India Flex workspace predictions 2021

Paras Arora, CEO, Qdesq, India's largest tech-enabled marketplace for flexible workspaces, talks about key trends

Shrinking demand for traditional leases: Long term office leases have been the go-to solution for enterprises for decades since they come with lower per sq ft costs and a sense of complete ownership of an office. Enterprises happily adopted such solutions in spite of the downsides of the same (being locked into fixed long-term rentals, higher per seat cost, paying upfront for seats you may / may not need in the future) because they were operating in relatively stable markets.

Shrinking demand for traditional leases: Long term office leases have been the go-to solution for enterprises for decades since they come with lower per sq ft costs and a sense of complete ownership of an office. Enterprises happily adopted such solutions in spite of the downsides of the same (being locked into fixed long-term rentals, higher per seat cost, paying upfront for seats you may / may not need in the future) because they were operating in relatively stable markets.

However, as global markets and supply chains get more integrated, they also become more complex. In an increasingly complex environment, small changes in market / supply chain conditions can cause severe downstream business cycle fluctuations, forcing enterprises to value flexibility and agility in their costs. This broader trend has been reinforced by the pandemic that has shuttered enterprises that had fixed office rental cost structures.

The second factor driving a decrease in this demand is the rise of the digital economy. The distribution of engagement levels for the user base of purely tech products follows a Pareto distribution (supermajority of user base is lightly engaged). This implies that most of your users face low switching costs when considering competitive products. Incremental innovation + ad dollars by competitors can cause a bank run on your user base. Which means. Today you have a 100 million users. Tomorrow, you’ve lost half your flock. For tech products, any Goliath can become a David overnight.

Small wonder then that in the face of this variability, we are witnessing a chilling effect on enterprise demand for long term leases, with both traditional and tech companies aligning their office space cost structures around flexibility and agility. We expect this trend to accelerate with time.

The meteoric rise of Work Near Home: In addition to the factors pushing enterprise demand away from traditionally leased offices, there are multiple pull factors that make the flex workspace product attractive to enterprises. Converting fixed rental payments into variable costs that increase or decrease as a function of the labour strength of the company is obviously a key factor.

However flex workspaces also offer enterprises the ability to create a flexible CRE portfolio strategy that matches the needs of their business. Let:

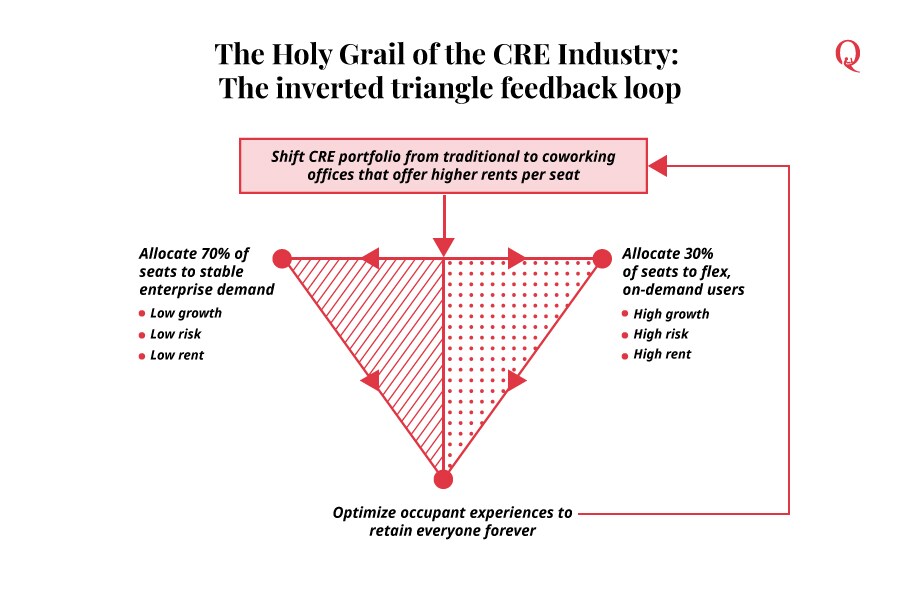

Razor sharp focus on optimizing the occupant experience: What is the holy grail for owners of CRE? How do commercial office space providers go about optimizing their returns from a CRE portfolio?

Flex workspaces naturally offer higher earnings and margins for flex space operators versus traditionally leased spaces. With the recent pandemic, not only has enterprise demand taken off, but operators have also found a renewed focus on optimizing the occupant experience in a bid to improve profitability and stay afloat. We expect this focus on occupant experiences to persist after the pandemic because flex space operators would have realized that every occupant retained for every additional month means lower selling, marketing, brokerage expenses, and higher revenues.

Providers will find new ways to differentiate their offerings: The current discovery process for flex workspaces comprises of searching basis location and price. However, the addition of exponentially more stock month on month will force flex space operators to start differentiating themselves in unique ways as they all compete to rank high for digital search results. Think filters enabling the demand side to discover workspaces that are:

This trend will also accelerate once operators realize that flex workspace differentiation is the only way to compete on the basis of value versus pricing + location, and enhance consumer price insensitivity. This should help the industry realize pricing gains of 25-50% on a per seat basis, uplift profitability, and accelerate supply addition rates.

Disclaimer: The views, suggestions and opinions expressed here are the sole responsibility of the experts. No Forbes India journalist was involved in the writing and production of this article.

First Published: Nov 25, 2020, 16:19

Subscribe Now