How Avendus Stayed Ahead of the Market

A PE-like investment strategy, heavy on research and support to management, has enabled Avendus Fund to beat the market by a wide margin

Manoj Thakur

Age: 45

Education: IIT Bombay, MMS, Masters in management, AIM, Manila

Career Profile: GE Asia Pacific Capital Technology Fund, CDPQ (Canadian Pension fund), head of M&A at AS Watson (subsidiary of Hutchison Whampoa)

The formula is pretty simple if a fund manager is to make money on stocks. First, identify and pick an undervalued company’s stock. Second, hold it till the value goes up. Third, sell and find your next winner. If you are lucky, you get your payoff early. If you are not, you wait till the market discovers value in what you picked years ago.

In short, you need pluck and luck to succeed with stock-picking, both when you invest and when you exit. Especially when the market is full of smart fund managers, each hoping he has found a hidden gem before the others do. The catch is your best picks tend to be in the small- and mid-cap space, where market depth is low and volatility can drown even a good stock.

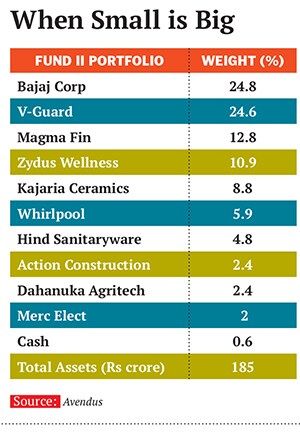

But Manoj Thakur appears not only to have kept his head above water, but made a heroic splash with his second Rs 160 crore Avendus Fund. At a time when other fund managers have been struggling to perform in a wayward market, Thakur’s Avendus Fund II has returned 12.4 percent annually even while the benchmark BSE Smallcap Index was down by 17 percent for the last two years.

You could say Avendus Fund had both pluck and luck in a market which has yielded poor returns in the aggregate over the last five years.

The Avendus success story in India began with a casual conversation in November 2010, when Thakur, CEO of Avendus PE Investment Advisors, was visiting the offices of Antique Broking, a Mumbai-based broking house operating out of south Mumbai’s commercial district of Nariman Point. As an alternative investment management firm, Thakur’s Avendus Fund II was foraging for investment opportunities among small companies that were likely to benefit from India’s rapid urbanisation.

Thakur indicated an interest in a company called V-Guard, a then Rs 600 crore Kochi-based company manufacturing power stabilisers (voltage, UPS, et al). Thakur saw V-Guard as a potential beneficiary in an urban growth scenario where the quality of power supply was always in doubt. This is where chance played a small role. Thakur’s hunch about V-Guard rang a bell in the mind of analyst Amol Rao of Antique Broking. Rao had been to college with Mithun Chittilappilly, then executive director and currently managing director of V-Guard, and he quickly offered to fix up a meeting between Thakur and Chittilappilly in Kochi.

The meeting convinced Thakur he was on to a good thing and he ended up buying 4.4 percent in V-Guard in February 2011 for Avendus Fund II at an average price of around Rs 186. Today, even in the current bear market, V-Guard trades at nearly thrice that price (Rs 516 as on August 28, 2013), accounting for 24 percent of the fund’s portfolio.

With such a huge exposure to one company, one can assume that it is a big risk. But that’s the way Thakur plays his game, almost like a private equity player would: Do your homework on a company, take calculated but concentrated bets, and laugh all the way to the bank when some of those bets pay off in a big way. Thakur credits the success of his fund to quality research where the fund manager and his team do the ground work on their own before investing. The fund invests in publicly-listed companies and takes a long-term approach to investing. Unlike regular mutual funds, Avendus Fund II is a close-ended fund for high net worth individuals (Rs 1 crore minimum investment) and does not feel pressured to make frequent redemption payments to skittish investors.

“The Indian market has more than 3,000 [investible] companies, most of them under-researched. There are some hidden gems out there that are not tracked by investors at all. All we do is look for the companies that are growing fast and are not yet on investors’ radars,” says Thakur. His Avendus PE Investment Advisors is a wholly-owned subsidiary of Avendus Capital, a top league Indian-owned investment bank.

Investment themes

The investment themes Thakur likes are urbanisation, rural prosperity and consumerism. This is how Avendus picked V-Guard.  Thakur remembers the day when he discussed the stock with Sandip Shenoy, CEO of Antique Broking. What impressed him about V-Guard was not just the numbers, but the fact that it had Deloitte as its auditor. He reasoned that if an unknown company in Kochi could think of appointing one of the Big Four global audit firms—and they don’t come cheap—Chittilapilly must have something going for him. It was enough to get him to put himself on a flight to Kochi to meet the Chittilappilly family. It was only after visiting the company’s Kochi office and a meeting with Mithun Chittilappilly that Thakur committed himself. Not on the investment itself, but for an even more rigorous look at V-Guard.

Thakur remembers the day when he discussed the stock with Sandip Shenoy, CEO of Antique Broking. What impressed him about V-Guard was not just the numbers, but the fact that it had Deloitte as its auditor. He reasoned that if an unknown company in Kochi could think of appointing one of the Big Four global audit firms—and they don’t come cheap—Chittilapilly must have something going for him. It was enough to get him to put himself on a flight to Kochi to meet the Chittilappilly family. It was only after visiting the company’s Kochi office and a meeting with Mithun Chittilappilly that Thakur committed himself. Not on the investment itself, but for an even more rigorous look at V-Guard.

Thakur found that the company was expanding at the rate of 40 percent in the southern and 100 percent in the northern region of India. Even when the world was talking about a slowdown, the team at V-guard was gung-ho about growth, big-ticket expansion and new products. The company, Thakur reasoned, had everything going for it: Promoters hungry for growth, new markets, new products, and a sound distribution network, among other things.

But the research was not all about Thakur making the big call. He had six people in his team working on V-Guard, who looked not only at the bottom line, but how the company was faring in each product line, in each geography. Thakur and team talked not only to the management, but the company’s distributors and stockists in every major market. For example, one of his analysts, Ankush Kedia, went to Bihar—a new market—to figure out whether V-Guard was trying to buy customers by offering extended credit periods. Happily, he found that V-Guard wasn’t over-extending credit beyond the industry norm. Kedia found that V-Guard’s southern parentage was seen as trustworthy, and most stores were happy to stock the company’s products.

The numbers proved lucrative. The company was trading at 11 times earnings when its sales were growing at 30 percent per annum. Little wonder, the stock is holding its own even in today’s bear market.

But V-Guard wasn’t Thakur’s only big hit. Avendus’s major assumption is that in a rapidly urbanising and aspirational country, an important consumer trend would be uptrading: Where consumers move from lower-priced products to higher priced ones.

Hair oil is a case in point. A Rs 15,000 crore segment in the Rs 2 lakh crore FMCG market, hair oil is largely about coconut oil—where Marico rules the roost. But here’s the point: Coconut oil is not the fastest-growing part of the hair oil market. Almond oil is. This is where Thakur and team focussed, and they discovered a gem in Bajaj Corp, makers of Bajaj Almond Drop hair oil.

Avendus noted that in an industry growing at 25 percent annually, Bajaj Corp was growing at 35 percent. He needed no further convincing about Bajaj Corp and took up a stake of 12.5 percent in the company at Rs 104 per share. Even in a bear market, Bajaj was quoting at Rs 242 (as on August 28). Following a similar logic, Avendus also invested in Zydus Pharma, Kajaria Ceramics and Magma Fincorp.

If Avendus has been canny in its stock-picking judgments, where it differentiates itself is in mapping a clear exit route. You can pick the best gems at throwaway prices, but you can’t make a pile by just sitting on them, waiting to hatch. Making money in stocks needs you to do two more things: Burnishing your stock, and making it shine enough to attract other buyers.

When you invest in an unknown company, the chances are it will remain unknown unless the management gets a leg up from you. Avendus works hard with the managements of the companies it invests in to make them better known to other investors. This is what gives Avendus its exit strategy. “We were not known to the overall market. We had no connections. It was only after Avendus’s entry that the overall market noticed us,” says Chittilappilly.

Early strategy

Thakur’s interest in small companies, however, predates Avendus. He had earlier invested in UTV and Entertainment Networks India (owners of Radio Mirchi) to the extent of $10 million each, through CDPQ, a Canadian pension fund with assets worth $250 billion, which he was managing from Hong Kong.

UTV brought him to the notice of Ranu Vohra, who was working for Hinduja Finance in 1991. Hinduja had a small stake in UTV, and Thakur bought himself a 33 percent piece of the action. He held the UTV stock for six years and sold it for a tidy sum that yielded him 20 percent annual average returns.

Thakur’s and Ranu’s paths crossed again when the latter left Hinduja Finance to start Avendus Capital, an investment banking firm with which Thakur maintained a business relationship. It all came together in Hong Kong in 2007, when Vohra was attending a private equity conference and toying with the idea of starting an alternative investment fund for high net worth clients under Sebi’s new guidelines. Vohra asked Thakur, who was also at the conference, whether he would head this new venture. Thakur said yes, and in 2008 he relocated to Mumbai after joining Avendus Capital as a partner.

“Manoj has a knack of finding out interesting businesses in their early stages of growth. Since we had been acquainted for almost 10 years, I thought it was a great opportunity to get him on board. Thus we set the ball rolling,” says Vohra. Avendus first looked at the private equity space and decided that it was simply too tough to make money in unlisted companies, especially after the global financial crisis had decimated most markets. Instead, he found a sea of opportunity in listed stocks that were going unsung.

Avendus opted for the PIPE model (private investment in public equity) and started to build a team around it. Thakur started a proof-of-concept fund with a small corpus of just Rs 20 crore in September 2009. It was a four-year fund which closed in August 2013. It invested in just seven companies and returned 13.1 percent annually as compared to Nifty’s 5.6 percent during the same period.

But even before Avendus Fund I was wound down, Avendus Fund II was launched in January 2011 with a more ambitious corpus. The fund pays out profits to investors on every exit it makes, instead of using the gains to make new investments.

Avendus Fund II’s philosophy is to restrict investments to just about 10 stocks, and concentrate even this in one or two potential high-flyers. Thakur believes that high returns come from concentrated positions and not spreading your risks over many stocks. “When portfolios are spread over 50 stocks they also end up diluting the returns,” he says. Since Thakur goes for multi-baggers, concentration is a must.

“Their approach to investment is very logical and they return the profits to investors. The fact that the fund manager makes it a point to communicate with you and is also known to you makes a lot of difference,” says Aditya Khanna, director, C&S Electric Equipment, who is an investor with Avendus Fund II. He also plans to invest in Avendus Fund III which commenced operations from July 2013 and already has commitments to the tune of Rs 100 crore.

Fund III will again have a completely new set of companies but the overall philosophy will be exactly the same as Fund II, which is to look for interesting businesses in the small-cap segment of the market that enjoys market pricing power. “In spite of all the macroeconomic problems India is facing, there are companies that are fundamentally doing very well. Our job is to find these companies through rigorous research,” says Thakur.

But what about liquidity? Who will buy them to give Avendus a profitable exit? Thakur feels that as long as the businesses are strong and growing, liquidity is not really an issue. He has proved that with Funds I and II and he is confident that he will get such stocks for Fund III as well.

Surely, there are risks? What if the current downturn kills some investee companies? Thakur acknowledges the risks. “But that’s exactly the reason for all the rigorous research,” he says.

His investors aren’t complaining.

Additional reporting by Aangi Kothari

First Published: Sep 10, 2013, 06:42

Subscribe Now