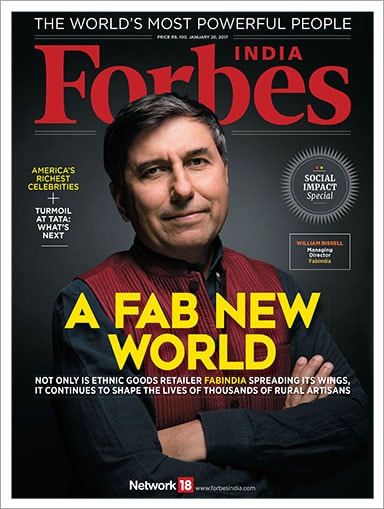

Doing good, doing well

Social ventures need to be profitable to achieve scale. The two objectives can co-exist

In fact, the key element of any debate relating to social enterprise is whether profit and social good can co-exist. The answer is a resounding yes. Profitability—even if the returns are lower than other enterprises—needs to be an important element woven into such ventures (like Fabindia, our cover story). As Assistant Editor Anshul Dhamija, who put this issue together, writes: “Profit is inherent to any private enterprise. Without it, you do not get scale. And only with scale can there be impact.”

This Social Impact special issue attempts to take a close look at some of the elements of the social entrepreneurship ecosystem—the interesting ventures taking shape, the impact investing segment and its challenges, and the road ahead for social ventures. This issue also throws up some telling facts and figures: The highest number of social enterprises, at 21 percent, is in the financial inclusion space, followed by clean energy, agri-business and livelihood (at 15 percent each). Health care, education and water and sanitation come lower, with 11 percent, 9 percent and 8 percent respectively. Clearly, these are areas which need attention. Unfortunately, one estimate shows that as much as 85 percent of impact investment comes in by way of foreign capital, and Indian investors are still to warm up adequately to social ventures. Hopefully, that will change in the future.

This issue also gets you the Forbes listing of The World’s Most Powerful People, 74 individuals who have the most impact on a rapidly-changing world. Russian President Vladimir Putin tops the list with US President-Elect Donald Trump at number two, followed by German Chancellor Angela Merkel at third place. Not very far behind, at number 9, is Prime Minister Narendra Modi. The only other Indian on the list is Reliance Industries chairman Mukesh Ambani. Uber boss Travis Kalanick, who is drawing up big plans to broadbase his $68 billion company’s presence in the mobility space, figures at number 64.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

First Published: Jan 06, 2017, 07:27

Subscribe Now