 65 to 70 percent of Nykaa’s orders are being delivered the next day. On quick commerce, Nayar tells Forbes India, “We are in the beauty business, and we will keep improving our delivery timelines for our beauty customers." Recently, news reports state that Nykaa has, in fact, been working on its quick commerce initiative—Nykaa Now, in a couple of cities.

Anchit Nayar, CEO, Beauty Ecommerce, Nykaa, clarified during the analyst call: “There are large parts of our business that are not addressable by quick commerce—not in an affordable and sustainable way. Hence, we are not looking to do 30-minute deliveries for that part. But there is also an important part of our overall business, which we call ‘fast moving everyday SKUs (stock keeping units)’." These are products that consumers buy every day as essential products, rather than a deliberate beauty purchase—which might be more relevant to the quick commerce part of the business. And to dominate market share in those SKUs, Anchit reckons, it is necessary to be competitive in the quick commerce category, which will be addressed via Nykaa Now. “The investment of setting up rapid stores or warehouses isn’t going to be large. Our average order values tend to be quite high, so we feel that this business can actually be profitable—at this point, it is not going to be margin dilutive nor is it a large capital investment," explains Anchit.

Scaling Up

Nykaa also helped multiple homegrown beauty brands grow—via programmes like BEAUTY&YOU, which is run by Estée Lauder Companies’ New Incubation Ventures. When Nayar was starting out in the beauty industry, new beauty brands would take close to five to seven years, to reach the ₹100 crore-turnover mark. While barriers to entry continue to remain high, she notes, “Now platforms [like Nykaa] have so much scale that a new brand can touch the ₹100-crore mark in one-and-a-half years to two years, if they do everything right. In fact, touching ₹30 crore to ₹40 crore is quite easy."

![]() In FY24, Nykaa brought global brands such as Rihanna’s Fenty Beauty, Charlotte Tilbury, e.l.f. Cosmetics, CeraVe, Redken and Millie Bobby Brown’s Florence by Mills, among many others. “In this quarter, we’ve launched some global marquee brands—luxury brand Yves Saint Laurent and professional luxury haircare brand Kerastase, both owned by the L’Oreal group, a premium derma cosmetic skin care brand Eucerin, owned by the Beiersdorf Group, and Korean skin care brand Dr.Jart+ from the Estee Lauder Group," said Anchit during the analyst call.

In FY24, Nykaa brought global brands such as Rihanna’s Fenty Beauty, Charlotte Tilbury, e.l.f. Cosmetics, CeraVe, Redken and Millie Bobby Brown’s Florence by Mills, among many others. “In this quarter, we’ve launched some global marquee brands—luxury brand Yves Saint Laurent and professional luxury haircare brand Kerastase, both owned by the L’Oreal group, a premium derma cosmetic skin care brand Eucerin, owned by the Beiersdorf Group, and Korean skin care brand Dr.Jart+ from the Estee Lauder Group," said Anchit during the analyst call.

On the other hand, Nykaa launched its fashion vertical in 2019 in an extremely competitive market. Thanks to its premium customers and private labels—over 3,200 brands—the vertical has differentiated itself. Currently, it serves over 6 million customers and holds approximately 20 percent market share of the premium online fashion market. It contributes approximately 27 percent to the company’s GMV in FY24.

“Looking at the fashion consumption in India, we’re still at the lower end of the spectrum with per capita consumption being at just $54, which is expected to grow to $160 by 2030, signifying that there’s accelerated growth expected in the coming years," noted Adwaita Nayar, CEO, Nykaa Fashion, in the FY24 annual report. Despite the low per capita consumption in the country, she says, the average spend per customer on the platform is about $130 and likely to go up to approximately $200 by 2030.

In the last year, Nykaa Fashion became an exclusive ecommerce partner for multinational sportswear retailer Footlocker in India. It also has the online rights to run footlocker.co.in, and the team is building and running Footlocker India’s social media.

![]()

“Fashion has seen a consumption challenge in recent times—there is definitely down trending and consumers are buying lower. The reason, we believe, is that festive and wedding have been bunched up towards the second half of the year, so we are feeling optimistic," explains Nayar.

In April 2024, the company announced the launch of Nysaa—expanding its multibrand omnichannel beauty retail operations into the GCC (Gulf Cooperation Council). “This [GCC] presents a great opportunity with a $30 billion BPC market, and one of the highest per capita BPC consumptions in the world," write Nayar. Nysaa is a joint venture between Nykaa and GCC-based Apparel Group. Nysaa has over 50 brands in stores and over 170 online, including Kylie Cosmetics, Augustinus Bader, Dr Barbara Strum and more. The ecommerce platform went live in January 2024 and launched its first store in March. “We are aiming to roll out 70 stores over the next five years," she says.

For now, there are no plans to further expand internationally. She says, “You need to digest what you do first… so no new markets immediately."

The beauty vertical consists of the beauty ecommerce platform, physical retail stores, owned brands as well as the eB2B business called Superstore—all of which are scaling fast. The beauty business for Nykaa has been its core revenue driver, accounting for 73 percent of the consolidated GMV (gross merchandise value)—which is at ₹12,400 crore in FY24, a 28 percent year over year increase.

The beauty vertical consists of the beauty ecommerce platform, physical retail stores, owned brands as well as the eB2B business called Superstore—all of which are scaling fast. The beauty business for Nykaa has been its core revenue driver, accounting for 73 percent of the consolidated GMV (gross merchandise value)—which is at ₹12,400 crore in FY24, a 28 percent year over year increase. Experts believe that Nykaa continues to have a first-mover advantage. “Multiple firms—platforms (quick commerce and ecommerce), private label-based ones have tried to make inroads in BPC during the past three years, but have failed to scale up… Nykaa retains its market leadership in the BPC segment with growth rates in line with the industry average Nykaa maintains its moat in online BPC ahead of its peers," says Karan Taurani, senior vice president–research analyst, Elara Capital. “The concern for them is improvement in terms of margins, because of increased competition, most other platforms are resorting to discounts. Hence, margin improvement is going to be a challenge for Nykaa," he says.

Experts believe that Nykaa continues to have a first-mover advantage. “Multiple firms—platforms (quick commerce and ecommerce), private label-based ones have tried to make inroads in BPC during the past three years, but have failed to scale up… Nykaa retains its market leadership in the BPC segment with growth rates in line with the industry average Nykaa maintains its moat in online BPC ahead of its peers," says Karan Taurani, senior vice president–research analyst, Elara Capital. “The concern for them is improvement in terms of margins, because of increased competition, most other platforms are resorting to discounts. Hence, margin improvement is going to be a challenge for Nykaa," he says. In FY24, Nykaa brought global brands such as Rihanna’s Fenty Beauty, Charlotte Tilbury, e.l.f. Cosmetics, CeraVe, Redken and Millie Bobby Brown’s Florence by Mills, among many others. “In this quarter, we’ve launched some global marquee brands—luxury brand Yves Saint Laurent and professional luxury haircare brand Kerastase, both owned by the L’Oreal group, a premium derma cosmetic skin care brand Eucerin, owned by the Beiersdorf Group, and Korean skin care brand Dr.Jart+ from the Estee Lauder Group," said Anchit during the analyst call.

In FY24, Nykaa brought global brands such as Rihanna’s Fenty Beauty, Charlotte Tilbury, e.l.f. Cosmetics, CeraVe, Redken and Millie Bobby Brown’s Florence by Mills, among many others. “In this quarter, we’ve launched some global marquee brands—luxury brand Yves Saint Laurent and professional luxury haircare brand Kerastase, both owned by the L’Oreal group, a premium derma cosmetic skin care brand Eucerin, owned by the Beiersdorf Group, and Korean skin care brand Dr.Jart+ from the Estee Lauder Group," said Anchit during the analyst call.